In this digital age, where screens dominate our lives The appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes in creative or artistic projects, or simply adding an element of personalization to your area, Corporate Income Tax Rebate Meaning are a great source. With this guide, you'll take a dive into the sphere of "Corporate Income Tax Rebate Meaning," exploring the benefits of them, where you can find them, and the ways that they can benefit different aspects of your life.

Get Latest Corporate Income Tax Rebate Meaning Below

Corporate Income Tax Rebate Meaning

Corporate Income Tax Rebate Meaning - Income Tax Rebate Meaning, Income Tax Rebate Meaning In Hindi, What Is A Corporate Tax Rebate, What Is A Corporate Income Tax Return, What Is Corporate Income Tax, What Is Tax Rebate In India

Web 12 f 233 vr 2023 nbsp 0183 32 A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money

Web 6 lignes nbsp 0183 32 Corporate Income Tax Rebates Corporate Income Tax rebates are given to companies to

The Corporate Income Tax Rebate Meaning are a huge selection of printable and downloadable content that can be downloaded from the internet at no cost. These resources come in various styles, from worksheets to templates, coloring pages and much more. The appealingness of Corporate Income Tax Rebate Meaning is their versatility and accessibility.

More of Corporate Income Tax Rebate Meaning

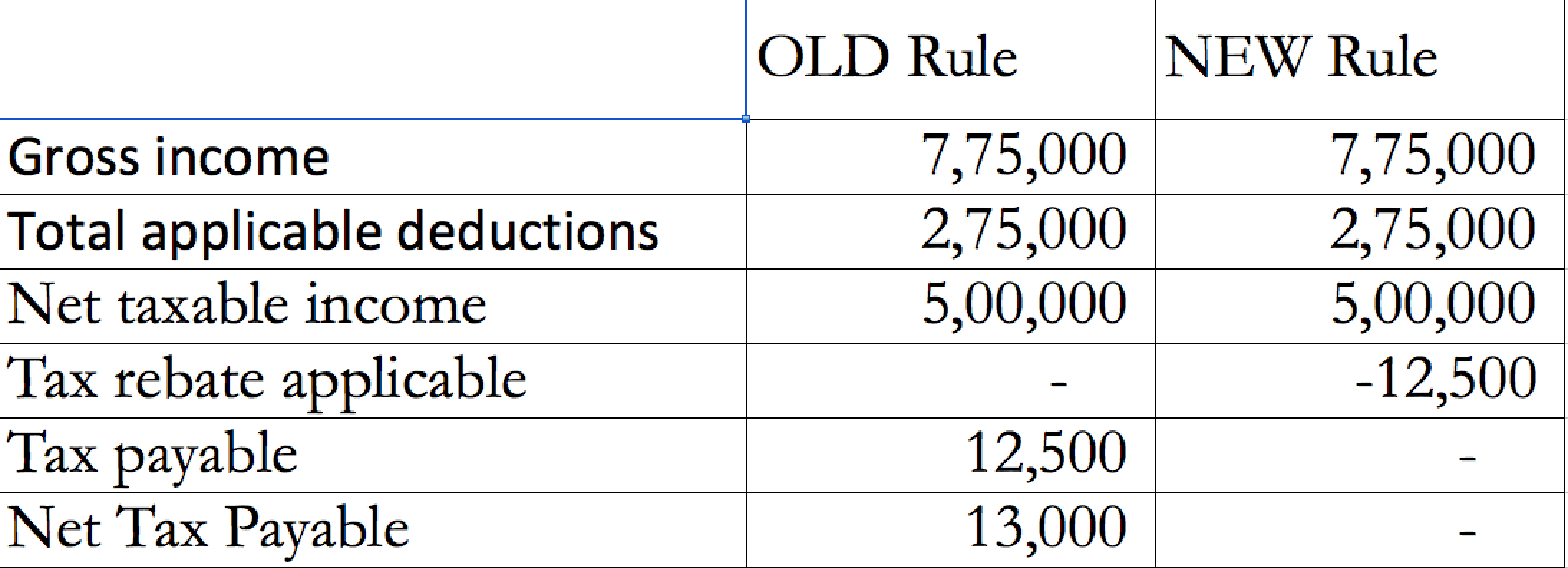

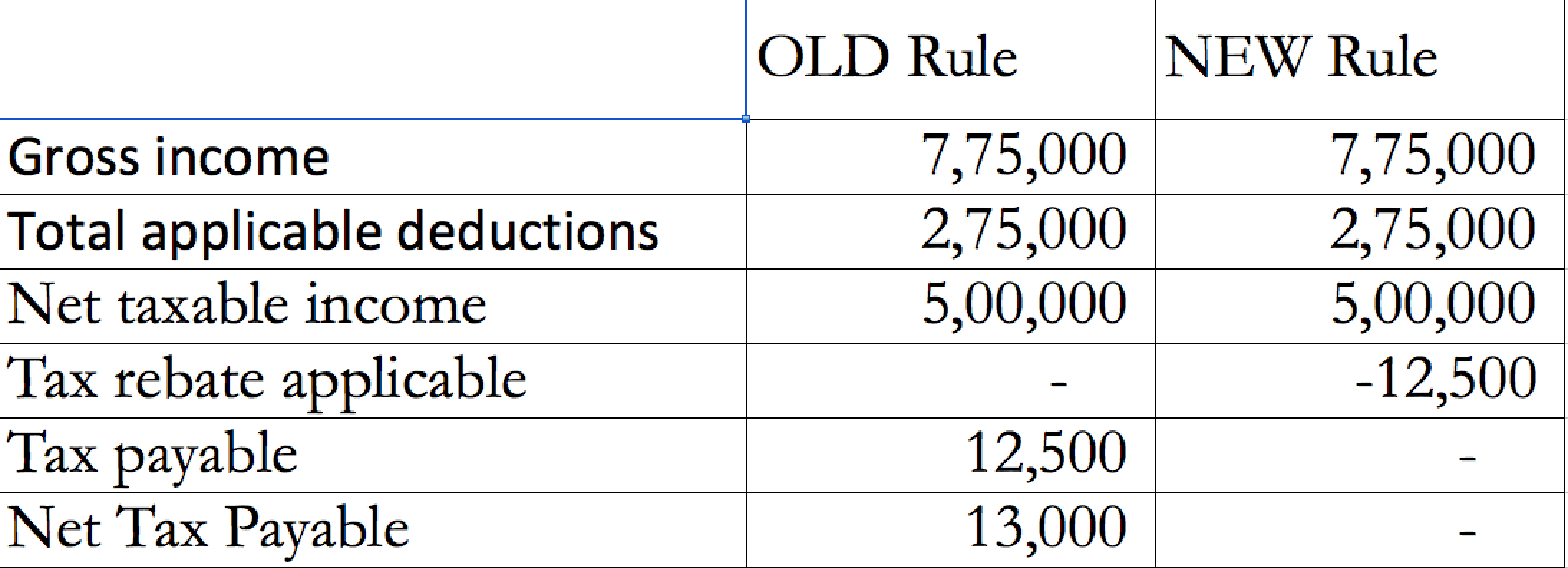

Decoding Section 87A Rebate Provision Under Income Tax Act

Decoding Section 87A Rebate Provision Under Income Tax Act

Web 21 janv 2021 nbsp 0183 32 Business tax credits are an amount that companies can subtract from the taxes owed to a government Business tax credits are applied against the taxes owed

Web A rebate is a cashback or refund given to the customers against the purchase which acts as an incentive to complete the transaction Unlike discounts allotted before the actual

The Corporate Income Tax Rebate Meaning have gained huge appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

customization We can customize designs to suit your personal needs, whether it's designing invitations to organize your schedule or decorating your home.

-

Educational value: The free educational worksheets offer a wide range of educational content for learners of all ages. This makes them a useful resource for educators and parents.

-

Easy to use: You have instant access numerous designs and templates will save you time and effort.

Where to Find more Corporate Income Tax Rebate Meaning

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Web Type of Digital Service 1 File Estimated Chargeable Income ECI 2 File Form C S Form C S Lite 3 File Form C 4 File Form for Dormant Company 5 Submit Document

Web 1 d 233 c 2022 nbsp 0183 32 Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more immediate than tax refunds because governments can enact them at

Since we've got your curiosity about Corporate Income Tax Rebate Meaning We'll take a look around to see where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Corporate Income Tax Rebate Meaning designed for a variety needs.

- Explore categories like furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Great for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs covered cover a wide array of topics, ranging starting from DIY projects to party planning.

Maximizing Corporate Income Tax Rebate Meaning

Here are some fresh ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Corporate Income Tax Rebate Meaning are an abundance of useful and creative resources catering to different needs and passions. Their accessibility and flexibility make them an essential part of the professional and personal lives of both. Explore the vast world of Corporate Income Tax Rebate Meaning to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes they are! You can download and print these files for free.

-

Can I use free printing templates for commercial purposes?

- It depends on the specific rules of usage. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables could be restricted in their usage. Check the terms of service and conditions provided by the author.

-

How do I print Corporate Income Tax Rebate Meaning?

- You can print them at home with printing equipment or visit the local print shops for the highest quality prints.

-

What program do I need in order to open printables that are free?

- The majority are printed in the PDF format, and can be opened with free programs like Adobe Reader.

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Income Tax Rebate Under Section 87A Rebate For Financial Year GST

Check more sample of Corporate Income Tax Rebate Meaning below

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Tax Rebate For Individual Deductions For Individuals reliefs

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Tax Rebate 2017 Malaysia Malaysia Personal Income Tax Guide 2017

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web 6 lignes nbsp 0183 32 Corporate Income Tax Rebates Corporate Income Tax rebates are given to companies to

https://www.investopedia.com/terms/r/rebate.…

Web 22 janv 2022 nbsp 0183 32 A rebate is a credit paid to a buyer of a portion of the amount paid for a product or service In a short sale a rebate is a fee that the borrower of stock pays to the investor who loaned the

Web 6 lignes nbsp 0183 32 Corporate Income Tax Rebates Corporate Income Tax rebates are given to companies to

Web 22 janv 2022 nbsp 0183 32 A rebate is a credit paid to a buyer of a portion of the amount paid for a product or service In a short sale a rebate is a fee that the borrower of stock pays to the investor who loaned the

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Tax Rebate 2017 Malaysia Malaysia Personal Income Tax Guide 2017

Income Tax Rebate Under Section 87A

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants