In the age of digital, where screens have become the dominant feature of our lives The appeal of tangible, printed materials hasn't diminished. If it's to aid in education and creative work, or simply adding an individual touch to the space, Hra Rebate Rules In Income Tax are a great source. This article will take a dive through the vast world of "Hra Rebate Rules In Income Tax," exploring what they are, how to find them and the ways that they can benefit different aspects of your daily life.

Get Latest Hra Rebate Rules In Income Tax Below

Hra Rebate Rules In Income Tax

Hra Rebate Rules In Income Tax - Hra Rebate Rules In Income Tax, Hra Exemption Rule In Income Tax Pdf, Hra Exemption In Income Tax, Hra Exemption In Income Tax Calculation, Hra Exemption In Income Tax With Example, Hra Exemption In Income Tax 2022-23, Hra Exemption In Income Tax Return, Hra Exemption In Income Tax Under Section, Hra Exemption In Income Tax 2023-24, Hra Exemption In Income Tax Form

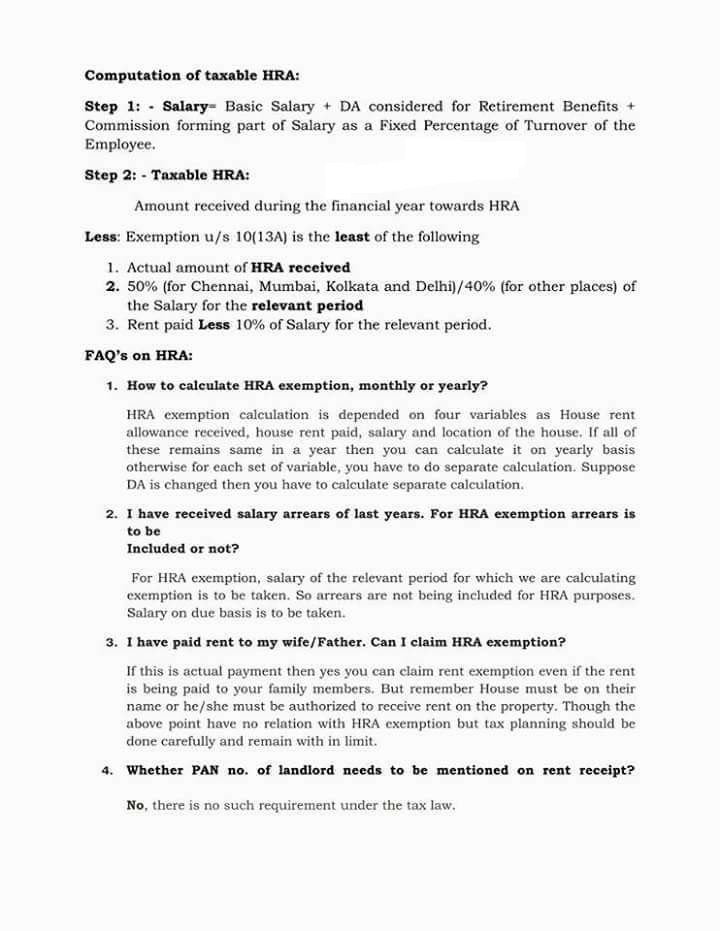

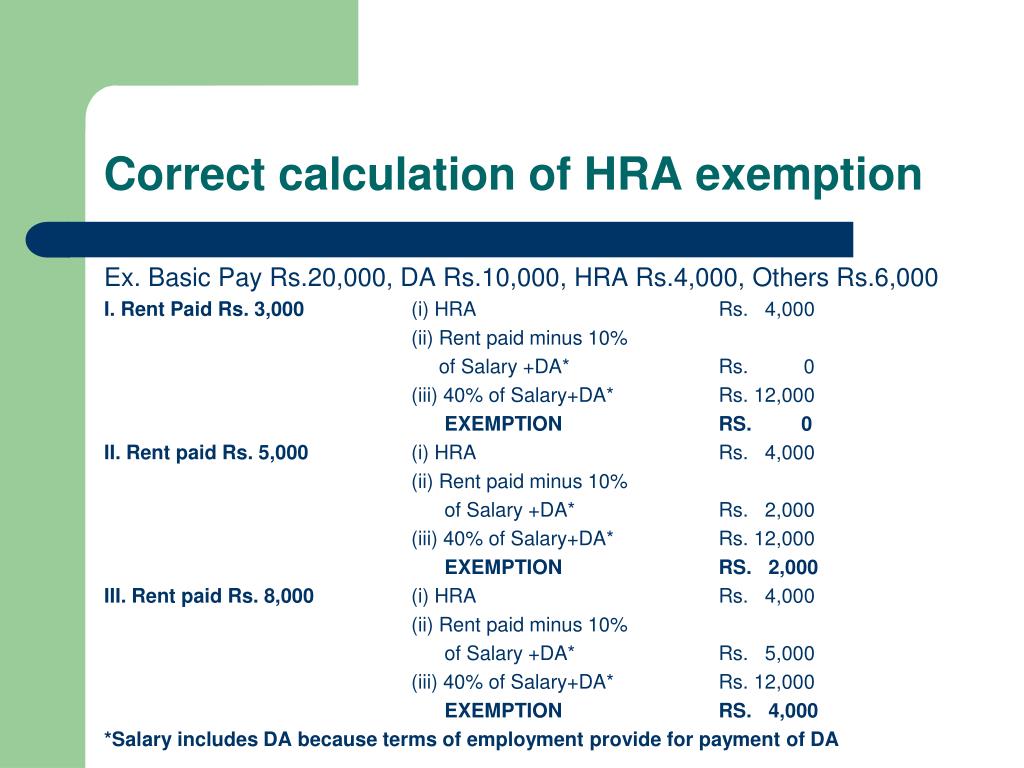

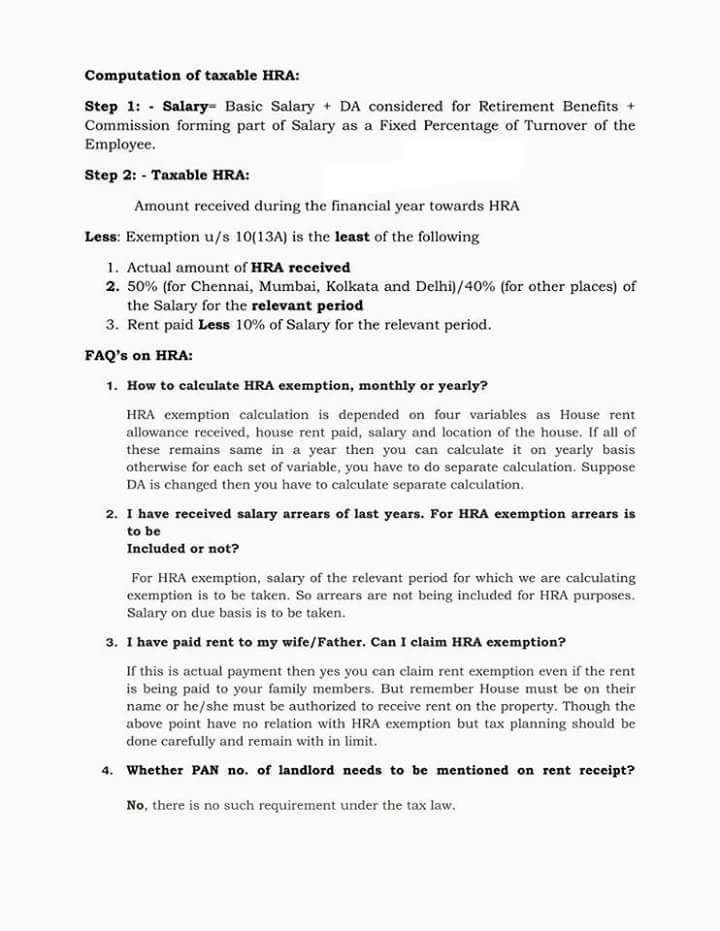

Web 28 juin 2018 nbsp 0183 32 1 Actual House Rent Allowance HRA received from your employer 2 Actual house rent paid by you minus 10 of your basic salary 3 50 of your basic salary if you live in a metro or 40 of your basic

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under

The Hra Rebate Rules In Income Tax are a huge range of downloadable, printable material that is available online at no cost. They are available in numerous formats, such as worksheets, templates, coloring pages, and more. The great thing about Hra Rebate Rules In Income Tax is their flexibility and accessibility.

More of Hra Rebate Rules In Income Tax

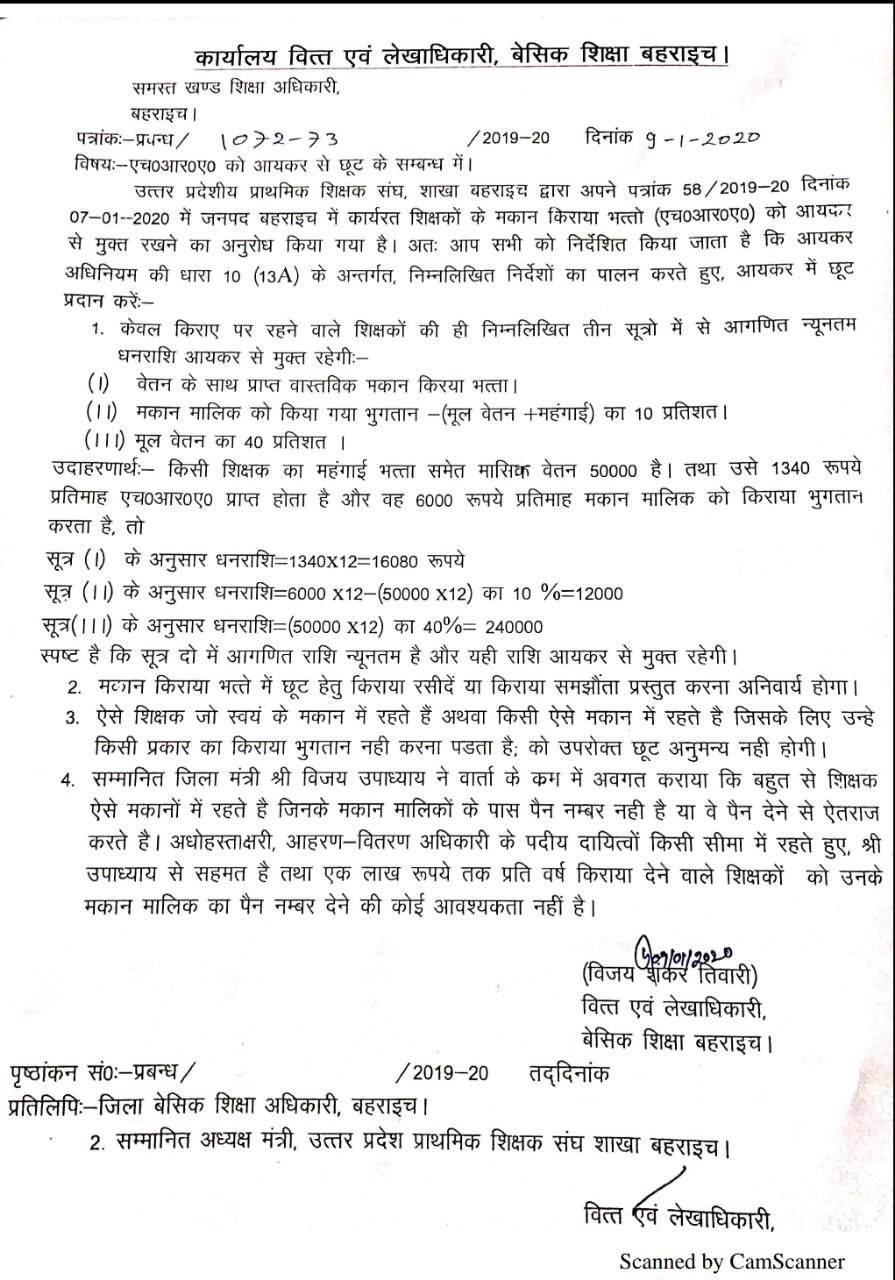

HRA Income Tax Deduction Rules Teacher Haryana Education News

HRA Income Tax Deduction Rules Teacher Haryana Education News

Web 22 avr 2022 nbsp 0183 32 Listed below are the conditions All you want to know about rent receipt amp its role in saving tax Conditions for claiming HRA rebate under Section 10 13A Key

Web 19 juil 2023 nbsp 0183 32 What is HRA House Rent Allowance Eligibility Criteria to Claim Tax Deductions On HRA How much HRA exemption is available under the income tax act

Hra Rebate Rules In Income Tax have risen to immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Modifications: This allows you to modify printables to your specific needs in designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Impact: The free educational worksheets cater to learners of all ages, which makes the perfect tool for teachers and parents.

-

Simple: Fast access various designs and templates cuts down on time and efforts.

Where to Find more Hra Rebate Rules In Income Tax

Income Tax Department Puts House Rental Allowance HRA Exemption Rules

Income Tax Department Puts House Rental Allowance HRA Exemption Rules

Web Rent paid 10 of the basic salary including Dearness Allowance For example if your basic salary including Dearness Allowance is INR 50 000 month you receive a HRA of

Web 6 janv 2018 nbsp 0183 32 Although it is a part of your salary HRA unlike basic salary is not fully taxable Subject to certain conditions a part of HRA is exempted under Section 10 13A

If we've already piqued your interest in Hra Rebate Rules In Income Tax Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Hra Rebate Rules In Income Tax for various uses.

- Explore categories such as decorating your home, education, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs are a vast selection of subjects, starting from DIY projects to planning a party.

Maximizing Hra Rebate Rules In Income Tax

Here are some ideas in order to maximize the use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Hra Rebate Rules In Income Tax are an abundance of useful and creative resources that meet a variety of needs and interests. Their access and versatility makes them a valuable addition to both professional and personal lives. Explore the vast collection that is Hra Rebate Rules In Income Tax today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes they are! You can download and print these resources at no cost.

-

Are there any free printables for commercial purposes?

- It depends on the specific usage guidelines. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables could be restricted regarding their use. Make sure to read the terms of service and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home using any printer or head to an area print shop for top quality prints.

-

What software do I need in order to open printables free of charge?

- Many printables are offered in PDF format. They can be opened using free programs like Adobe Reader.

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

PPT WELCOME TO THE T D S SEMINAR PowerPoint Presentation Free

Check more sample of Hra Rebate Rules In Income Tax below

How To Rebate In HRA In Income Tax 2022

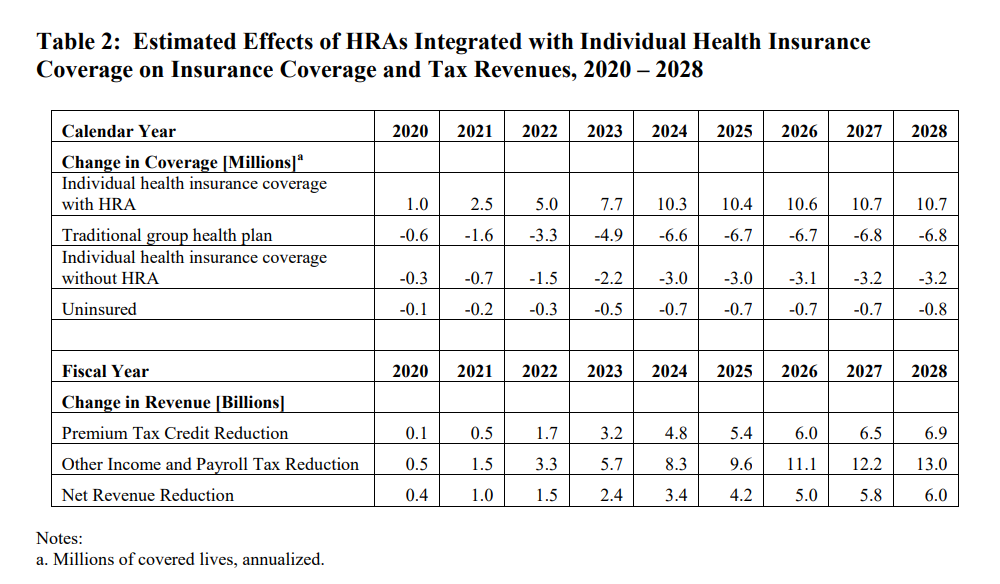

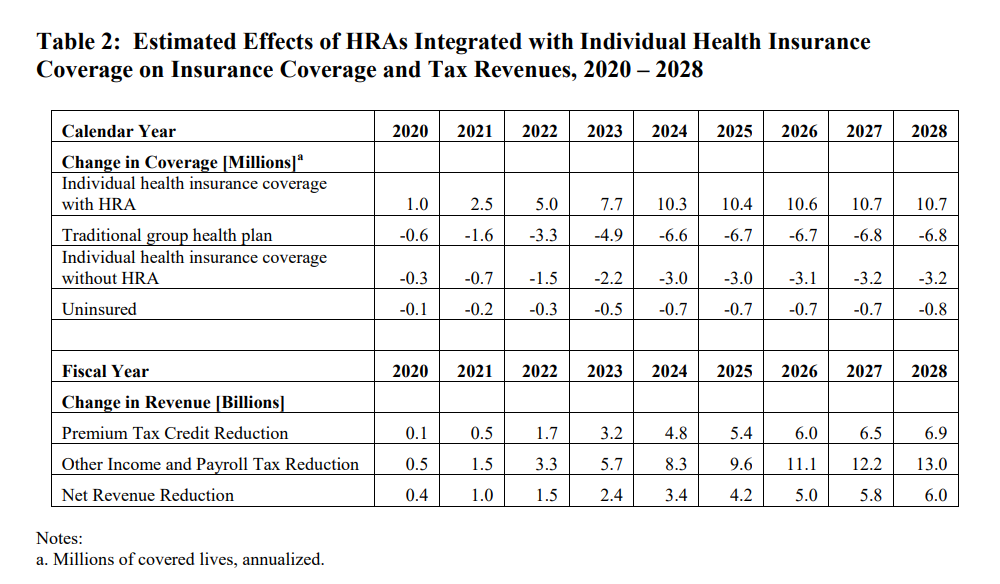

Sizing Up The Proposed HRA Rule AAF

How To Get Full Rebate On HRA In Income Tax

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Salaried Person Here s All You Need To Know About HRA Tax Deduction

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

https://taxguru.in/income-tax/house-rent-all…

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 House rent allowance is eligible for HRA deduction under Section 10 13A of the Income Tax Act if an individual meets the following criteria The person claiming

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under

Web 22 sept 2022 nbsp 0183 32 House rent allowance is eligible for HRA deduction under Section 10 13A of the Income Tax Act if an individual meets the following criteria The person claiming

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Sizing Up The Proposed HRA Rule AAF

Salaried Person Here s All You Need To Know About HRA Tax Deduction

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

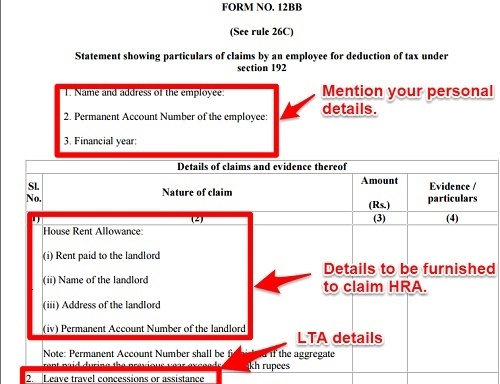

Form 12BB Changes In Declaring HRA LTA And Sec 80 Deductions

Tax Rebate On HRA

Tax Rebate On HRA

Form 12BB To Claim HRA Deduction By Salaried Employees