In this day and age where screens have become the dominant feature of our lives and the appeal of physical printed objects isn't diminished. Whatever the reason, whether for education for creative projects, simply adding an individual touch to your home, printables for free are now a useful source. The following article is a take a dive to the depths of "Income Tax Rebate On Interest," exploring the different types of printables, where to find them, and how they can add value to various aspects of your lives.

Get Latest Income Tax Rebate On Interest Below

Income Tax Rebate On Interest

Income Tax Rebate On Interest - Income Tax Rebate On Interest On Home Loan, Income Tax Rebate On Interest On Housing Loan, Income Tax Rebate On Interest, Income Tax Rebate On Interest Paid On Home Loan, Income Tax Rebate On Interest On Fixed Deposit, Income Tax Rebate On Interest Income For Senior Citizens, Income Tax Rebate+interest On House Building Loan, Income Tax Exemption On Interest, Income Tax Relief On Interest, Income Tax Rebate On Hba Interest

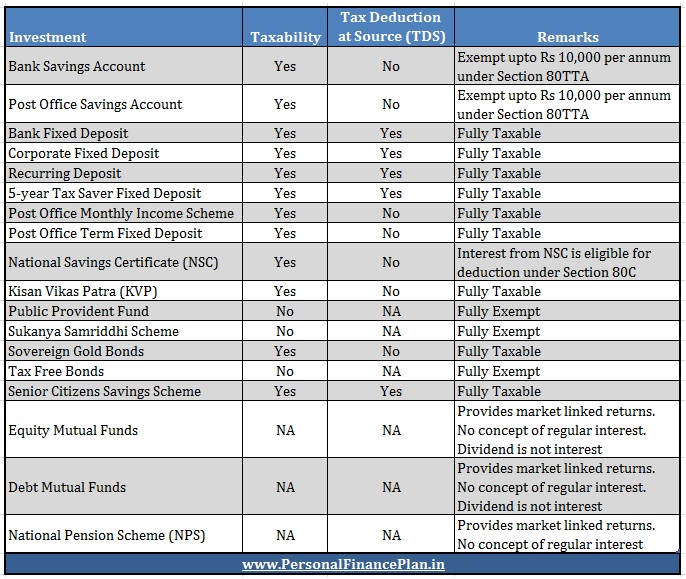

Web 22 f 233 vr 2023 nbsp 0183 32 22 February 2023 No changes from last year From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on interest from a

Web 14 avr 2017 nbsp 0183 32 Senior citizens can claim a tax deduction up to Rs 50 000 on FD interest income while filing their income tax return What is the TDS rate on FDs Interest

Printables for free include a vast range of downloadable, printable resources available online for download at no cost. They are available in numerous forms, including worksheets, templates, coloring pages, and much more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Income Tax Rebate On Interest

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Web 9 d 233 c 2022 nbsp 0183 32 This form will have all the information you need to add the income to your tax return Once you hit the 1 500 of earned interest income for the year you can report all of your taxable interest on

Web 11 janv 2023 nbsp 0183 32 Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first time

Income Tax Rebate On Interest have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Modifications: It is possible to tailor designs to suit your personal needs be it designing invitations and schedules, or even decorating your house.

-

Educational Impact: Education-related printables at no charge offer a wide range of educational content for learners from all ages, making the perfect tool for parents and educators.

-

The convenience of instant access a variety of designs and templates helps save time and effort.

Where to Find more Income Tax Rebate On Interest

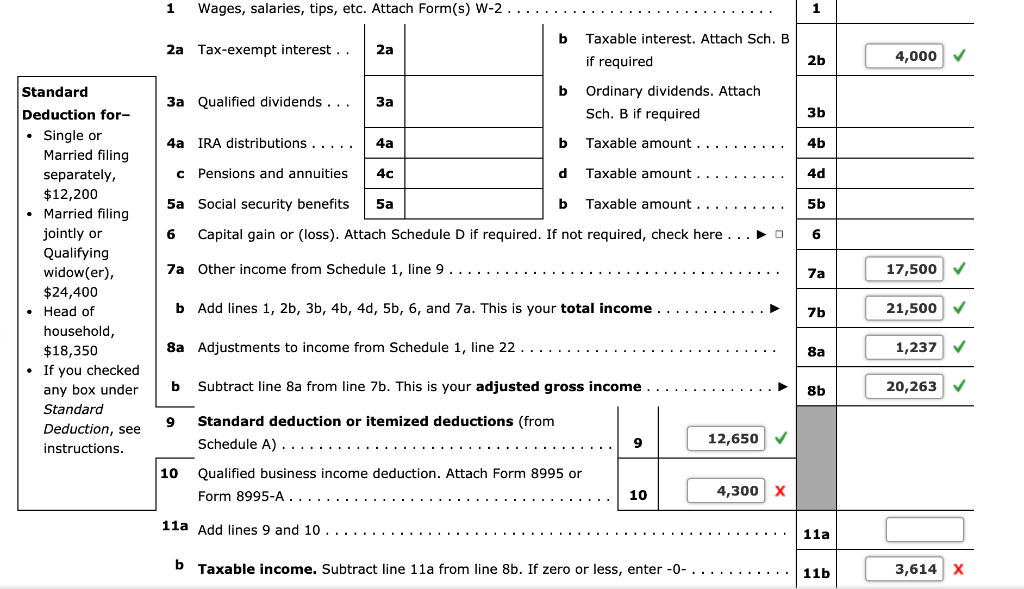

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Web 26 juil 2022 nbsp 0183 32 Income tax return ITR filing How savings bank interest is taxed and can you save the income tax on it Here s your answer Anshul Jul 26 2022 1 47 37 PM IST

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

In the event that we've stirred your interest in Income Tax Rebate On Interest we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection with Income Tax Rebate On Interest for all uses.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free, flashcards, and learning tools.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- The blogs covered cover a wide selection of subjects, including DIY projects to party planning.

Maximizing Income Tax Rebate On Interest

Here are some fresh ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home, or even in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate On Interest are an abundance with useful and creative ideas that cater to various needs and interests. Their availability and versatility make them a valuable addition to each day life. Explore the endless world of Income Tax Rebate On Interest today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes they are! You can download and print the resources for free.

-

Can I download free printables for commercial uses?

- It's all dependent on the rules of usage. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables could be restricted in use. Be sure to review the conditions and terms of use provided by the author.

-

How do I print printables for free?

- You can print them at home with a printer or visit a local print shop for more high-quality prints.

-

What software will I need to access printables free of charge?

- The majority of PDF documents are provided in PDF format, which can be opened with free software like Adobe Reader.

Tax Rebate For Individual Deductions For Individuals reliefs

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Check more sample of Income Tax Rebate On Interest below

2007 Tax Rebate Tax Deduction Rebates

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://cleartax.in/s/income-tax-on-fixed-deposit-interest

Web 14 avr 2017 nbsp 0183 32 Senior citizens can claim a tax deduction up to Rs 50 000 on FD interest income while filing their income tax return What is the TDS rate on FDs Interest

https://www.idfcfirstbank.com/finfirst-blogs/finance/is-tax-refund...

Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your

Web 14 avr 2017 nbsp 0183 32 Senior citizens can claim a tax deduction up to Rs 50 000 on FD interest income while filing their income tax return What is the TDS rate on FDs Interest

Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Retirement Income Tax Rebate Calculator Greater Good SA

Income Tax Benefits On Housing Loan Interest And Principal House Poster

Income Tax Benefits On Housing Loan Interest And Principal House Poster

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates