In this age of electronic devices, in which screens are the norm however, the attraction of tangible printed items hasn't gone away. No matter whether it's for educational uses as well as creative projects or just adding personal touches to your home, printables for free are now a useful resource. Through this post, we'll take a dive deeper into "Income Tax 80dd Exemption Limit," exploring their purpose, where they are, and how they can improve various aspects of your lives.

Get Latest Income Tax 80dd Exemption Limit Below

Income Tax 80dd Exemption Limit

Income Tax 80dd Exemption Limit - Income Tax 80dd Exemption Limit, Income Tax Exemption Limit Under Section 80dd, Income Tax 80u Exemption Limit, Income Tax 80ddb Exemption Limit

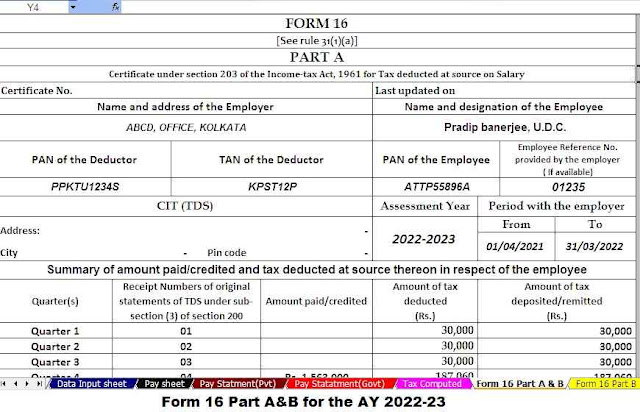

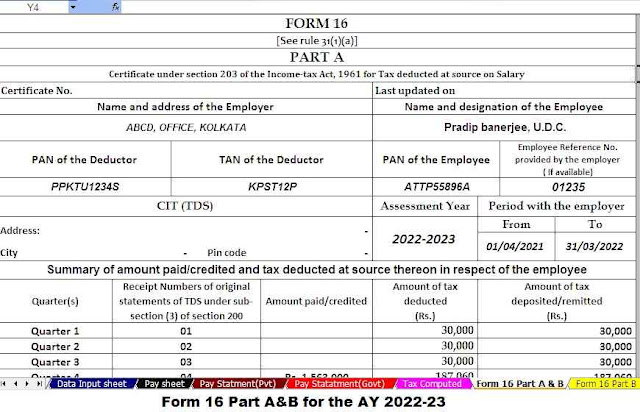

As per section 80DD the assessee is eligible to claim a deduction of INR 75 000 from his gross total income However in case the dependant is a person with severe disability the assessee is eligible to claim a deduction of INR 1 25 Lakhs

Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical maintenance of a dependant who is a person with a major disability

Printables for free include a vast assortment of printable documents that can be downloaded online at no cost. They come in many designs, including worksheets templates, coloring pages and more. One of the advantages of Income Tax 80dd Exemption Limit lies in their versatility as well as accessibility.

More of Income Tax 80dd Exemption Limit

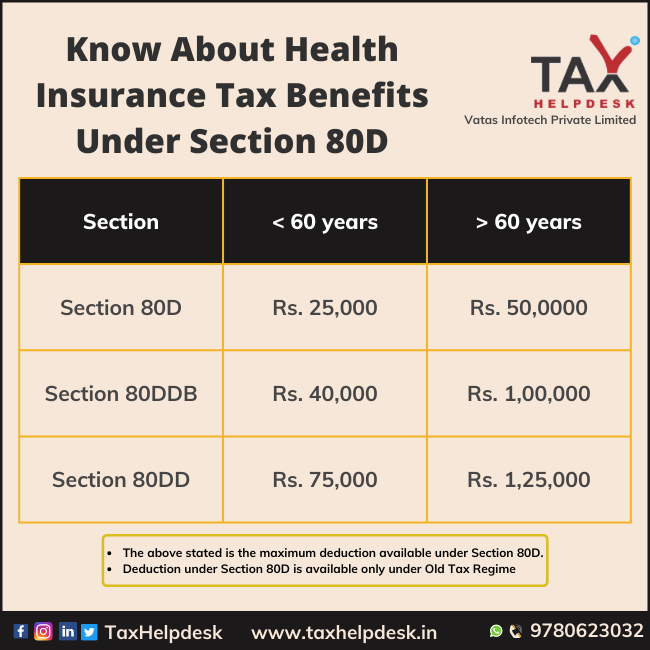

Know About Health Insurance Tax Benefits Under Section 80D

Know About Health Insurance Tax Benefits Under Section 80D

Maximum Amount of Deduction under Section 80DD Irrespective of the actual expenditure a fixed amount of deduction is applicable depending upon the severity of disability as per Section 80DD More than 80 disability Rs 1 25 lakh 40 to 80 disability Rs 75 000

What is the 80DD deduction Limit Section 80DD of the Income Tax Act allows flat deductions irrespective of the amount of expenditure incurred during the year but it should not be nil However the amount of deduction depends upon the severity of

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization There is the possibility of tailoring printed materials to meet your requirements be it designing invitations planning your schedule or even decorating your house.

-

Educational Value Printables for education that are free can be used by students of all ages. This makes them a valuable tool for parents and teachers.

-

Convenience: You have instant access numerous designs and templates will save you time and effort.

Where to Find more Income Tax 80dd Exemption Limit

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Learn about Income tax deductions under Section 80DD of Income Tax Act eligibility conditions for tax exemption deduction limit and much more

Section 80DD of the Income Tax Act 1961 offers support to medical caretakers through tax exemptions and deductions Know the eligibility limits and conditions

After we've peaked your interest in printables for free and other printables, let's discover where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Income Tax 80dd Exemption Limit for various applications.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs are a vast range of interests, that range from DIY projects to party planning.

Maximizing Income Tax 80dd Exemption Limit

Here are some unique ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet for teaching at-home or in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax 80dd Exemption Limit are an abundance of innovative and useful resources which cater to a wide range of needs and passions. Their accessibility and versatility make them a great addition to your professional and personal life. Explore the many options that is Income Tax 80dd Exemption Limit today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes they are! You can print and download these files for free.

-

Can I download free printouts for commercial usage?

- It's based on specific conditions of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may have restrictions in use. Make sure you read the conditions and terms of use provided by the designer.

-

How do I print Income Tax 80dd Exemption Limit?

- Print them at home with a printer or visit an area print shop for better quality prints.

-

What program is required to open Income Tax 80dd Exemption Limit?

- The majority of PDF documents are provided in the PDF format, and is open with no cost software like Adobe Reader.

Illinois Tax Exempt Certificate

Income Tax Exemption Limit Likely To Be Enhanced In Budget

Check more sample of Income Tax 80dd Exemption Limit below

Income Tax Basic Exemption Limit In India some Facts To Know ITR Guide

Preventive Check Up 80d Wkcn

Claim Deduction Under Section 80DD Learn By Quicko

Anything To Everything Income Tax Guide For Individuals Including

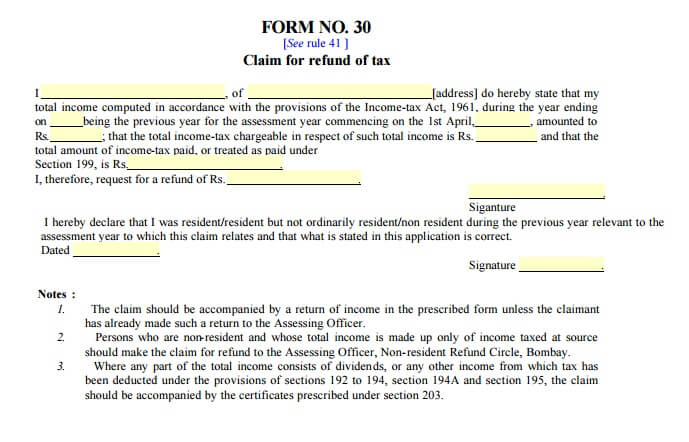

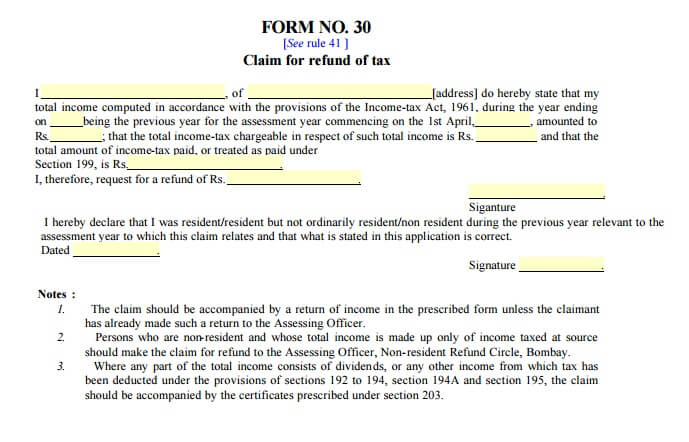

80DD FORM PDF

Section 80U Tax Deductions For Disabled Individuals Tax2win

https://tax2win.in/guide/section-80dd

Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical maintenance of a dependant who is a person with a major disability

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Section 80DDB of Income Tax Act Deductions Under Section 80DDB can be claimed with respect to the expenses incurred in medical expenses Know more on how to claim and whom to take the certificate from

Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical maintenance of a dependant who is a person with a major disability

Section 80DDB of Income Tax Act Deductions Under Section 80DDB can be claimed with respect to the expenses incurred in medical expenses Know more on how to claim and whom to take the certificate from

Anything To Everything Income Tax Guide For Individuals Including

Preventive Check Up 80d Wkcn

80DD FORM PDF

Section 80U Tax Deductions For Disabled Individuals Tax2win

80DD Deduction Income Tax I 80DD Deduction For Ay 2021 22 YouTube

Section 80DD Tax Exemption For The People With Disabilities As Per

Section 80DD Tax Exemption For The People With Disabilities As Per

Section 80D Deduction For Medical Insurance Health Checkups 2019