In the digital age, in which screens are the norm and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes project ideas, artistic or simply to add an individual touch to the area, Federal Solar Tax Rebate Form have proven to be a valuable resource. This article will dive deep into the realm of "Federal Solar Tax Rebate Form," exploring what they are, where to get them, as well as how they can be used to enhance different aspects of your lives.

Get Latest Federal Solar Tax Rebate Form Below

Federal Solar Tax Rebate Form

Federal Solar Tax Rebate Form - Federal Solar Tax Rebate Form, Federal Solar Tax Credit Irs Form, Federal Tax Credit For Solar Form, Federal Tax Rebates For Solar, How To Claim Federal Solar Rebate, What Is The Federal Rebate For Solar Panels, Is There A Federal Solar Tax Credit

Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of

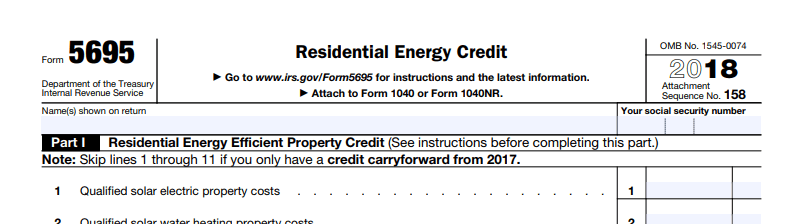

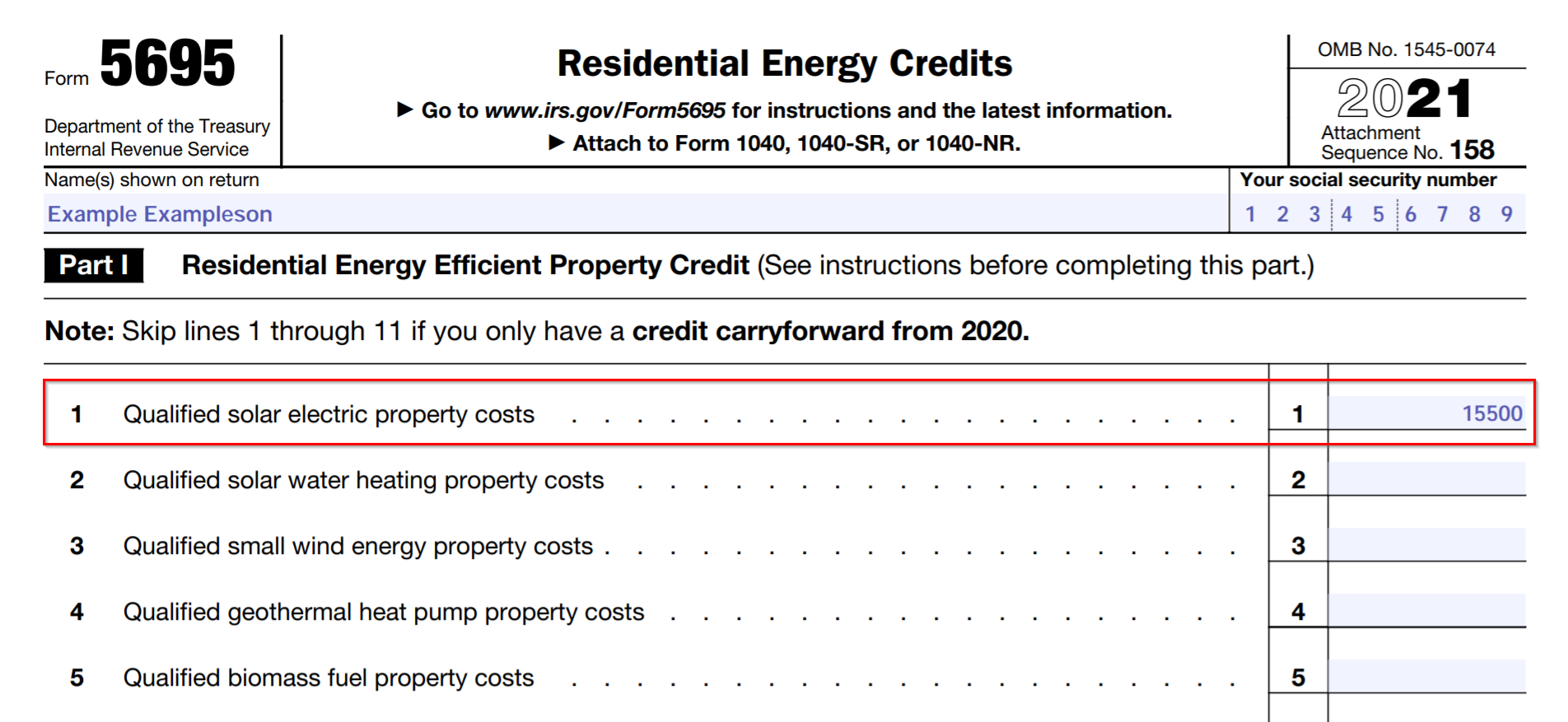

Web For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property

Federal Solar Tax Rebate Form provide a diverse selection of printable and downloadable materials online, at no cost. These resources come in various designs, including worksheets templates, coloring pages and many more. The attraction of printables that are free is their flexibility and accessibility.

More of Federal Solar Tax Rebate Form

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar

Web 17 f 233 vr 2023 nbsp 0183 32 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take

Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC

Federal Solar Tax Rebate Form have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Customization: They can make printables to fit your particular needs whether it's making invitations planning your schedule or decorating your home.

-

Educational Worth: Free educational printables can be used by students from all ages, making these printables a powerful instrument for parents and teachers.

-

Accessibility: Fast access various designs and templates will save you time and effort.

Where to Find more Federal Solar Tax Rebate Form

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

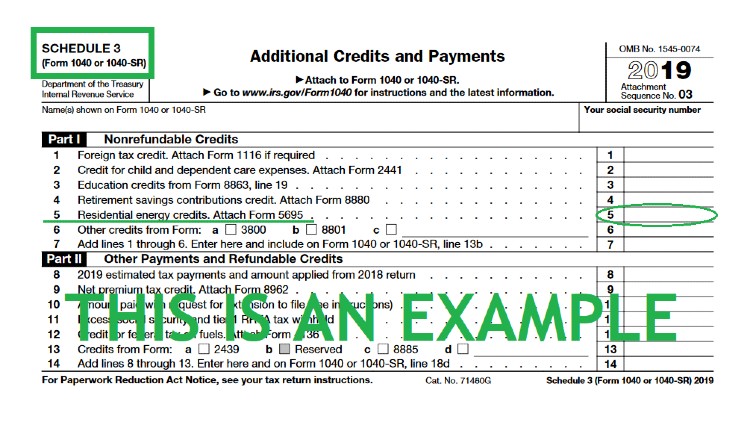

Web 26 avr 2023 nbsp 0183 32 You will need four IRS tax forms to file for your solar tax credit Form 1040 Schedule 3 Form 1040 Form 5695 Instructions for Form 5695 latest version You ll also need Receipts from your solar

Web This webpage provides an overview of the federal investment and production tax credits for businesses that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP energy

We hope we've stimulated your interest in Federal Solar Tax Rebate Form We'll take a look around to see where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Federal Solar Tax Rebate Form for all reasons.

- Explore categories such as decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a broad array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Federal Solar Tax Rebate Form

Here are some new ways of making the most of Federal Solar Tax Rebate Form:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Federal Solar Tax Rebate Form are an abundance of fun and practical tools for a variety of needs and hobbies. Their availability and versatility make them an invaluable addition to the professional and personal lives of both. Explore the vast world of Federal Solar Tax Rebate Form to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I make use of free printouts for commercial usage?

- It's contingent upon the specific rules of usage. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables may be subject to restrictions regarding their use. Be sure to read the terms of service and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home using the printer, or go to a print shop in your area for premium prints.

-

What software do I need in order to open printables for free?

- The majority of printed documents are in PDF format, which can be opened with free software, such as Adobe Reader.

The Declining Federal Solar Tax Credit And Top Things To Know For 2019

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Check more sample of Federal Solar Tax Rebate Form below

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

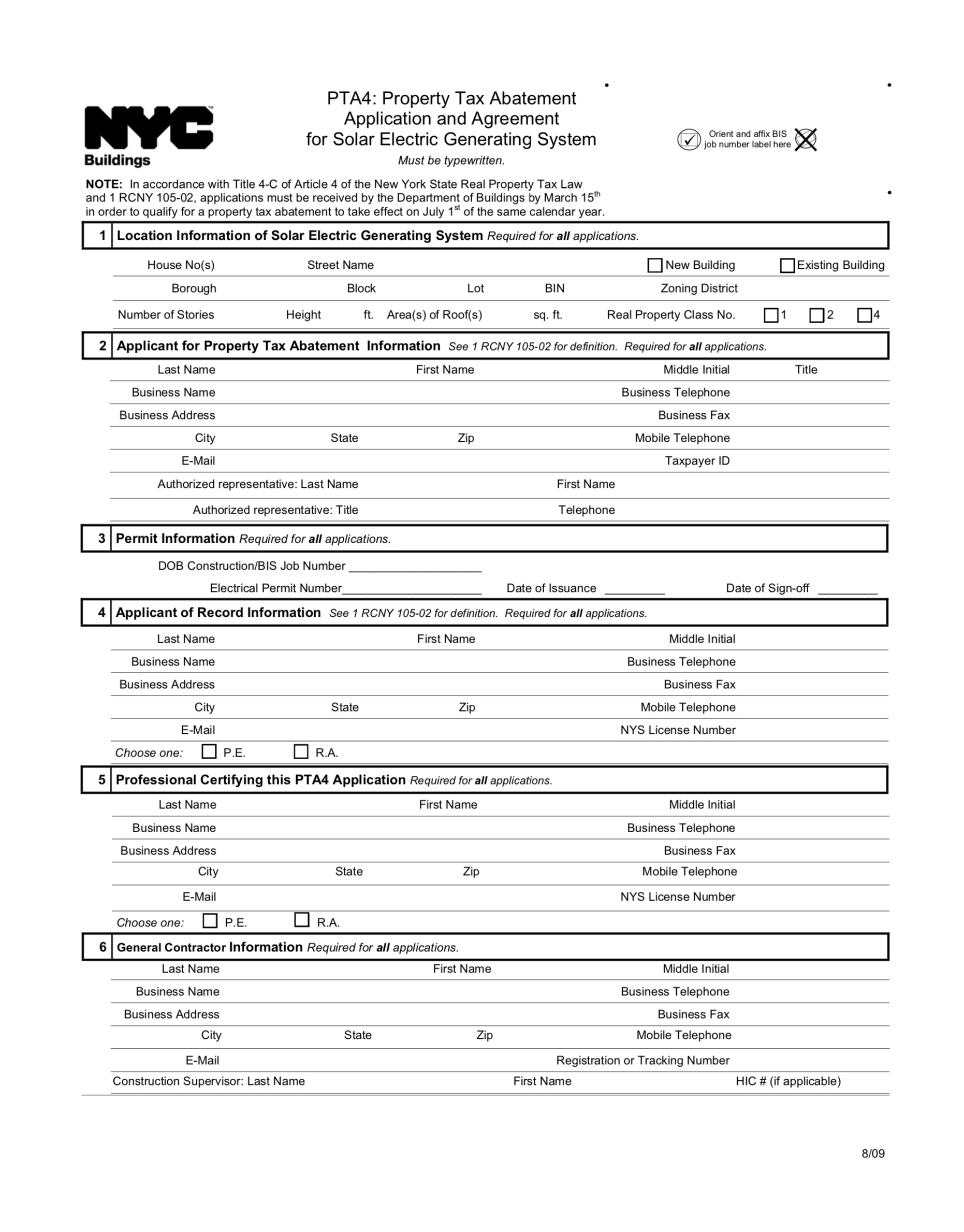

NYC Solar Property Tax Abatement Form PTA4 Explained Sologistics

Solar Tax Credit And Your Boat

Filing For The Solar Tax Credit Wells Solar

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

https://www.irs.gov/instructions/i5695

Web For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to

Web For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property

Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to

Solar Tax Credit And Your Boat

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Filing For The Solar Tax Credit Wells Solar

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Filing For The Solar Tax Credit Wells Solar

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

How To Claim The Federal Solar Tax Credit SAVKAT Inc