In this day and age in which screens are the norm, the charm of tangible printed products hasn't decreased. If it's to aid in education in creative or artistic projects, or just adding the personal touch to your space, Hra Tax Rebate Under Section are a great resource. For this piece, we'll take a dive deep into the realm of "Hra Tax Rebate Under Section," exploring their purpose, where to find them and how they can improve various aspects of your daily life.

Get Latest Hra Tax Rebate Under Section Below

Hra Tax Rebate Under Section

Hra Tax Rebate Under Section - Hra Tax Exemption Under Section 10 (13a), Hra Tax Exemption Under Which Section, Can Hra Be Claimed In Itr, How Much Hra Can Be Claimed In Itr, Can We Claim Hra Deduction In Itr, Deduction For Hra Under Section 80

Web 9 f 233 vr 2023 nbsp 0183 32 Actual Rent Paid 10 of Basic Salary INR 1 30 000 1 80 000 10 5 00 000 INR 1 30 000 will be exempt from the total House Rent Allowance received

Web 22 avr 2022 nbsp 0183 32 All you want to know about rent receipt amp its role in saving tax Conditions for claiming HRA rebate under Section 10 13A Key conditions that ought to be fulfilled

The Hra Tax Rebate Under Section are a huge array of printable materials available online at no cost. They are available in a variety of forms, including worksheets, coloring pages, templates and much more. The value of Hra Tax Rebate Under Section lies in their versatility and accessibility.

More of Hra Tax Rebate Under Section

Hra Deduction Under Section 10 Design schmitt

Hra Deduction Under Section 10 Design schmitt

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under

Web 10 f 233 vr 2023 nbsp 0183 32 Conditions to claim rebate under Section 10 13A Following are the key conditions you ought to fulfil Only salaried individuals can claim deductions under this

The Hra Tax Rebate Under Section have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

customization This allows you to modify print-ready templates to your specific requirements in designing invitations and schedules, or even decorating your home.

-

Educational Value These Hra Tax Rebate Under Section provide for students of all ages, which makes them a great tool for parents and educators.

-

Simple: Fast access an array of designs and templates, which saves time as well as effort.

Where to Find more Hra Tax Rebate Under Section

HRA Tax Rebate HRA In Income Tax HRA Rebate Kasie Le HRA Rebate

HRA Tax Rebate HRA In Income Tax HRA Rebate Kasie Le HRA Rebate

Web The exemption for HRA would be allowed under Section 10 13A or under Section 80GG as the case may be HRA exemption rules Here are some rules for claiming HRA

Web House Rent Allowance HRA is a common element in the salary structure for most employees It is an amount paid to you by your employer as part of your salary As a

If we've already piqued your interest in Hra Tax Rebate Under Section Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Hra Tax Rebate Under Section designed for a variety objectives.

- Explore categories like decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a wide spectrum of interests, that includes DIY projects to planning a party.

Maximizing Hra Tax Rebate Under Section

Here are some innovative ways ensure you get the very most use of Hra Tax Rebate Under Section:

1. Home Decor

- Print and frame gorgeous art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Hra Tax Rebate Under Section are a treasure trove of creative and practical resources for a variety of needs and preferences. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Hra Tax Rebate Under Section truly completely free?

- Yes they are! You can download and print these files for free.

-

Can I use free templates for commercial use?

- It depends on the specific usage guidelines. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables may be subject to restrictions concerning their use. Be sure to review the terms and condition of use as provided by the designer.

-

How can I print Hra Tax Rebate Under Section?

- Print them at home using either a printer at home or in a print shop in your area for top quality prints.

-

What program do I need to run Hra Tax Rebate Under Section?

- The majority of PDF documents are provided with PDF formats, which can be opened with free software, such as Adobe Reader.

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

Income Tax Rebate Under Section 87a Working And Eligibili Flickr

Check more sample of Hra Tax Rebate Under Section below

Income Tax HRA

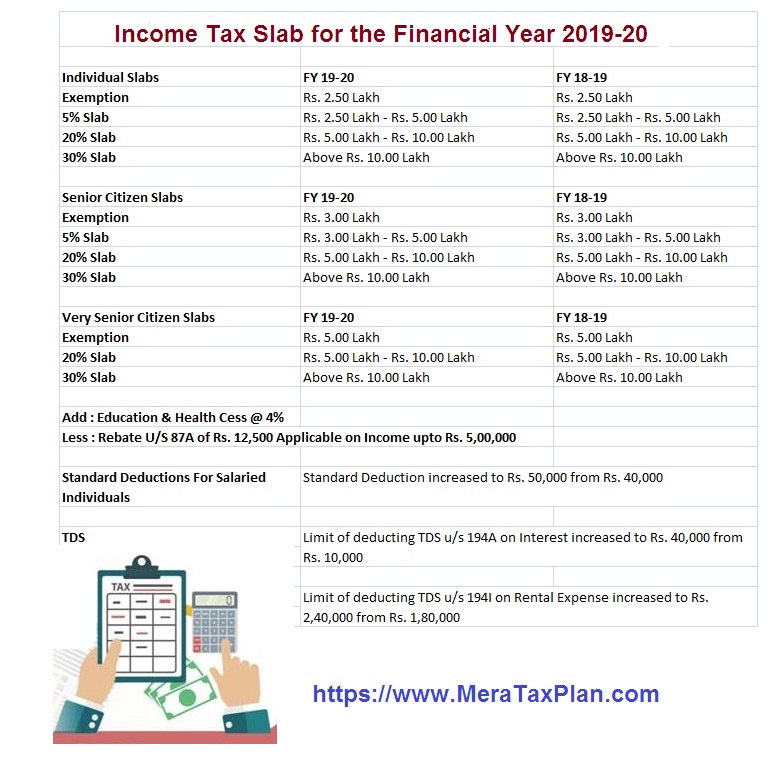

Tds Slab Rate For Ay 2019 20

Download New Form 12BB To Claim Tax Deduction On LTA And HRA With

How To Get MORE Out Of Your HRA Rediff Getahead

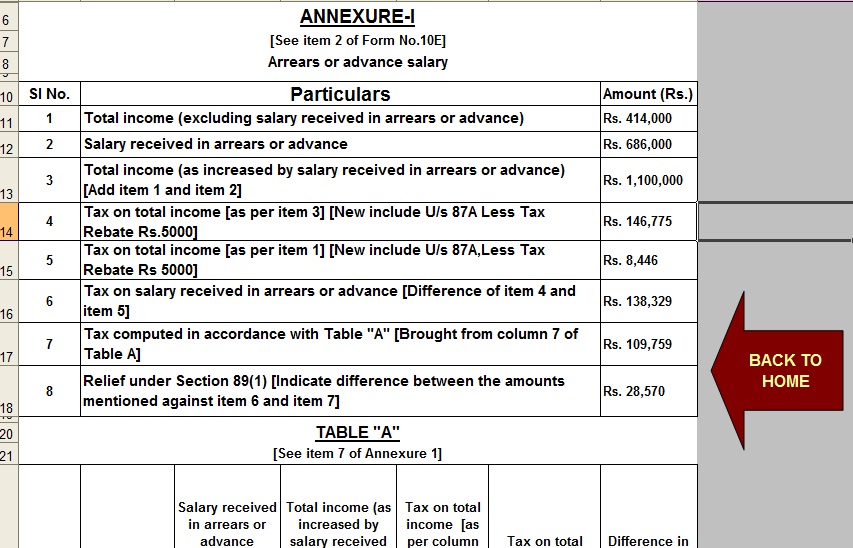

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate Under Section 87A

https://housing.com/news/hra-house-rent-allowance-tax-exemption

Web 22 avr 2022 nbsp 0183 32 All you want to know about rent receipt amp its role in saving tax Conditions for claiming HRA rebate under Section 10 13A Key conditions that ought to be fulfilled

https://taxadda.com/house-rent-allowance-hra-section-10-13a

Web House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the employee

Web 22 avr 2022 nbsp 0183 32 All you want to know about rent receipt amp its role in saving tax Conditions for claiming HRA rebate under Section 10 13A Key conditions that ought to be fulfilled

Web House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the employee

How To Get MORE Out Of Your HRA Rediff Getahead

Tds Slab Rate For Ay 2019 20

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Calculation Of HRA Exemption Under Section10 13a

Calculation Of HRA Exemption Under Section10 13a

Theme Presentation1