In a world when screens dominate our lives it's no wonder that the appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses as well as creative projects or simply to add the personal touch to your area, Georgia State Tax Standard Deduction 2022 are now a useful resource. Through this post, we'll take a dive into the sphere of "Georgia State Tax Standard Deduction 2022," exploring the different types of printables, where to find them and how they can enhance various aspects of your life.

Get Latest Georgia State Tax Standard Deduction 2022 Below

Georgia State Tax Standard Deduction 2022

Georgia State Tax Standard Deduction 2022 - Georgia State Tax Standard Deduction 2022, Georgia State Income Tax Standard Deduction 2022, Standard Deduction For Ga State Income Tax, What Is Georgia Standard Deduction

The Tax tables below include the tax rates thresholds and allowances included in the Georgia Tax Calculator 2022 Georgia Residents Income Tax Tables in 2022 Personal

Georgia provides a standard Personal Exemption tax deduction of 2 700 00 in 2022 per qualifying filer and 3 000 00 per qualifying dependent s this is used to reduce the

Georgia State Tax Standard Deduction 2022 offer a wide range of downloadable, printable content that can be downloaded from the internet at no cost. They come in many styles, from worksheets to templates, coloring pages and many more. The great thing about Georgia State Tax Standard Deduction 2022 is in their variety and accessibility.

More of Georgia State Tax Standard Deduction 2022

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Enacted on May 10 2022 the Georgia Economic Recovery Act House Bill 586 extends the sales and use tax exemption for sales of tickets fees or charges for

The annual standard deductions used in the guide s percentage method increased to 5 400 from 4 600 for single taxpayers and heads of household to

Georgia State Tax Standard Deduction 2022 have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize printables to your specific needs for invitations, whether that's creating them, organizing your schedule, or decorating your home.

-

Educational Use: Printables for education that are free provide for students of all ages, making these printables a powerful instrument for parents and teachers.

-

It's easy: You have instant access a variety of designs and templates can save you time and energy.

Where to Find more Georgia State Tax Standard Deduction 2022

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Georgia offers tax deductions and credits to reduce your state tax liability including a standard deduction itemized deductions a disaster assistance credit and a low

The income tax withholding formula for the State of Georgia includes the following changes The Standard Deduction for employees who claim Single or Head

We hope we've stimulated your interest in printables for free we'll explore the places you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Georgia State Tax Standard Deduction 2022 for all goals.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets, flashcards, and learning tools.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs covered cover a wide range of topics, that includes DIY projects to party planning.

Maximizing Georgia State Tax Standard Deduction 2022

Here are some inventive ways of making the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to build your knowledge at home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Georgia State Tax Standard Deduction 2022 are a treasure trove of fun and practical tools designed to meet a range of needs and hobbies. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast collection that is Georgia State Tax Standard Deduction 2022 today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes you can! You can print and download these free resources for no cost.

-

Can I utilize free printing templates for commercial purposes?

- It depends on the specific terms of use. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Are there any copyright rights issues with Georgia State Tax Standard Deduction 2022?

- Some printables may come with restrictions regarding their use. Check the terms and conditions offered by the designer.

-

How can I print Georgia State Tax Standard Deduction 2022?

- Print them at home using a printer or visit an in-store print shop to get more high-quality prints.

-

What program is required to open printables free of charge?

- The majority of printables are as PDF files, which can be opened using free software, such as Adobe Reader.

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Tax Filing 2022 Usa Latest News Update

Check more sample of Georgia State Tax Standard Deduction 2022 below

10 2023 California Tax Brackets References 2023 BGH

U S Tax Brackets Personal Income Tax

Tax Rates Absolute Accounting Services

WFR Georgia State Fixes 2022 Resourcing Edge

Standard Deduction 2020 Age 65 Standard Deduction 2021

California Individual Tax Rate Table 2021 20 Brokeasshome

https://ga-us.icalculator.com/income-tax-rates/2022.html

Georgia provides a standard Personal Exemption tax deduction of 2 700 00 in 2022 per qualifying filer and 3 000 00 per qualifying dependent s this is used to reduce the

https://www.house.ga.gov/.../RDC/Tax_Reform_Update.pdf

House Bill 593 increased the standard deduction to 5 400 for single filers and 7 100 for married taxpayers filing a joint return beginning tax year 2022 2022 HB 1437

Georgia provides a standard Personal Exemption tax deduction of 2 700 00 in 2022 per qualifying filer and 3 000 00 per qualifying dependent s this is used to reduce the

House Bill 593 increased the standard deduction to 5 400 for single filers and 7 100 for married taxpayers filing a joint return beginning tax year 2022 2022 HB 1437

WFR Georgia State Fixes 2022 Resourcing Edge

U S Tax Brackets Personal Income Tax

Standard Deduction 2020 Age 65 Standard Deduction 2021

California Individual Tax Rate Table 2021 20 Brokeasshome

Standard Deduction On Salary For AY 2022 23 New Tax Route

Tax Deduction Everything You Should Know About TDS And VDS

Tax Deduction Everything You Should Know About TDS And VDS

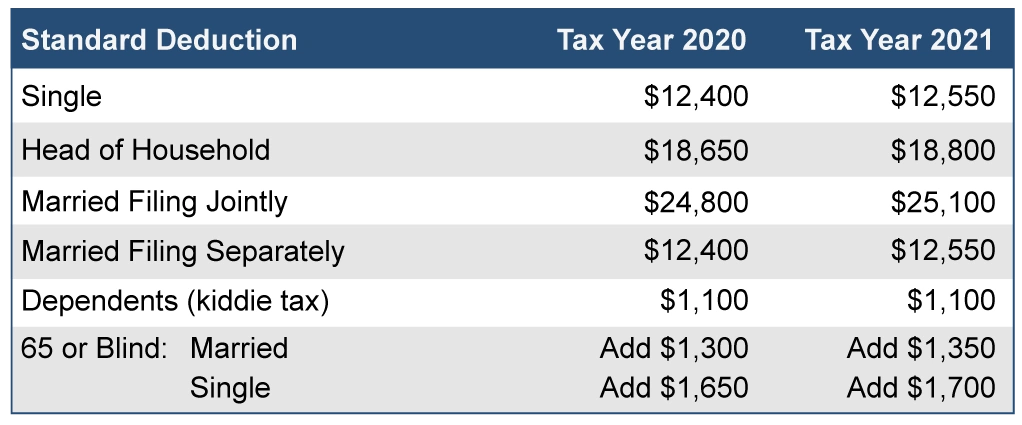

What Is The Standard Deduction For 2021