In this digital age, in which screens are the norm The appeal of tangible printed objects isn't diminished. In the case of educational materials project ideas, artistic or simply adding an element of personalization to your home, printables for free can be an excellent source. This article will dive into the world "Child Education Tax Deduction India," exploring their purpose, where you can find them, and how they can add value to various aspects of your daily life.

Get Latest Child Education Tax Deduction India Below

Child Education Tax Deduction India

Child Education Tax Deduction India - Child Education Tax Deduction India, Child Education Tax Benefit India, Child Education Allowance Tax Exemption India, Deduction For Child Education, Tax Exemption For Child Education In India, Child Education Expenses Tax Deduction

Updated As amended in finance act 2020 As per section 10 14 of Income tax children education allowance and Hostel Expenditure Allowance are eligible for deduction available to individuals employed in

Since both parents can claim tax benefits under children education allowance of Rs 1 5 Lakh each year the total claim rises to 2 times this maximum deduction i e Rs 3 Lakh

Child Education Tax Deduction India encompass a wide assortment of printable, downloadable materials online, at no cost. These resources come in many styles, from worksheets to templates, coloring pages and more. The benefit of Child Education Tax Deduction India lies in their versatility and accessibility.

More of Child Education Tax Deduction India

Higher Income Tax Deduction On NPS Likely For Private Sector Employees

Higher Income Tax Deduction On NPS Likely For Private Sector Employees

The Children s Education Allowance or CEA is a group of tax benefits offered by India s Income Tax department to promote literacy particularly in the

Limit of Deduction Rs 100 per month per child up to a maximum of 2 children Condition The individual taxpayer must be employed in India Furthermore

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Personalization This allows you to modify designs to suit your personal needs whether it's making invitations making your schedule, or decorating your home.

-

Educational value: These Child Education Tax Deduction India cater to learners of all ages. This makes them an invaluable tool for parents and educators.

-

Accessibility: immediate access the vast array of design and templates is time-saving and saves effort.

Where to Find more Child Education Tax Deduction India

Special Education Tax Deductions Tax Strategies For Parents

Special Education Tax Deductions Tax Strategies For Parents

In the context of the same Section 80C of the Income Tax Act 1961 allows for deduction for expenditure incurred towards education of children by the assessee a person by

Tax deduction can be claimed for educating the children exclusively It cannot be claimed for fee paid for educating any other else Tax deduction on Tuition fees can only be claimed for full time courses

We've now piqued your interest in printables for free Let's take a look at where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection with Child Education Tax Deduction India for all purposes.

- Explore categories such as interior decor, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- The blogs covered cover a wide range of topics, that range from DIY projects to planning a party.

Maximizing Child Education Tax Deduction India

Here are some unique ways ensure you get the very most of Child Education Tax Deduction India:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Child Education Tax Deduction India are a treasure trove of creative and practical resources which cater to a wide range of needs and interest. Their access and versatility makes them a wonderful addition to both professional and personal lives. Explore the vast collection that is Child Education Tax Deduction India today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes they are! You can download and print these free resources for no cost.

-

Can I utilize free printables for commercial use?

- It's dependent on the particular usage guidelines. Always consult the author's guidelines before using their printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may have restrictions in use. Be sure to review the terms and conditions set forth by the author.

-

How can I print Child Education Tax Deduction India?

- You can print them at home using a printer or visit a local print shop to purchase more high-quality prints.

-

What program will I need to access printables free of charge?

- The majority of printed documents are as PDF files, which is open with no cost software, such as Adobe Reader.

Education Tax Credits And Deductions Guide Nj

Tax Deduction India 2023

Check more sample of Child Education Tax Deduction India below

Tuition Fees Deduction India

Refundable Nonrefundable Education Tax Credits Finance Zacks

Education Tax Deduction How To Get Back 13 If You Pay For A

How Much Does An Architect Make In Nyc

5 Commonly Overlooked Education Tax Credits And Deductions Chime

Claiming A Continuing Education Tax Deduction While Abroad

https://groww.in/p/tax/children-education-allowance

Since both parents can claim tax benefits under children education allowance of Rs 1 5 Lakh each year the total claim rises to 2 times this maximum deduction i e Rs 3 Lakh

https://tax2win.in/guide/tution-fees-deduction-under-section-80c

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize

Since both parents can claim tax benefits under children education allowance of Rs 1 5 Lakh each year the total claim rises to 2 times this maximum deduction i e Rs 3 Lakh

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize

How Much Does An Architect Make In Nyc

Refundable Nonrefundable Education Tax Credits Finance Zacks

5 Commonly Overlooked Education Tax Credits And Deductions Chime

Claiming A Continuing Education Tax Deduction While Abroad

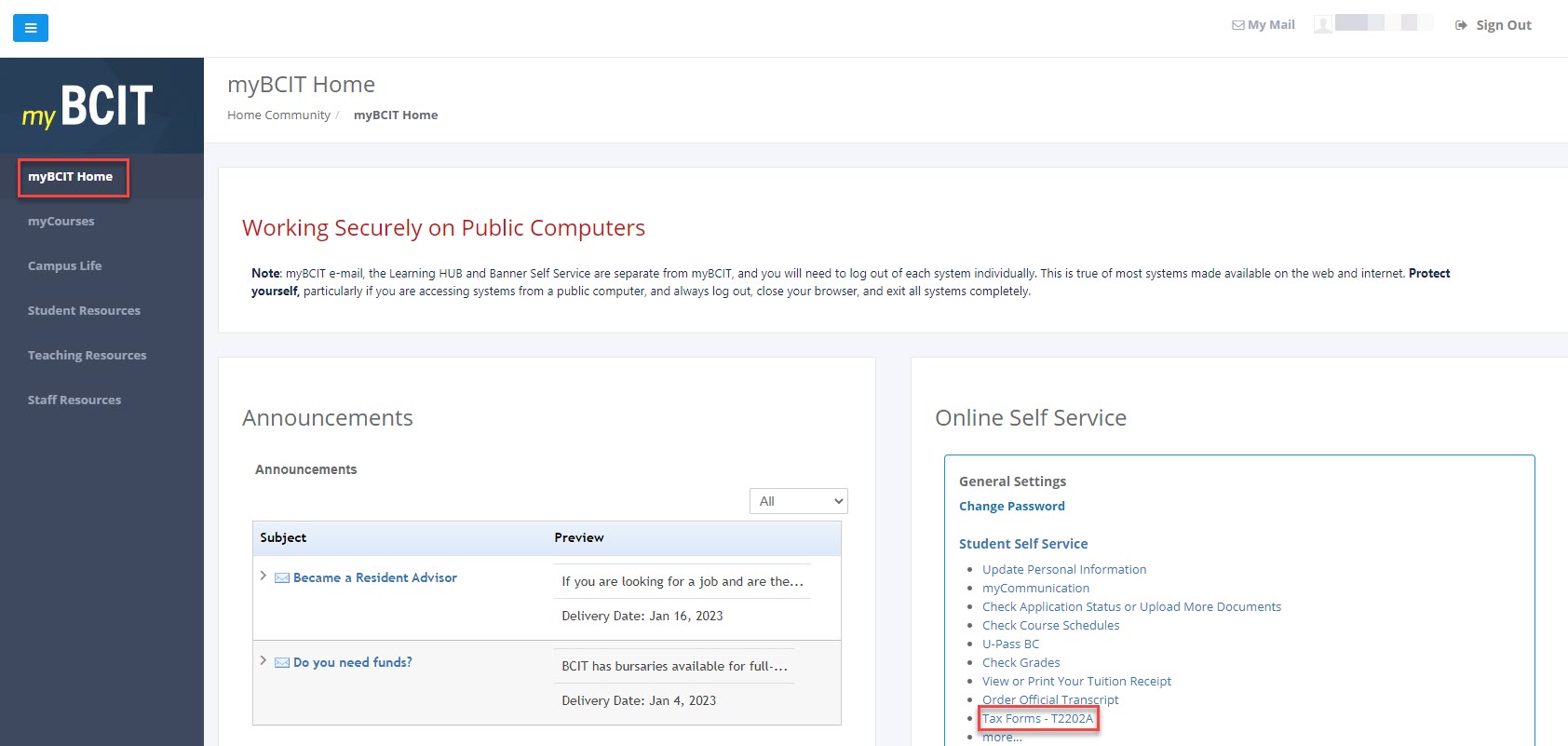

Printing Your Tuition Tax Receipt T2202 In MyBCIT Online Self Service

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Drug Co Allowed Cost Of Docs France Meet As Tax Deduction India News