Today, with screens dominating our lives and the appeal of physical printed items hasn't gone away. Be it for educational use for creative projects, simply to add an individual touch to your home, printables for free are a great source. With this guide, you'll dive to the depths of "Heat Pump Tax Credit 2022 Inflation Reduction Act," exploring what they are, how to find them and how they can be used to enhance different aspects of your life.

Get Latest Heat Pump Tax Credit 2022 Inflation Reduction Act Below

Heat Pump Tax Credit 2022 Inflation Reduction Act

Heat Pump Tax Credit 2022 Inflation Reduction Act - Heat Pump Tax Credit 2022 Inflation Reduction Act, Heat Pumps That Qualify For Energy Tax Credit, Is There A Tax Credit For Heat Pumps, Heat Pump Qualify For Energy Credit, Does My New Heat Pump Qualify Tax Credit

Dramatically Reducing Greenhouse Gas Pollution DOE s preliminary assessment finds that the Inflation Reduction Act and the Bipartisan Infrastructure Law in combination with past actions are projected to drive 2030 economy wide

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements under 25C of the Internal Revenue Code Code and residential energy property under 25D of the Code

Heat Pump Tax Credit 2022 Inflation Reduction Act provide a diverse assortment of printable, downloadable materials available online at no cost. They are available in a variety of forms, including worksheets, coloring pages, templates and many more. The beauty of Heat Pump Tax Credit 2022 Inflation Reduction Act is in their versatility and accessibility.

More of Heat Pump Tax Credit 2022 Inflation Reduction Act

How To Take Advantage Of The Heat Pump Tax Credit

How To Take Advantage Of The Heat Pump Tax Credit

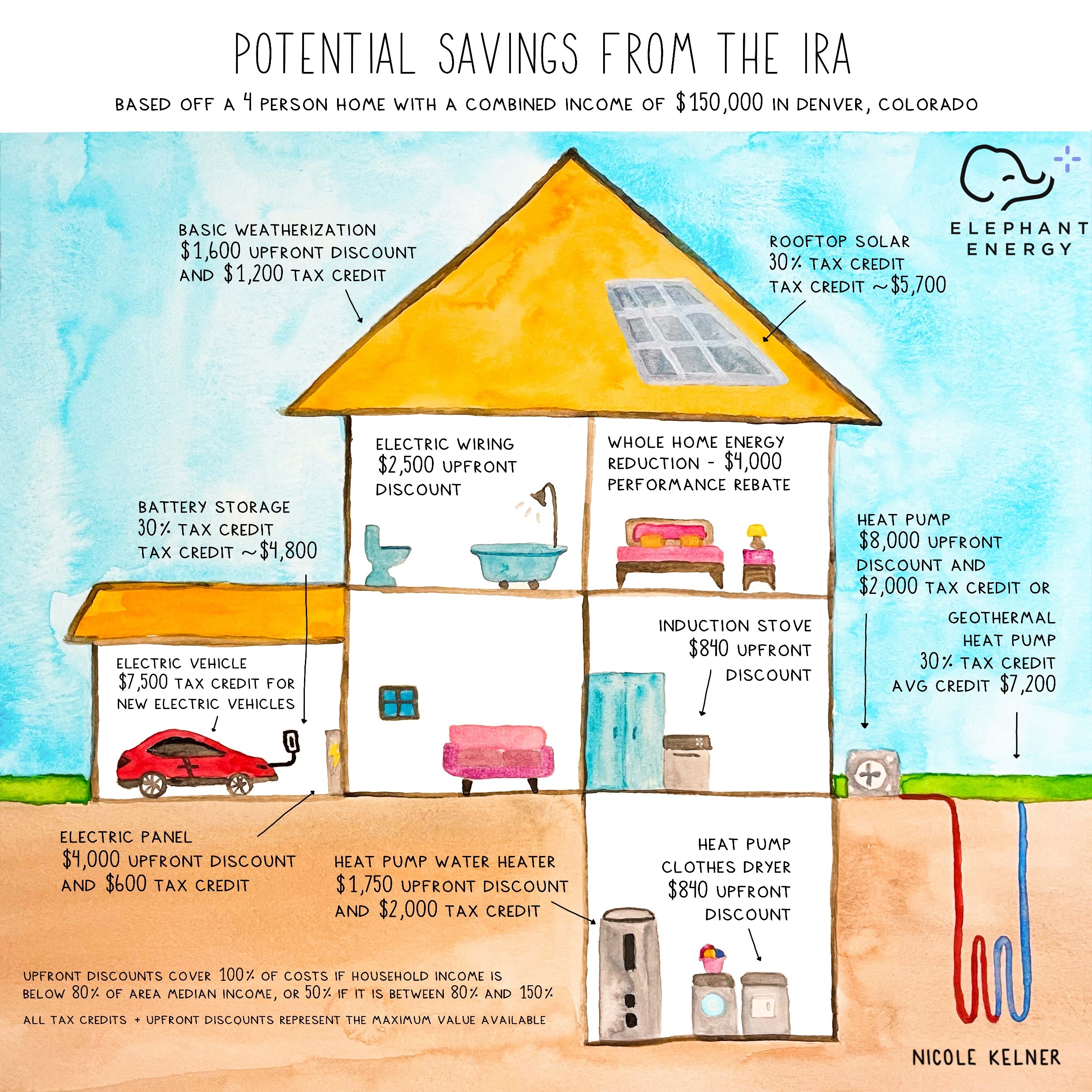

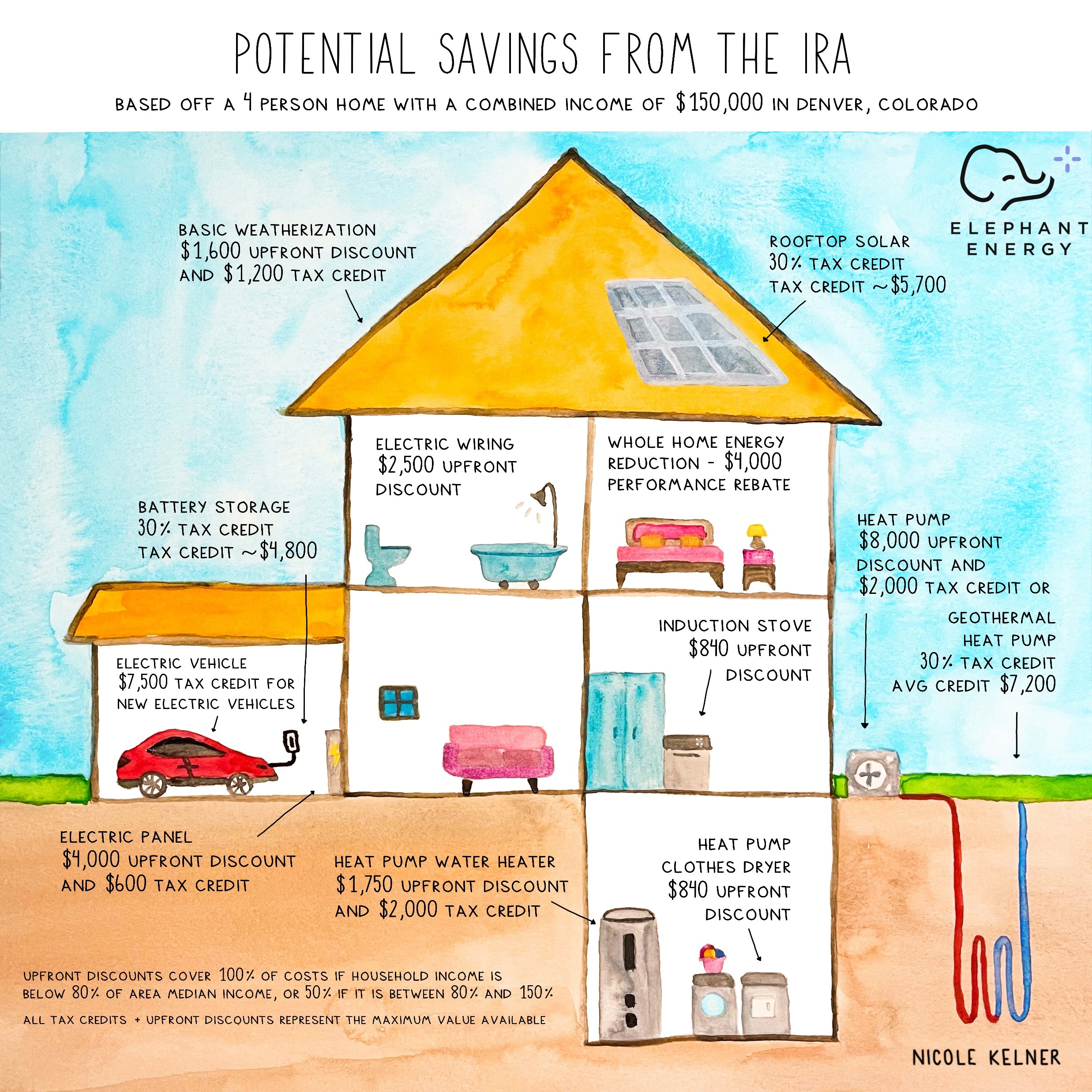

Tax Credit Available for 2022 Tax Year Updated Tax Credit Available for 2023 2032 Tax Years Home Clean Electricity Products Solar electricity 30 of cost Fuel Cells Wind Turbine Battery Storage N A 30 of cost Heating Cooling and Water Heating Heat pumps 300 30 of cost up to 2 000 per year Heat pump water

DOE has published a door hanger detailing the tax credits consumers can receive from the Inflation Reduction Act for installing heat pumps or rooftop solar making energy efficiency improvements

The Heat Pump Tax Credit 2022 Inflation Reduction Act have gained huge popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Customization: There is the possibility of tailoring printing templates to your own specific requirements when it comes to designing invitations planning your schedule or decorating your home.

-

Educational value: Printing educational materials for no cost offer a wide range of educational content for learners of all ages. This makes them a useful aid for parents as well as educators.

-

It's easy: immediate access an array of designs and templates cuts down on time and efforts.

Where to Find more Heat Pump Tax Credit 2022 Inflation Reduction Act

Inflation Reduction Act Health Insurance Broker Raleigh

Inflation Reduction Act Health Insurance Broker Raleigh

Up to 1 750 for a heat pump water heater Up to 8 000 for a heat pump for space heating or cooling Up to 840 for an electric stove cooktop range or oven or an electric heat pump

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

If we've already piqued your curiosity about Heat Pump Tax Credit 2022 Inflation Reduction Act we'll explore the places you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection with Heat Pump Tax Credit 2022 Inflation Reduction Act for all uses.

- Explore categories like home decor, education, craft, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a wide array of topics, ranging starting from DIY projects to party planning.

Maximizing Heat Pump Tax Credit 2022 Inflation Reduction Act

Here are some fresh ways create the maximum value of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings and birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Heat Pump Tax Credit 2022 Inflation Reduction Act are an abundance of fun and practical tools that cater to various needs and interests. Their availability and versatility make them a fantastic addition to any professional or personal life. Explore the vast array that is Heat Pump Tax Credit 2022 Inflation Reduction Act today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes, they are! You can print and download these free resources for no cost.

-

Are there any free templates for commercial use?

- It's contingent upon the specific rules of usage. Always check the creator's guidelines before using their printables for commercial projects.

-

Do you have any copyright rights issues with Heat Pump Tax Credit 2022 Inflation Reduction Act?

- Certain printables may be subject to restrictions in use. Be sure to review the terms and regulations provided by the creator.

-

How do I print printables for free?

- You can print them at home using the printer, or go to any local print store for more high-quality prints.

-

What program do I require to view printables free of charge?

- The majority are printed with PDF formats, which can be opened using free software, such as Adobe Reader.

Inflation Reduction Act Of 2022 The Hollander Group

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

Check more sample of Heat Pump Tax Credit 2022 Inflation Reduction Act below

Heat Pump Tax Credits And Rebates Now Available For Homeowners Moneywise

Inflation Reduction Act Summary What It Means For New HVAC Systems

The Inflation Reduction Act pumps Up Heat Pumps Hvac

Expired Tax Credits Expected To Be Renewed 2022 04 14 ACHR News

BREAKING DOWN The EV Tax Credit 2022 Inflation Reduction Act 2022

How To Take Advantage Of The Heat Pump Tax Credit

https://www.irs.gov/pub/taxpros/fs-2022-40.pdf

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements under 25C of the Internal Revenue Code Code and residential energy property under 25D of the Code

https://home.treasury.gov/news/press-releases/jy1830

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a sufficient

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements under 25C of the Internal Revenue Code Code and residential energy property under 25D of the Code

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a sufficient

Expired Tax Credits Expected To Be Renewed 2022 04 14 ACHR News

Inflation Reduction Act Summary What It Means For New HVAC Systems

BREAKING DOWN The EV Tax Credit 2022 Inflation Reduction Act 2022

How To Take Advantage Of The Heat Pump Tax Credit

What You Need To Know About The Inflation Reduction Act Traders

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L

What s In The Inflation Reduction Act And What s Next For Its