In a world where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education project ideas, artistic or simply adding an element of personalization to your home, printables for free have become a valuable source. The following article is a dive to the depths of "Income Tax Deductions For Medical Expenses India," exploring the benefits of them, where to get them, as well as how they can add value to various aspects of your life.

Get Latest Income Tax Deductions For Medical Expenses India Below

Income Tax Deductions For Medical Expenses India

Income Tax Deductions For Medical Expenses India - Income Tax Deductions For Medical Expenses India, Income Tax Deduction Parents Medical Expenses India, What Kind Of Medical Expenses Are Tax Deductible In India, Is Medical Expenses Tax Deductible In India, Income Tax Deduction For Medical Expenses, What Is The Tax Deduction For Medical Expenses

A taxpayer may claim Section 80D medical expenses deduction under income tax act Health insurance premiums for the following family members are deductible Self Spouse Children Parents Hindu Undivided Families HUF can also claim deductions under section 80D For HUF each member s premium payment is

Any money paid by an employee for obtaining medical treatment for him or her or family upto a maximum of Rs 15 000 will be tax free Also the expenses incurred by the employer on the medical treatment of an employee and

Printables for free include a vast assortment of printable, downloadable content that can be downloaded from the internet at no cost. They are available in numerous types, like worksheets, coloring pages, templates and more. The beauty of Income Tax Deductions For Medical Expenses India lies in their versatility as well as accessibility.

More of Income Tax Deductions For Medical Expenses India

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

Read more on these deductions Medical Expenditure and Insurance Premium Section 80D Section 80D is a deduction you can claim on medical expenses One could save tax on medical insurance premiums paid for the health of self family and dependent parents The limit for Section 80D deduction is Rs 25 000 for premiums paid for self family

Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If you are making payment of

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Modifications: This allows you to modify print-ready templates to your specific requirements such as designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value Printing educational materials for no cost cater to learners of all ages, making them an invaluable tool for parents and teachers.

-

Easy to use: Access to an array of designs and templates, which saves time as well as effort.

Where to Find more Income Tax Deductions For Medical Expenses India

Funeral Expenses Tax Deductible Canada Best Reviews

Funeral Expenses Tax Deductible Canada Best Reviews

The Central Government of India provides provisions for taxpayers to claim deductions and benefits in respect to health insurance premium paid under Section 80D of the Income Tax Act A tax

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are satisfied a The medical expenditure must be incurred either on self spouse or dependent children or and parents

Now that we've ignited your interest in Income Tax Deductions For Medical Expenses India Let's see where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Income Tax Deductions For Medical Expenses India to suit a variety of purposes.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free with flashcards and other teaching materials.

- The perfect resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- The blogs covered cover a wide range of topics, that includes DIY projects to party planning.

Maximizing Income Tax Deductions For Medical Expenses India

Here are some unique ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Utilize free printable worksheets to reinforce learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Deductions For Medical Expenses India are a treasure trove of innovative and useful resources for a variety of needs and pursuits. Their accessibility and flexibility make them an invaluable addition to each day life. Explore the vast world of Income Tax Deductions For Medical Expenses India right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Deductions For Medical Expenses India really absolutely free?

- Yes they are! You can print and download these resources at no cost.

-

Does it allow me to use free printables to make commercial products?

- It's based on specific terms of use. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may have restrictions in their usage. Be sure to read the terms and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home using an printer, or go to an area print shop for higher quality prints.

-

What program do I need to run printables at no cost?

- Many printables are offered in PDF format. They can be opened using free software such as Adobe Reader.

Eligibility

8 Tax Itemized Deduction Worksheet Worksheeto

Check more sample of Income Tax Deductions For Medical Expenses India below

Tax Deductions For Medical And Dental Expenses EzTaxReturn Blog

Income Tax Deduction For Medical Expenses IndiaFilings

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

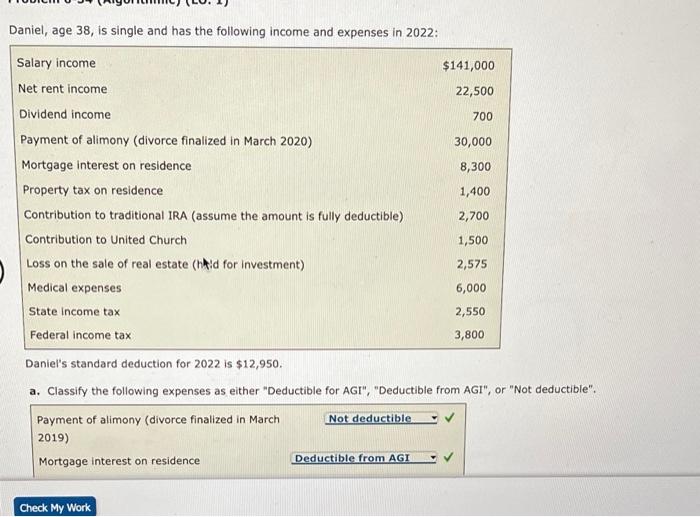

Solved Daniel Age 38 Is Single And Has The Following Chegg

Tax Deductions For Medical Expenses Health Insurance IRS

Tax Deductions For Medical Professionals

https://www.indiafilings.com/learn/income-tax...

Any money paid by an employee for obtaining medical treatment for him or her or family upto a maximum of Rs 15 000 will be tax free Also the expenses incurred by the employer on the medical treatment of an employee and

https://cleartax.in/s/income-tax-benefit-employee...

As per an amendment in the Budget 2018 tax exemption on medical reimbursement amounting to Rs 15 000 and transport allowance amounting to Rs 19 200 in a financial year have been replaced with a standard deduction of Rs 40 000 This amendment became applicable from FY 2018 19 i e starting 1st April 2018

Any money paid by an employee for obtaining medical treatment for him or her or family upto a maximum of Rs 15 000 will be tax free Also the expenses incurred by the employer on the medical treatment of an employee and

As per an amendment in the Budget 2018 tax exemption on medical reimbursement amounting to Rs 15 000 and transport allowance amounting to Rs 19 200 in a financial year have been replaced with a standard deduction of Rs 40 000 This amendment became applicable from FY 2018 19 i e starting 1st April 2018

Solved Daniel Age 38 Is Single And Has The Following Chegg

Income Tax Deduction For Medical Expenses IndiaFilings

Tax Deductions For Medical Expenses Health Insurance IRS

Tax Deductions For Medical Professionals

Tax Deductions For Medical Expenses

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Epf Contribution Table For Age Above 60 2019 Frank Lyman

2021 Taxes For Retirees Explained Cardinal Guide