In this day and age in which screens are the norm, the charm of tangible printed items hasn't gone away. For educational purposes or creative projects, or simply to add the personal touch to your home, printables for free are a great resource. We'll dive to the depths of "Income Tax Rebate On Donation To Charitable Trust," exploring what they are, where to find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Income Tax Rebate On Donation To Charitable Trust Below

Income Tax Rebate On Donation To Charitable Trust

Income Tax Rebate On Donation To Charitable Trust - Income Tax Rebate On Donation To Charitable Trust, Tax Benefit On Charity Donations India, Are Donations To A Charitable Trust Tax Deductible

Web 28 mars 2023 nbsp 0183 32 Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax

Web 1 mars 2021 nbsp 0183 32 Cash A trust s or estate s cash donations to charity can be deducted to the extent of the lesser of the taxable income for the year or the amount of the contribution

Income Tax Rebate On Donation To Charitable Trust provide a diverse range of downloadable, printable content that can be downloaded from the internet at no cost. The resources are offered in a variety designs, including worksheets coloring pages, templates and many more. The benefit of Income Tax Rebate On Donation To Charitable Trust is their versatility and accessibility.

More of Income Tax Rebate On Donation To Charitable Trust

Tax Rebate Digital Tax Filing Taxes Tax Services

Tax Rebate Digital Tax Filing Taxes Tax Services

Web 3 ao 251 t 2023 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

Web 23 juin 2023 nbsp 0183 32 Charitable Trusts A charitable trust de 173 scribed in Internal Revenue Code section 4947 a 1 is a trust that is not tax exempt all of the unexpired interests of

Income Tax Rebate On Donation To Charitable Trust have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Flexible: They can make printables to your specific needs whether it's making invitations or arranging your schedule or decorating your home.

-

Educational Value: These Income Tax Rebate On Donation To Charitable Trust can be used by students of all ages. This makes them an essential aid for parents as well as educators.

-

The convenience of Quick access to numerous designs and templates, which saves time as well as effort.

Where to Find more Income Tax Rebate On Donation To Charitable Trust

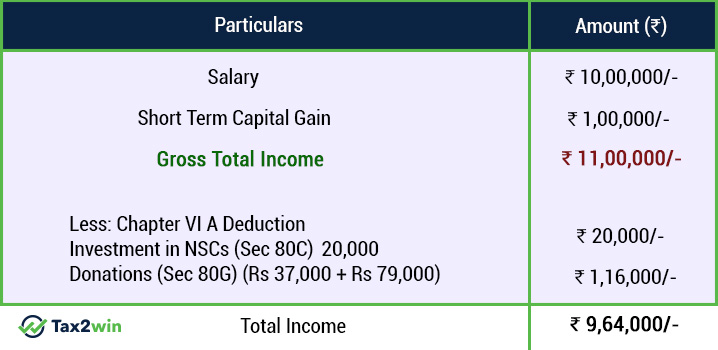

Chapter VI A 80G Deduction For Donation To Charitable Institution

Chapter VI A 80G Deduction For Donation To Charitable Institution

Web 28 juil 2023 nbsp 0183 32 Types of Charitable Remainder Trusts Taxes on Income Payments From a Charitable Remainder Trust Charitable Deductions for Contributions to a Charitable

Web C Donations U s 80G to the following are eligible for 100 Deduction subject to Qualifying Limit Donation to Government or any approved local authority institution or association

Since we've got your curiosity about Income Tax Rebate On Donation To Charitable Trust, let's explore where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Income Tax Rebate On Donation To Charitable Trust for various objectives.

- Explore categories like decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Perfect for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- The blogs are a vast selection of subjects, everything from DIY projects to party planning.

Maximizing Income Tax Rebate On Donation To Charitable Trust

Here are some creative ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate On Donation To Charitable Trust are a treasure trove of useful and creative resources that meet a variety of needs and passions. Their availability and versatility make these printables a useful addition to the professional and personal lives of both. Explore the endless world of Income Tax Rebate On Donation To Charitable Trust right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes you can! You can print and download the resources for free.

-

Are there any free printables in commercial projects?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues when you download Income Tax Rebate On Donation To Charitable Trust?

- Some printables may come with restrictions regarding their use. Always read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home with any printer or head to any local print store for more high-quality prints.

-

What program must I use to open printables at no cost?

- The majority of printed documents are as PDF files, which is open with no cost software such as Adobe Reader.

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Taxation Of Charitable Religious Trust

Check more sample of Income Tax Rebate On Donation To Charitable Trust below

Charitable Donation Receipt Template Template Business

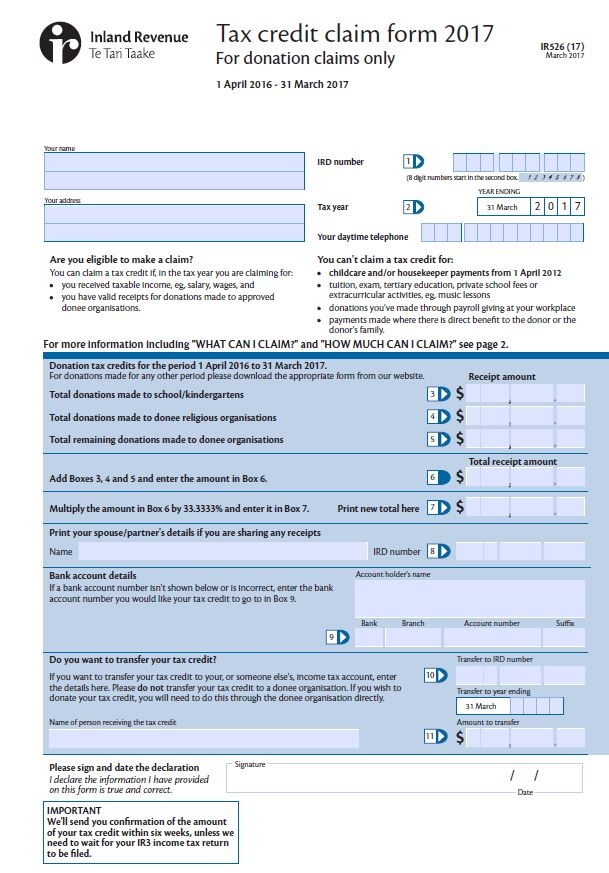

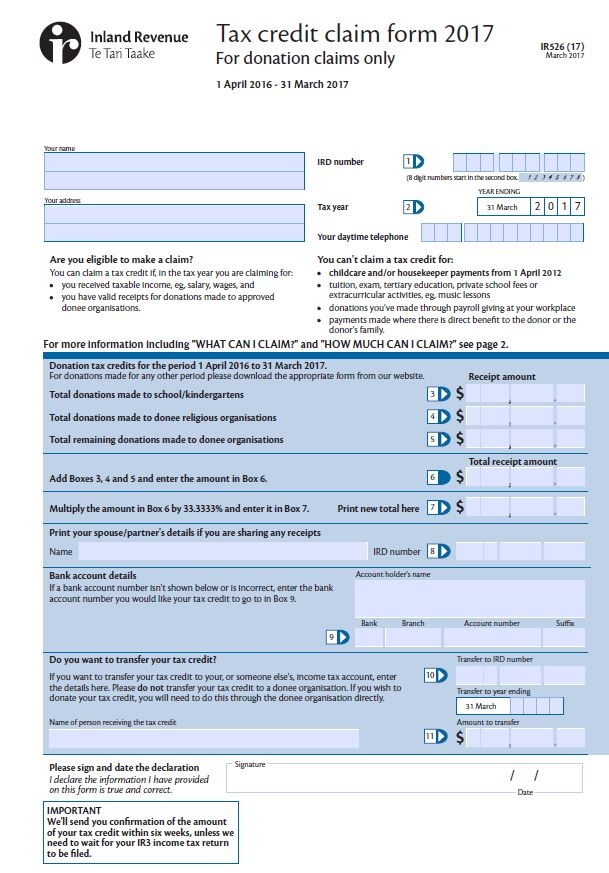

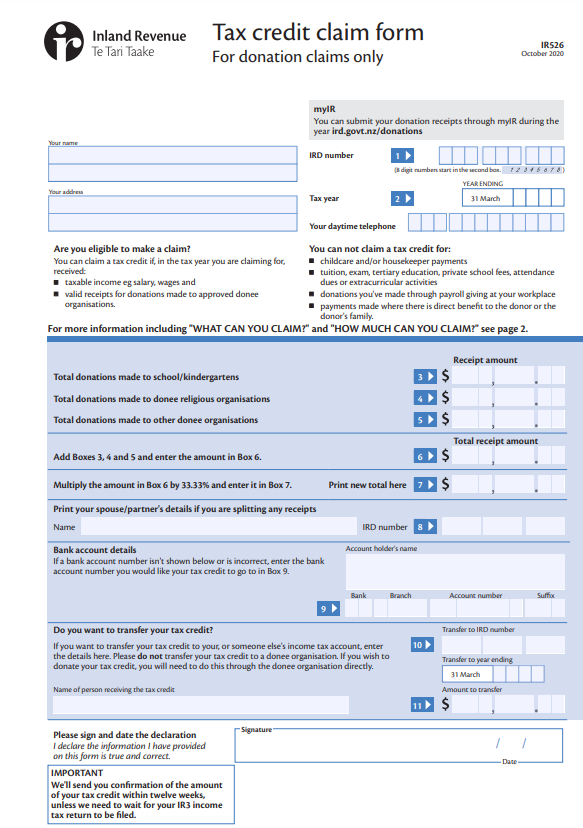

Emigrate Or Immigrate Ir526 Form

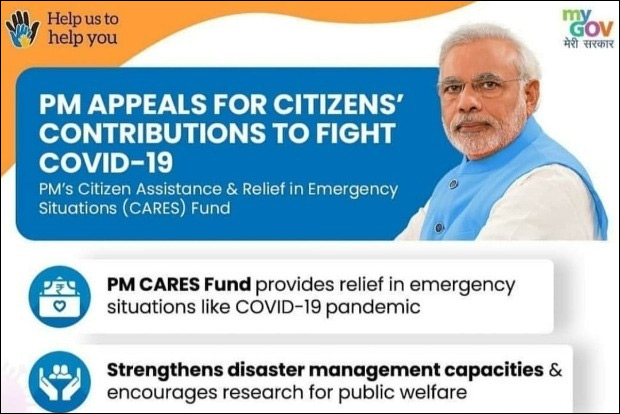

Pm Cares Fund Income Tax Rebate 2022 Carrebate

Sample Official Donation Receipts Canada ca Receipts Charitable

Explore Our Printable Furniture Donation Receipt Template Receipt

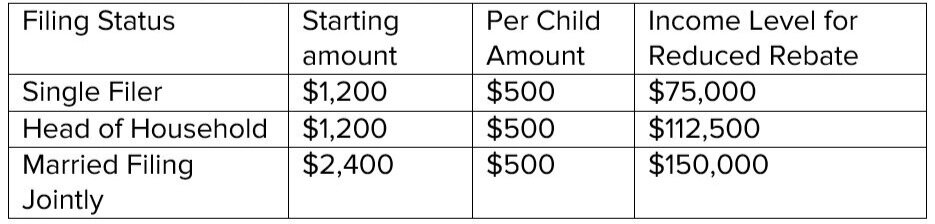

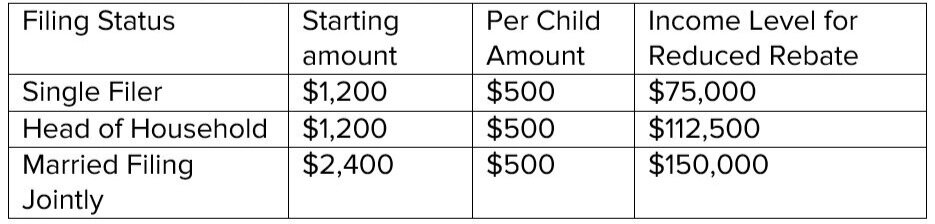

Individual Income Tax Rebate

https://www.thetaxadviser.com/issues/2021/mar/charitable-income-tax...

Web 1 mars 2021 nbsp 0183 32 Cash A trust s or estate s cash donations to charity can be deducted to the extent of the lesser of the taxable income for the year or the amount of the contribution

https://cleartax.in/s/charitable-trusts-ngo-income-tax-benefits

Web 27 avr 2018 nbsp 0183 32 As per 80G you can deduct your donations to Central and State Relief Funds NGOs and other charitable institutions from your total income to arrive at your

Web 1 mars 2021 nbsp 0183 32 Cash A trust s or estate s cash donations to charity can be deducted to the extent of the lesser of the taxable income for the year or the amount of the contribution

Web 27 avr 2018 nbsp 0183 32 As per 80G you can deduct your donations to Central and State Relief Funds NGOs and other charitable institutions from your total income to arrive at your

Sample Official Donation Receipts Canada ca Receipts Charitable

Emigrate Or Immigrate Ir526 Form

Explore Our Printable Furniture Donation Receipt Template Receipt

Individual Income Tax Rebate

Irs Rules For Church Donations Hobi Akuarium

CARES Act Q A About Recovery Rebates Student Loans Health Care

CARES Act Q A About Recovery Rebates Student Loans Health Care

Donate Your Tax Return To UNICEF NZ