In a world with screens dominating our lives however, the attraction of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons as well as creative projects or simply to add an extra personal touch to your area, Can You Claim Sales Tax Back In Canada have become an invaluable resource. Through this post, we'll take a dive into the world "Can You Claim Sales Tax Back In Canada," exploring their purpose, where to locate them, and how they can improve various aspects of your life.

Get Latest Can You Claim Sales Tax Back In Canada Below

Can You Claim Sales Tax Back In Canada

Can You Claim Sales Tax Back In Canada -

Sales tax recovery is the process of recovering the sales tax paid on purchases made in Canada The recovery is done through a refund of the GST or HST paid on eligible purchases that were determined through a detailed analysis as having not been refunded previously

How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate application If you are eligible to claim a rebate under more than one code use a separate rebate application for each reason code

Can You Claim Sales Tax Back In Canada include a broad range of downloadable, printable material that is available online at no cost. These printables come in different formats, such as worksheets, coloring pages, templates and many more. The beauty of Can You Claim Sales Tax Back In Canada is in their versatility and accessibility.

More of Can You Claim Sales Tax Back In Canada

ARMSLIST For Sale SIG P322

ARMSLIST For Sale SIG P322

You may be eligible for a rebate of the provincial part of the HST you paid on eligible goods other than specified motor vehicles if you meet all of the following conditions You are a resident of Canada You bought goods in a

If you are running a business here in Canada and you are registered for GST HST you can claim back the sales tax paid on business purchases This can be accomplished using the Input Tax Credit

Can You Claim Sales Tax Back In Canada have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Individualization There is the possibility of tailoring the design to meet your needs such as designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Impact: Free educational printables offer a wide range of educational content for learners of all ages, making them an essential device for teachers and parents.

-

It's easy: You have instant access many designs and templates helps save time and effort.

Where to Find more Can You Claim Sales Tax Back In Canada

Tips For A Terrific First Trip To Ireland

Tips For A Terrific First Trip To Ireland

If you reside in Canada you may be entitled to a rebate of the Qu bec sales tax QST in respect of corporeal movable property including a mobile home or a floating home or a road vehicle purchased in Qu bec that you take or ship to another province or to the Northwest Territories Yukon or Nunavut Road vehicle

The Casual Refund Program allows Canadians who return goods to the United States to claim a refund for the duty and sales tax paid on those goods when they were originally purchased Unfortunately the process can often be

In the event that we've stirred your curiosity about Can You Claim Sales Tax Back In Canada, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in Can You Claim Sales Tax Back In Canada for different uses.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Ideal for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- These blogs cover a broad range of interests, starting from DIY projects to party planning.

Maximizing Can You Claim Sales Tax Back In Canada

Here are some fresh ways of making the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to reinforce learning at home and in class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Can You Claim Sales Tax Back In Canada are a treasure trove of practical and innovative resources that cater to various needs and preferences. Their accessibility and flexibility make them a great addition to the professional and personal lives of both. Explore the many options of Can You Claim Sales Tax Back In Canada to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes you can! You can download and print these documents for free.

-

Does it allow me to use free printables to make commercial products?

- It's determined by the specific terms of use. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may have restrictions concerning their use. Make sure you read these terms and conditions as set out by the creator.

-

How do I print Can You Claim Sales Tax Back In Canada?

- Print them at home using an printer, or go to a local print shop for top quality prints.

-

What program is required to open printables free of charge?

- The majority are printed with PDF formats, which is open with no cost software like Adobe Reader.

How To Claim Back Sales Tax Paid On Business Purchases

Claimable Sales Tax

.png?width=688&name=image (9).png)

Check more sample of Can You Claim Sales Tax Back In Canada below

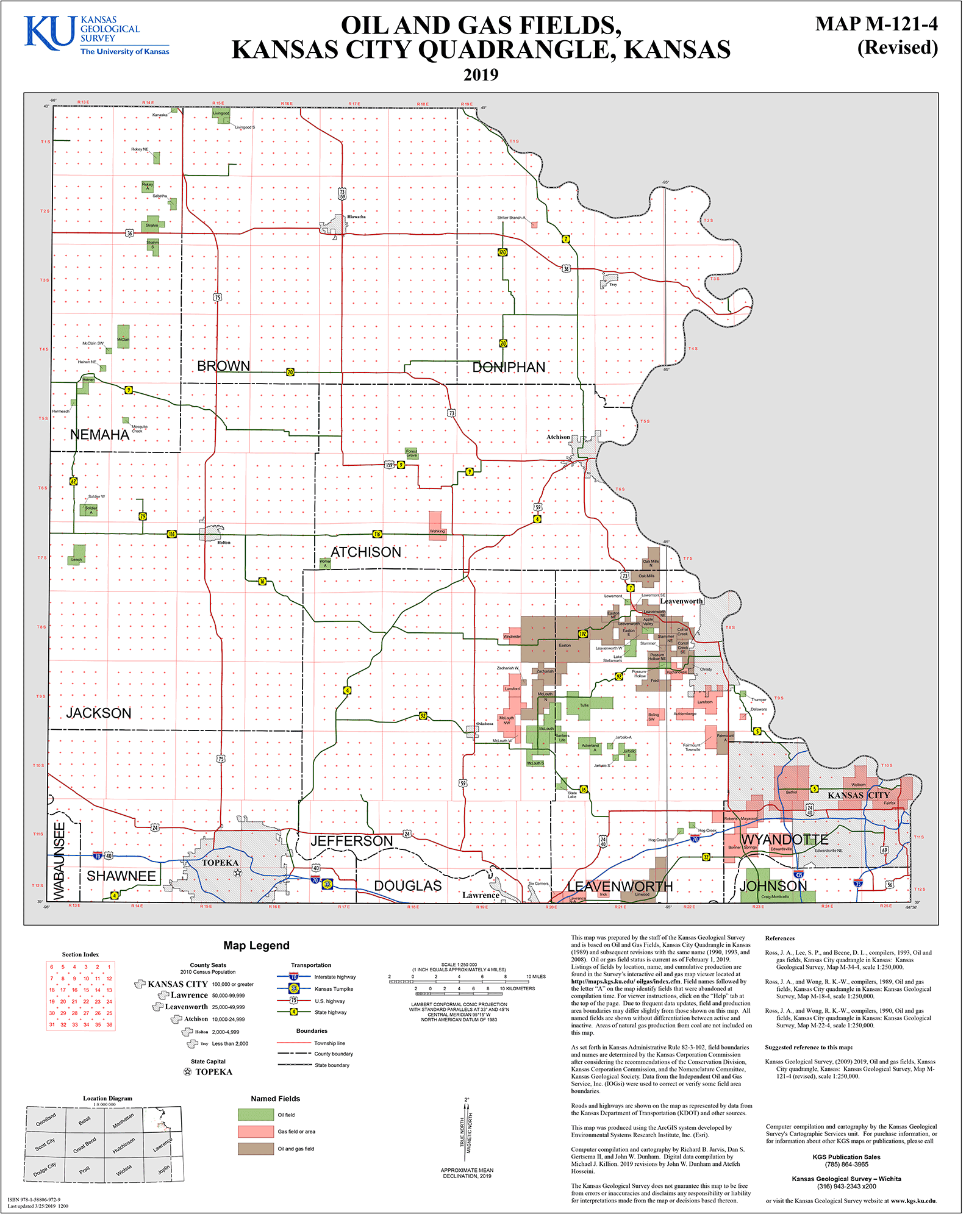

KGS 2 Degree Maps Kansas City Oil And Gas Fields

Tips For A Terrific First Trip To Ireland

FARM Tips For Filing Taxes Firsttuesday Journal

MultiVault Standard GV2000C STD DCG Stores

Jennifer Garner Reacts To Ben Affleck Saying Their Divorce Is His

Is The Angel Tax Back

https://www.canada.ca/en/revenue-agency/services/...

How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate application If you are eligible to claim a rebate under more than one code use a separate rebate application for each reason code

https://www.visitorstocanada.com/rebate-on-exports...

To claim your GST HST rebate use the following application form GST189 General Application for Rebate of GST HST Eligibility Conditions Exported Commercial Goods To qualify for the tax rebate you must Be a non Canadian resident

How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate application If you are eligible to claim a rebate under more than one code use a separate rebate application for each reason code

To claim your GST HST rebate use the following application form GST189 General Application for Rebate of GST HST Eligibility Conditions Exported Commercial Goods To qualify for the tax rebate you must Be a non Canadian resident

MultiVault Standard GV2000C STD DCG Stores

Tips For A Terrific First Trip To Ireland

Jennifer Garner Reacts To Ben Affleck Saying Their Divorce Is His

Is The Angel Tax Back

How To Claim Sales Tax Refund As Per Law Law Ki Dunya

Amberg GEW88

Amberg GEW88

Amberg GEW88