In the age of digital, where screens dominate our lives The appeal of tangible printed objects isn't diminished. Whatever the reason, whether for education project ideas, artistic or just adding an extra personal touch to your home, printables for free are now an essential resource. With this guide, you'll take a dive to the depths of "Income Tax Rebate For Central Government Employees," exploring the different types of printables, where they are, and how they can enrich various aspects of your daily life.

Get Latest Income Tax Rebate For Central Government Employees Below

Income Tax Rebate For Central Government Employees

Income Tax Rebate For Central Government Employees - Income Tax Rebate For Central Government Employees, Income Tax Return For Central Government Employees, Income Tax Deduction For Central Government Employees, Income Tax Exemption For Central Govt Employees, How To File Income Tax Return For Central Government Employees, Income Tax Deduction For Central Govt Employees, Income Tax Of Central Government Employees, Tax Benefits For Central Government Employees

Web 21 sept 2022 nbsp 0183 32 Recently the government announced that the contribution of employers in NPS for the central government would rise from 10 to 14 Additionally the

Web A retired employee above 60 years of age who is in receipt of pension income from his former employer can claim a deduction upto Rs 50 000 against such salary income Am

Printables for free cover a broad variety of printable, downloadable material that is available online at no cost. These resources come in various types, like worksheets, coloring pages, templates and much more. The beauty of Income Tax Rebate For Central Government Employees lies in their versatility as well as accessibility.

More of Income Tax Rebate For Central Government Employees

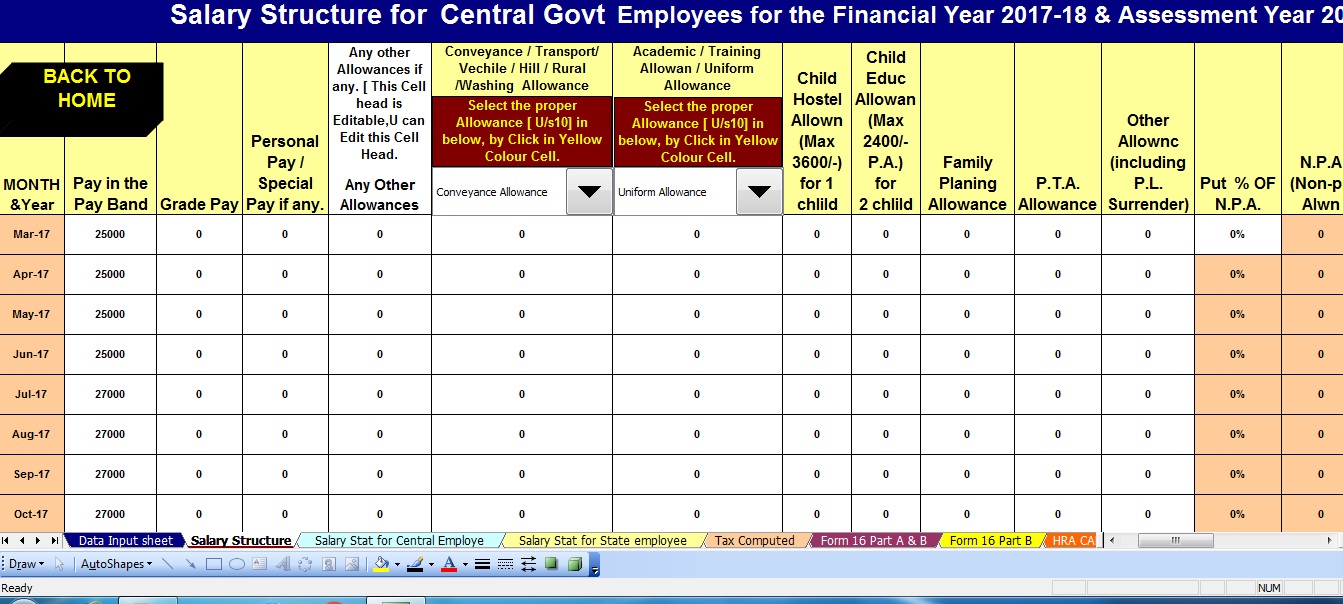

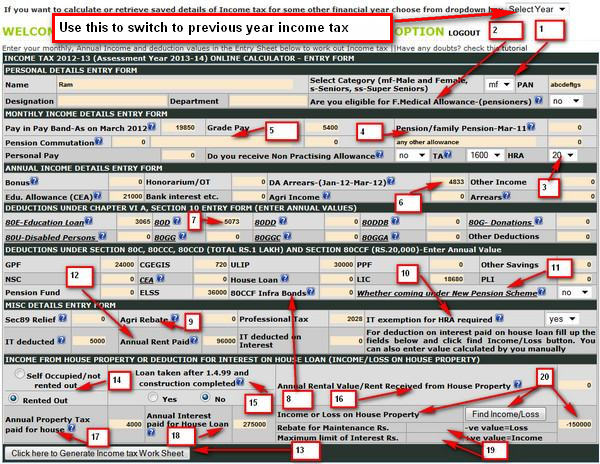

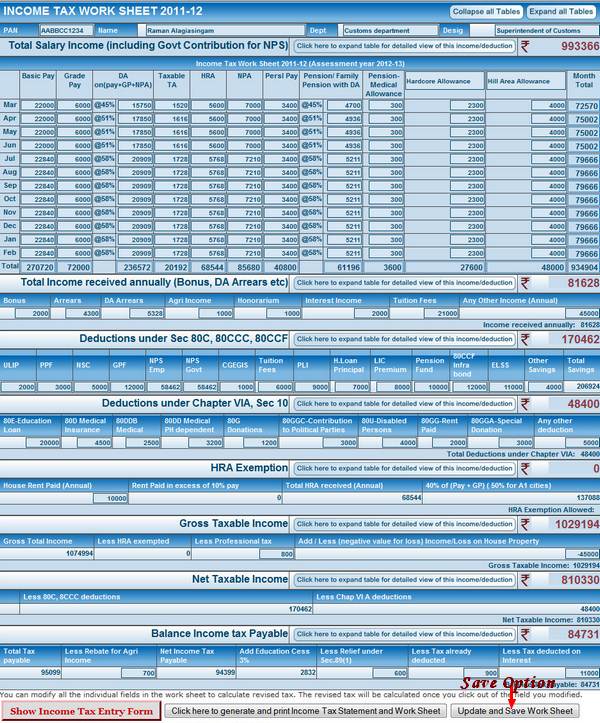

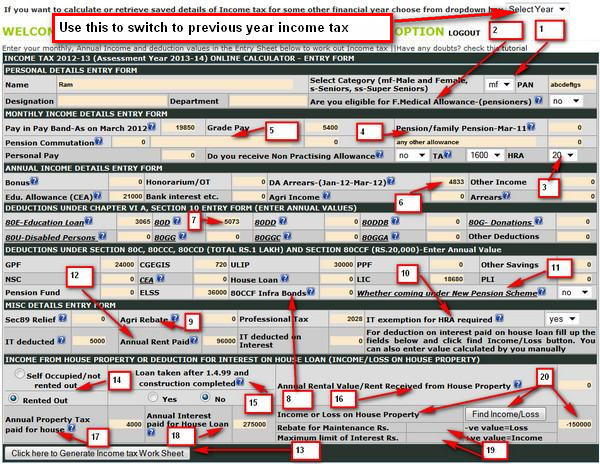

Income Tax Calculator 2012 13 For Central Government Employees

Income Tax Calculator 2012 13 For Central Government Employees

Web As per the Finance Act 2021 the rates of income tax for the FY 2021 22 i e Assessment Year 2022 23 are as follows Rates of tax A Normal Rates of tax In the case of every

Web rebate shall be 100 of income tax or Rs 12 500 whichever is less The Rates for Charging Income Tax for Financial Year 2020 21 i e AY 2021 22 Other than Senior

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: We can customize printables to your specific needs such as designing invitations and schedules, or decorating your home.

-

Educational value: Education-related printables at no charge provide for students of all ages, making them an invaluable tool for teachers and parents.

-

Easy to use: instant access a plethora of designs and templates, which saves time as well as effort.

Where to Find more Income Tax Rebate For Central Government Employees

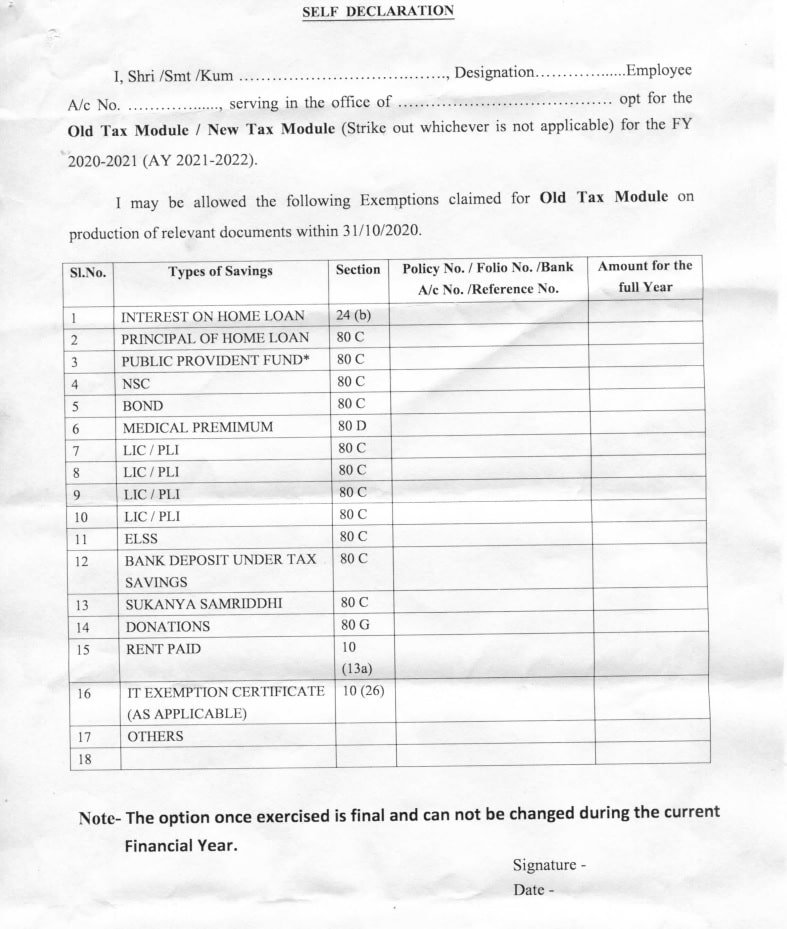

New Income Tax Regime Declaration Form 2020 21 PDF Download For

New Income Tax Regime Declaration Form 2020 21 PDF Download For

Web 1 f 233 vr 2022 nbsp 0183 32 Currently only central government employees are eligible to claim tax benefit of 14 The corporate surcharge will be reduced from 12 to 7 FM said Finance Minister Nirmala Sitharaman in

Web 1 f 233 vr 2022 nbsp 0183 32 The income tax slabs for the financial year 2022 23 remain the same The FM further announced that both the Central and state government employees tax

Now that we've piqued your curiosity about Income Tax Rebate For Central Government Employees Let's look into where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Income Tax Rebate For Central Government Employees to suit a variety of motives.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs covered cover a wide array of topics, ranging that range from DIY projects to planning a party.

Maximizing Income Tax Rebate For Central Government Employees

Here are some fresh ways of making the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Income Tax Rebate For Central Government Employees are an abundance with useful and creative ideas that can meet the needs of a variety of people and desires. Their availability and versatility make them a wonderful addition to your professional and personal life. Explore the many options of Income Tax Rebate For Central Government Employees and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes you can! You can print and download these files for free.

-

Can I use free printables for commercial use?

- It's based on the rules of usage. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables could be restricted concerning their use. Check the terms and conditions offered by the creator.

-

How do I print Income Tax Rebate For Central Government Employees?

- You can print them at home with either a printer or go to a local print shop for higher quality prints.

-

What software do I need to open printables free of charge?

- The majority of PDF documents are provided in PDF format. They can be opened using free software such as Adobe Reader.

Income Tax Calculator 2012 13 For Central Government Employees

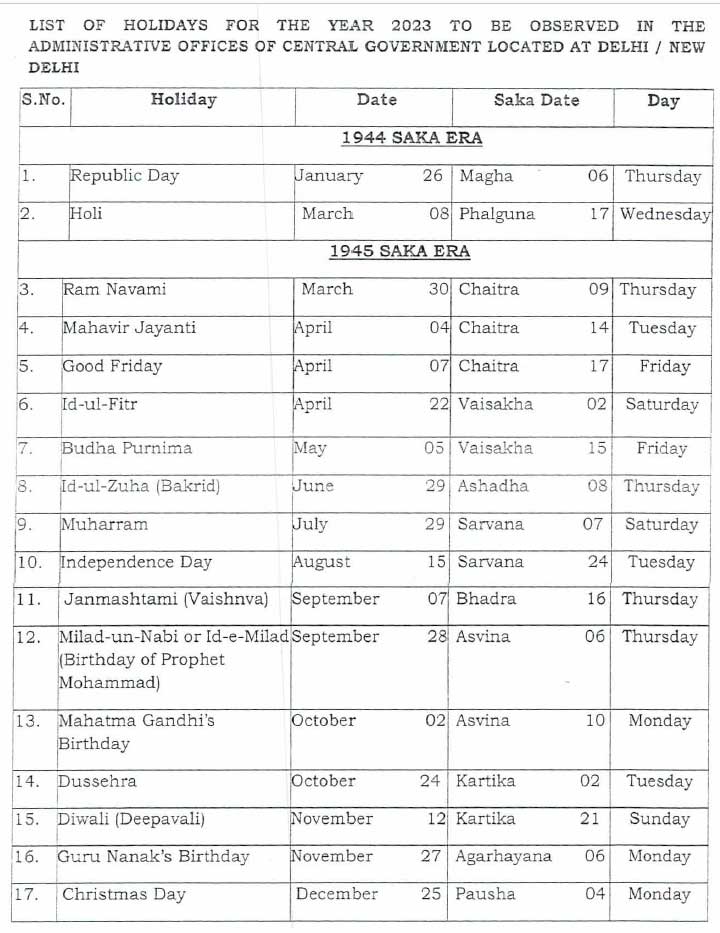

Central Government Offices Gazetted Holidays 2023 Central Government

Check more sample of Income Tax Rebate For Central Government Employees below

Interim Budget 2019 20 The Talk Of The Town Trade Brains

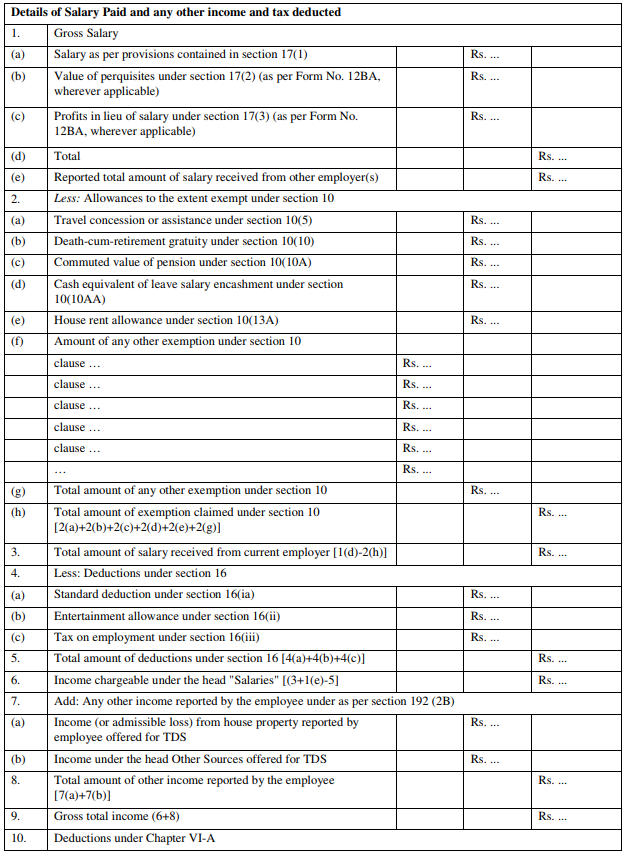

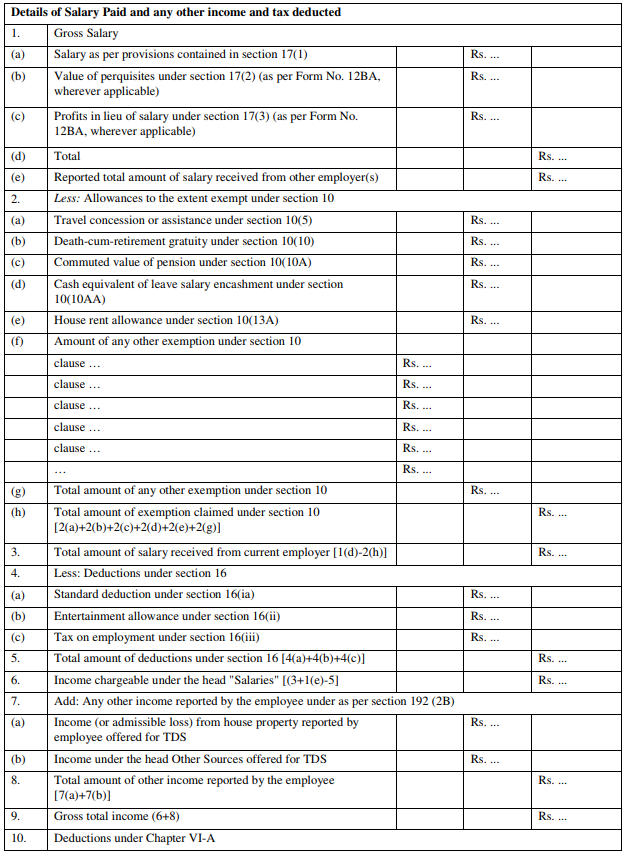

CBDT Notification 2019 Important Amendment In Form 16 Central

Malaysia Personal Income Tax Guide 2020 YA 2019

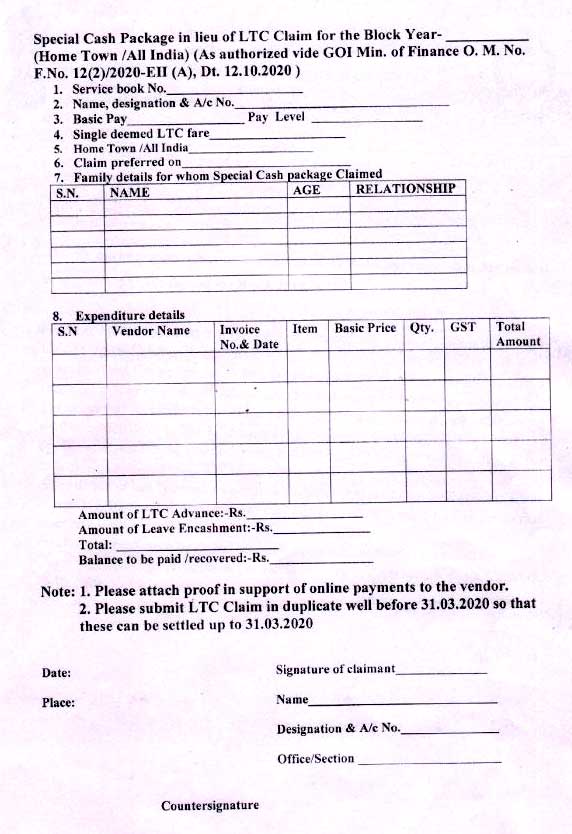

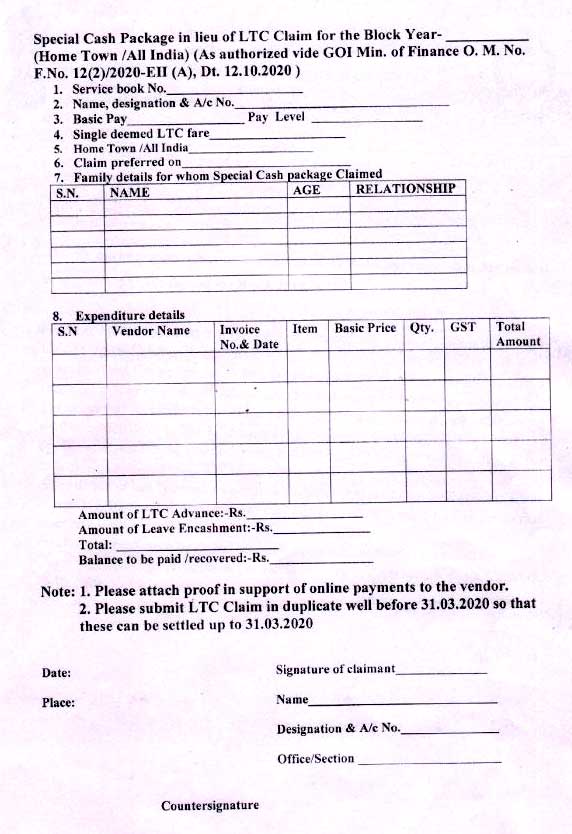

Special Cash Package In Lieu Of LTC Fare For CG Employees 2018 2021

India s Dual Tax system Old Vs New Tax Regime Zoho Payroll

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

https://incometaxindia.gov.in/Booklets Pamphlets/e-PDF__…

Web A retired employee above 60 years of age who is in receipt of pension income from his former employer can claim a deduction upto Rs 50 000 against such salary income Am

https://www.financialexpress.com/budget/emp…

Web 1 f 233 vr 2022 nbsp 0183 32 Employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80CCD 2 of the Income Tax Act 14 of salary for central government employees and 10 for others This

Web A retired employee above 60 years of age who is in receipt of pension income from his former employer can claim a deduction upto Rs 50 000 against such salary income Am

Web 1 f 233 vr 2022 nbsp 0183 32 Employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80CCD 2 of the Income Tax Act 14 of salary for central government employees and 10 for others This

Special Cash Package In Lieu Of LTC Fare For CG Employees 2018 2021

CBDT Notification 2019 Important Amendment In Form 16 Central

India s Dual Tax system Old Vs New Tax Regime Zoho Payroll

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

2007 Tax Rebate Tax Deduction Rebates

2007 Tax Rebate Tax Deduction Rebates

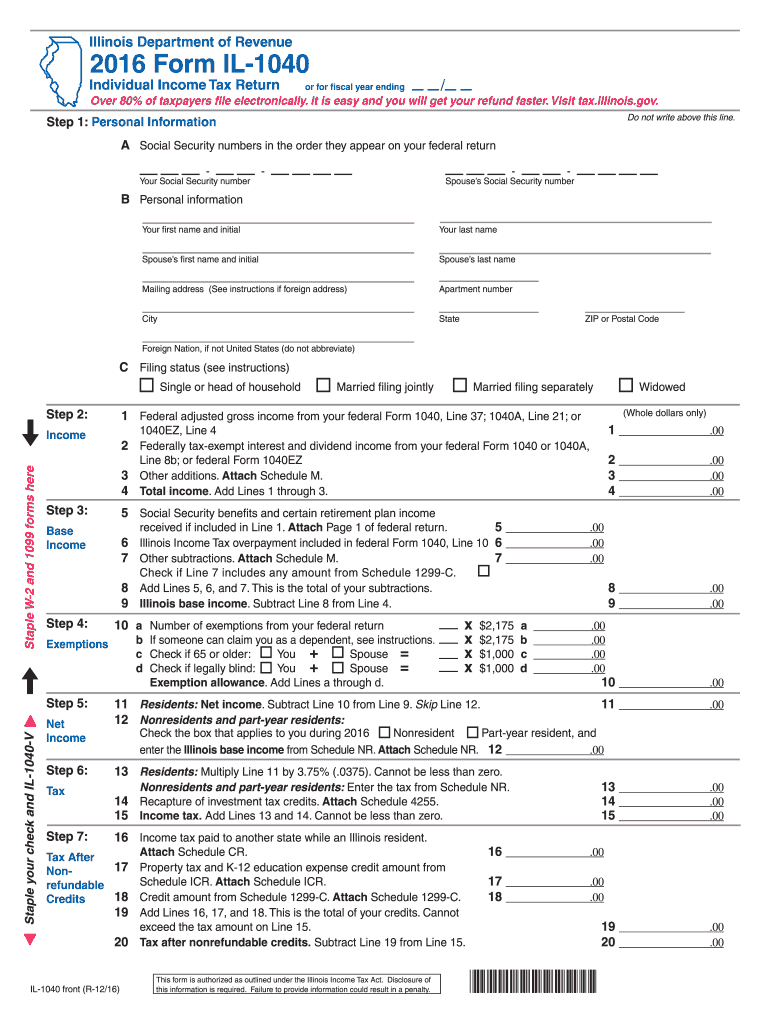

Illinois Form Tax 2016 Fill Out Sign Online DocHub