In a world where screens have become the dominant feature of our lives The appeal of tangible printed materials isn't diminishing. Whether it's for educational purposes, creative projects, or simply adding an individual touch to the area, First Time Homeowner Rebate can be an excellent source. Here, we'll dive into the world "First Time Homeowner Rebate," exploring what they are, how to locate them, and how they can improve various aspects of your daily life.

Get Latest First Time Homeowner Rebate Below

First Time Homeowner Rebate

First Time Homeowner Rebate - First Time Homeowner Rebate, First Time Home Buyer Rebate, First Time Home Buyer Rebate Canada, First Time Home Buyer Rebate Alberta, First Time Home Buyer Rebate Toronto, First Time Home Buyer Rebate Nova Scotia, First Time Home Buyer Rebate Bc, First Time Home Buyer Rebate Calculator, First Time Home Buyer Rebate Manitoba, First Time Buyer Rebate Toronto

Web 23 mai 2023 nbsp 0183 32 Published May 23 2023 Canada s 10 000 Tax Credit for First Time Home Buyers The First Time Home Buyers Tax Credit worth up to 1 500 can help offset a portion of your home

Web 27 janv 2023 nbsp 0183 32 First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying

First Time Homeowner Rebate provide a diverse assortment of printable, downloadable materials that are accessible online for free cost. These resources come in many kinds, including worksheets templates, coloring pages, and much more. One of the advantages of First Time Homeowner Rebate lies in their versatility and accessibility.

More of First Time Homeowner Rebate

Tax Credits Rebates For First Time Home Buyers In Toronto First

Tax Credits Rebates For First Time Home Buyers In Toronto First

Web 28 nov 2022 nbsp 0183 32 The First Time Homebuyer Act of 2021 enables federal tax credits worth up to 15 000 It applies to any home purchased after January 1 2021 with no end date or

Web If you were allowed the first time homebuyer credit for a qualifying home purchase made between April 9 2008 and December 31 2008 you generally must repay the credit over

First Time Homeowner Rebate have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Flexible: There is the possibility of tailoring printables to fit your particular needs be it designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational value: These First Time Homeowner Rebate provide for students from all ages, making them a vital tool for teachers and parents.

-

Affordability: Access to a plethora of designs and templates, which saves time as well as effort.

Where to Find more First Time Homeowner Rebate

First Time Home Buyer Income Tax Credits Rebates And Benefits

First Time Home Buyer Income Tax Credits Rebates And Benefits

Web 21 avr 2023 nbsp 0183 32 Ideal for first time buyers the HBP allows each borrower to withdraw up to 35 000 70 000 for a couple You then have 15 years to repay what you ve borrowed interest free starting two years after you

Web The First Time Home Buyer Incentive is a shared equity mortgage with the Government of Canada which offers 5 or 10 for a first time buyer s purchase of a newly

We hope we've stimulated your interest in First Time Homeowner Rebate We'll take a look around to see where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of First Time Homeowner Rebate for various needs.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs covered cover a wide selection of subjects, that range from DIY projects to planning a party.

Maximizing First Time Homeowner Rebate

Here are some fresh ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home and in class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

First Time Homeowner Rebate are a treasure trove with useful and creative ideas that meet a variety of needs and passions. Their access and versatility makes them a wonderful addition to any professional or personal life. Explore the endless world of First Time Homeowner Rebate today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are First Time Homeowner Rebate truly are they free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I use the free printables for commercial use?

- It's dependent on the particular usage guidelines. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with First Time Homeowner Rebate?

- Certain printables may be subject to restrictions on usage. Make sure you read the terms and condition of use as provided by the author.

-

How do I print printables for free?

- You can print them at home using your printer or visit the local print shop for top quality prints.

-

What program do I require to view First Time Homeowner Rebate?

- The majority of printed documents are with PDF formats, which is open with no cost software such as Adobe Reader.

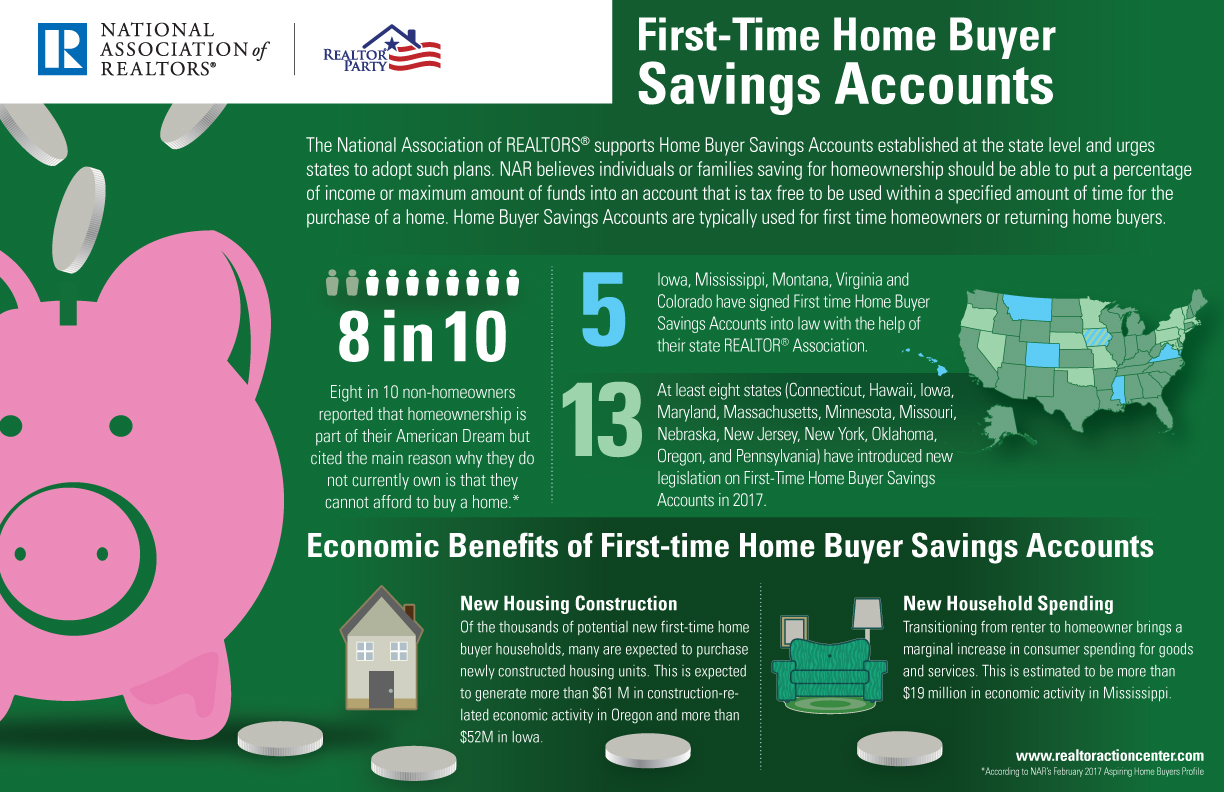

First time Home Buyer Savings Accounts

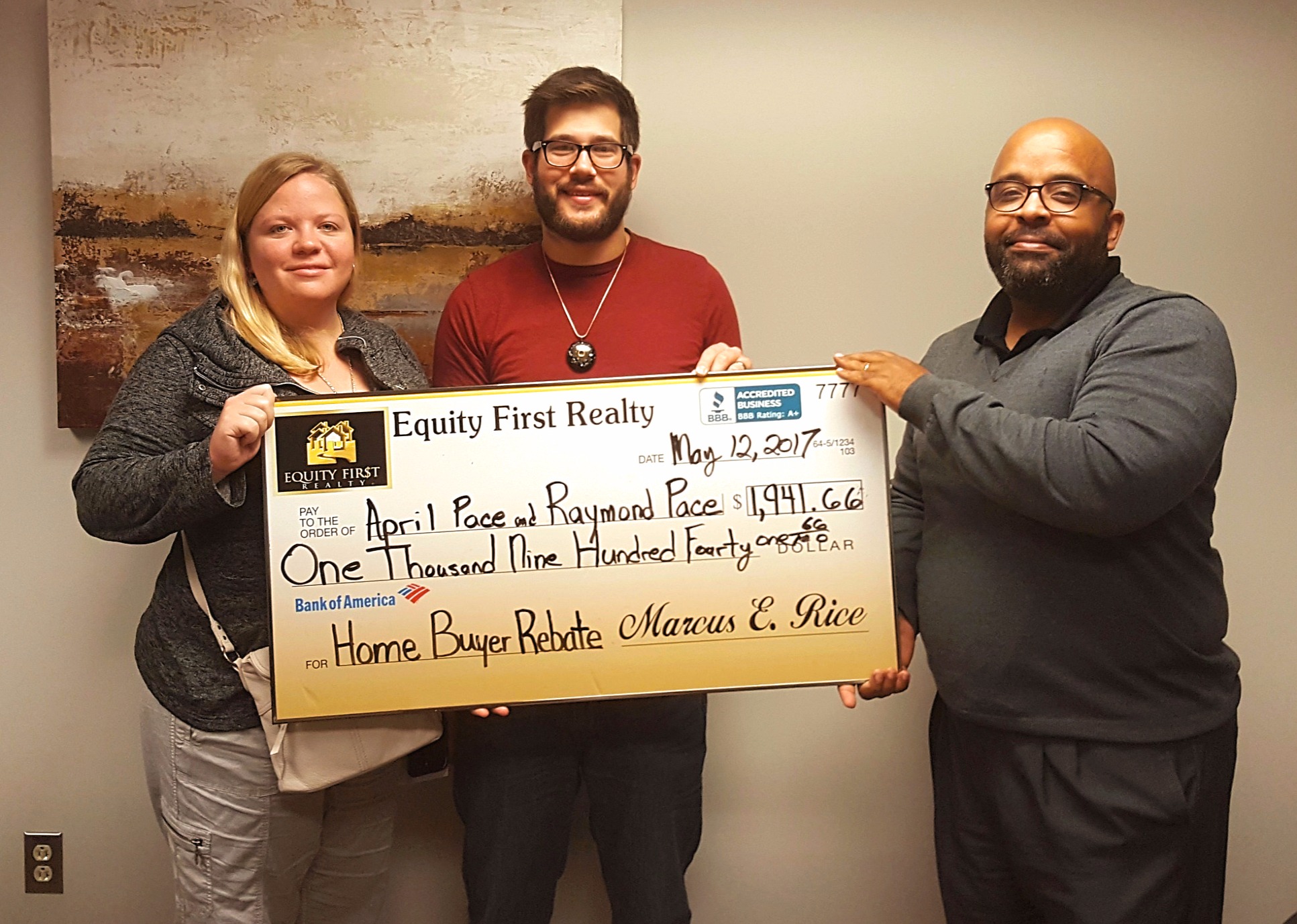

First Time Homebuyers Receive A Virginia Realtor Rebate

Check more sample of First Time Homeowner Rebate below

Virginia First Time Homebuyer Rebate Program

First Time HomeOWNER s Class

First time Homebuyer Tax Credit 2021 Eligibility Ideas 2022

First Time Homeowner Checklist What To Do Before Moving Into Your New

First Time Home Buyer Rebate Qualification Team Bansal YouTube

5 Tips For First Time Home Buyers Infographic First Time Home Buyers

https://www.canada.ca/en/revenue-agency/programs/about-canada-reven…

Web 27 janv 2023 nbsp 0183 32 First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying

https://www.forbes.com/advisor/taxes/what-is …

Web 19 f 233 vr 2021 nbsp 0183 32 President Joe Biden has proposed a maximum 15 000 tax credit for first time homebuyers that would go toward down payments A bill to implement the president s plan was introduced in Congress in

Web 27 janv 2023 nbsp 0183 32 First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying

Web 19 f 233 vr 2021 nbsp 0183 32 President Joe Biden has proposed a maximum 15 000 tax credit for first time homebuyers that would go toward down payments A bill to implement the president s plan was introduced in Congress in

First Time Homeowner Checklist What To Do Before Moving Into Your New

First Time HomeOWNER s Class

First Time Home Buyer Rebate Qualification Team Bansal YouTube

5 Tips For First Time Home Buyers Infographic First Time Home Buyers

First Time Home Buyer Rebates Credits Buying A Home

First Time Homeowner Checklist What You Need To Do Before Moving In

First Time Homeowner Checklist What You Need To Do Before Moving In

First Time Homeowner HVAC Questions Answers