In the age of digital, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons such as creative projects or just adding an element of personalization to your area, Eligibility Recovery Rebate Credit have proven to be a valuable resource. This article will dive into the world "Eligibility Recovery Rebate Credit," exploring the benefits of them, where to find them, and how they can improve various aspects of your lives.

Get Latest Eligibility Recovery Rebate Credit Below

Eligibility Recovery Rebate Credit

Eligibility Recovery Rebate Credit - Eligibility Recovery Rebate Credit, Eligibility For Recovery Rebate Credit 2020, Recovery Rebate Credit Eligibility 2022, Recovery Rebate Credit Eligibility Calculator, Recovery Rebate Credit 2023 Eligibility

Web 1 d 233 c 2022 nbsp 0183 32 If the result is zero or a negative amount you don t qualify for any additional credit on your 2020 tax return If your result is a positive amount then you are eligible for a 2020 Recovery Rebate Credit

Web 8 f 233 vr 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments

Eligibility Recovery Rebate Credit include a broad collection of printable items that are available online at no cost. These resources come in various styles, from worksheets to templates, coloring pages and many more. The great thing about Eligibility Recovery Rebate Credit lies in their versatility as well as accessibility.

More of Eligibility Recovery Rebate Credit

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Form Printable Rebate Form

Web The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with adjusted gross income up to a phase out threshold of 75 000 150 000 in the case of a joint

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the

Eligibility Recovery Rebate Credit have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Personalization We can customize printables to fit your particular needs in designing invitations planning your schedule or even decorating your house.

-

Educational Use: Printing educational materials for no cost are designed to appeal to students of all ages. This makes them a great tool for parents and educators.

-

Easy to use: Fast access a variety of designs and templates, which saves time as well as effort.

Where to Find more Eligibility Recovery Rebate Credit

Recovery Rebate Eligibility Recovery Rebate

Recovery Rebate Eligibility Recovery Rebate

Web The eligibility criteria for the RRC is generally the same as for EIPs except that the RRC is based on tax year 2020 information instead of the tax year 2019 or tax year 2018 information used for EIP1 and tax year 2019 information used for EIP2

Web 16 nov 2022 nbsp 0183 32 Check eligibility for Recovery Rebate Credit IR 2021 49 March 2 2021 WASHINGTON The Internal Revenue Service reminds first time filers and those who usually don t have a federal filing requirement to consider filing a 2020 tax return They

We've now piqued your curiosity about Eligibility Recovery Rebate Credit we'll explore the places you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Eligibility Recovery Rebate Credit for a variety motives.

- Explore categories such as decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free, flashcards, and learning tools.

- It is ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- These blogs cover a broad spectrum of interests, everything from DIY projects to planning a party.

Maximizing Eligibility Recovery Rebate Credit

Here are some ideas to make the most of Eligibility Recovery Rebate Credit:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print free worksheets to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Eligibility Recovery Rebate Credit are a treasure trove filled with creative and practical information catering to different needs and needs and. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the many options of Eligibility Recovery Rebate Credit now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes, they are! You can print and download these materials for free.

-

Can I use the free printing templates for commercial purposes?

- It depends on the specific usage guidelines. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables might have limitations on use. You should read the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home using either a printer or go to the local print shops for the highest quality prints.

-

What software do I need to open printables that are free?

- The majority are printed in the format of PDF, which is open with no cost software such as Adobe Reader.

Track Your Recovery Rebate With This Worksheet Style Worksheets

6 Tips What Is A Recovery Rebate Credit 2021 Alprojectalproject

Check more sample of Eligibility Recovery Rebate Credit below

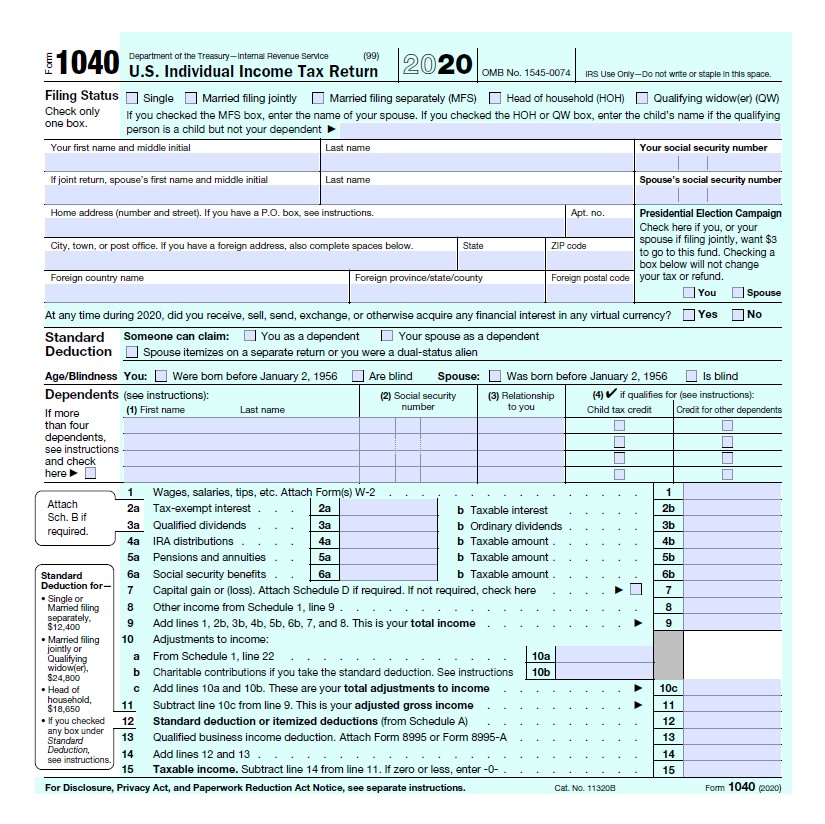

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Federal Recovery Rebate Credit Recovery Rebate

Tax Time Guide Didn T Get Economic Impact Payments Check Eligibility

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

Who Is Eligible For A Recovery Rebate Credit Printable Rebate Form

https://www.irs.gov/newsroom/check-your-recovery-rebate-credit-eligibi…

Web 8 f 233 vr 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-b...

Web 10 d 233 c 2021 nbsp 0183 32 An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the 2020 Recovery Rebate Credit if the individual met the eligibility requirements

Web 8 f 233 vr 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments

Web 10 d 233 c 2021 nbsp 0183 32 An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the 2020 Recovery Rebate Credit if the individual met the eligibility requirements

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

Federal Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

Who Is Eligible For A Recovery Rebate Credit Printable Rebate Form

How To Figure The Recovery Rebate Credit Recovery Rebate

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style