In the age of digital, with screens dominating our lives however, the attraction of tangible printed objects isn't diminished. Whatever the reason, whether for education such as creative projects or simply to add a personal touch to your home, printables for free have proven to be a valuable source. Here, we'll dive into the world "Deduction For Hra Under Section 80," exploring their purpose, where to locate them, and how they can enrich various aspects of your lives.

Get Latest Deduction For Hra Under Section 80 Below

Deduction For Hra Under Section 80

Deduction For Hra Under Section 80 -

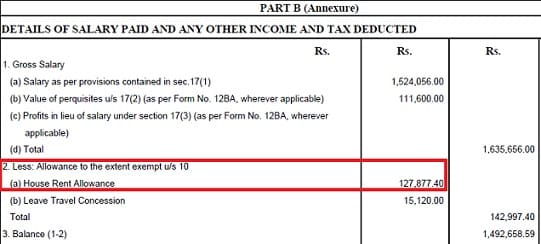

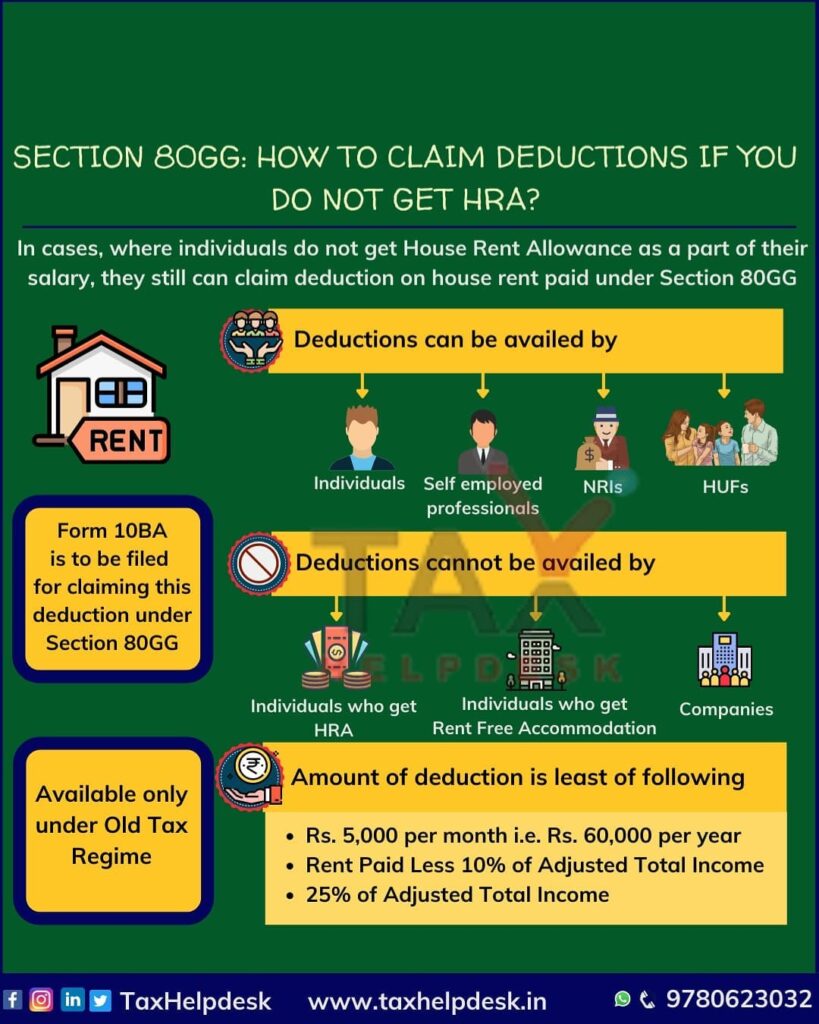

Deduction under Section 80GG is available only to those employees who do not get HRA or to self employed persons The deduction limit under the section is

Individuals paying rent but not receiving house rent allowance can claim a deduction under Section 80GG Also the individual

Printables for free cover a broad assortment of printable, downloadable material that is available online at no cost. These materials come in a variety of styles, from worksheets to coloring pages, templates and more. The beauty of Deduction For Hra Under Section 80 is their versatility and accessibility.

More of Deduction For Hra Under Section 80

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Amount of Deduction Section 80GG The least of the following is available for exemption from tax under Section 80GG i Rent paid in excess of 10 of

HRA is not part of the salary If HRA is not part of their salary package they can claim tax deductions under Section 80GG Chapter VI A of the Income Tax Act All

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Customization: The Customization feature lets you tailor printed materials to meet your requirements be it designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value Downloads of educational content for free can be used by students from all ages, making these printables a powerful aid for parents as well as educators.

-

It's easy: instant access many designs and templates saves time and effort.

Where to Find more Deduction For Hra Under Section 80

Events Festivals In India A Ministry Of Tourism Initiative

Events Festivals In India A Ministry Of Tourism Initiative

80gg deduction limit and tax deductions under this section are based on Tax Rule 2A As per Section 10 13A the least amount from the following calculations is considered a

How do you claim tax deduction under Section 80GG in case HRA is not a part of your salary package What are the major conditions for claiming a rebate under

In the event that we've stirred your interest in printables for free and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of applications.

- Explore categories like decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs are a vast array of topics, ranging everything from DIY projects to party planning.

Maximizing Deduction For Hra Under Section 80

Here are some inventive ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Deduction For Hra Under Section 80 are an abundance filled with creative and practical information that satisfy a wide range of requirements and passions. Their availability and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the vast world of Deduction For Hra Under Section 80 and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can download and print these free resources for no cost.

-

Do I have the right to use free printing templates for commercial purposes?

- It is contingent on the specific conditions of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables could be restricted in use. Make sure to read the terms of service and conditions provided by the designer.

-

How do I print Deduction For Hra Under Section 80?

- You can print them at home using a printer or visit a local print shop for more high-quality prints.

-

What software do I require to open printables that are free?

- Many printables are offered in PDF format, which is open with no cost software such as Adobe Reader.

Events Festivals In India A Ministry Of Tourism Initiative

Deduction Under Section 80D Ultimate Guide

Check more sample of Deduction For Hra Under Section 80 below

How To Claim Deductions If You Do Not Get HRA Section 80GG

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

Tax Deduction On House Rent U S 80GG Without HRA For Employees

Section 80U Tax Deductions For Disabled Individuals Tax2win

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

What Is House Rent Allowance HRA Exemption Rules For FY 2018 19

https://cleartax.in/s/hra-house-rent-allowance

Individuals paying rent but not receiving house rent allowance can claim a deduction under Section 80GG Also the individual

https://cleartax.in/s/80c-80-deductions

Yes if you do not receive HRA as a part of a salary component the Rent paid can be claimed as deduction under section 80GG However the maximum

Individuals paying rent but not receiving house rent allowance can claim a deduction under Section 80GG Also the individual

Yes if you do not receive HRA as a part of a salary component the Rent paid can be claimed as deduction under section 80GG However the maximum

Section 80U Tax Deductions For Disabled Individuals Tax2win

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

What Is House Rent Allowance HRA Exemption Rules For FY 2018 19

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Additional Post Allowance APA For DA HRA Under 7th CPC

Additional Post Allowance APA For DA HRA Under 7th CPC

How To Claim Deductions If You Do Not Get HRA Section 80GG