In the digital age, when screens dominate our lives however, the attraction of tangible printed material hasn't diminished. Whatever the reason, whether for education in creative or artistic projects, or simply to add an element of personalization to your area, Education Loan Rebate In Income Tax Under Section 80e are a great resource. We'll take a dive through the vast world of "Education Loan Rebate In Income Tax Under Section 80e," exploring what they are, where you can find them, and how they can improve various aspects of your lives.

Get Latest Education Loan Rebate In Income Tax Under Section 80e Below

Education Loan Rebate In Income Tax Under Section 80e

Education Loan Rebate In Income Tax Under Section 80e - Education Loan Rebate In Income Tax Under Section 80e, Does Education Loan Comes Under 80c, Can I Get Tax Benefit On Education Loan, Is Education Loan Interest Tax Deductible, Is Education Loan Tax Deductible

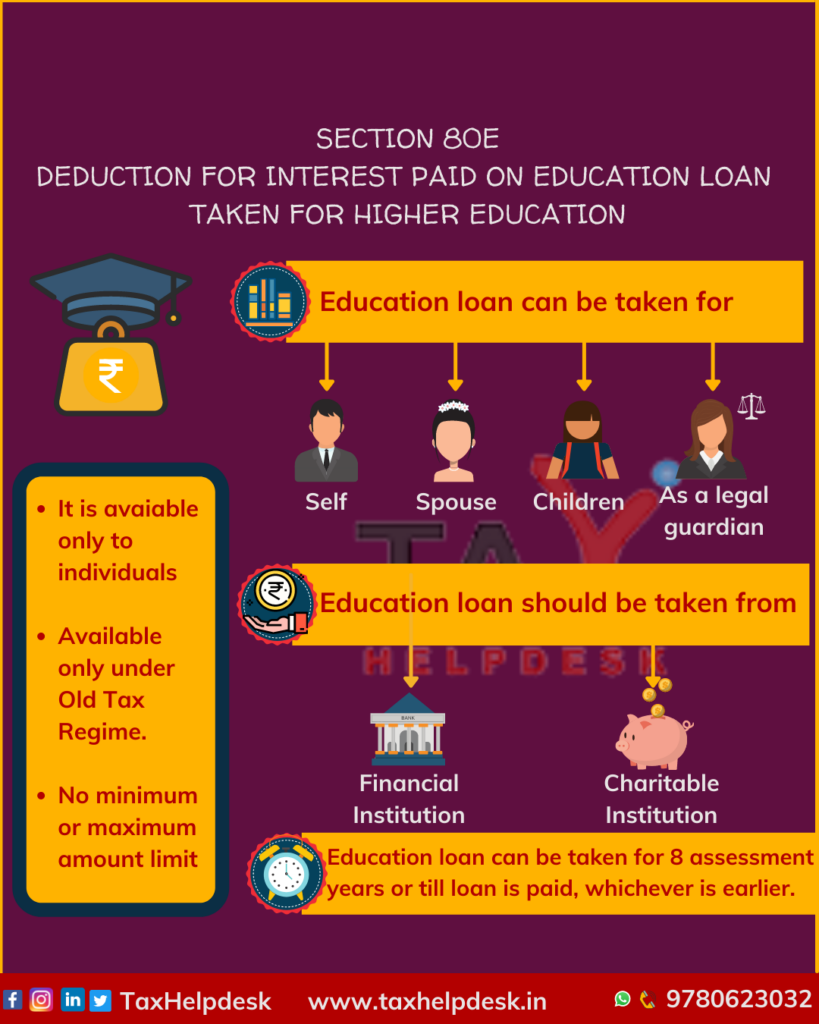

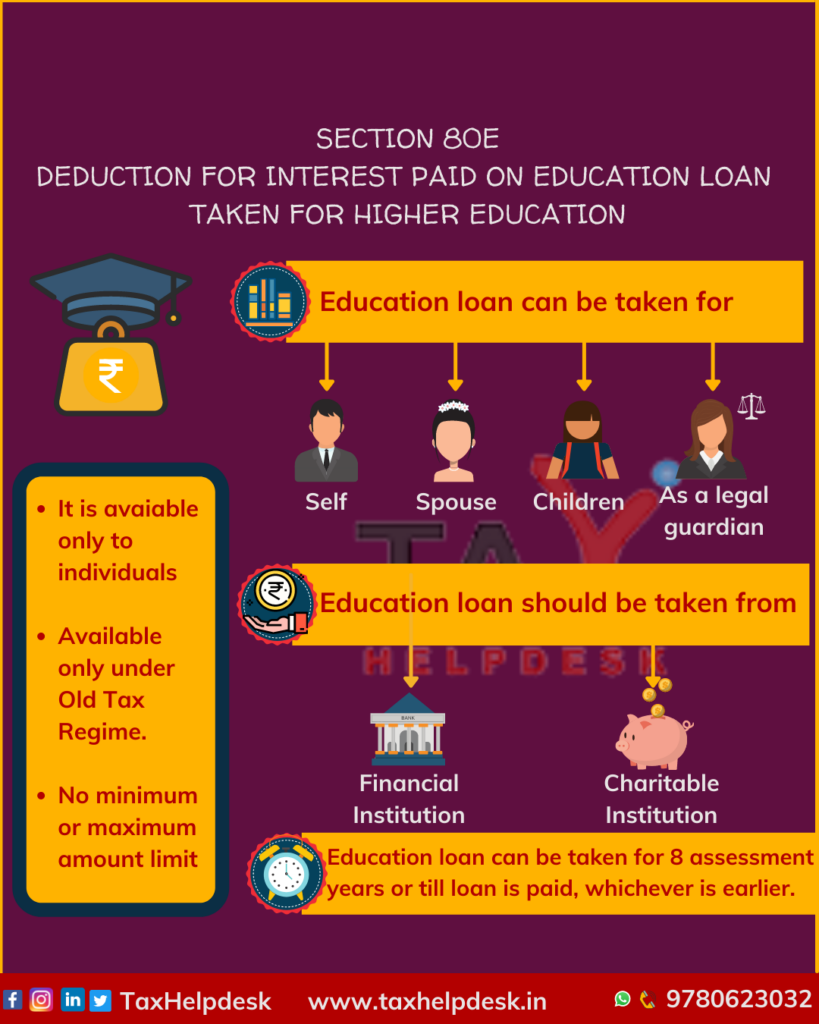

The provisions of Section 80E of the Income Tax Act 1961 specifically cater to educational loans This section offers deductions that apply to the interest component of these loans Moreover these deductions can only be claimed by individuals once repayment for a said loan has started

Education loan offers tax deduction under Section 80E for interest allows for 8 years claiming Deduction available for individuals for higher studies loan Must be from approved institutions Interest only deductible No maximum

Education Loan Rebate In Income Tax Under Section 80e include a broad selection of printable and downloadable materials that are accessible online for free cost. The resources are offered in a variety forms, like worksheets templates, coloring pages and more. The appealingness of Education Loan Rebate In Income Tax Under Section 80e is in their variety and accessibility.

More of Education Loan Rebate In Income Tax Under Section 80e

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

These benefits help you to reduce the overall cost of your education loan The deduction under section 80E for Interest on educational loan is available to an individual if following conditions are satisfied 1 Who is eligible for Section 80E Deduction for educational loan

Section 80E of the Income Tax Act is a tax saving provision that provides tax deductions to individuals who have taken education loans to pursue their higher studies Hence the 80E deduction has the dual benefit of helping pay for education while saving money on taxes

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Modifications: They can make print-ready templates to your specific requirements when it comes to designing invitations or arranging your schedule or decorating your home.

-

Educational value: Educational printables that can be downloaded for free offer a wide range of educational content for learners from all ages, making the perfect tool for parents and educators.

-

An easy way to access HTML0: The instant accessibility to a myriad of designs as well as templates can save you time and energy.

Where to Find more Education Loan Rebate In Income Tax Under Section 80e

How To Save Tax Under Section 80C 80E 80G 80DDB FY 2020 21

How To Save Tax Under Section 80C 80E 80G 80DDB FY 2020 21

Section 80E of the Income Tax Act in India allows you to deduct the interest paid on an education loan from your taxable income This benefit applies to loans taken for your higher education your spouse s or children s and there s no

Section 80E of the Income Tax Act provides a valuable deduction on the interest paid on education loans paving the way for individuals to fulfill their dreams of higher education despite financial constraints Key Highlights of Section 80E 1

Now that we've piqued your interest in printables for free We'll take a look around to see where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Education Loan Rebate In Income Tax Under Section 80e designed for a variety uses.

- Explore categories like home decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a broad selection of subjects, starting from DIY projects to party planning.

Maximizing Education Loan Rebate In Income Tax Under Section 80e

Here are some ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Education Loan Rebate In Income Tax Under Section 80e are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and interests. Their accessibility and flexibility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast world of Education Loan Rebate In Income Tax Under Section 80e to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Education Loan Rebate In Income Tax Under Section 80e truly available for download?

- Yes they are! You can print and download the resources for free.

-

Can I use free printables for commercial uses?

- It's contingent upon the specific terms of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright problems with Education Loan Rebate In Income Tax Under Section 80e?

- Certain printables might have limitations on their use. Be sure to check the terms and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer at home or in the local print shop for top quality prints.

-

What program do I require to view printables that are free?

- Many printables are offered in the PDF format, and can be opened using free software, such as Adobe Reader.

Deduction Under Section 80E Interest Paid On Higher Education

Hits On Whatsapp Income tax Act Section 80E

Check more sample of Education Loan Rebate In Income Tax Under Section 80e below

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

Section 80E Income Tax Deductions On Education Loan FY 2023

Deduction Under Section 80E Income Tax Act 1961 CommerceLesson in

Understanding Section 80E And Its Importance For Education Loan

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Deduction Under Section 80E Interest Paid On Higher Education

https://cleartax.in/s/section-80e-deduction-interest-education-loan

Education loan offers tax deduction under Section 80E for interest allows for 8 years claiming Deduction available for individuals for higher studies loan Must be from approved institutions Interest only deductible No maximum

https://tax2win.in/guide/sec-80e-deduction-interest-on-education-loan

For example You have taken an education loan in FY 2022 23 and started paying interest in the same year In this case you can claim a deduction u s 80E for AY 2023 24 to AY 2029 30 i e 8 assessment years Consider a different situation where you have repaid the complete loan in 5 years only

Education loan offers tax deduction under Section 80E for interest allows for 8 years claiming Deduction available for individuals for higher studies loan Must be from approved institutions Interest only deductible No maximum

For example You have taken an education loan in FY 2022 23 and started paying interest in the same year In this case you can claim a deduction u s 80E for AY 2023 24 to AY 2029 30 i e 8 assessment years Consider a different situation where you have repaid the complete loan in 5 years only

Understanding Section 80E And Its Importance For Education Loan

Section 80E Income Tax Deductions On Education Loan FY 2023

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Deduction Under Section 80E Interest Paid On Higher Education

Income Tax Rebate Under Section 87A All You Need To Know

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

80E Tax