In this age of technology, where screens dominate our lives yet the appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons such as creative projects or just adding an element of personalization to your area, Hmrc Student Loan Tax Return have proven to be a valuable resource. For this piece, we'll take a dive deeper into "Hmrc Student Loan Tax Return," exploring what they are, how to find them and the ways that they can benefit different aspects of your life.

Get Latest Hmrc Student Loan Tax Return Below

Hmrc Student Loan Tax Return

Hmrc Student Loan Tax Return - Hmrc Student Loan Tax Return, Hmrc Student Loan Types, Is Student Loan Tax Deductible Uk, Can You Claim Student Loans On Taxes

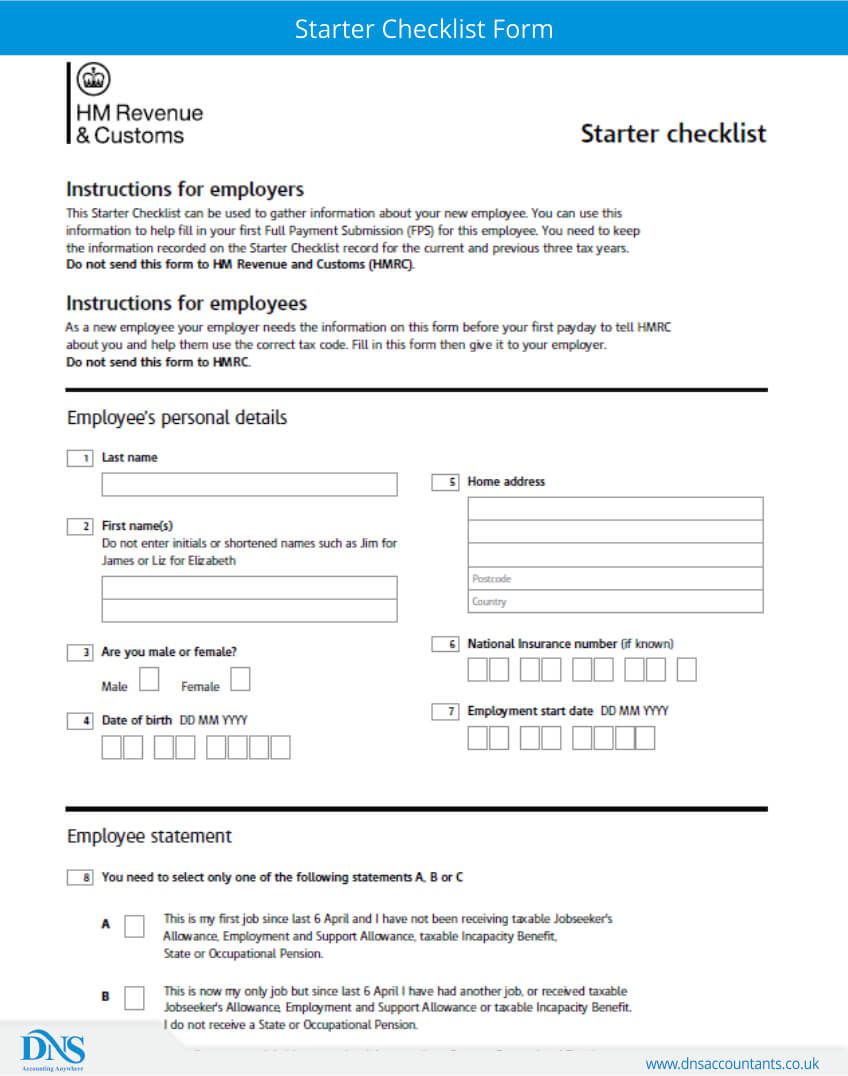

The 2021 22 self assessment tax returns will be the first time Plan 4 loan repayments are included Taxpayers filing their tax returns using HMRC online services should have any loan repayments deducted through the PAYE system automatically pre populated on their self assessment tax returns Student loan repayments

You can ask for a refund if you made repayments but your income over the whole tax year 6 April to 5 April the following year was less than 22 015 a year for Plan 1 27 295 a year for Plan 2

Hmrc Student Loan Tax Return offer a wide range of downloadable, printable materials available online at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and more. The appealingness of Hmrc Student Loan Tax Return is in their variety and accessibility.

More of Hmrc Student Loan Tax Return

Can I Get A Student Loan Tax Deduction TheStreet

Can I Get A Student Loan Tax Deduction TheStreet

HMRC do not take any notice of SLC or even tax returns Many of my clients have paid their student loans off over the last 6 years this was duly reported to HMRC via their tax returns My record to date completing a self assessment for 2018 19 and HMRC s software is still saying there is a Student Loan Plan 1 in place

The student loan repayment due for the year is calculated from your income in the tax year NOT the amount of debt remaining The calculated repayment amount will be a percentage of all net adjusted income above a threshold

Hmrc Student Loan Tax Return have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: There is the possibility of tailoring printing templates to your own specific requirements for invitations, whether that's creating them, organizing your schedule, or decorating your home.

-

Educational Benefits: The free educational worksheets can be used by students of all ages, which makes them an invaluable instrument for parents and teachers.

-

Convenience: immediate access a plethora of designs and templates can save you time and energy.

Where to Find more Hmrc Student Loan Tax Return

How Student Loan Debt Can Affect Your Tax Return CBS San Francisco

How Student Loan Debt Can Affect Your Tax Return CBS San Francisco

Having a student loan is not in itself a reason for needing to complete a self assessment tax return You usually only have to complete one if it is needed for your taxes and HM Revenue Customs HMRC ask you to do so or you notify them that you have a tax reason for needing one

The basic rules are fairly simple There are no repayments due if the annual income is no more than 15 000 in a tax year but payments are then due at a rate of 9 on the excess For self employed students the income taken into account is the total income including any investment income

If we've already piqued your interest in printables for free Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Hmrc Student Loan Tax Return for different reasons.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning tools.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- These blogs cover a wide spectrum of interests, including DIY projects to planning a party.

Maximizing Hmrc Student Loan Tax Return

Here are some new ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets for teaching at-home as well as in the class.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Hmrc Student Loan Tax Return are an abundance of fun and practical tools that satisfy a wide range of requirements and hobbies. Their accessibility and flexibility make these printables a useful addition to every aspect of your life, both professional and personal. Explore the endless world that is Hmrc Student Loan Tax Return today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes they are! You can print and download these tools for free.

-

Are there any free printables for commercial purposes?

- It's all dependent on the conditions of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns when using Hmrc Student Loan Tax Return?

- Some printables could have limitations regarding usage. Check the terms and conditions set forth by the designer.

-

How do I print Hmrc Student Loan Tax Return?

- Print them at home with your printer or visit an in-store print shop to get better quality prints.

-

What program will I need to access printables for free?

- Many printables are offered as PDF files, which can be opened with free software like Adobe Reader.

Printable P46 Form Printable Forms Free Online

Student Loan Interest Can You Deduct It On Your Tax Return Kemper CPA

Check more sample of Hmrc Student Loan Tax Return below

How I Applied For The Maryland Student Loan Tax Credit FIRE Esquire

P45 Vs P60 What s The Difference Revolut

Defaulted Student Loan Tax Refund Studentqw

Student loan tax tips 01 IonTuition Student Loan Repayment Technology

Capgemini Helps HMRC Modernize Student Loans Service Capgemini USA

Trust Tax Return Hmrc Address TAX

https://www.gov.uk/repaying-your-student-loan/getting-a-refund

You can ask for a refund if you made repayments but your income over the whole tax year 6 April to 5 April the following year was less than 22 015 a year for Plan 1 27 295 a year for Plan 2

https://community.hmrc.gov.uk/customerforums/sa/bb...

Hi I finished paying my student loan half way through the tax year 2021 22 and paid 2301 in deductions The self assessment calculator keeps calculating that I owe 6110 in student

You can ask for a refund if you made repayments but your income over the whole tax year 6 April to 5 April the following year was less than 22 015 a year for Plan 1 27 295 a year for Plan 2

Hi I finished paying my student loan half way through the tax year 2021 22 and paid 2301 in deductions The self assessment calculator keeps calculating that I owe 6110 in student

Student loan tax tips 01 IonTuition Student Loan Repayment Technology

P45 Vs P60 What s The Difference Revolut

Capgemini Helps HMRC Modernize Student Loans Service Capgemini USA

Trust Tax Return Hmrc Address TAX

Example Of Form SA302 From HMRC For Mortgage Applications Pay Off

1098 E Tax Form Printable Printable Forms Free Online

1098 E Tax Form Printable Printable Forms Free Online

Students Targeted By Massive HMRC Email Scam Save The Student