In a world in which screens are the norm but the value of tangible printed objects hasn't waned. No matter whether it's for educational uses in creative or artistic projects, or simply adding some personal flair to your area, Income Tax Rebate On Child Education Loan are now an essential source. We'll take a dive deep into the realm of "Income Tax Rebate On Child Education Loan," exploring what they are, how they are available, and how they can be used to enhance different aspects of your life.

Get Latest Income Tax Rebate On Child Education Loan Below

Income Tax Rebate On Child Education Loan

Income Tax Rebate On Child Education Loan - Income Tax Rebate On Child Education Loan, Tax Benefit On Child Education Loan, Can I Get Tax Benefit On Education Loan, Income Tax Benefit On Child Education, Income Tax Relief For Education Loan, Does Education Loan Comes Under 80c

Web 31 mai 2023 nbsp 0183 32 Interest paid on education loans taken for higher studies of self spouse or children including for whom you are the legal guardian can be claimed as a deduction

Web 30 mars 2023 nbsp 0183 32 Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A

Income Tax Rebate On Child Education Loan include a broad range of downloadable, printable documents that can be downloaded online at no cost. These resources come in various forms, including worksheets, templates, coloring pages and much more. One of the advantages of Income Tax Rebate On Child Education Loan is their versatility and accessibility.

More of Income Tax Rebate On Child Education Loan

2022 Child Tax Rebate Stratford Crier

2022 Child Tax Rebate Stratford Crier

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is

Web 5 avr 2023 nbsp 0183 32 The tax benefits offered on children s education are as follows Childrens Education Allowance Hostel Expenditure Allowance Tax deduction on tuition fees

Income Tax Rebate On Child Education Loan have risen to immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization This allows you to modify printing templates to your own specific requirements whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational value: Downloads of educational content for free cater to learners of all ages, making them a vital tool for parents and teachers.

-

Accessibility: instant access many designs and templates saves time and effort.

Where to Find more Income Tax Rebate On Child Education Loan

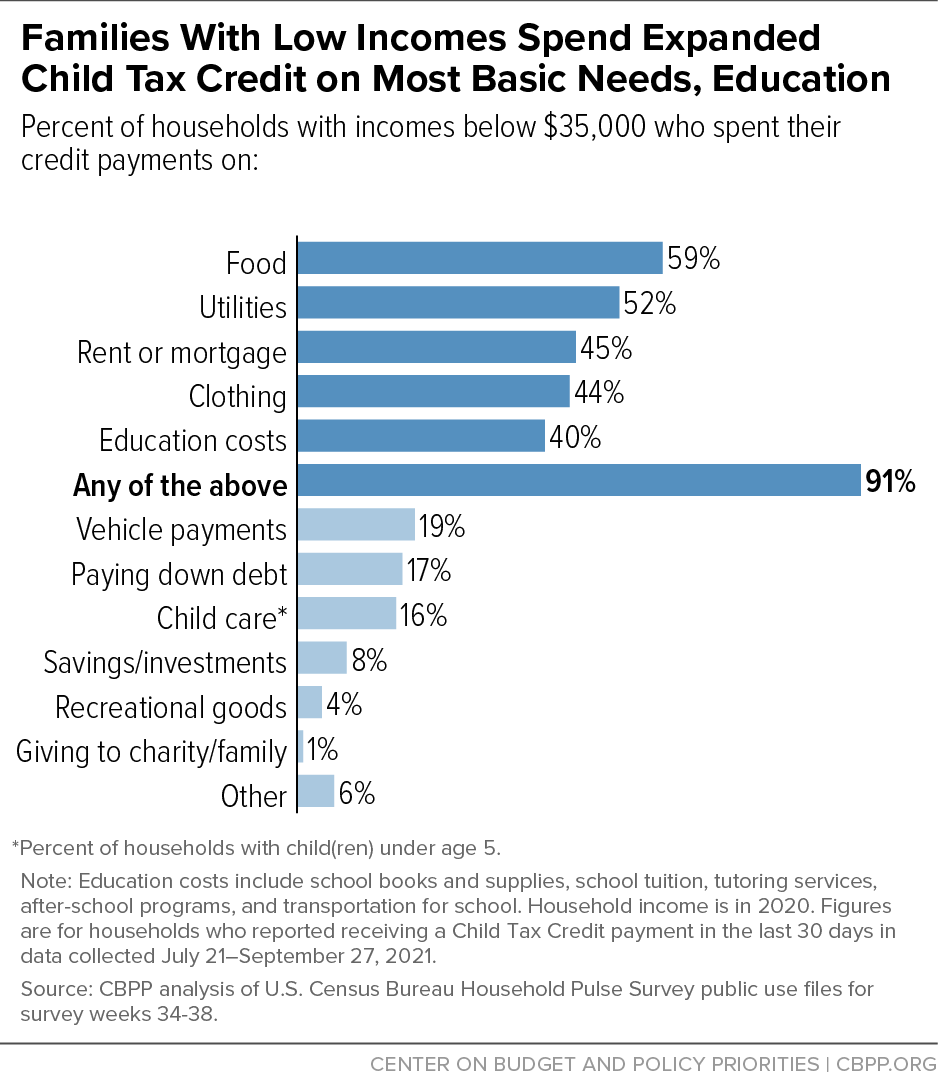

9 In 10 Families With Low Incomes Are Using Child Tax Credits To Pay

9 In 10 Families With Low Incomes Are Using Child Tax Credits To Pay

Web 23 f 233 vr 2018 nbsp 0183 32 3 The income tax deduction on education loan is only available for up to eight years or until the payment of interest in full whichever is earlier For example if you

Web 16 oct 2020 nbsp 0183 32 You can claim tax deductions on education loans as tuition fees paid to any college university or other educational institution under Section 80E of the Income Tax Act You can take education loan tax

Since we've got your curiosity about Income Tax Rebate On Child Education Loan Let's see where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Income Tax Rebate On Child Education Loan for various needs.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free or flashcards as well as learning materials.

- The perfect resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- The blogs are a vast spectrum of interests, everything from DIY projects to planning a party.

Maximizing Income Tax Rebate On Child Education Loan

Here are some new ways in order to maximize the use of Income Tax Rebate On Child Education Loan:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Rebate On Child Education Loan are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and desires. Their accessibility and versatility make them an invaluable addition to both professional and personal life. Explore the many options of Income Tax Rebate On Child Education Loan to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate On Child Education Loan truly gratis?

- Yes they are! You can download and print these files for free.

-

Are there any free printouts for commercial usage?

- It's based on the conditions of use. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright problems with Income Tax Rebate On Child Education Loan?

- Certain printables could be restricted on use. Be sure to review these terms and conditions as set out by the designer.

-

How do I print Income Tax Rebate On Child Education Loan?

- You can print them at home using your printer or visit a local print shop to purchase top quality prints.

-

What software do I require to view printables at no cost?

- A majority of printed materials are in PDF format. These can be opened using free software like Adobe Reader.

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

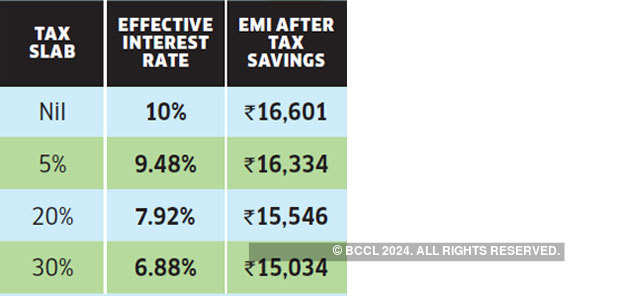

Education Loan Tax Benefits How Education Loan Can Help Your Child

Check more sample of Income Tax Rebate On Child Education Loan below

Here s How You Calculate Your Adjusted Gross Income AGI

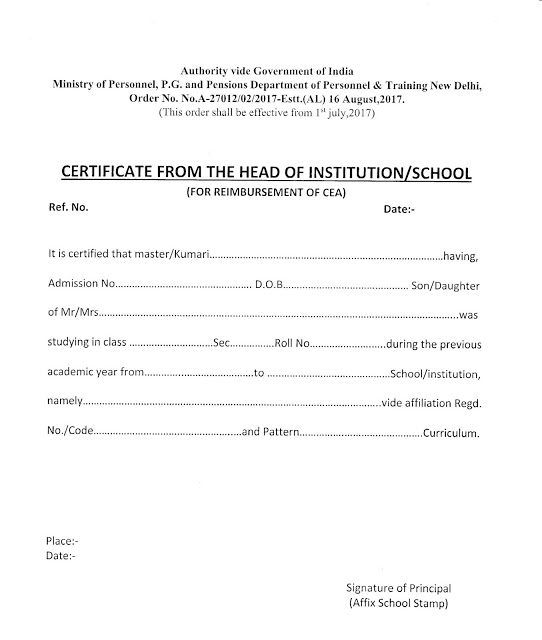

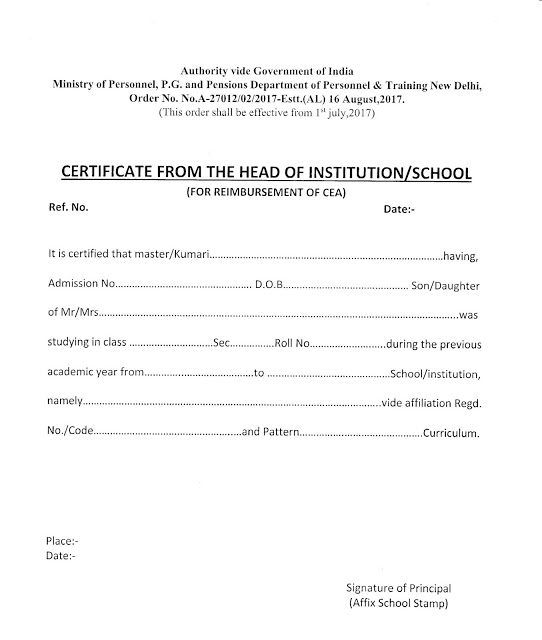

Children Education Allowance CEA Approved Format CEA

Section 87A Tax Rebate Under Section 87A

Education Rebate Income Tested

What Does Rebate Lost Mean On Student Loans

Child Care Rebate Income Tax Return 2022 Carrebate

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A

https://www.irs.gov/publications/p970

Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you

Web 30 mars 2023 nbsp 0183 32 Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A

Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you

Education Rebate Income Tested

Children Education Allowance CEA Approved Format CEA

What Does Rebate Lost Mean On Student Loans

Child Care Rebate Income Tax Return 2022 Carrebate

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

DEDUCTION UNDER SECTION 80C TO 80U PDF

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax Rebate Under Section 87A