In this day and age where screens have become the dominant feature of our lives and the appeal of physical printed materials isn't diminishing. It doesn't matter if it's for educational reasons project ideas, artistic or simply to add an individual touch to the space, Income Tax Rebate On Home Loan Principal Amount are now an essential resource. For this piece, we'll take a dive deep into the realm of "Income Tax Rebate On Home Loan Principal Amount," exploring what they are, where you can find them, and ways they can help you improve many aspects of your daily life.

Get Latest Income Tax Rebate On Home Loan Principal Amount Below

Income Tax Rebate On Home Loan Principal Amount

Income Tax Rebate On Home Loan Principal Amount - Income Tax Rebate On Home Loan Principal Amount, Tax Exemption On Home Loan Principal Amount, Income Tax Rebate On Home Loan Rules, Section 80c Tax Benefit On Home Loan (principal Amount), Is Principal Amount Of Home Loan Tax Deductible, Maximum Tax Rebate On Home Loan

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Web 9 f 233 vr 2018 nbsp 0183 32 For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home

Income Tax Rebate On Home Loan Principal Amount provide a diverse collection of printable items that are available online at no cost. They come in many formats, such as worksheets, templates, coloring pages and many more. One of the advantages of Income Tax Rebate On Home Loan Principal Amount lies in their versatility and accessibility.

More of Income Tax Rebate On Home Loan Principal Amount

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Web 25 mars 2016 nbsp 0183 32 What should be the Principle amount that I show on Housing Loan Is it Rs 1 12 422 81 Full FY 2017 18 Or is it for the

Web 31 mai 2022 nbsp 0183 32 The following are the various tax exemptions on home loans available in India 1 Section 80C Tax Deduction On Principal Amount It allows you to claim a

Income Tax Rebate On Home Loan Principal Amount have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Customization: There is the possibility of tailoring printables to fit your particular needs be it designing invitations and schedules, or decorating your home.

-

Educational Worth: Downloads of educational content for free cater to learners of all ages. This makes them a valuable aid for parents as well as educators.

-

It's easy: immediate access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Income Tax Rebate On Home Loan Principal Amount

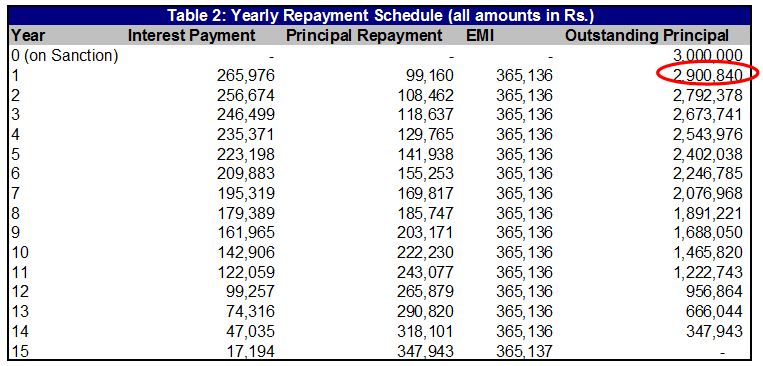

Home Loan Repayment Schedule

Home Loan Repayment Schedule

Web 28 janv 2014 nbsp 0183 32 As per the law I can get tax benefits on principle up to 1L rs and interest 2 5L for first 2 years then 1 5L if first loan and loan amount lt 25L I am starting my

Web Tax saving on home loan increases the affordability of your home loan With the help of a home loan tax benefit calculator you can find out your exact tax exemption My Annual

Now that we've piqued your interest in Income Tax Rebate On Home Loan Principal Amount We'll take a look around to see where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Income Tax Rebate On Home Loan Principal Amount for various applications.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning tools.

- This is a great resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad range of topics, ranging from DIY projects to planning a party.

Maximizing Income Tax Rebate On Home Loan Principal Amount

Here are some ideas of making the most use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Rebate On Home Loan Principal Amount are an abundance of innovative and useful resources for a variety of needs and needs and. Their availability and versatility make them a wonderful addition to every aspect of your life, both professional and personal. Explore the vast collection of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate On Home Loan Principal Amount truly completely free?

- Yes they are! You can download and print these documents for free.

-

Does it allow me to use free printables for commercial use?

- It's determined by the specific usage guidelines. Always check the creator's guidelines before using any printables on commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may have restrictions in use. Make sure you read the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- Print them at home using either a printer at home or in a local print shop for the highest quality prints.

-

What program do I need to run printables at no cost?

- Most printables come with PDF formats, which is open with no cost software, such as Adobe Reader.

Loan Principal Definition Deltapart

Home Loan EMI Calculator 2023 Free Excel Sheet Stable Investor

Check more sample of Income Tax Rebate On Home Loan Principal Amount below

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Home Loan Repayment Template Home Loan Calculator Home Etsy

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Home Loan Tax Benefits How Much Do You Really Get Stable Investor

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://blog.bankbazaar.com/home-loan-tax-…

Web 9 f 233 vr 2018 nbsp 0183 32 For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This

Web 9 f 233 vr 2018 nbsp 0183 32 For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home

Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Home Loan Tax Benefits How Much Do You Really Get Stable Investor

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

INCOME TAX REBATE ON HOME LOAN

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh