In a world in which screens are the norm and the appeal of physical, printed materials hasn't diminished. For educational purposes project ideas, artistic or just adding a personal touch to your home, printables for free are now an essential source. For this piece, we'll take a dive deeper into "Income Tax Rebate On Education Loan In India," exploring the different types of printables, where to get them, as well as how they can improve various aspects of your life.

Get Latest Income Tax Rebate On Education Loan In India Below

Income Tax Rebate On Education Loan In India

Income Tax Rebate On Education Loan In India - Income Tax Rebate On Education Loan In India, Tax Benefit On Education Loan In India, Does Education Loan Comes Under 80c, Can I Get Tax Benefit On Education Loan, Income Tax Relief For Education Loan

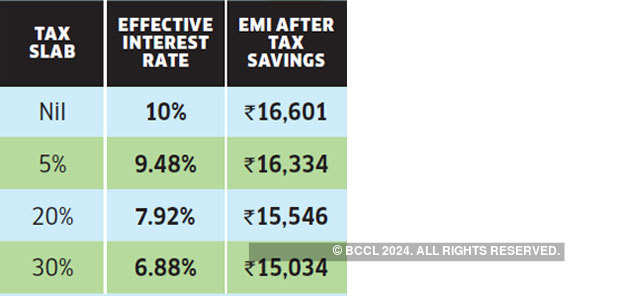

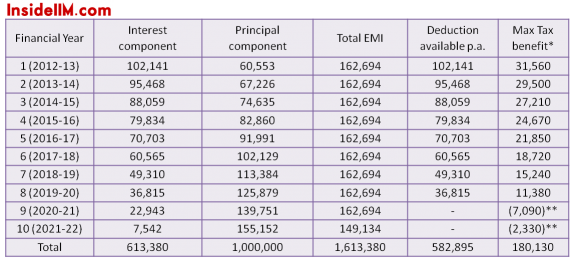

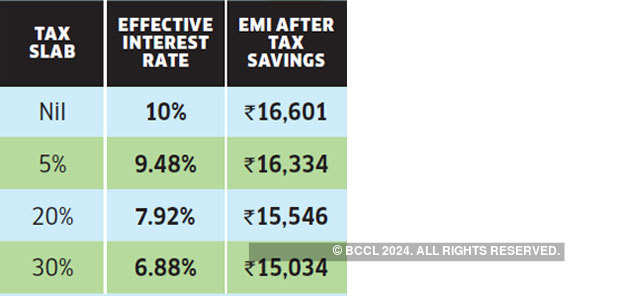

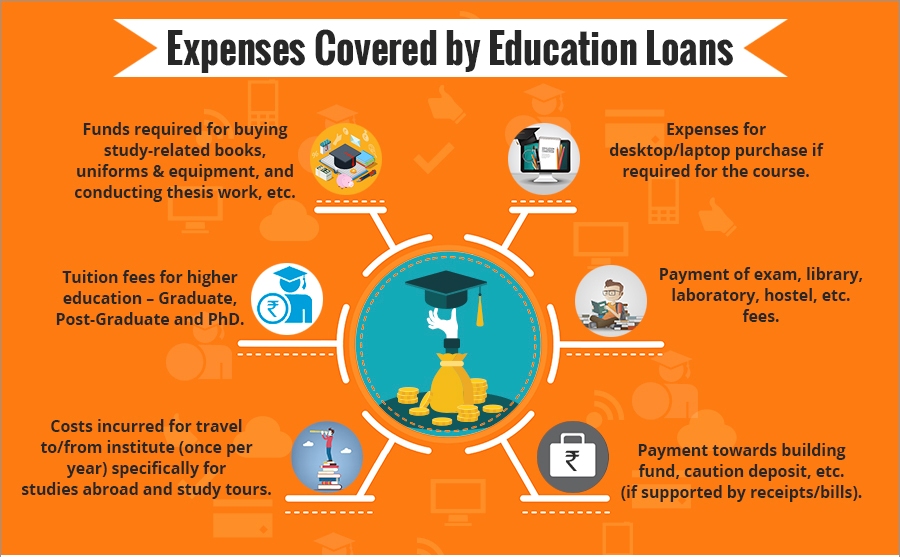

Web 25 ao 251 t 2022 nbsp 0183 32 Apart from funding your higher education costs an education loan offers excellent tax benefits No matter if you are a student or a parent you can reduce your

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

Income Tax Rebate On Education Loan In India encompass a wide collection of printable documents that can be downloaded online at no cost. These printables come in different forms, including worksheets, templates, coloring pages, and much more. The beauty of Income Tax Rebate On Education Loan In India is in their versatility and accessibility.

More of Income Tax Rebate On Education Loan In India

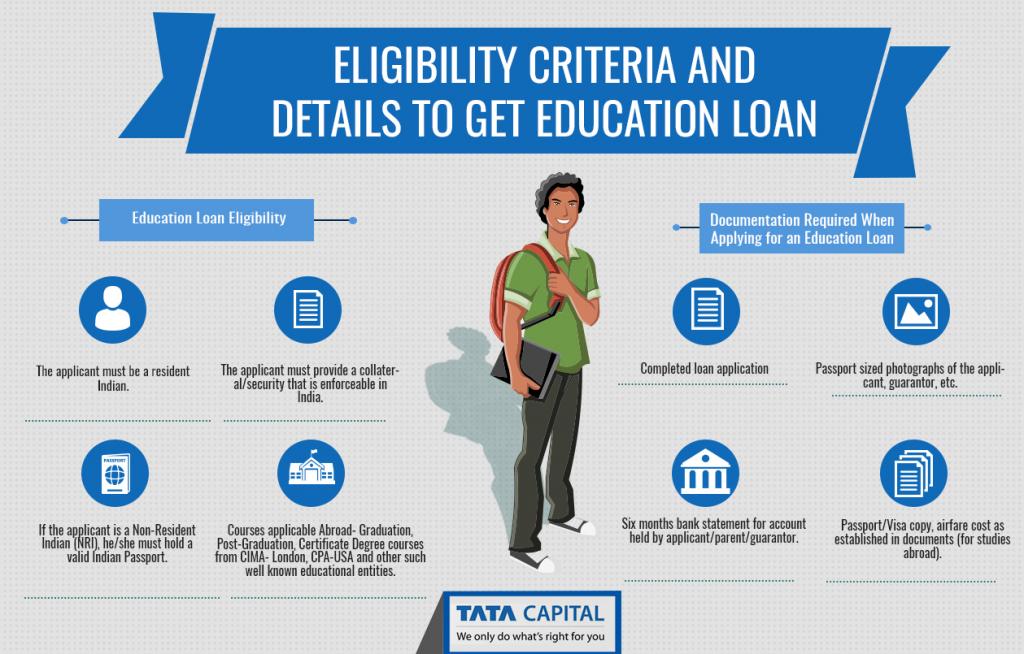

Income Tax Deduction On Education Loan 80E CAGMC

Income Tax Deduction On Education Loan 80E CAGMC

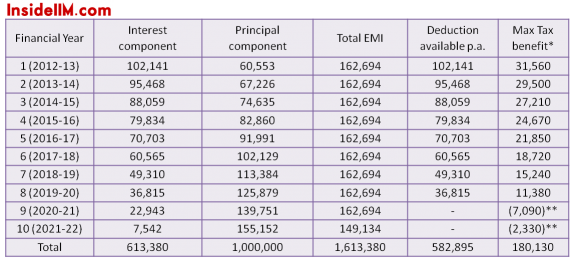

Web 16 f 233 vr 2021 nbsp 0183 32 The Income Tax Act sets no maximum limits on the tax benefits However students can only obtain tax benefits from the interest paid on the education loan

Web 5 avr 2023 nbsp 0183 32 In a financial year individuals can claim a maximum deduction of Rs 1 5 lakh for payments made towards tuition fees along with deductions for items such as

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization The Customization feature lets you tailor print-ready templates to your specific requirements such as designing invitations to organize your schedule or decorating your home.

-

Educational Worth: Education-related printables at no charge are designed to appeal to students of all ages, making them an invaluable tool for parents and teachers.

-

Affordability: You have instant access many designs and templates helps save time and effort.

Where to Find more Income Tax Rebate On Education Loan In India

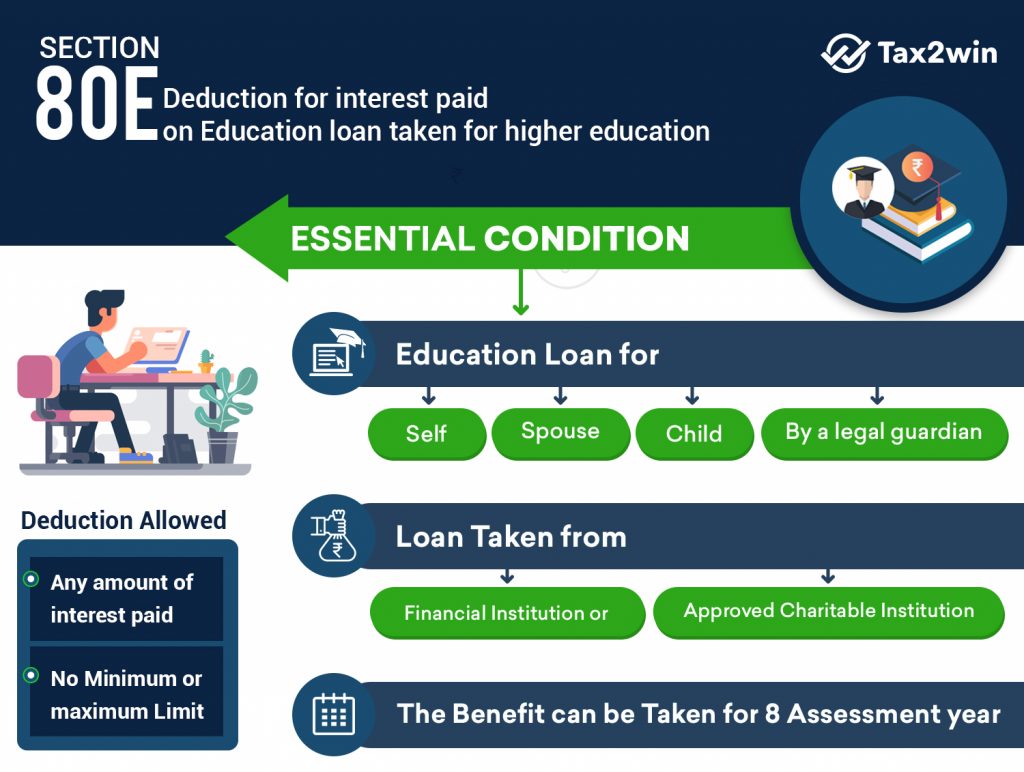

Section 80E Deduction For Interest On Education Loan Tax2win

Section 80E Deduction For Interest On Education Loan Tax2win

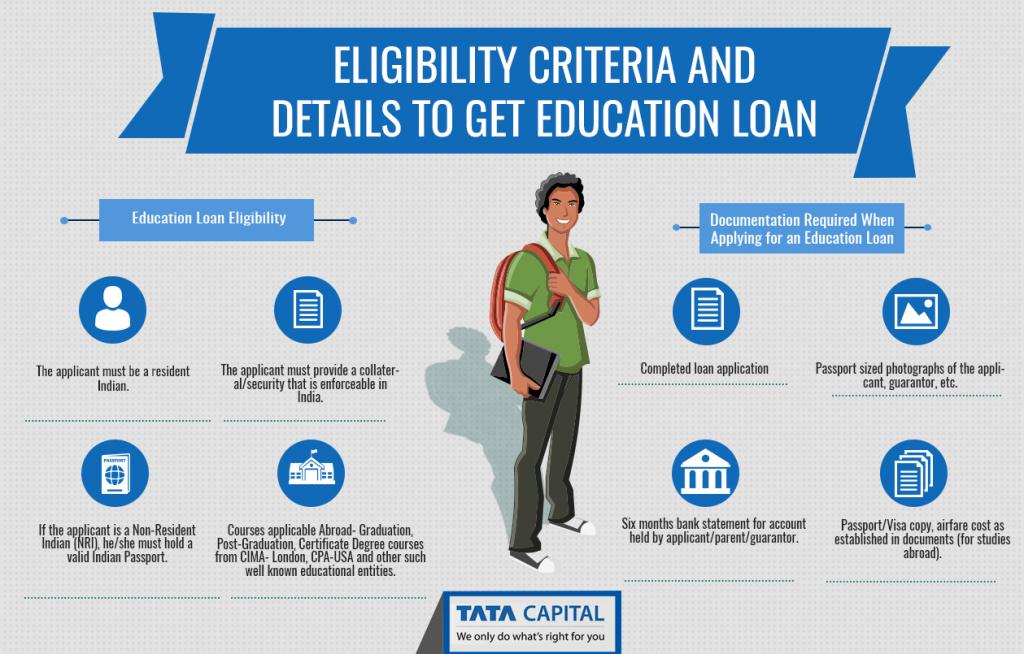

Web This article will cover all the education loan subsidy schemes in India Read the article till the end to gain a clear insight on the schemes features eligibility criteria etc Types of Education Loan Subsidy Schemes

Web If you intend to take a loan for pursuing higher studies in India or abroad you can claim a deduction under section 80E of the Income Tax Act 1961 which caters specifically to

Now that we've ignited your interest in printables for free We'll take a look around to see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection in Income Tax Rebate On Education Loan In India for different purposes.

- Explore categories like home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free, flashcards, and learning materials.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast selection of subjects, all the way from DIY projects to party planning.

Maximizing Income Tax Rebate On Education Loan In India

Here are some ways that you can make use use of Income Tax Rebate On Education Loan In India:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Utilize free printable worksheets for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Rebate On Education Loan In India are a treasure trove of fun and practical tools that satisfy a wide range of requirements and needs and. Their access and versatility makes them an essential part of every aspect of your life, both professional and personal. Explore the vast array of Income Tax Rebate On Education Loan In India today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes they are! You can print and download these materials for free.

-

Can I utilize free printables for commercial use?

- It's based on specific terms of use. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables could be restricted on usage. Be sure to check the terms and condition of use as provided by the author.

-

How can I print Income Tax Rebate On Education Loan In India?

- You can print them at home with the printer, or go to the local print shop for top quality prints.

-

What software must I use to open printables at no cost?

- The majority of printables are in the format PDF. This can be opened with free software such as Adobe Reader.

Education Rebate Income Tested

DEDUCTION UNDER SECTION 80C TO 80U PDF

Check more sample of Income Tax Rebate On Education Loan In India below

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

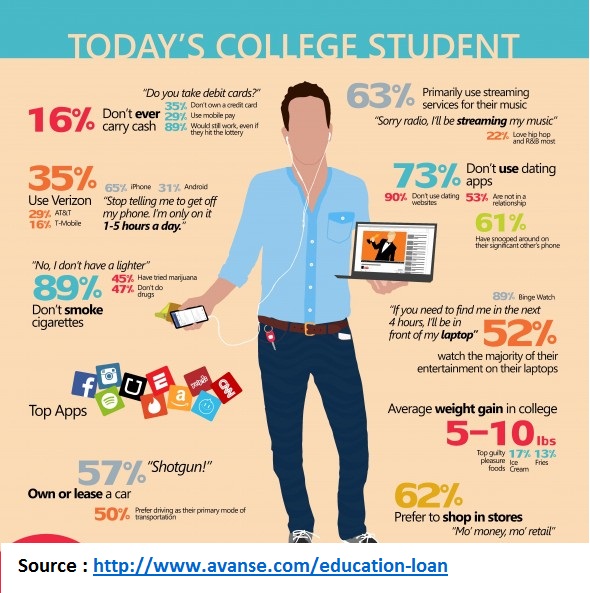

Today s College Student Education Loans In India

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

All You Need To Know About Tax Benefits On Education Loan Interest

Education Loan Tax Benefits How Education Loan Can Help Your Child

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

https://tax2win.in/guide/sec-80e-deduction-interest-on-education-loan

Web 28 juin 2019 nbsp 0183 32 Less Interest paid Deduction u s 80E Rs 1 00 000 Net Taxable Income Rs 5 00 000 The interest paid Rs 1 00 000 on education loan is deducted from the

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

Web 28 juin 2019 nbsp 0183 32 Less Interest paid Deduction u s 80E Rs 1 00 000 Net Taxable Income Rs 5 00 000 The interest paid Rs 1 00 000 on education loan is deducted from the

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Today s College Student Education Loans In India

All You Need To Know About Tax Benefits On Education Loan Interest

Education Loan Tax Benefits How Education Loan Can Help Your Child

Bank Of India Education Loan Interest Rate 2018 Loan Walls

PPT Education Loan In India PowerPoint Presentation Free Download

PPT Education Loan In India PowerPoint Presentation Free Download

Education Loan Jain Finance