Today, where screens dominate our lives, the charm of tangible printed items hasn't gone away. Whatever the reason, whether for education for creative projects, just adding the personal touch to your area, Income Tax Rebate Under Section 10 10d are now a vital source. In this article, we'll dive through the vast world of "Income Tax Rebate Under Section 10 10d," exploring what they are, how to find them, and how they can add value to various aspects of your life.

Get Latest Income Tax Rebate Under Section 10 10d Below

Income Tax Rebate Under Section 10 10d

Income Tax Rebate Under Section 10 10d - Income Tax Rebate Under Section 10(10d), What Is Income Tax Section 10(10d), What Is Tax Exemption Under Section 10 10d, What Is Section 10(10d) Of Income Tax Act, What Is Section 10 In Itr, Tax Benefit Under Section 10 10d

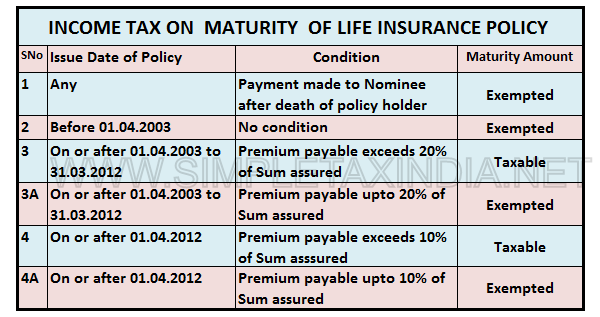

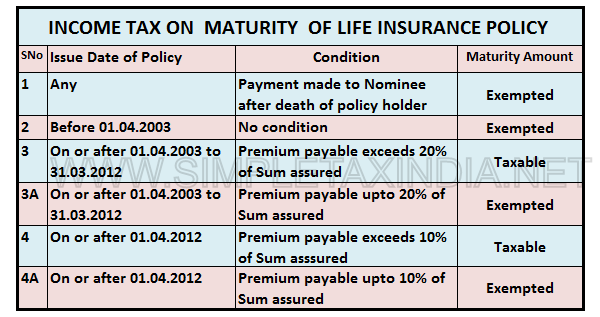

Section S 10 10D provides for exemption with respect to sum received under a life insurance policy including sum allocated by way of bonus subject to certain specific

Taxability as per fourth proviso to Section 10 10D of the ITA The consideration received will be exempt under clause 10D as the annual premium

Printables for free cover a broad array of printable materials available online at no cost. They are available in numerous forms, like worksheets templates, coloring pages and many more. The appeal of printables for free is their versatility and accessibility.

More of Income Tax Rebate Under Section 10 10d

Income Tax Rebate Under Section 87a Working And Eligibility

Income Tax Rebate Under Section 87a Working And Eligibility

Under Section 10 10D of the Income Tax Act of 1961 the beneficiaries enjoy tax exemptions on the disbursed sum assured and any other accrued bonus

Under Section 10 10D any sum received from a life insurance policy including the maturity amount or the amount received upon surrender is exempt from income tax

The Income Tax Rebate Under Section 10 10d have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization: This allows you to modify the templates to meet your individual needs when it comes to designing invitations and schedules, or decorating your home.

-

Educational Value Printables for education that are free offer a wide range of educational content for learners of all ages. This makes them an essential resource for educators and parents.

-

Affordability: immediate access a plethora of designs and templates can save you time and energy.

Where to Find more Income Tax Rebate Under Section 10 10d

Exemption Under Section 10 10d

Exemption Under Section 10 10d

Section 10 10D of the Income Tax Act of 1961 specifies the rules concerning the taxability of claims such as death and maturity benefit It allows an individual to avail of tax

Section 10 10D of the Income tax Act 1961 ITA provides for exemption on any sum received under a life insurance policy including the sum allocated by way of bonus on

We've now piqued your curiosity about Income Tax Rebate Under Section 10 10d, let's explore where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Income Tax Rebate Under Section 10 10d designed for a variety objectives.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets including flashcards, learning tools.

- Ideal for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a wide selection of subjects, from DIY projects to planning a party.

Maximizing Income Tax Rebate Under Section 10 10d

Here are some creative ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free for teaching at-home as well as in the class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Rebate Under Section 10 10d are a treasure trove of fun and practical tools that satisfy a wide range of requirements and hobbies. Their accessibility and flexibility make them a wonderful addition to each day life. Explore the many options of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes you can! You can download and print these free resources for no cost.

-

Can I make use of free printables for commercial use?

- It is contingent on the specific rules of usage. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables could be restricted concerning their use. You should read the terms and conditions offered by the creator.

-

How do I print Income Tax Rebate Under Section 10 10d?

- Print them at home with the printer, or go to the local print shops for the highest quality prints.

-

What program will I need to access printables at no cost?

- The majority of PDF documents are provided in the format of PDF, which can be opened with free software such as Adobe Reader.

Income Tax Rebate Under Section 87A

Section 87A Tax Rebate Under Section 87A Rebates Financial

Check more sample of Income Tax Rebate Under Section 10 10d below

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Section 10 10D Of Income Tax Act Exemptions Payouts

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

CBDT Issued Guidelines Under Clause 10D Section 10 Of The Income Tax

All About Income Tax Rebate Under Section 87A INFORMATIONS ONLY COM

https://cleartax.in/s/unit-linked-insurance-plan-taxation-rules

Taxability as per fourth proviso to Section 10 10D of the ITA The consideration received will be exempt under clause 10D as the annual premium

https://www.kotaklife.com/insurance-guide/savings...

Key Takeaways Section 10 10D governs tax exemptions on life insurance payouts and understanding its terms is crucial for informed financial decisions To avail

Taxability as per fourth proviso to Section 10 10D of the ITA The consideration received will be exempt under clause 10D as the annual premium

Key Takeaways Section 10 10D governs tax exemptions on life insurance payouts and understanding its terms is crucial for informed financial decisions To avail

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

CBDT Issued Guidelines Under Clause 10D Section 10 Of The Income Tax

All About Income Tax Rebate Under Section 87A INFORMATIONS ONLY COM

Income Tax Rebate Under Section 87A Goyal Mangal Company

INCOME TAX ON MATURITY RECEIPT OF LIFE INSURANCE POLICY S K And

INCOME TAX ON MATURITY RECEIPT OF LIFE INSURANCE POLICY S K And

.webp)

SuperCA