In this digital age, where screens dominate our lives and the appeal of physical printed products hasn't decreased. If it's to aid in education project ideas, artistic or simply adding a personal touch to your area, Income Tax Rebate On Agricultural Income have become an invaluable source. For this piece, we'll take a dive into the sphere of "Income Tax Rebate On Agricultural Income," exploring what they are, how to get them, as well as the ways that they can benefit different aspects of your lives.

Get Latest Income Tax Rebate On Agricultural Income Below

Income Tax Rebate On Agricultural Income

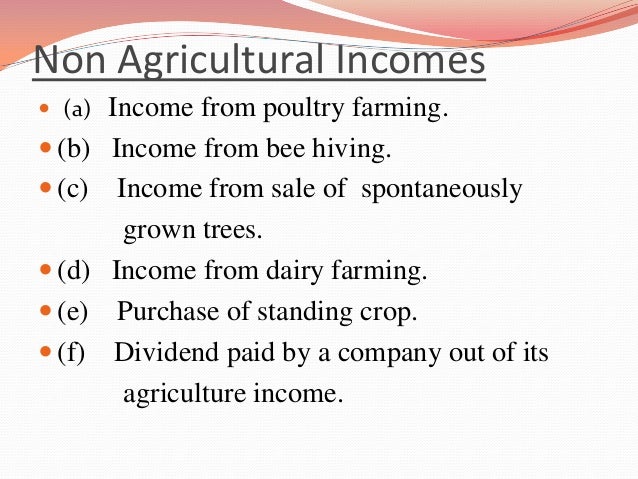

Income Tax Rebate On Agricultural Income - Income Tax Rebate On Agricultural Income, Income Tax Return Agricultural Income, Income Tax Exemption For Agriculture Income, Income Tax Return Filing For Agricultural Income, Tax Rebate On Agricultural Income, What Is Agricultural Income In Income Tax, What Is The Tax On Agricultural Income

Web When availing Rebate u s 87A is agricultural income included in the total income Quora

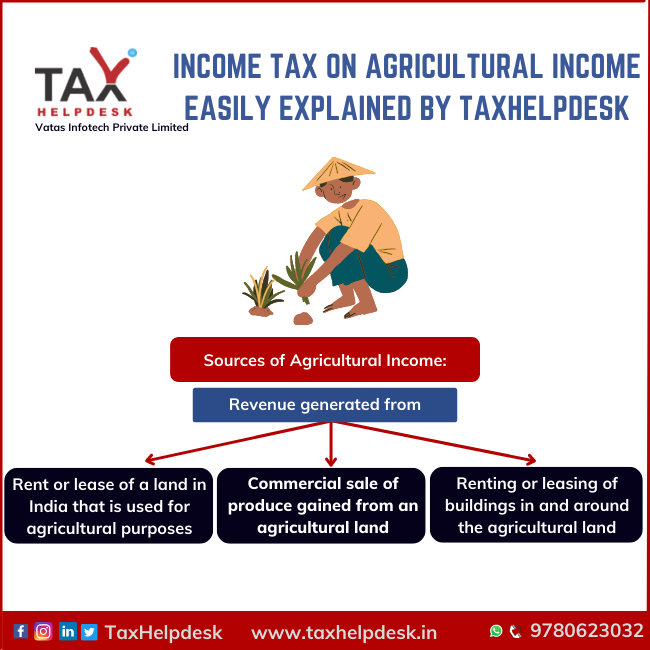

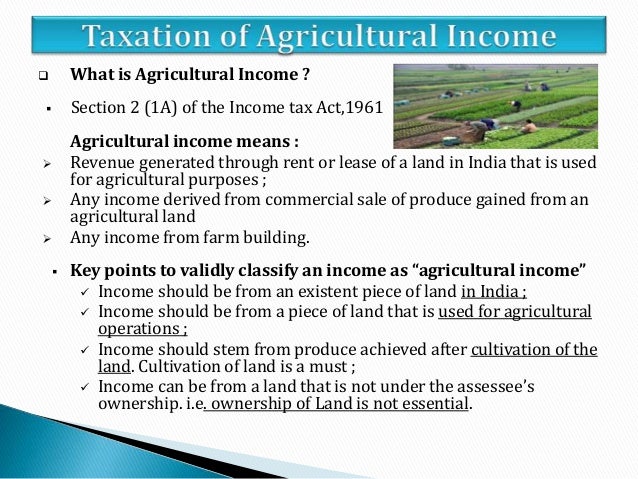

Web 31 juil 2019 nbsp 0183 32 In India agricultural income is treated differently from other types of income for tax purposes As per the Income Tax Act agricultural income is exempt from

Income Tax Rebate On Agricultural Income provide a diverse range of downloadable, printable documents that can be downloaded online at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages, and much more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Income Tax Rebate On Agricultural Income

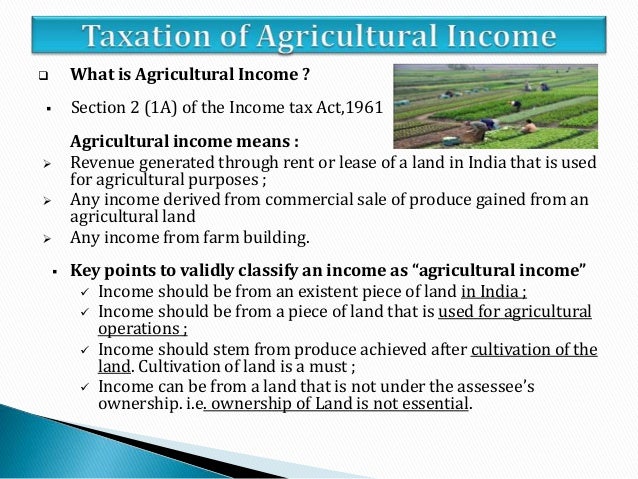

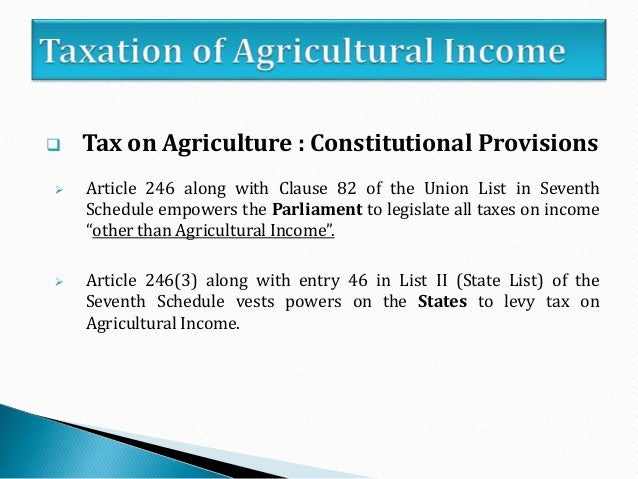

Taxation Of Agricultural Income

Taxation Of Agricultural Income

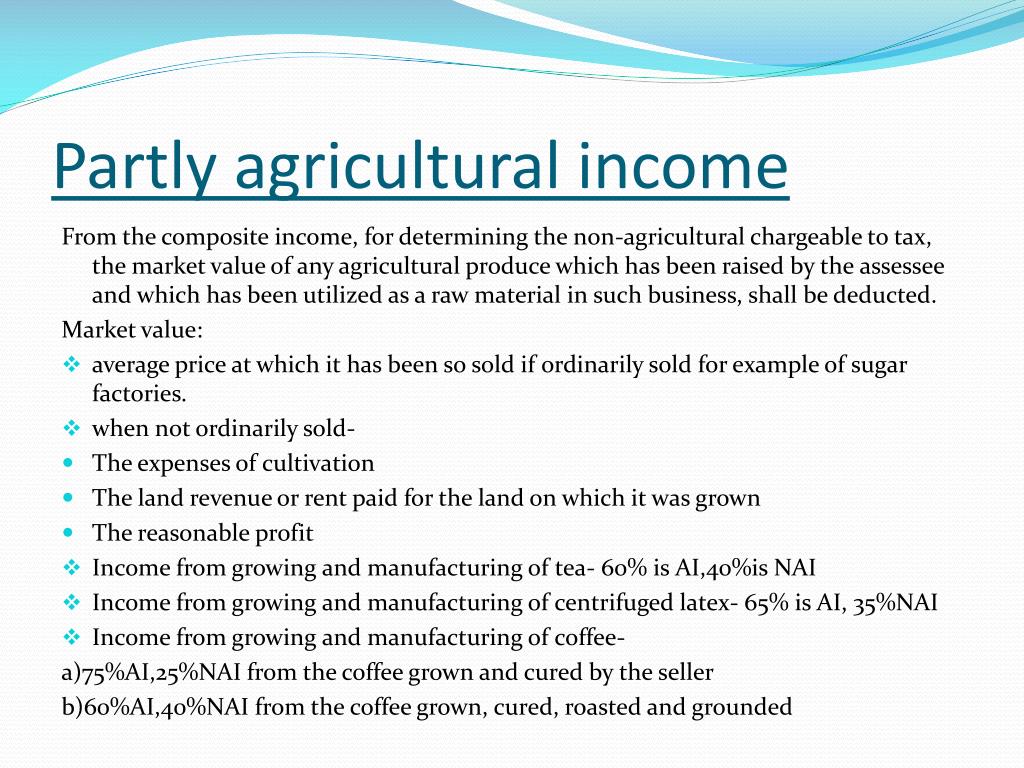

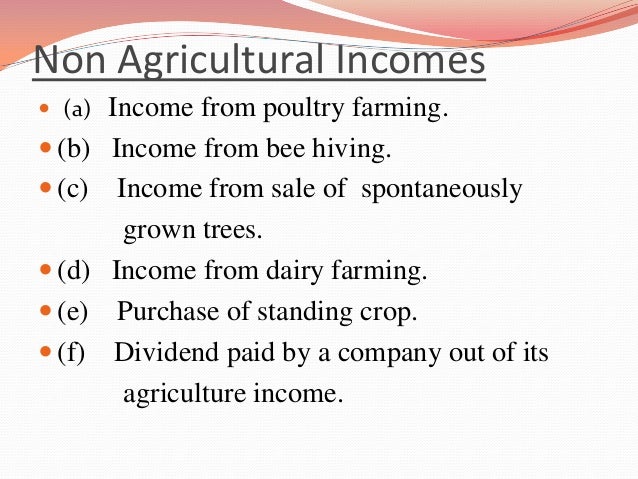

Web Section 10 1 of the Income tax Act 1961 exempts agricultural income from income tax ii any income derived from such land by agriculture or from processing of agricultural

Web 17 janv 2016 nbsp 0183 32 The tax on total income including agricultural income is Tax on Rs 6 25 000 50 000 The tax on agricultural income including basic tax slab is i e

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: Your HTML0 customization options allow you to customize print-ready templates to your specific requirements in designing invitations to organize your schedule or decorating your home.

-

Educational Value Education-related printables at no charge are designed to appeal to students of all ages, making them a useful tool for parents and teachers.

-

Convenience: Fast access numerous designs and templates cuts down on time and efforts.

Where to Find more Income Tax Rebate On Agricultural Income

When Availing Rebate U s 87A Is Agricultural Income Included In The

When Availing Rebate U s 87A Is Agricultural Income Included In The

Web 31 ao 251 t 2018 nbsp 0183 32 Income Including Agricultural Income 7 00 000 Tax on 7 00 000 52500 Less Rebate on Agricultural Income Tax on Rs 4 00 000 Rs 2 50 000 being basic

Web 20 juil 2023 nbsp 0183 32 Taxability on Agriculture Income A Y 2023 24 How to show agriculture income in ITR Rebate Agriculture Whatsapp No 7838268244 Only Paid Services

If we've already piqued your interest in Income Tax Rebate On Agricultural Income we'll explore the places the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Income Tax Rebate On Agricultural Income for various reasons.

- Explore categories like home decor, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing Income Tax Rebate On Agricultural Income

Here are some innovative ways in order to maximize the use use of Income Tax Rebate On Agricultural Income:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Rebate On Agricultural Income are a treasure trove of practical and imaginative resources for a variety of needs and passions. Their accessibility and versatility make them an invaluable addition to both professional and personal lives. Explore the plethora of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can print and download the resources for free.

-

Can I use free templates for commercial use?

- It's based on specific rules of usage. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may have restrictions regarding their use. Be sure to check the terms and conditions provided by the author.

-

How do I print Income Tax Rebate On Agricultural Income?

- You can print them at home with either a printer or go to an area print shop for premium prints.

-

What software will I need to access printables for free?

- Most PDF-based printables are available with PDF formats, which can be opened using free software such as Adobe Reader.

Taxation Of Agricultural Income

Income Tax On Agriculture Income Easily Explained By TaxHelpdesk

Check more sample of Income Tax Rebate On Agricultural Income below

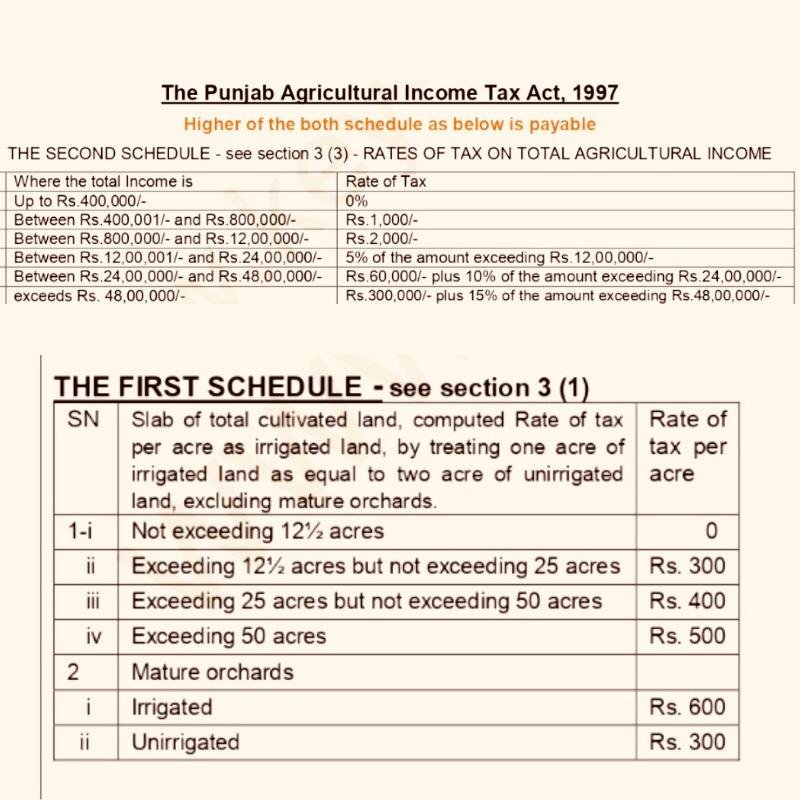

Tax On Agricultural Income In Pakistan Latest Tax Financial News

Agricultural Income In Indian Income Tax Act 1961

PPT AGRICULTURAL INCOME PowerPoint Presentation Free Download ID

How Is Agricultural Income Tax Calculated With Example Updated 2022

The Urgent Need To Tax Agricultural Income

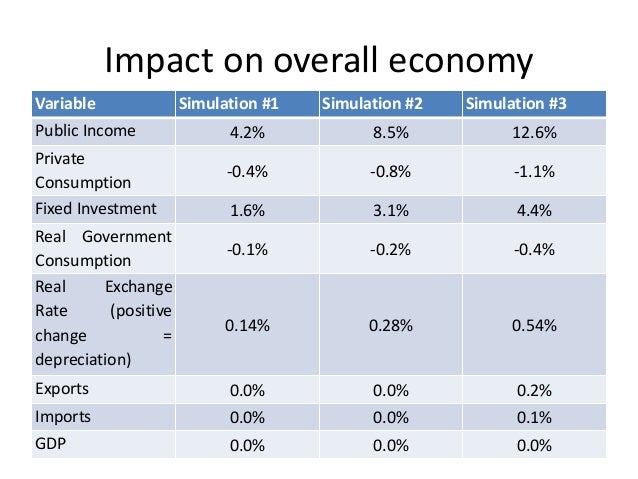

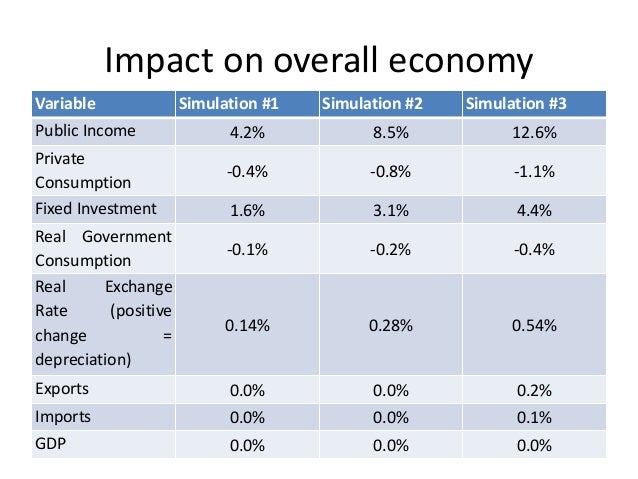

Economic Impact Of Agriculture Income Tax On Pakistan By Shehryar Ras

https://tax2win.in/guide/income-tax-agricultural-income

Web 31 juil 2019 nbsp 0183 32 In India agricultural income is treated differently from other types of income for tax purposes As per the Income Tax Act agricultural income is exempt from

https://taxguru.in/income-tax/calculate-tax-a…

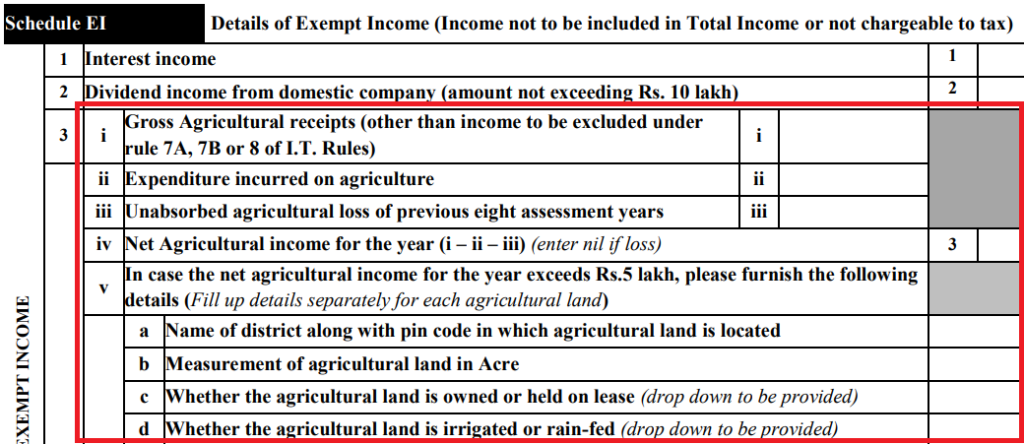

Web 18 mars 2020 nbsp 0183 32 Agricultural income is exempt from Income Tax under section 10 1 of the Income Tax Act 1961 However its included for rate purposes in computing the Income Tax Liability if following two

Web 31 juil 2019 nbsp 0183 32 In India agricultural income is treated differently from other types of income for tax purposes As per the Income Tax Act agricultural income is exempt from

Web 18 mars 2020 nbsp 0183 32 Agricultural income is exempt from Income Tax under section 10 1 of the Income Tax Act 1961 However its included for rate purposes in computing the Income Tax Liability if following two

How Is Agricultural Income Tax Calculated With Example Updated 2022

Agricultural Income In Indian Income Tax Act 1961

The Urgent Need To Tax Agricultural Income

Economic Impact Of Agriculture Income Tax On Pakistan By Shehryar Ras

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Should Government Tax Agricultural Income CoverNest Blog

Should Government Tax Agricultural Income CoverNest Blog

Key Changes In Income Tax Return ITR Forms For AY 2019 20