In the digital age, when screens dominate our lives, the charm of tangible printed objects hasn't waned. Whether it's for educational purposes such as creative projects or simply to add an individual touch to your area, How Are Estimated Taxes Calculated have become an invaluable source. We'll take a dive into the world of "How Are Estimated Taxes Calculated," exploring what they are, how they can be found, and how they can improve various aspects of your lives.

Get Latest How Are Estimated Taxes Calculated Below

How Are Estimated Taxes Calculated

How Are Estimated Taxes Calculated -

And if you want help calculating your taxes you can get straight to the tax preparation with our free estimated tax calculator This tool also functions as a self employed tax calculator Just enter in all your information and we ll tell you how much tax you owe

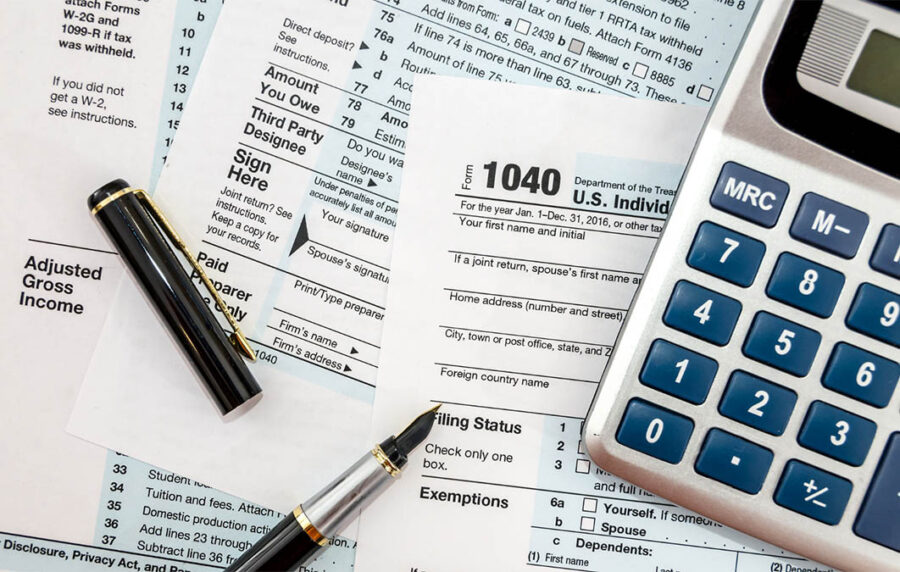

The Tax Cuts and Jobs Act enacted in December 2017 changed the way tax is calculated for most taxpayers including those with substantial income not subject to withholding As a result many taxpayers may need to adjust the amount of tax they pay each quarter through the estimated tax system

How Are Estimated Taxes Calculated include a broad range of printable, free items that are available online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and more. The appeal of printables for free is their flexibility and accessibility.

More of How Are Estimated Taxes Calculated

How To Estimate Taxes Estimated Taxes

How To Estimate Taxes Estimated Taxes

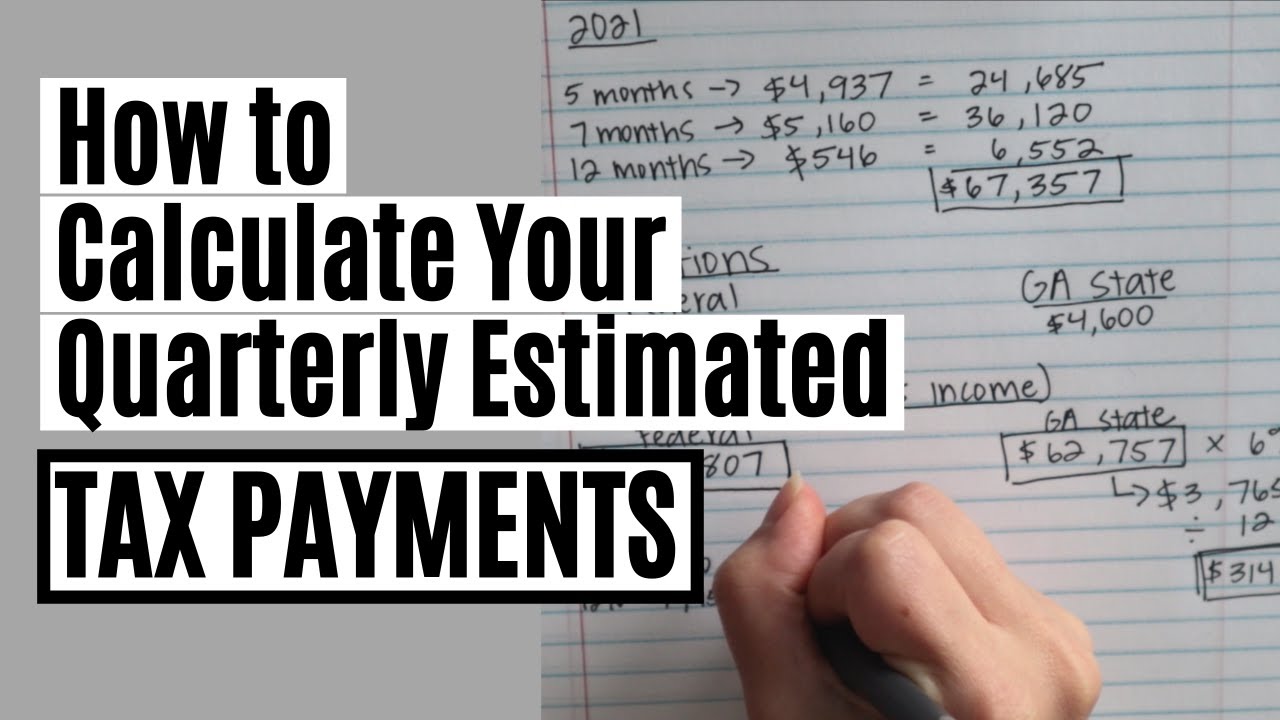

Based on your 2023 tax info we ll use the lower of the following IRS approved methods to calculate your estimated tax payments 90 of your estimated 2024 taxes 100 of your actual 2023 taxes 110 if your adjusted gross income was higher than 150 000 or 75 000 if Married Filing Separately

The IRS says that for most taxpayers if your estimated tax payments equal at least 90 of the total that you ended up owing for the year or at least 100 of the tax you paid on the

The How Are Estimated Taxes Calculated have gained huge popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: We can customize printing templates to your own specific requirements whether it's making invitations and schedules, or decorating your home.

-

Educational Benefits: These How Are Estimated Taxes Calculated provide for students from all ages, making them an essential tool for parents and educators.

-

It's easy: Access to a myriad of designs as well as templates reduces time and effort.

Where to Find more How Are Estimated Taxes Calculated

When Are 2022 Q3 Estimated Taxes Due Rocket Lawyer

When Are 2022 Q3 Estimated Taxes Due Rocket Lawyer

Estimated Tax Payments Definition Eligibility for Estimated Tax Payments Calculation of Estimated Tax Payments Determining Tax Liability Adjustments for Credits and Deductions Payment Schedule and Due Dates Methods of Submitting Estimated Tax Payments Tips for Managing Estimated Tax Payments Special Circumstances

Income Tax Tax Filings What Is Estimated Tax and Who Must Pay It By The Investopedia Team Updated June 06 2023 Reviewed by Ebony Howard Fact checked by Skylar Clarine What Is

In the event that we've stirred your curiosity about How Are Estimated Taxes Calculated, let's explore where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of How Are Estimated Taxes Calculated suitable for many uses.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- These blogs cover a broad range of topics, starting from DIY projects to party planning.

Maximizing How Are Estimated Taxes Calculated

Here are some inventive ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print worksheets that are free for teaching at-home and in class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

How Are Estimated Taxes Calculated are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and needs and. Their accessibility and flexibility make them a fantastic addition to both personal and professional life. Explore the many options of How Are Estimated Taxes Calculated to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes they are! You can download and print these resources at no cost.

-

Are there any free printables for commercial purposes?

- It's contingent upon the specific rules of usage. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables could be restricted regarding usage. Check these terms and conditions as set out by the designer.

-

How do I print printables for free?

- You can print them at home with any printer or head to the local print shops for superior prints.

-

What software do I need to open printables free of charge?

- Many printables are offered in the PDF format, and is open with no cost software, such as Adobe Reader.

How To Calculate Quarterly Estimated Tax Payments UNEARNED INCOME

Estimated Quarterly Tax Payments 1040 ES Guide Dates

Check more sample of How Are Estimated Taxes Calculated below

Estimated Quarterly Tax Payments Calculator Bench Accounting

What Are Estimated Taxes And Who Should Pay Them Military

What Are Estimated Taxes For Real Estate Agents

How Much Is The Penalty For Not Paying Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes 2022

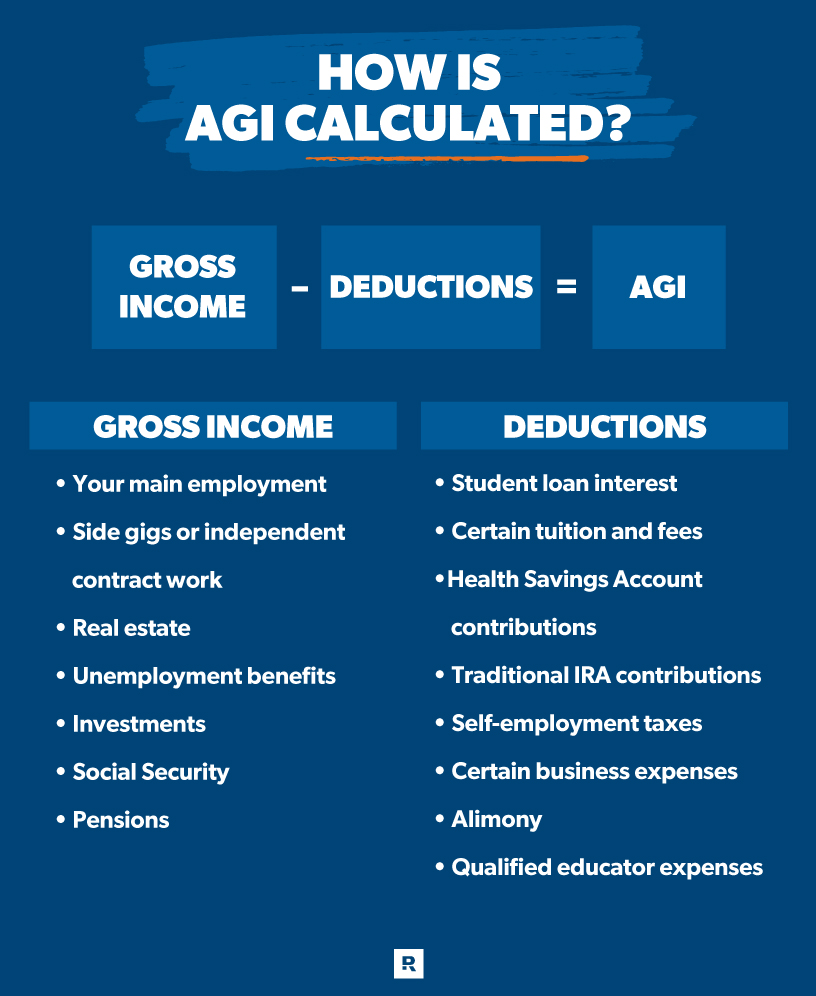

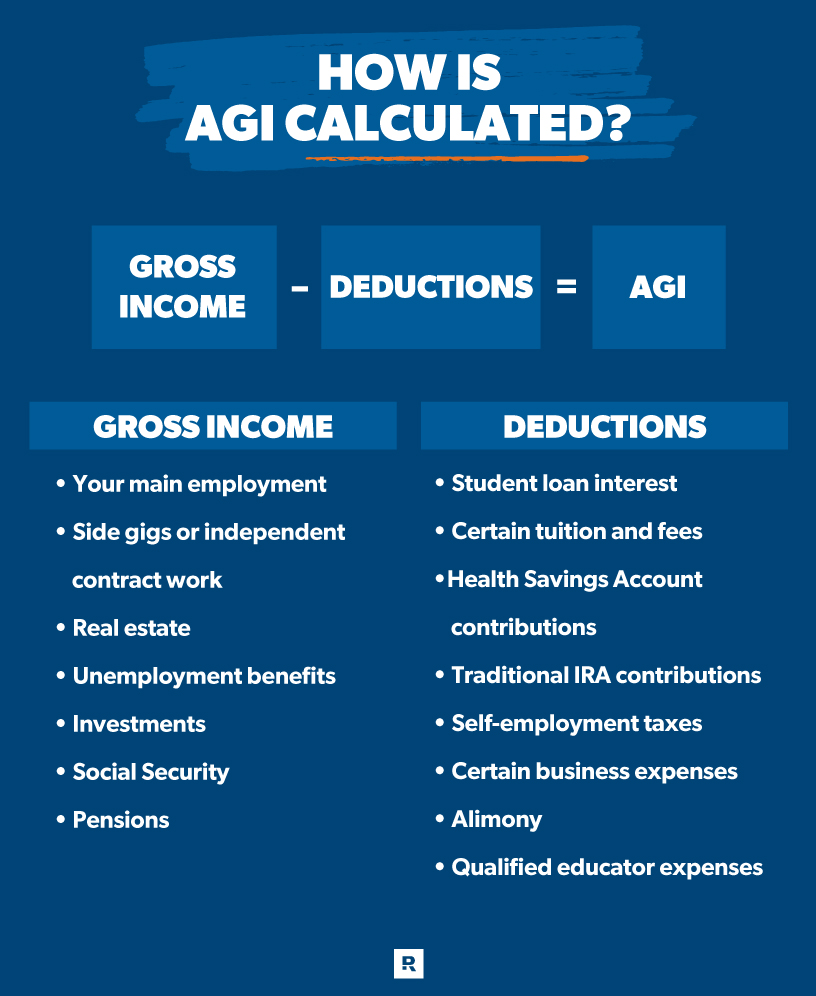

What Is Adjusted Gross Income AGI Ramsey

https://www.irs.gov/newsroom/basics-of-estimated...

The Tax Cuts and Jobs Act enacted in December 2017 changed the way tax is calculated for most taxpayers including those with substantial income not subject to withholding As a result many taxpayers may need to adjust the amount of tax they pay each quarter through the estimated tax system

https://www.nerdwallet.com/article/taxes/estimated-quarterly-taxes

Estimated tax payments are taxes paid to the IRS throughout the year on earnings that are not subject to federal tax withholding This can include self employment or freelancer earnings or

The Tax Cuts and Jobs Act enacted in December 2017 changed the way tax is calculated for most taxpayers including those with substantial income not subject to withholding As a result many taxpayers may need to adjust the amount of tax they pay each quarter through the estimated tax system

Estimated tax payments are taxes paid to the IRS throughout the year on earnings that are not subject to federal tax withholding This can include self employment or freelancer earnings or

How Much Is The Penalty For Not Paying Estimated Taxes

What Are Estimated Taxes And Who Should Pay Them Military

Quarterly Tax Calculator Calculate Estimated Taxes 2022

What Is Adjusted Gross Income AGI Ramsey

Estimated Taxes 2021 RiyaLilleia

What Are Estimated Taxes And How Do I Pay Them

What Are Estimated Taxes And How Do I Pay Them

Federal Tax Estimator 2022 FinbarAtharv