In this age of technology, where screens have become the dominant feature of our lives however, the attraction of tangible, printed materials hasn't diminished. Whether it's for educational purposes project ideas, artistic or just adding an individual touch to the area, Income Tax Rebate On Home Loan Section 24 can be an excellent resource. For this piece, we'll take a dive to the depths of "Income Tax Rebate On Home Loan Section 24," exploring what they are, where to get them, as well as how they can be used to enhance different aspects of your lives.

Get Latest Income Tax Rebate On Home Loan Section 24 Below

Income Tax Rebate On Home Loan Section 24

Income Tax Rebate On Home Loan Section 24 - Income Tax Rebate On Home Loan Section 24, Income Tax Benefit On Home Loan 2023-24, Income Tax Rebate On Second Housing Loan Interest, Income Tax Rebate On Home Loan Rules, Section 24 Income Tax Benefit On Interest On Home Loan, Maximum Tax Rebate On Home Loan, What Is The Maximum Limit Of Interest On Housing Loan Exemption

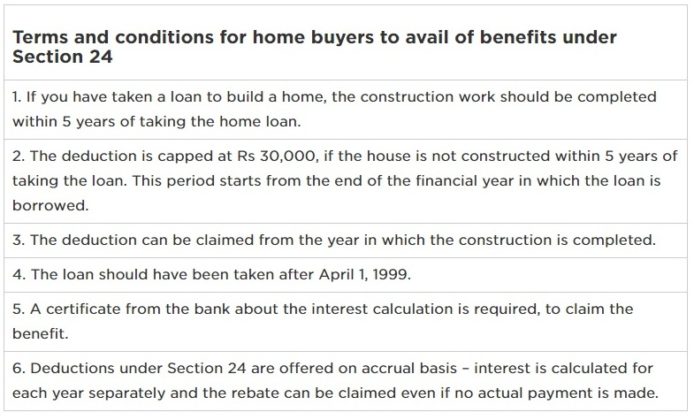

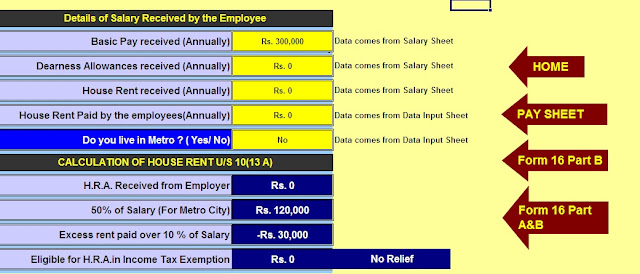

Web 20 juil 2023 nbsp 0183 32 Section 24A provides a flat 30 deduction on net annual value of the rented property if the property is bought using the owner s own money So if Ram bought a

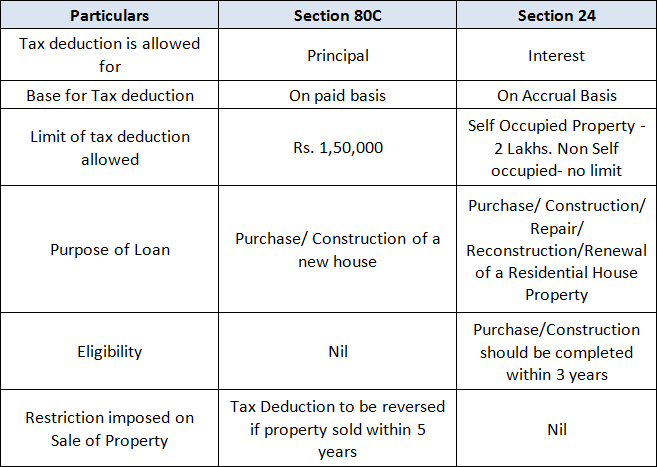

Web 11 janv 2023 nbsp 0183 32 Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2

Income Tax Rebate On Home Loan Section 24 encompass a wide assortment of printable content that can be downloaded from the internet at no cost. They are available in numerous styles, from worksheets to templates, coloring pages and much more. The benefit of Income Tax Rebate On Home Loan Section 24 lies in their versatility and accessibility.

More of Income Tax Rebate On Home Loan Section 24

Home Loan EMI And Tax Deduction On It EMI Calculator

Home Loan EMI And Tax Deduction On It EMI Calculator

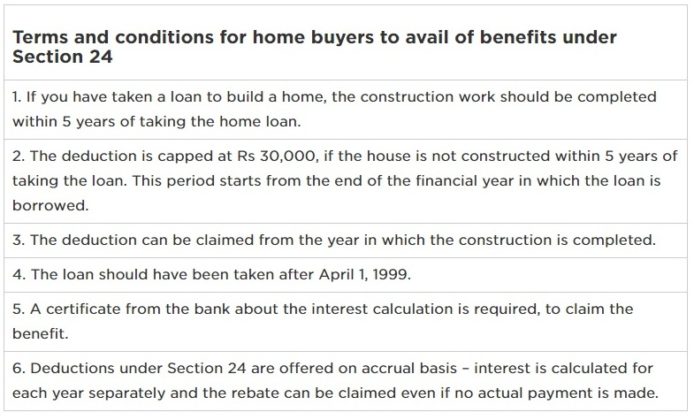

Web 9 f 233 vr 2018 nbsp 0183 32 The interest that you pay on your Home Loan is allowed as a deduction under Section 24 of the Income Tax Act If you are receiving

Web 7 janv 2023 nbsp 0183 32 There is an express need for more tax sops for home buyers as well as investors The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum

The Income Tax Rebate On Home Loan Section 24 have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

customization They can make printables to your specific needs, whether it's designing invitations and schedules, or decorating your home.

-

Educational Benefits: Printables for education that are free are designed to appeal to students of all ages. This makes the perfect tool for parents and educators.

-

An easy way to access HTML0: Fast access various designs and templates saves time and effort.

Where to Find more Income Tax Rebate On Home Loan Section 24

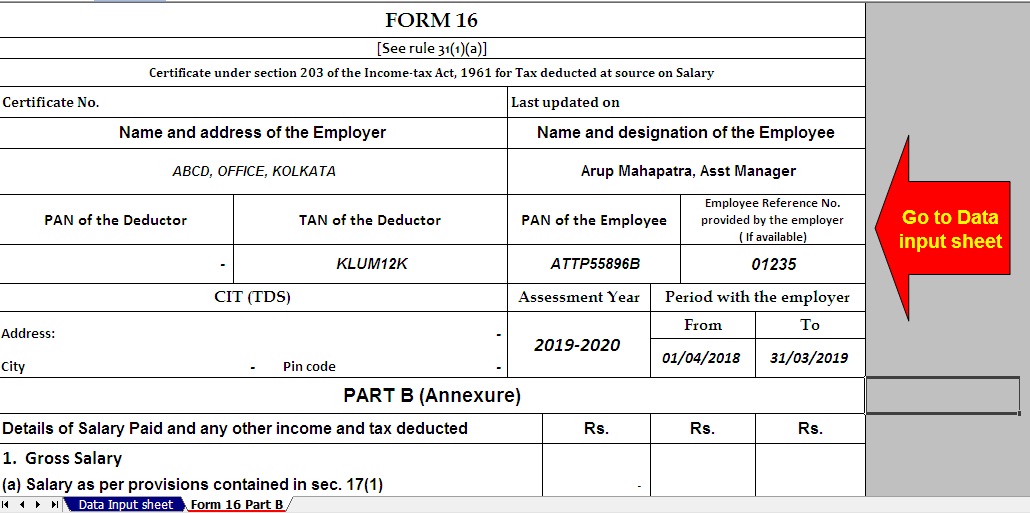

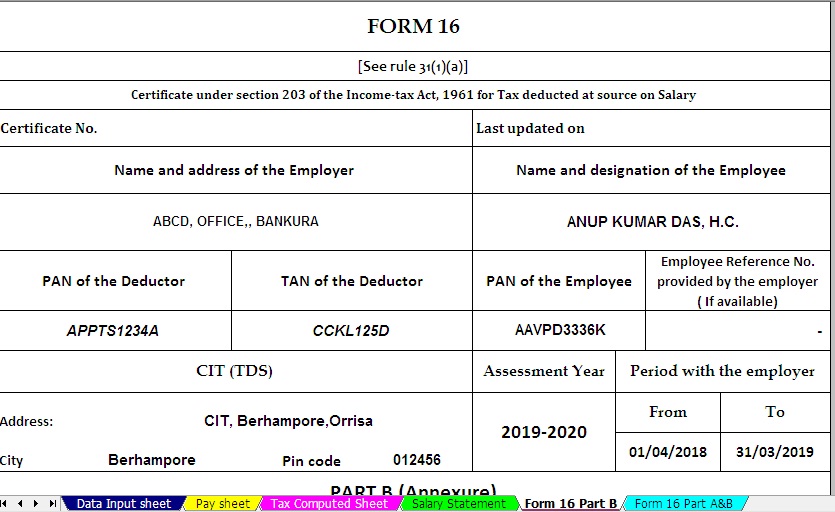

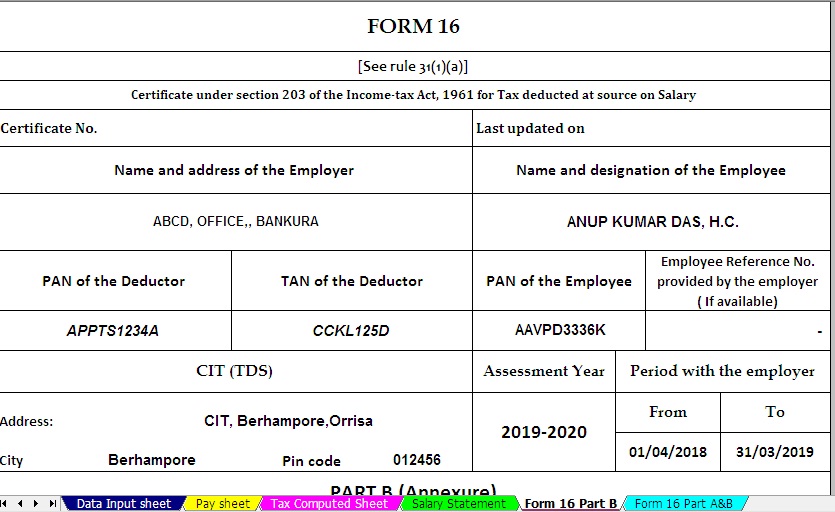

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

Web Section 24 Under this section you are allowed to enjoy tax benefits on the interest amount and up to Rs 2 lakhs

Web 5 f 233 vr 2023 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan

After we've peaked your interest in Income Tax Rebate On Home Loan Section 24 and other printables, let's discover where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Income Tax Rebate On Home Loan Section 24 designed for a variety objectives.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing including flashcards, learning tools.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Income Tax Rebate On Home Loan Section 24

Here are some fresh ways that you can make use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home (or in the learning environment).

3. Event Planning

- Invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate On Home Loan Section 24 are a treasure trove of useful and creative resources for a variety of needs and pursuits. Their access and versatility makes them a wonderful addition to both professional and personal life. Explore the endless world of Income Tax Rebate On Home Loan Section 24 today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes, they are! You can print and download these materials for free.

-

Can I use the free printouts for commercial usage?

- It is contingent on the specific conditions of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables might have limitations regarding usage. Make sure to read these terms and conditions as set out by the designer.

-

How do I print Income Tax Rebate On Home Loan Section 24?

- Print them at home with an printer, or go to an in-store print shop to get more high-quality prints.

-

What program do I require to view printables free of charge?

- Many printables are offered in PDF format. These can be opened using free software like Adobe Reader.

How Housing Loan Tax Benefit

How Section 24 Of Income Tax Act Makes Your Income Tax Free

Check more sample of Income Tax Rebate On Home Loan Section 24 below

Home Loan Tax Benefits Section 24 80EE 80C 10 Less Known Facts

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Taken Home Loan Must Read This Article On Section 24 For Huge Tax

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

All About Home Loan Income Tax Benefits Qualcon Dreams

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh on home loan interest paid This deduction is applicable in case of

Web 11 janv 2023 nbsp 0183 32 Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2

Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh on home loan interest paid This deduction is applicable in case of

Taken Home Loan Must Read This Article On Section 24 For Huge Tax

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

All About Home Loan Income Tax Benefits Qualcon Dreams

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Section 24 Of Income Tax Act Types Deductions Exceptions And How To

Section 24 Of Income Tax Act Types Deductions Exceptions And How To

Tax Benefit For Interest On Home Loan Under Income Tax Section 24