In the digital age, where screens rule our lives however, the attraction of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons or creative projects, or simply to add an element of personalization to your space, Hmrc Vat Return Payment Dates are a great source. For this piece, we'll dive into the world "Hmrc Vat Return Payment Dates," exploring what they are, where they can be found, and how they can improve various aspects of your lives.

Get Latest Hmrc Vat Return Payment Dates Below

Hmrc Vat Return Payment Dates

Hmrc Vat Return Payment Dates - Hmrc Vat Return Payment Dates, Hmrc Vat Return Due Dates, Hmrc Vat Return Submission Dates, Hmrc Vat Return Payment Deadlines, Hmrc Vat Return Dates 2023, Hmrc Vat Return Dates 2022, Hmrc Vat Return Dates

Tax Tax Advice VAT deadlines and penalties A guide 8 Jun 2023 For businesses that pay their VAT monthly or quarterly the deadline for both submitting a return and paying the VAT owing is one calendar month plus seven days after the VAT period has ended

The due dates for payments on account are the last working day of the second and third months of every VAT quarter no matter what your period end date is The 7 day extension for paying

The Hmrc Vat Return Payment Dates are a huge selection of printable and downloadable documents that can be downloaded online at no cost. They are available in numerous designs, including worksheets templates, coloring pages and more. The attraction of printables that are free is their flexibility and accessibility.

More of Hmrc Vat Return Payment Dates

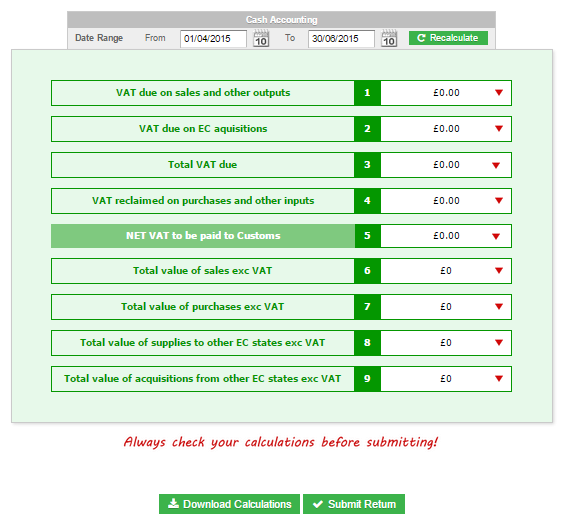

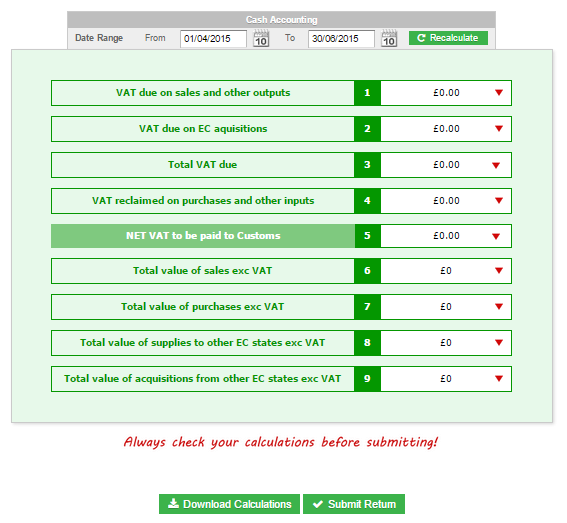

VAT Returns Guide VAT QuickFile

VAT Returns Guide VAT QuickFile

You should check your VAT return submission and payment deadline in your HMRC online account As a general rule the due date to submit and pay VAT returns in the UK is the 7th day of the second month following the reporting period More information about the applicable deadlines is available here

Quarter 1 January to March April 30 or May 7 for electronic payments Quarter 2 April to June July 31 or August 7 for electronic payments Quarter 3 July to September October 31 or November 7 for electronic payments Quarter 4 October to December January 31 or February 7 for electronic payments

Hmrc Vat Return Payment Dates have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: It is possible to tailor print-ready templates to your specific requirements for invitations, whether that's creating them for your guests, organizing your schedule or decorating your home.

-

Educational Impact: Printables for education that are free are designed to appeal to students of all ages. This makes these printables a powerful device for teachers and parents.

-

Simple: Quick access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Hmrc Vat Return Payment Dates

Hmrc Login Vat

Hmrc Login Vat

July 11th 2023 Importantly the deadlines for submitting your VAT return online and paying HMRC any VAT you owe are the same If you re not sure when your VAT return and payment deadline is you can check that in your VAT online account This will tell you When your VAT return is due When the payment must arrive in HMRC s account

The deadline for submitting VAT returns and making payment is usually one calendar month and seven days after the end of your VAT accounting period The accounting period is the period covered by the VAT return and is ordinarily three months in length

We hope we've stimulated your curiosity about Hmrc Vat Return Payment Dates We'll take a look around to see where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection with Hmrc Vat Return Payment Dates for all purposes.

- Explore categories such as decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching tools.

- The perfect resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a wide array of topics, ranging that includes DIY projects to party planning.

Maximizing Hmrc Vat Return Payment Dates

Here are some inventive ways in order to maximize the use of Hmrc Vat Return Payment Dates:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use these printable worksheets free of charge for teaching at-home for the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Hmrc Vat Return Payment Dates are an abundance of useful and creative resources which cater to a wide range of needs and interests. Their accessibility and flexibility make them an invaluable addition to any professional or personal life. Explore the vast array of Hmrc Vat Return Payment Dates right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes, they are! You can download and print these items for free.

-

Does it allow me to use free templates for commercial use?

- It's determined by the specific conditions of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright problems with Hmrc Vat Return Payment Dates?

- Certain printables may be subject to restrictions in their usage. Be sure to read the terms and conditions offered by the designer.

-

How do I print printables for free?

- Print them at home using either a printer or go to a local print shop to purchase high-quality prints.

-

What program do I need in order to open printables that are free?

- Most printables come in the format PDF. This is open with no cost software like Adobe Reader.

Full List Of Cost Of Living Payment Dates For DWP And HMRC Claimants

How To Pay Your VAT To HMRC Goselfemployed co

Check more sample of Hmrc Vat Return Payment Dates below

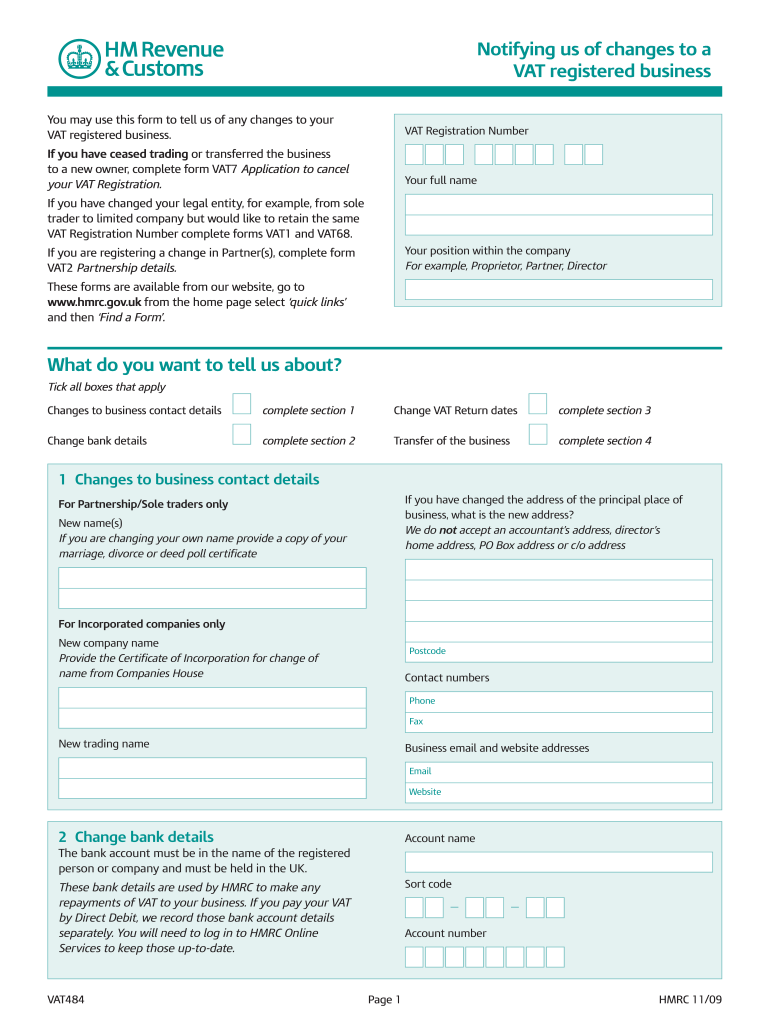

Vat484 Fill Out And Sign Printable PDF Template SignNow

Zimra Vat 7 Return Form Atlantacaqwe

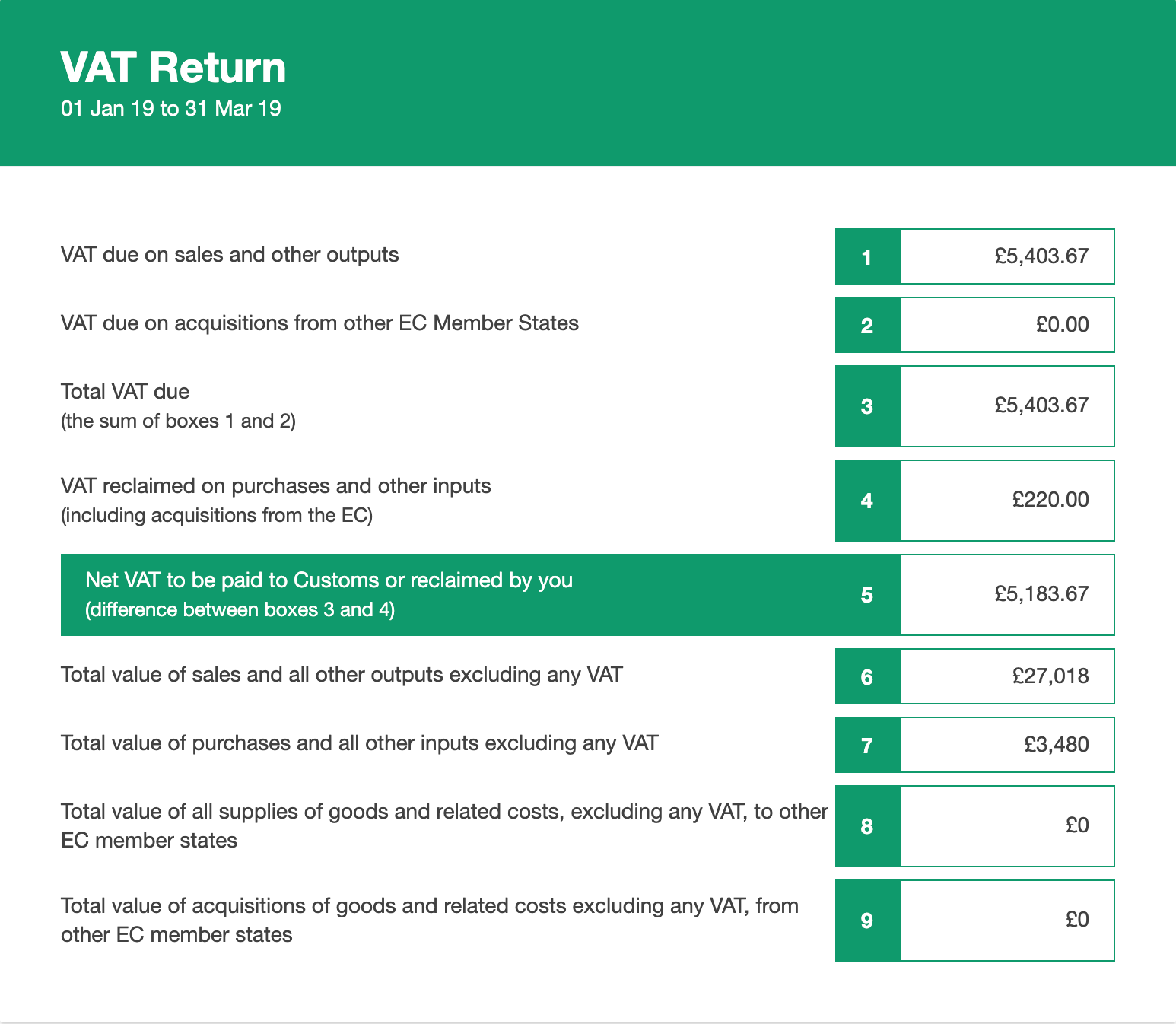

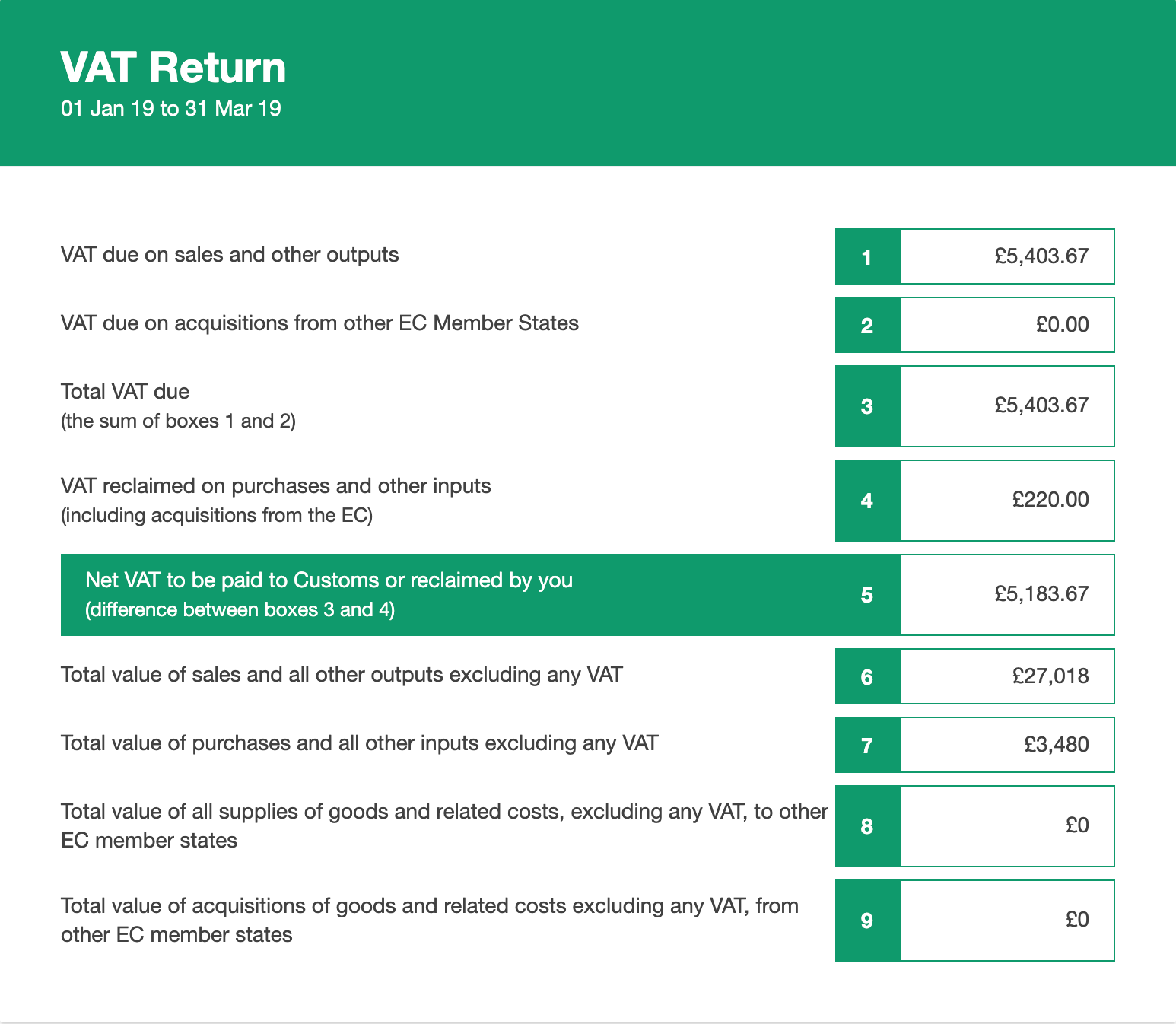

How To File A Nil VAT Return With HMRC Goselfemployed co

How To Pay HMRC VAT Corporation Tax Online Details And Guide

VAT Return Dates Payment Deadlines Goselfemployed co

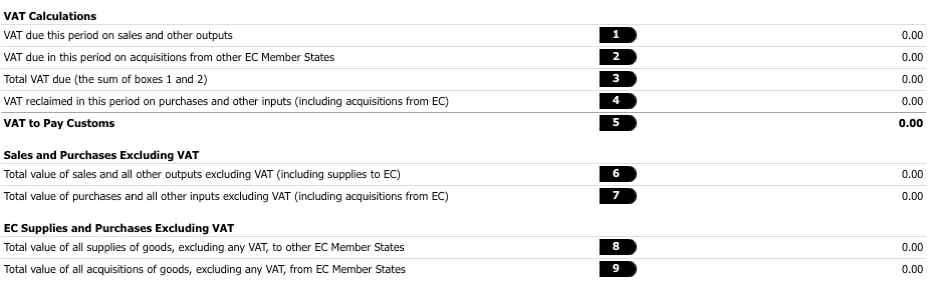

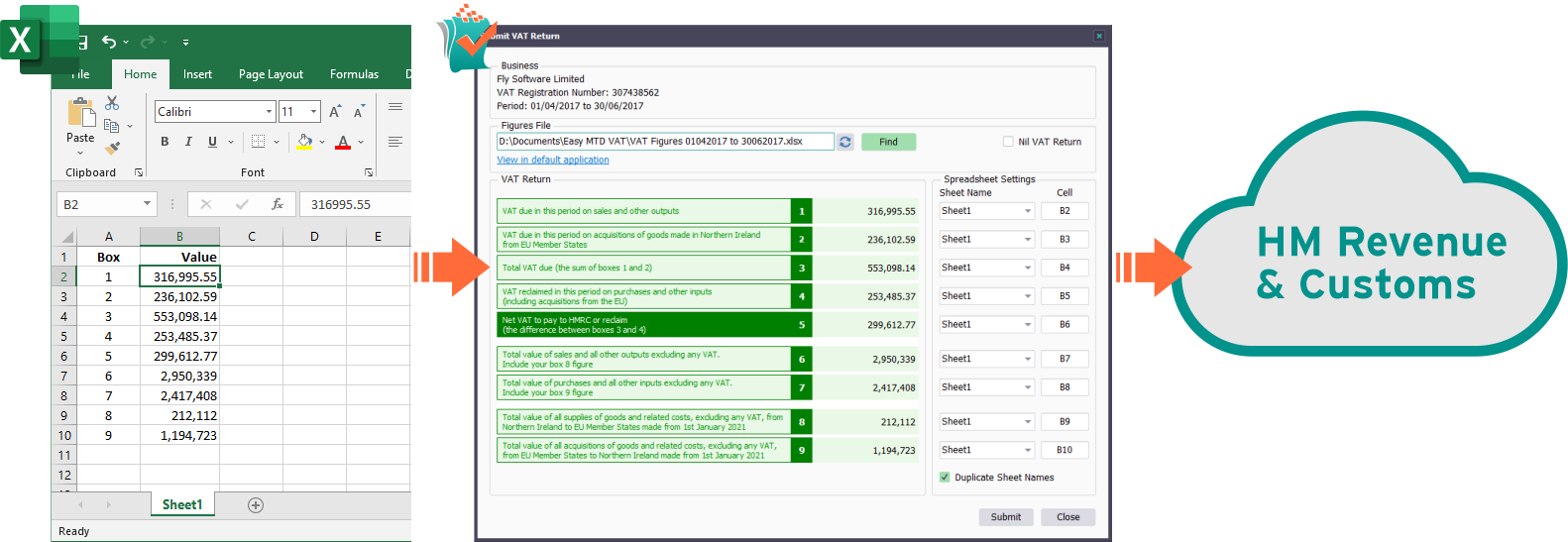

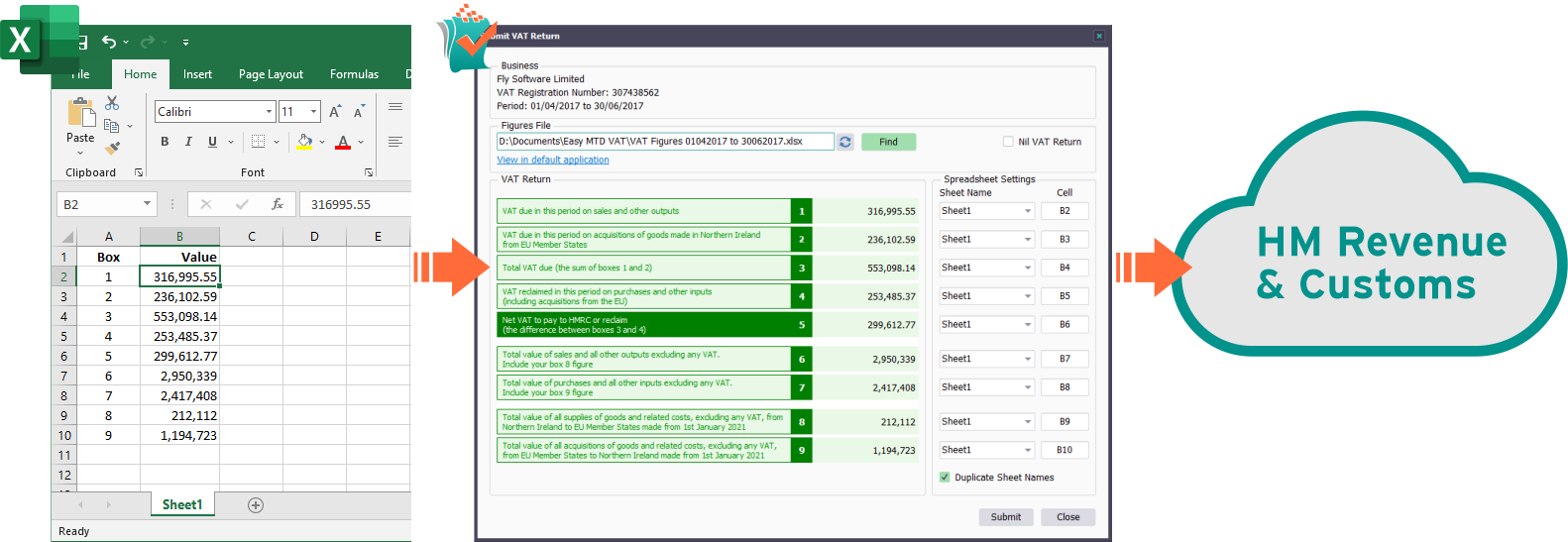

Making Tax Digital For VAT Bridging Software For Excel

https://www.gov.uk/guidance/vat-payments-on-account

The due dates for payments on account are the last working day of the second and third months of every VAT quarter no matter what your period end date is The 7 day extension for paying

https://www.gov.uk/vat-repayments

Repayments are usually made within 30 days of HMRC getting your VAT Return Contact HMRC if you have not heard anything after 30 days Your repayment will go direct to your bank account if

The due dates for payments on account are the last working day of the second and third months of every VAT quarter no matter what your period end date is The 7 day extension for paying

Repayments are usually made within 30 days of HMRC getting your VAT Return Contact HMRC if you have not heard anything after 30 days Your repayment will go direct to your bank account if

How To Pay HMRC VAT Corporation Tax Online Details And Guide

Zimra Vat 7 Return Form Atlantacaqwe

VAT Return Dates Payment Deadlines Goselfemployed co

Making Tax Digital For VAT Bridging Software For Excel

Hmrc Vat Payment Dates

VAT Return Dates Payment Deadlines Goselfemployed co

VAT Return Dates Payment Deadlines Goselfemployed co

VAT Return Deadline VAT Payment Dates Hellotax