In this age of technology, where screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. Whether it's for educational purposes such as creative projects or just adding an individual touch to your area, Hmrc Self Employed Tax Rebate are now a vital resource. For this piece, we'll dive into the sphere of "Hmrc Self Employed Tax Rebate," exploring what they are, where they are, and how they can add value to various aspects of your life.

Get Latest Hmrc Self Employed Tax Rebate Below

Hmrc Self Employed Tax Rebate

Hmrc Self Employed Tax Rebate - Hmrc Self Employed Tax Rebate, Hmrc Self Assessment Tax Rebate, Hmrc Self Employed Tax Return Login, Hmrc Self Employed Tax Return Contact Number, Hmrc Self Employed Tax Return Deadline, Hmrc Self Employed Tax Return Form, Hmrc Self Employment Tax Return Pages, Hmrc Self Assessment Tax Refund, Hmrc Self Assessment Tax Return Address, Hmrc Self Assessment Tax Refund How Long

Web You can usually claim working tax credits as a self employed person if you get a fostering allowance and your expenses aren t more than your allowance ie you don t make a

Web 13 juil 2023 nbsp 0183 32 If you ve left employment and received your last pay before 5 April the previous tax year use form 38 to claim a refund Claim online The quickest way to

The Hmrc Self Employed Tax Rebate are a huge variety of printable, downloadable materials that are accessible online for free cost. They are available in a variety of styles, from worksheets to templates, coloring pages and much more. The great thing about Hmrc Self Employed Tax Rebate is their versatility and accessibility.

More of Hmrc Self Employed Tax Rebate

Hmrc Self employed Short Form Notes Employment Form

Hmrc Self employed Short Form Notes Employment Form

Web If you pay the 20 basic rate of tax and claim tax relief on 163 6 a week you would get 163 1 20 per week in tax relief 20 of 163 6 You ll usually get tax relief through a change to your

Web 10 janv 2022 nbsp 0183 32 When you must tell HMRC In most cases if you re not eligible and have to pay the grant back you must tell us within 90 days of receiving the grant For the fourth

Hmrc Self Employed Tax Rebate have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization We can customize printables to your specific needs be it designing invitations as well as organizing your calendar, or decorating your home.

-

Educational value: Education-related printables at no charge can be used by students from all ages, making them a vital tool for parents and teachers.

-

The convenience of Instant access to the vast array of design and templates is time-saving and saves effort.

Where to Find more Hmrc Self Employed Tax Rebate

Minutes Of EGM By Shareholders For Closure Of The Company Lupon gov ph

Minutes Of EGM By Shareholders For Closure Of The Company Lupon gov ph

Web 6 avr 2023 nbsp 0183 32 April 6 2023 2 02 pm On occasion people are overcharged on their tax bill there is a system in place for you to receive money back from HMRC You may be

Web 5 avr 2017 nbsp 0183 32 If you re self employed the self employed ready reckoner tool can help you budget for your tax bill You may be able to claim a refund if you ve paid too much tax

Now that we've piqued your interest in Hmrc Self Employed Tax Rebate, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of uses.

- Explore categories such as decoration for your home, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets with flashcards and other teaching materials.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs are a vast range of interests, including DIY projects to party planning.

Maximizing Hmrc Self Employed Tax Rebate

Here are some fresh ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print free worksheets to enhance learning at home for the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Hmrc Self Employed Tax Rebate are an abundance of fun and practical tools designed to meet a range of needs and preferences. Their accessibility and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the world of Hmrc Self Employed Tax Rebate right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Hmrc Self Employed Tax Rebate really absolutely free?

- Yes you can! You can print and download these resources at no cost.

-

Are there any free printables for commercial purposes?

- It's based on the rules of usage. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables could have limitations in their usage. Always read the terms and conditions provided by the author.

-

How can I print Hmrc Self Employed Tax Rebate?

- You can print them at home using the printer, or go to the local print shop for high-quality prints.

-

What software must I use to open printables free of charge?

- Most PDF-based printables are available in PDF format, which is open with no cost software such as Adobe Reader.

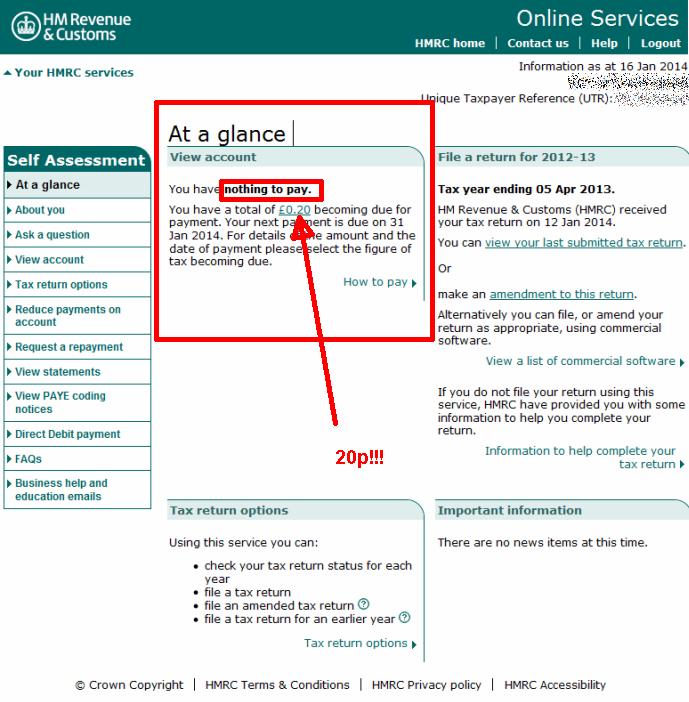

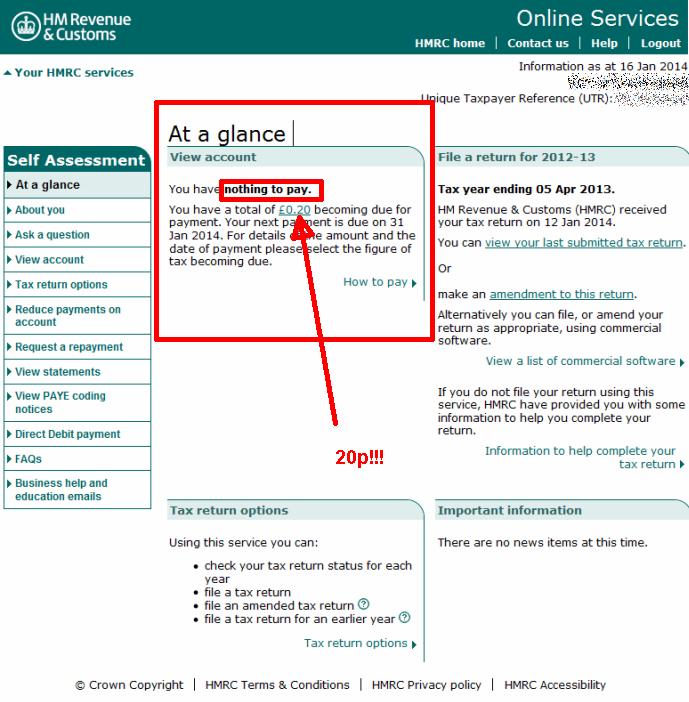

How You Can Claim Your Tax Rebate Using The Free HMRC App

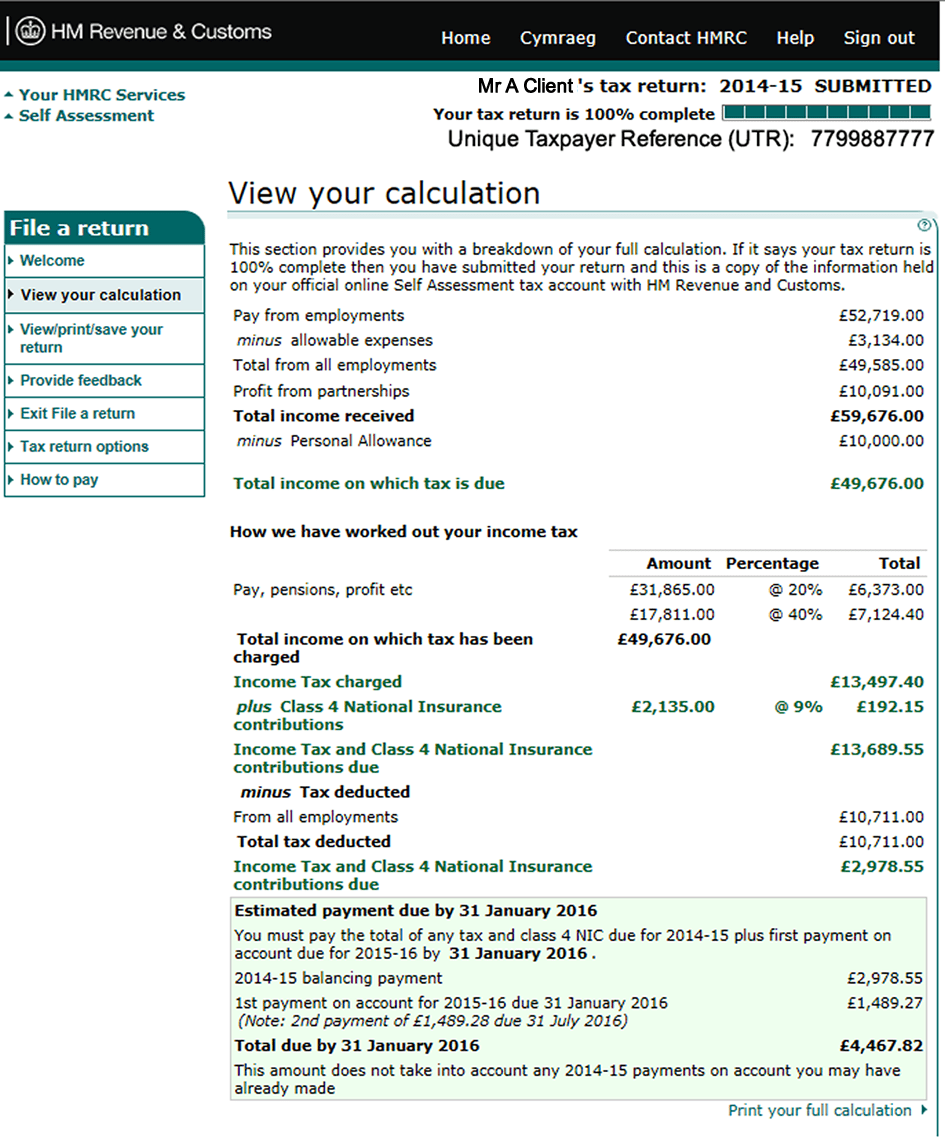

HMRC Tax Refunds Tax Rebates 3 Options Explained

Check more sample of Hmrc Self Employed Tax Rebate below

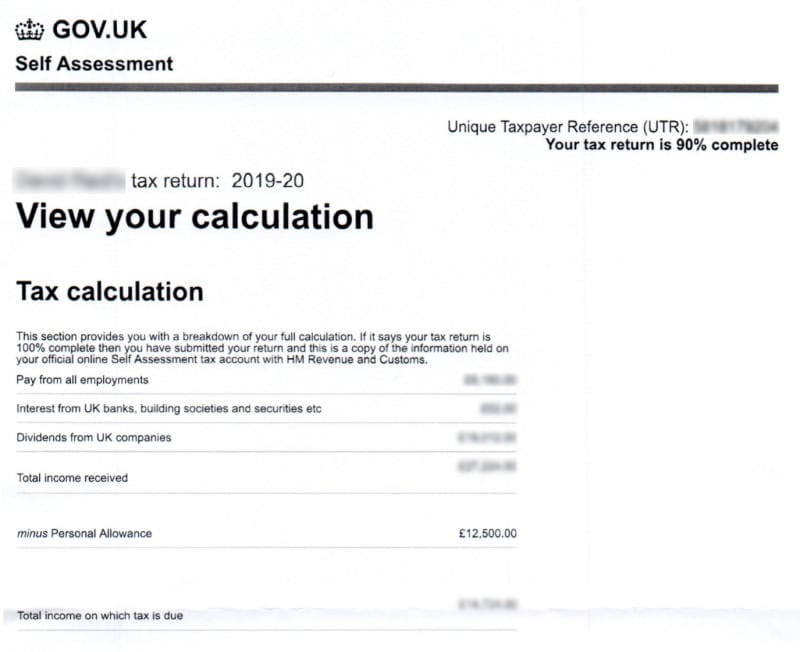

Downloading Your SA302s And Tax Year Overviews From The HMRC Website

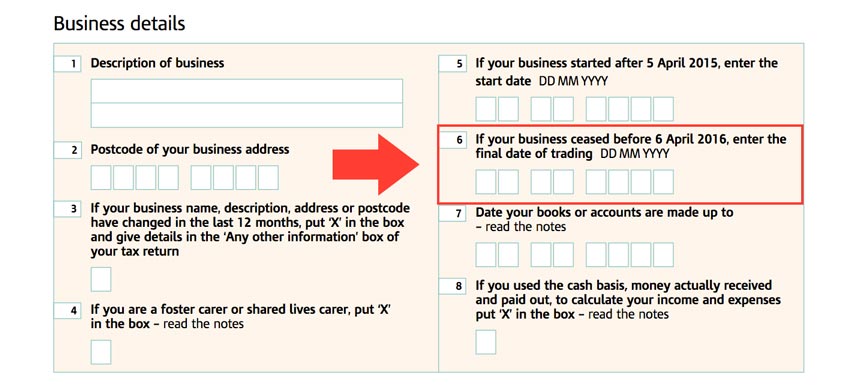

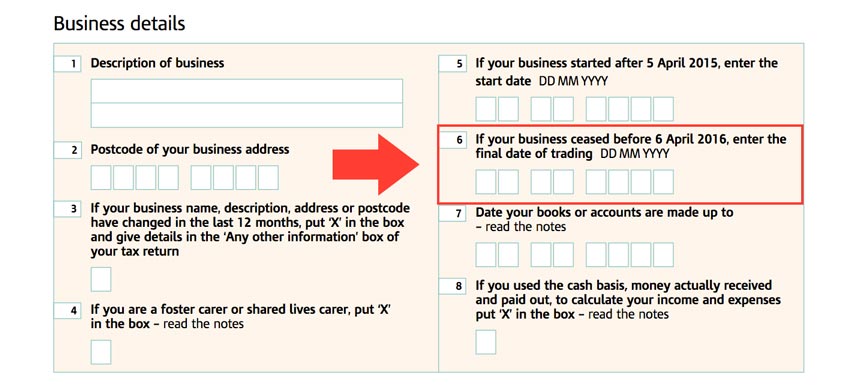

How To Stop Trading As Self Employed And Inform The HMRC

C1603 Form Fill Out And Sign Printable PDF Template SignNow

HMRC Give Tax Relief Pre approval Save The Thorold Arms

January 2014 Andysworld

HMRC Simplified Expenses Explained Goselfemployed co

https://www.gov.uk/guidance/claim-back-income-tax-when-youve-stopped...

Web 13 juil 2023 nbsp 0183 32 If you ve left employment and received your last pay before 5 April the previous tax year use form 38 to claim a refund Claim online The quickest way to

https://www.gov.uk/guidance/claim-income-tax-relief-for-your...

Web 3 mars 2016 nbsp 0183 32 complete Self Assessment tax returns except current year claims are claiming for expenses over 163 2 500 are claiming for more than 5 different jobs When

Web 13 juil 2023 nbsp 0183 32 If you ve left employment and received your last pay before 5 April the previous tax year use form 38 to claim a refund Claim online The quickest way to

Web 3 mars 2016 nbsp 0183 32 complete Self Assessment tax returns except current year claims are claiming for expenses over 163 2 500 are claiming for more than 5 different jobs When

HMRC Give Tax Relief Pre approval Save The Thorold Arms

How To Stop Trading As Self Employed And Inform The HMRC

January 2014 Andysworld

HMRC Simplified Expenses Explained Goselfemployed co

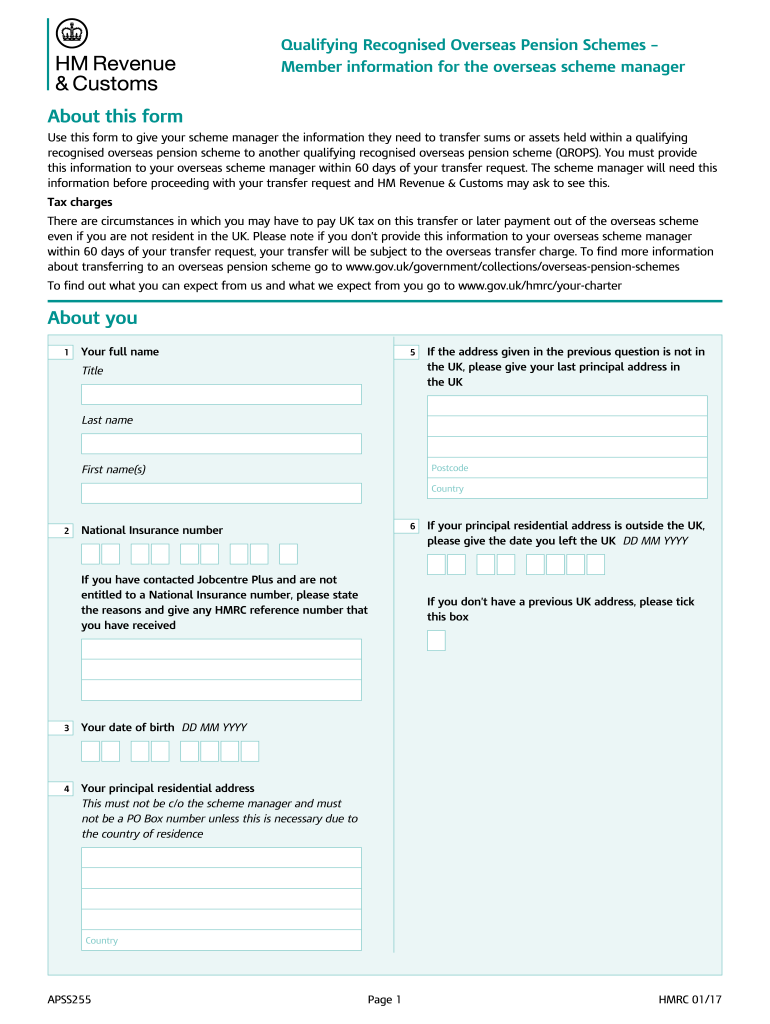

Cash Declaration HM Revenue Customs Hmrc Gov Fill Out Sign

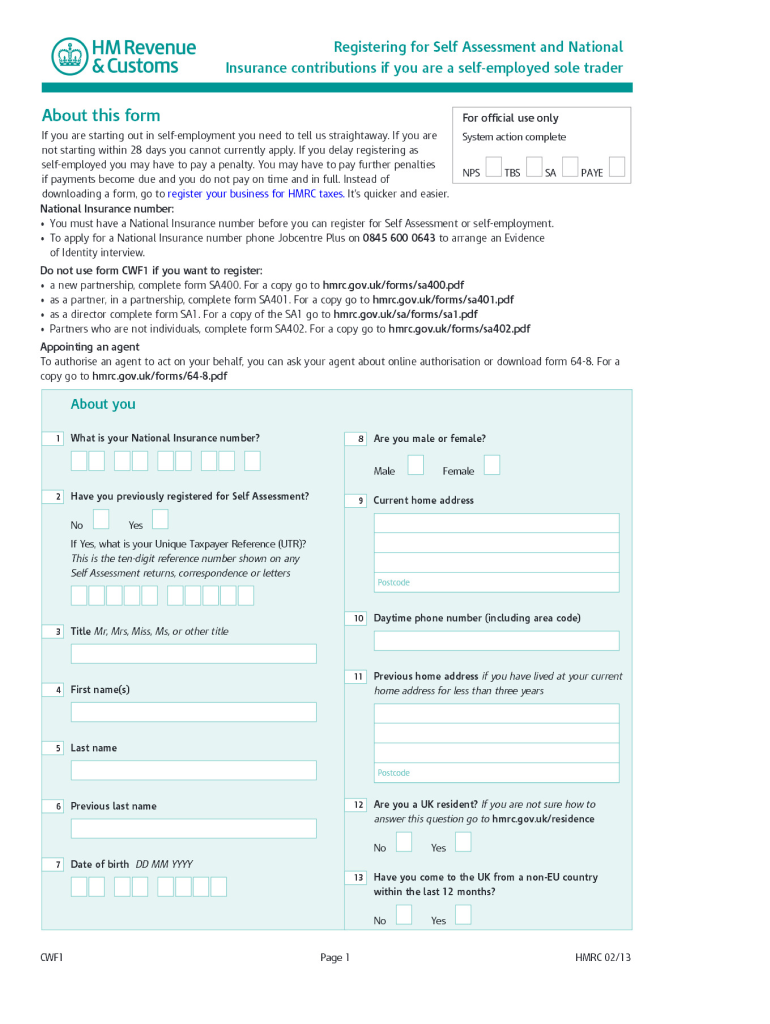

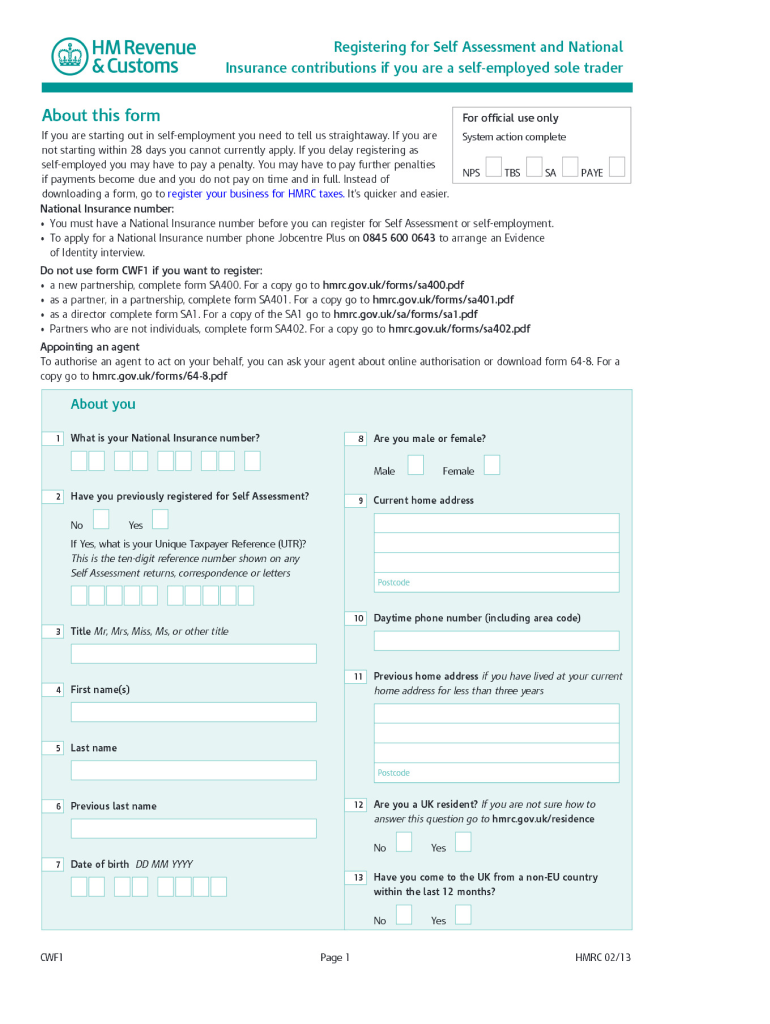

2013 2022 Form UK HMRC CWF1 Fill Online Printable Fillable Blank

2013 2022 Form UK HMRC CWF1 Fill Online Printable Fillable Blank

How To Appeal An HMRC Self Assessment Penalty SA370