In this digital age, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses for creative projects, simply to add an element of personalization to your space, How Are Real Estate Taxes Calculated In Illinois have become a valuable source. This article will dive to the depths of "How Are Real Estate Taxes Calculated In Illinois," exploring their purpose, where to locate them, and how they can improve various aspects of your lives.

Get Latest How Are Real Estate Taxes Calculated In Illinois Below

How Are Real Estate Taxes Calculated In Illinois

How Are Real Estate Taxes Calculated In Illinois - How Are Real Estate Taxes Calculated In Illinois, How Are Property Taxes Calculated In Illinois

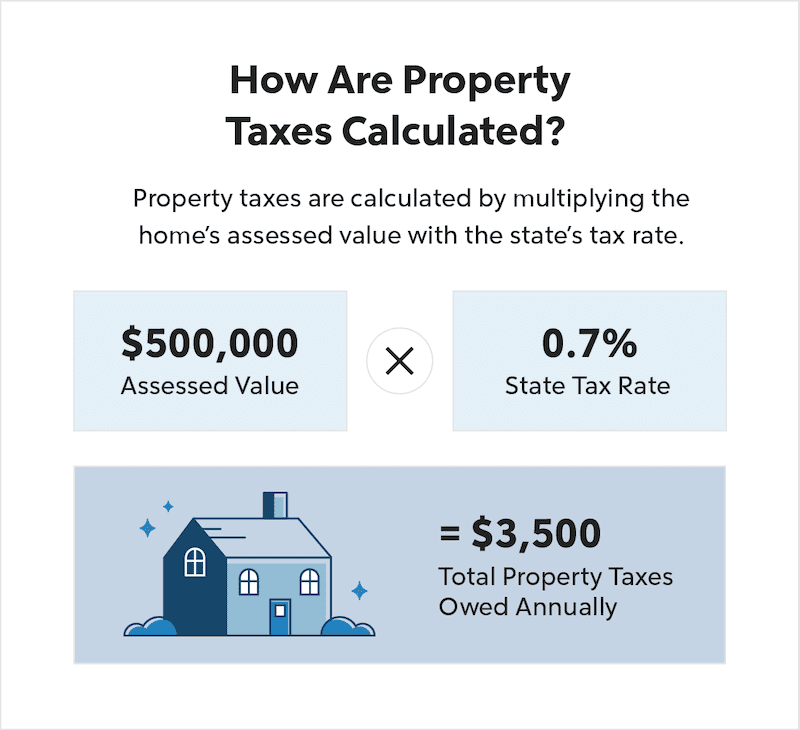

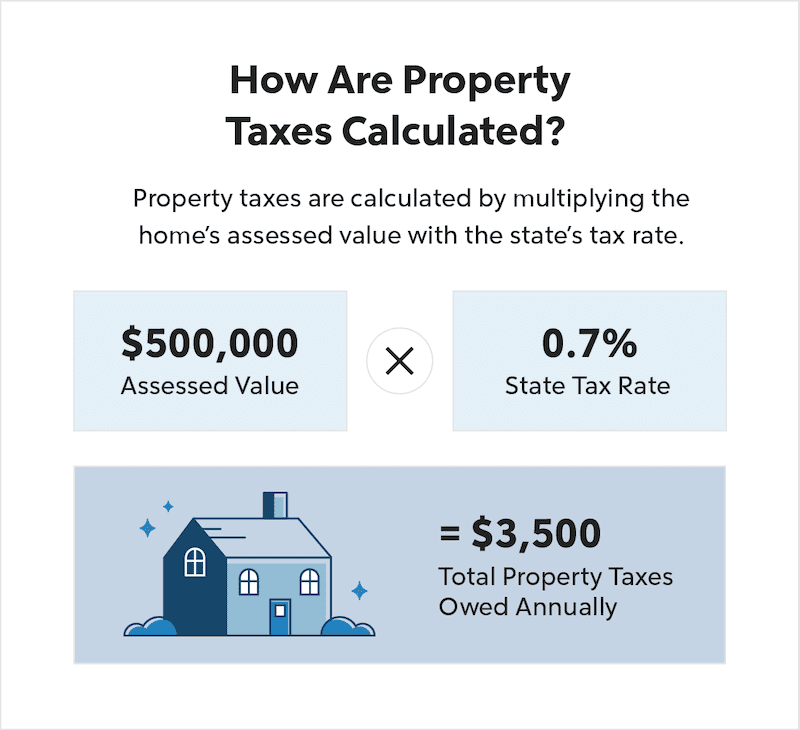

How is real property assessed in Illinois The required assessment level for tax purposes on any parcel of real property in any county except Cook County is 33 1 3 percent of the property s fair market value excluding farmland and farm buildings

In Illinois there are certain components that determine your property tax bill The real estate has an assessed value that is determined by the county assessor That amount is then multiplied by the state equalization factor to

The How Are Real Estate Taxes Calculated In Illinois are a huge selection of printable and downloadable content that can be downloaded from the internet at no cost. These printables come in different forms, including worksheets, templates, coloring pages, and many more. The benefit of How Are Real Estate Taxes Calculated In Illinois is their flexibility and accessibility.

More of How Are Real Estate Taxes Calculated In Illinois

How Are Property Taxes Calculated In Illinois Diamond Real Estate Law

How Are Property Taxes Calculated In Illinois Diamond Real Estate Law

How to Calculate a Tax Bill Property Tax bills in Illinois are typically due June 1 and September 1 for the prior year tax are in arrears Property is assessed as of January 1 of the year prior to tax bill All tax bills are calculated using the following method

Calculating Property Taxes in Illinois In Illinois there are two factors that come into play when calculating property tax The first is the Equalized Assessed Value of the property which is typically assessed at 1 3rd of it s fair market value

The How Are Real Estate Taxes Calculated In Illinois have gained huge popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Modifications: They can make the design to meet your needs, whether it's designing invitations, organizing your schedule, or even decorating your house.

-

Education Value Printables for education that are free cater to learners from all ages, making them a vital tool for parents and educators.

-

Easy to use: You have instant access numerous designs and templates can save you time and energy.

Where to Find more How Are Real Estate Taxes Calculated In Illinois

How High Are Property Taxes In Your State American Property Owners

How High Are Property Taxes In Your State American Property Owners

Assessments are a key and often misunderstood part of the property tax process The assess ments estimates of the market value of a property determine how much of the overall property tax burden within a jurisdiction falls on each individual property owner

Calculating an Estimated Residential Property Tax Bill The Cook County Assessor is responsible for determining the first part of the equation used by the Cook County Treasurer to calculate your property taxes

If we've already piqued your interest in printables for free we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of applications.

- Explore categories such as decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets Flashcards, worksheets, and other educational materials.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs covered cover a wide spectrum of interests, all the way from DIY projects to party planning.

Maximizing How Are Real Estate Taxes Calculated In Illinois

Here are some innovative ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Print out free worksheets and activities for teaching at-home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

How Are Real Estate Taxes Calculated In Illinois are an abundance with useful and creative ideas that can meet the needs of a variety of people and passions. Their accessibility and versatility make them a wonderful addition to both professional and personal life. Explore the vast collection of How Are Real Estate Taxes Calculated In Illinois right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes you can! You can print and download these tools for free.

-

Can I use free printing templates for commercial purposes?

- It's all dependent on the rules of usage. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions regarding their use. Make sure to read the terms and regulations provided by the designer.

-

How do I print printables for free?

- Print them at home with your printer or visit a print shop in your area for premium prints.

-

What program do I require to open How Are Real Estate Taxes Calculated In Illinois?

- A majority of printed materials are in the format PDF. This can be opened with free software such as Adobe Reader.

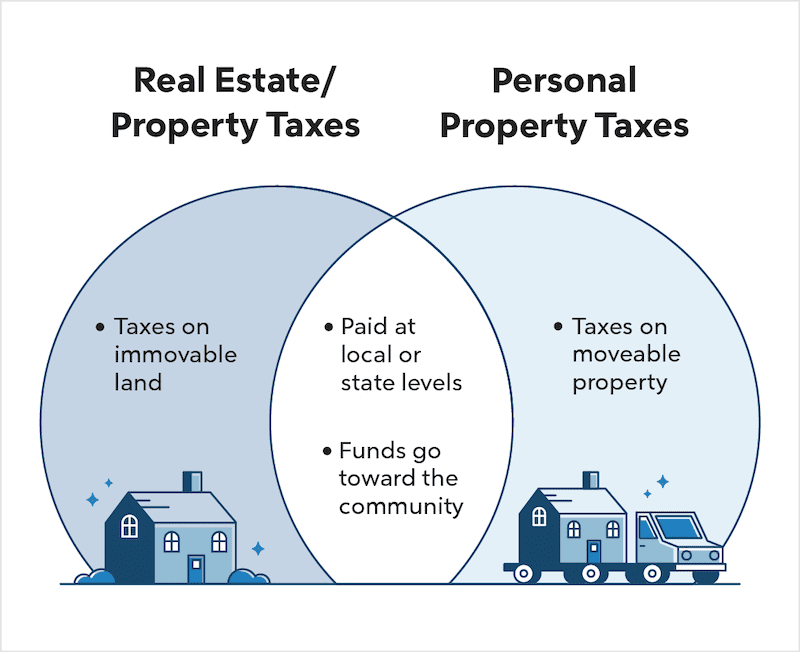

Real Estate Taxes Vs Property Taxes Quicken Loans

How To Avoid Paying Property Tax Sinkforce15

Check more sample of How Are Real Estate Taxes Calculated In Illinois below

The Real Estate Agent s Guide To Get Paid Info Graphic By Nestiny

How Do Home Buyer Agents Get Paid

:max_bytes(150000):strip_icc()/how-do-buyer-s-agents-get-paid-1798872_FINAL-74f688f80ea24f05932d17f21d83a550.png)

Are Real Estate Taxes Deductible AZexplained

How Are Real Estate Taxes Calculated LNGFRM

Clinton County Auditor Forms

Does Arizona Have Real Estate Taxes Unbiased Options

https://stelklaw.com/blog/real-estate-taxes-determined-illinois

In Illinois there are certain components that determine your property tax bill The real estate has an assessed value that is determined by the county assessor That amount is then multiplied by the state equalization factor to

https://www.propertytax101.org/illinois/taxcalculator

Our Illinois Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Illinois and across the entire United States

In Illinois there are certain components that determine your property tax bill The real estate has an assessed value that is determined by the county assessor That amount is then multiplied by the state equalization factor to

Our Illinois Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Illinois and across the entire United States

How Are Real Estate Taxes Calculated LNGFRM

:max_bytes(150000):strip_icc()/how-do-buyer-s-agents-get-paid-1798872_FINAL-74f688f80ea24f05932d17f21d83a550.png)

How Do Home Buyer Agents Get Paid

Clinton County Auditor Forms

Does Arizona Have Real Estate Taxes Unbiased Options

How Are Real Estate Taxes Determined Realty Times

Michigan Property Tax Rates By Township Revered Weblog Picture Show

Michigan Property Tax Rates By Township Revered Weblog Picture Show

How Are Real Estate Taxes Paid In Massachusetts