In the age of digital, where screens dominate our lives however, the attraction of tangible printed materials hasn't faded away. Whether it's for educational purposes as well as creative projects or simply adding an extra personal touch to your home, printables for free have become a valuable source. This article will take a dive through the vast world of "Child Care Expenses Tax Deduction Canada," exploring their purpose, where you can find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Child Care Expenses Tax Deduction Canada Below

Child Care Expenses Tax Deduction Canada

Child Care Expenses Tax Deduction Canada - Child Care Expenses Tax Deduction Canada, How Much Can You Claim For Child Care Expenses In Canada, What Child Expenses Are Tax Deductible Canada, What Are Tax Deductible Child Care Expenses

Child care expenses including babysitters and daycare are tax deductible but there are limitations on who can claim the expenses For example in a two parent household only the spouse or common law partner with the lower net income can claim child care expenses

How Much of Your Child Care Expenses Can You Claim Canadian taxpayers can claim up to 8 000 per child for children under the age of 7 years at the end of the year 5 000 per child for children aged 7 to 16 years

Child Care Expenses Tax Deduction Canada encompass a wide selection of printable and downloadable materials online, at no cost. They come in many forms, including worksheets, templates, coloring pages, and more. The appealingness of Child Care Expenses Tax Deduction Canada is in their variety and accessibility.

More of Child Care Expenses Tax Deduction Canada

Daycare Business Income And Expense Sheet To File Your Daycare Business

Daycare Business Income And Expense Sheet To File Your Daycare Business

You can use form T778 Child care expenses deduction to claim child care expenses you paid for your child ren in 2023 You can claim child care expenses if you or your spouse or common law partner paid someone to look after an eligible child so that you or both of you can Earn income from employment

First the amount of any deduction for child care expenses is limited to two thirds of the taxpayer s earned income for the year The income figure used to calculate the two thirds figure is generally the amount shown on Line 150 of the annual tax return

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Customization: Your HTML0 customization options allow you to customize printed materials to meet your requirements for invitations, whether that's creating them for your guests, organizing your schedule or decorating your home.

-

Educational Impact: The free educational worksheets can be used by students of all ages, which makes them a vital device for teachers and parents.

-

Affordability: The instant accessibility to an array of designs and templates cuts down on time and efforts.

Where to Find more Child Care Expenses Tax Deduction Canada

Home Office Deduction Worksheet 2021

Home Office Deduction Worksheet 2021

Taxes Personal Finance What every parent needs to know about deducting child care expenses come tax time Jamie Golombek Here are the rules surrounding the deduction its limits and a recent interpretation that could prevent you from claiming a deduction Published Sep 13 2019 5 minute read Join the conversation

Child care expenses 101 Daycare summer camp nurseries and nanny services are all deductible expenses for parents but the tax deduction must be claimed by the parent in the lower tax bracket There are exceptions however such as the value of the deduction which can vary greatly per child

We've now piqued your curiosity about Child Care Expenses Tax Deduction Canada Let's take a look at where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Child Care Expenses Tax Deduction Canada for various motives.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets along with flashcards, as well as other learning tools.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- The blogs are a vast range of interests, starting from DIY projects to party planning.

Maximizing Child Care Expenses Tax Deduction Canada

Here are some innovative ways of making the most of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Child Care Expenses Tax Deduction Canada are an abundance of practical and imaginative resources that meet a variety of needs and hobbies. Their availability and versatility make them a valuable addition to each day life. Explore the vast collection of Child Care Expenses Tax Deduction Canada right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes, they are! You can print and download these files for free.

-

Does it allow me to use free printables for commercial use?

- It's based on specific usage guidelines. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Do you have any copyright violations with Child Care Expenses Tax Deduction Canada?

- Some printables may have restrictions concerning their use. Always read the terms and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home using any printer or head to a local print shop to purchase top quality prints.

-

What software must I use to open printables free of charge?

- Most PDF-based printables are available in the PDF format, and is open with no cost programs like Adobe Reader.

Brilliant Tax Write Off Template Stores Inventory Excel Format

Home Office Renovation Tax Deduction Canada Bedrock Construction Calgary

Check more sample of Child Care Expenses Tax Deduction Canada below

Does CRA Have Discretion To Adjust Child care Expense Tax Deduction 20

Using The Child Care Tax Credit To Deduct Day Care Expenses

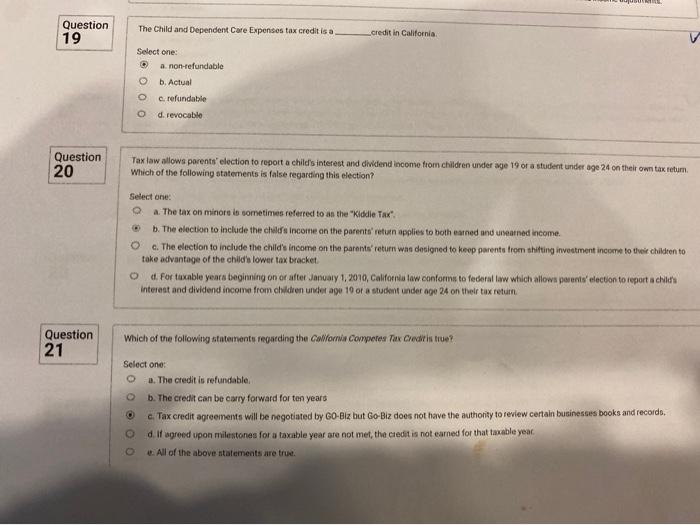

Solved Question 19 The Child And Dependent Care Expenses Tax Chegg

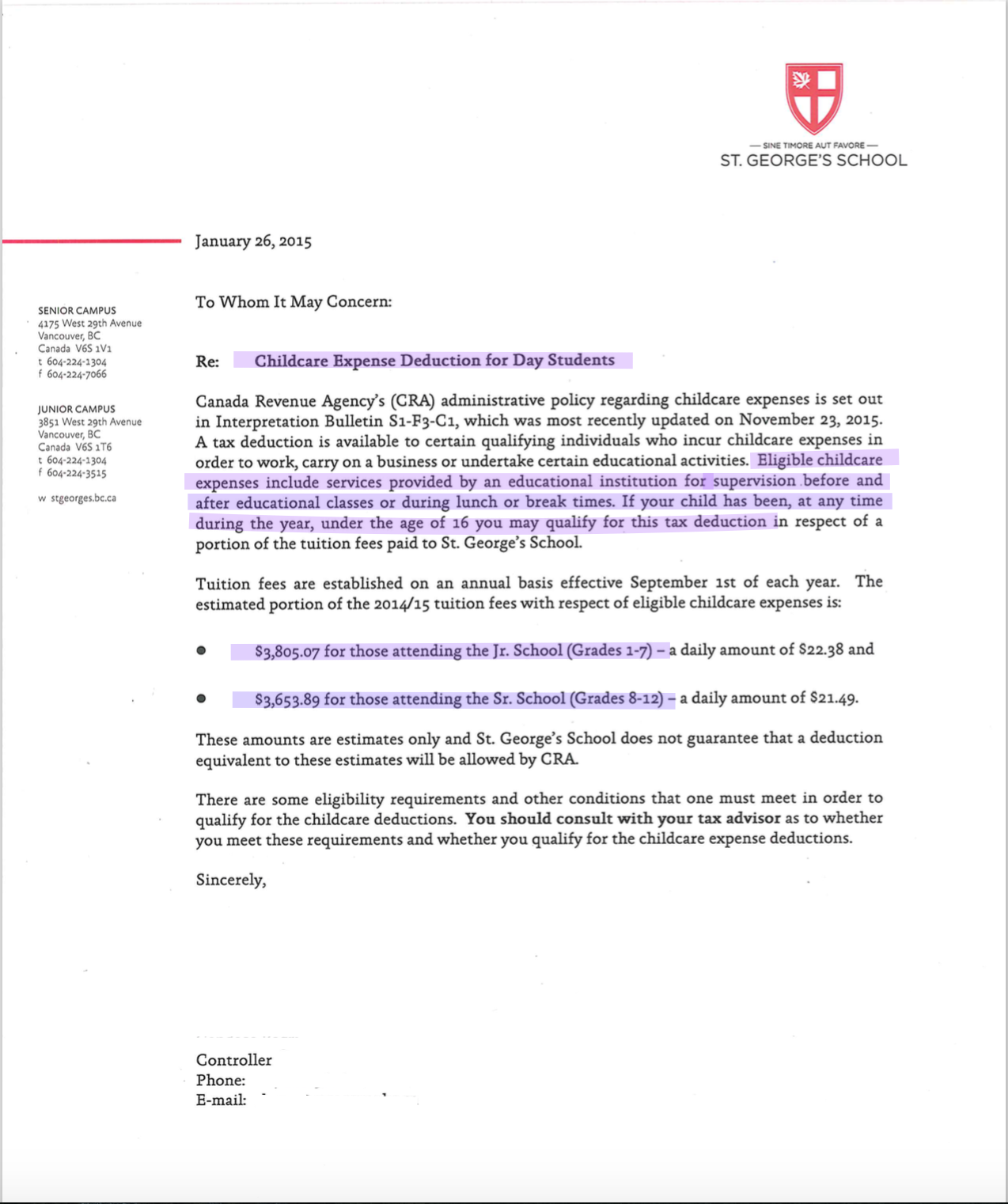

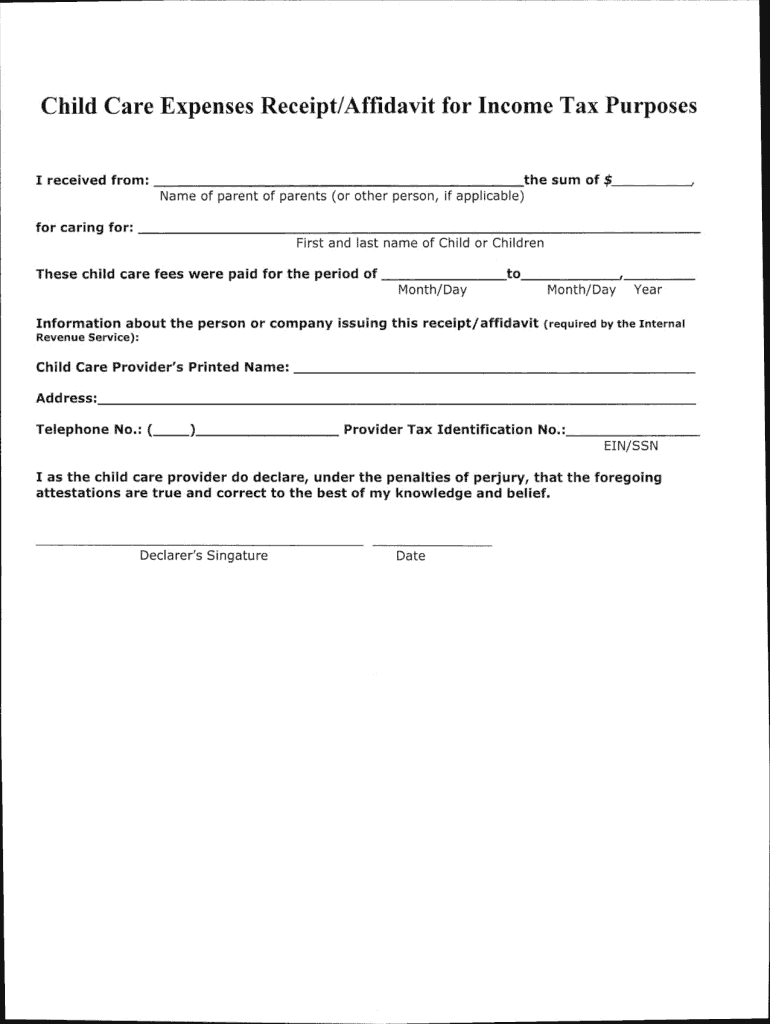

Child Care Receipt Template Canada Form Fill Out And Sign Printable

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Ads responsive txt Child Care Provider Medical Consent Form Elegant

https:// turbotax.intuit.ca /tips/claiming-child-care-expenses-5175

How Much of Your Child Care Expenses Can You Claim Canadian taxpayers can claim up to 8 000 per child for children under the age of 7 years at the end of the year 5 000 per child for children aged 7 to 16 years

https://www. taxtips.ca /filing/child-care-costs.htm

Common law partner basic personal amount Allowable Child Care Expenses Eligible Child Care Expense Examples day care centres and day nursery schools some individuals providing child care services day camps and day sports schools

How Much of Your Child Care Expenses Can You Claim Canadian taxpayers can claim up to 8 000 per child for children under the age of 7 years at the end of the year 5 000 per child for children aged 7 to 16 years

Common law partner basic personal amount Allowable Child Care Expenses Eligible Child Care Expense Examples day care centres and day nursery schools some individuals providing child care services day camps and day sports schools

Child Care Receipt Template Canada Form Fill Out And Sign Printable

Using The Child Care Tax Credit To Deduct Day Care Expenses

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Ads responsive txt Child Care Provider Medical Consent Form Elegant

Tax Implications and Rewards Of Grandparents Taking Care Of

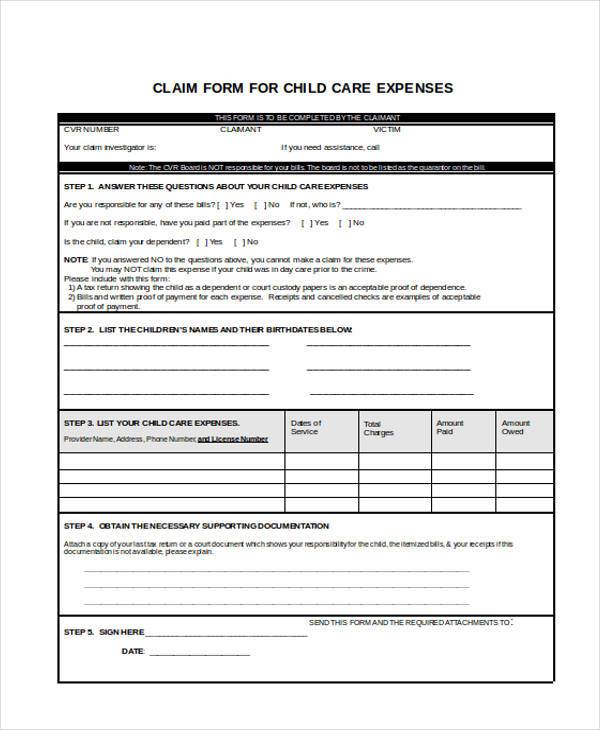

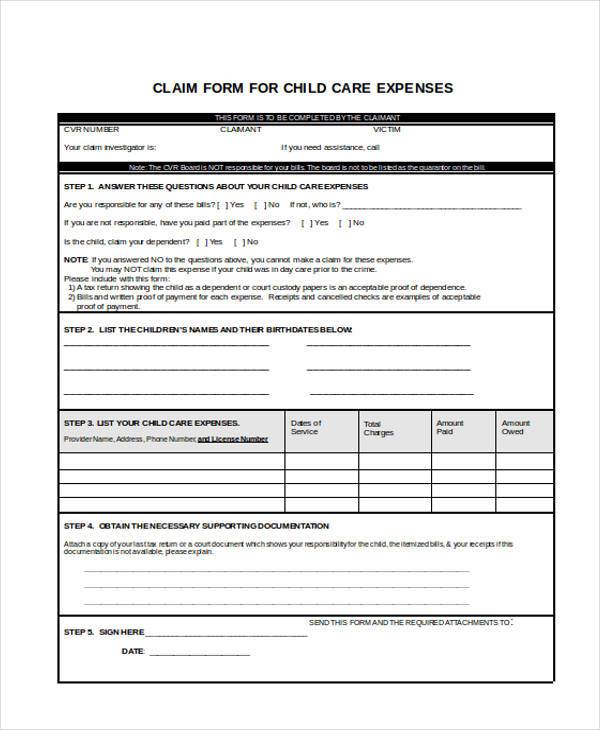

FREE 8 Sample Child Care Expense Forms In PDF MS Word

FREE 8 Sample Child Care Expense Forms In PDF MS Word

Work From Home Tax Deduction Canada 6 Answers To Canadians Biggest