In this digital age, where screens dominate our lives yet the appeal of tangible printed materials hasn't faded away. In the case of educational materials for creative projects, simply adding an individual touch to the area, Income Tax Exemption On Medical Expenditure have become a valuable source. With this guide, you'll dive into the world of "Income Tax Exemption On Medical Expenditure," exploring what they are, how they can be found, and ways they can help you improve many aspects of your daily life.

Get Latest Income Tax Exemption On Medical Expenditure Below

Income Tax Exemption On Medical Expenditure

Income Tax Exemption On Medical Expenditure - Income Tax Exemption On Medical Expenditure, Income Tax Rebate On Medical Expenditure, Income Tax Benefit On Medical Expenses, Income Tax Benefit On Medical Bills, Income Tax Rebate On Medical Expenses For Senior Citizens, Income Tax Exemption For Medical Bills, Income Tax Deductible Medical Expenses, Is Medical Expenditure Tax Exempt, Exemption Of Medical Expenditure Under 80d, Income Tax Exemption For Medical Expenses

Section 80DD of the income tax act provides a flat deduction irrespective of the amount of expenditure incurred by the family of a disabled dependent This is in consideration of the

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical

Income Tax Exemption On Medical Expenditure offer a wide range of downloadable, printable material that is available online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Income Tax Exemption On Medical Expenditure

Income Tax Exemption On Gratuity Income Castuff

Income Tax Exemption On Gratuity Income Castuff

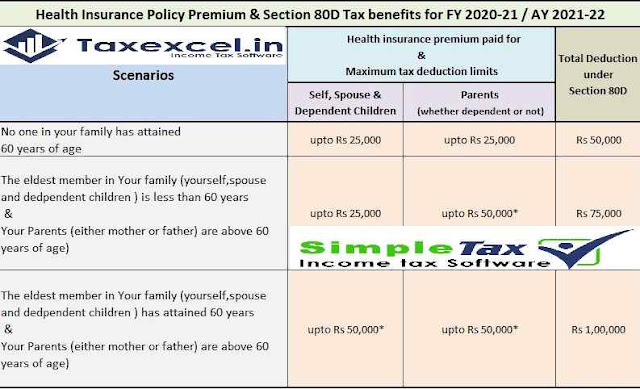

Budget 2018 amended Section 80D of the Income tax Act which allows a deduction for medical expenditure incurred on senior citizens

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental

Income Tax Exemption On Medical Expenditure have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

The ability to customize: Your HTML0 customization options allow you to customize printables to your specific needs in designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Worth: These Income Tax Exemption On Medical Expenditure can be used by students of all ages, which makes them an essential tool for parents and teachers.

-

Accessibility: Instant access to numerous designs and templates can save you time and energy.

Where to Find more Income Tax Exemption On Medical Expenditure

Gratuity Under Income Tax Act All You Need To Know

Gratuity Under Income Tax Act All You Need To Know

This deduction can be claimed by an individual for medical expenses incurred for himself herself or for a dependant The law defines dependant as

Under section 80D it allows the policyholder to save tax by claiming medical insurance incurred on self spouse dependent parents as a deduction from income before paying

We hope we've stimulated your interest in Income Tax Exemption On Medical Expenditure We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Income Tax Exemption On Medical Expenditure for all needs.

- Explore categories such as home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing including flashcards, learning tools.

- It is ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs are a vast spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Income Tax Exemption On Medical Expenditure

Here are some ways how you could make the most of Income Tax Exemption On Medical Expenditure:

1. Home Decor

- Print and frame stunning artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets for teaching at-home for the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Exemption On Medical Expenditure are an abundance of fun and practical tools designed to meet a range of needs and preferences. Their access and versatility makes them a great addition to any professional or personal life. Explore the vast collection of Income Tax Exemption On Medical Expenditure now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes they are! You can download and print these items for free.

-

Are there any free printouts for commercial usage?

- It's contingent upon the specific conditions of use. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download Income Tax Exemption On Medical Expenditure?

- Some printables could have limitations regarding usage. Be sure to check the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home with an printer, or go to any local print store for higher quality prints.

-

What software do I require to open Income Tax Exemption On Medical Expenditure?

- The majority of printables are in PDF format. They is open with no cost software, such as Adobe Reader.

Preventive Check Up 80d Wkcn

Know Tax Benefits On Health Insurance And Medical Expenditure TaxHelpdesk

Check more sample of Income Tax Exemption On Medical Expenditure below

CBDT Notifies Income Tax Exemption On California Public Employees

Income Tax Exemption On Electric Vehicle Deduction On Electric Vehicle

Tax Exemption Of Health Insurance U s 80 D F Y 2020 21 With Automated

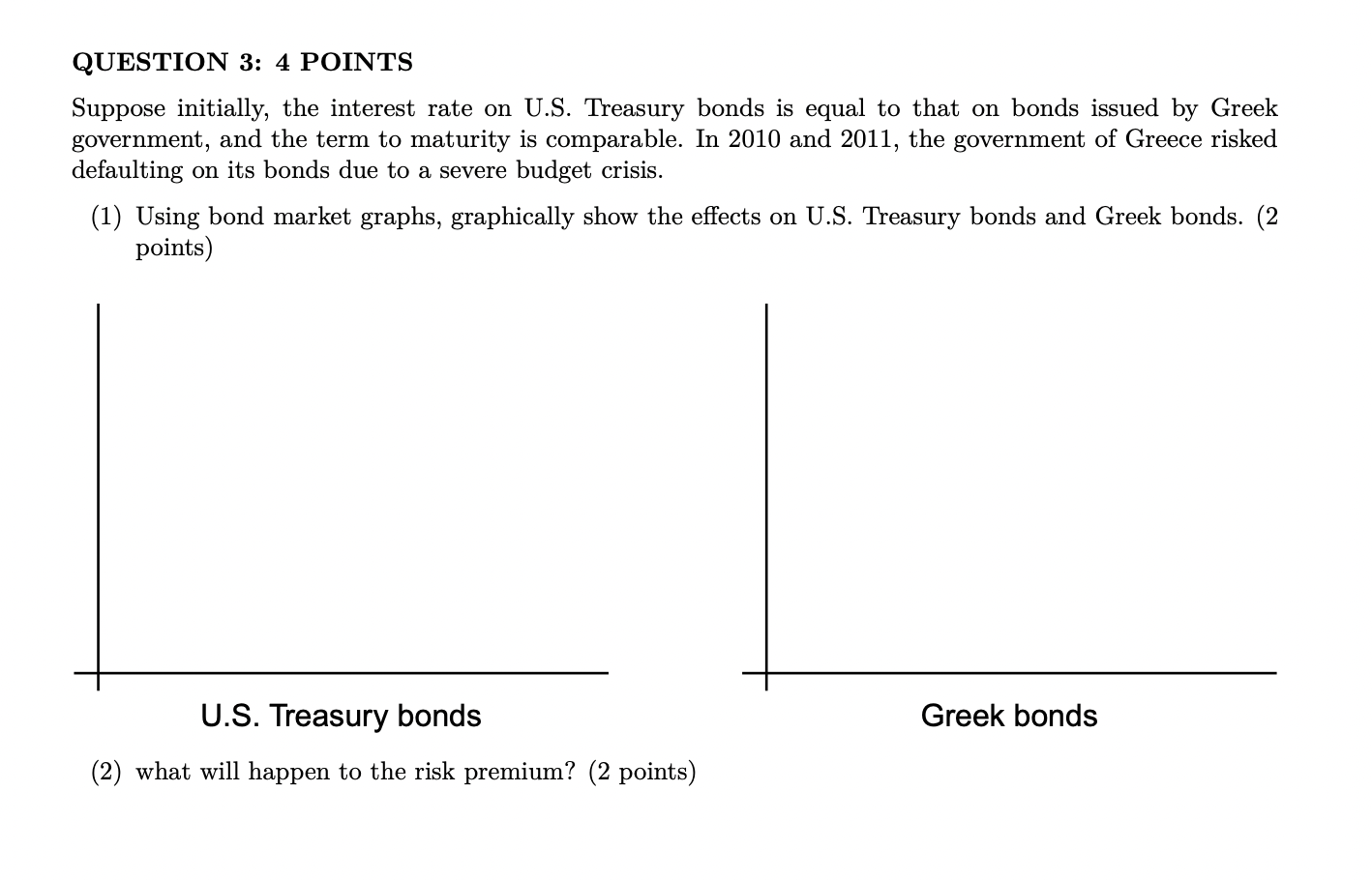

Solved QUESTION 2 4 POINTS Suppose The Income Tax Exemption Chegg

Finance Minister U turns On Eskom Exemption On Irregular Fruitless And

Sample Letter Exemption Doc Template PdfFiller

https://tax2win.in/guide/section-80ddb

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical

https://m.economictimes.com/wealth/tax/how-to-save...

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax

Solved QUESTION 2 4 POINTS Suppose The Income Tax Exemption Chegg

Income Tax Exemption On Electric Vehicle Deduction On Electric Vehicle

Finance Minister U turns On Eskom Exemption On Irregular Fruitless And

Sample Letter Exemption Doc Template PdfFiller

WA Government Relaxes Expenditure Exemption Rules For Explorers

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Example Of Taxable Supplies Jspag