In this age of technology, when screens dominate our lives The appeal of tangible printed items hasn't gone away. Whether it's for educational purposes as well as creative projects or simply to add an individual touch to your home, printables for free are now a useful resource. With this guide, you'll take a dive to the depths of "Energy Efficiency Tax Rebates," exploring what they are, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest Energy Efficiency Tax Rebates Below

Energy Efficiency Tax Rebates

Energy Efficiency Tax Rebates - Energy Efficient Tax Rebates, Energy Efficient Tax Rebates 2023, Energy Efficiency Tax Credit 2023, Energy Efficiency Tax Credit, Energy Efficiency Tax Credits Inflation Reduction Act, Energy Efficiency Tax Credit Canada, Energy Efficiency Tax Deductions, Energy Efficiency Tax Credits For Businesses, Energy Efficiency Tax Credit Commercial Buildings, Energy Efficiency Tax Credit Insulation

Web The law includes 391 billion to support clean energy and address climate change including 8 8 billion in rebates for home energy efficiency and electrification projects

Web 21 d 233 c 2022 nbsp 0183 32 December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more

Energy Efficiency Tax Rebates offer a wide range of downloadable, printable documents that can be downloaded online at no cost. They are available in numerous forms, including worksheets, templates, coloring pages, and many more. The beauty of Energy Efficiency Tax Rebates is their flexibility and accessibility.

More of Energy Efficiency Tax Rebates

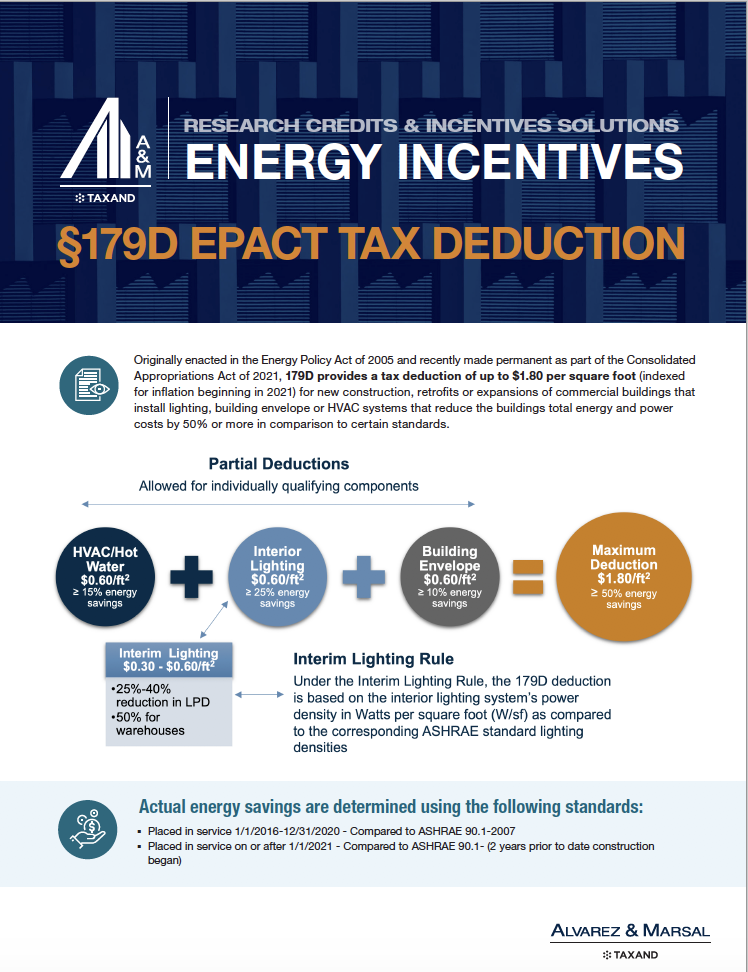

Extra Tax Benefits For Installing Energy Efficient Lighting

Extra Tax Benefits For Installing Energy Efficient Lighting

Web 26 juil 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on

Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Personalization It is possible to tailor printed materials to meet your requirements, whether it's designing invitations, organizing your schedule, or even decorating your home.

-

Educational value: Downloads of educational content for free are designed to appeal to students of all ages, which makes them an essential resource for educators and parents.

-

Easy to use: You have instant access many designs and templates can save you time and energy.

Where to Find more Energy Efficiency Tax Rebates

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

Web the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 Beginning January 1 2023 the amount

Web 17 mars 2023 nbsp 0183 32 Save More with Tax Credits for Energy Efficient Home Improvements Tax credits for energy efficient home improvements are extended and expanded because of the Inflation Reduction Act

Now that we've ignited your curiosity about Energy Efficiency Tax Rebates Let's see where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Energy Efficiency Tax Rebates designed for a variety objectives.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a wide range of interests, starting from DIY projects to planning a party.

Maximizing Energy Efficiency Tax Rebates

Here are some unique ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Energy Efficiency Tax Rebates are a treasure trove of creative and practical resources designed to meet a range of needs and hobbies. Their access and versatility makes these printables a useful addition to both personal and professional life. Explore the world of Energy Efficiency Tax Rebates right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes you can! You can download and print these files for free.

-

Can I use free printables for commercial uses?

- It is contingent on the specific terms of use. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may contain restrictions on use. Make sure you read the terms and regulations provided by the designer.

-

How can I print Energy Efficiency Tax Rebates?

- You can print them at home with either a printer or go to an area print shop for the highest quality prints.

-

What program do I require to view printables that are free?

- Most printables come in PDF format, which is open with no cost software such as Adobe Reader.

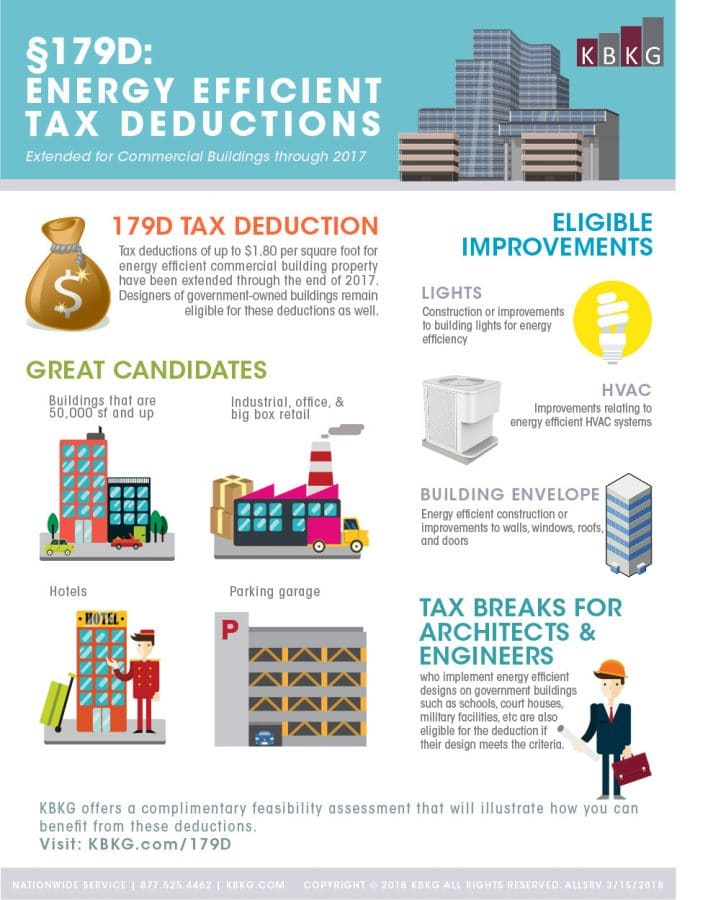

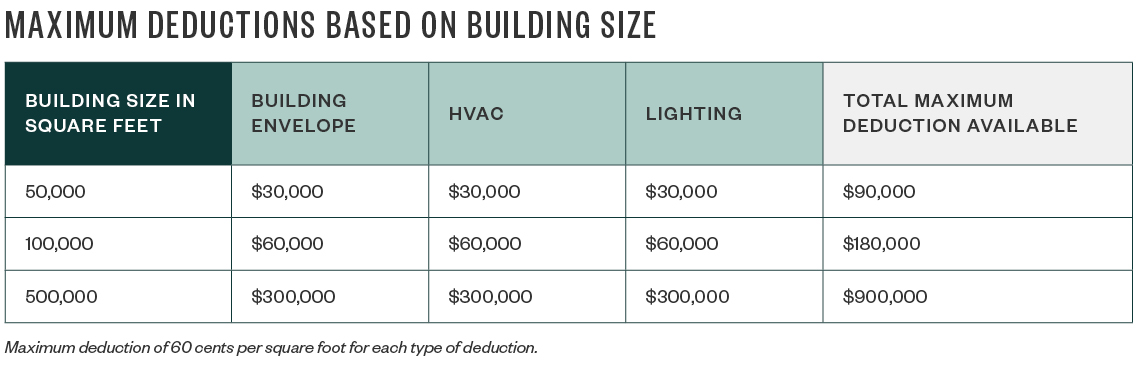

179D Energy Efficiency Deductions Extended Through 2017

Energy Efficiency Tax Credits For 2023 Earthwise Windows

Check more sample of Energy Efficiency Tax Rebates below

Tax Incentives For Energy Efficient Buildings

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Energy Rebates In MA That Homeowners Can Claim Today

45L The Energy Efficient Home Credit Extended Through 2017

Home Energy Efficient Improvements Tax Rebates

How To Get Energy Efficiency Improvement Rebates Air Assurance

https://www.energy.gov/policy/articles/making-our-homes-more-efficient...

Web 21 d 233 c 2022 nbsp 0183 32 December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 21 d 233 c 2022 nbsp 0183 32 December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

45L The Energy Efficient Home Credit Extended Through 2017

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Home Energy Efficient Improvements Tax Rebates

How To Get Energy Efficiency Improvement Rebates Air Assurance

Energy Incentives 179D EPact Tax Deduction Alvarez Marsal

Be Green Save Find Energy Tax Credits Rebates The Savvy Age

Be Green Save Find Energy Tax Credits Rebates The Savvy Age

New Energy Efficiency Rebates For Small Businesses Announced BSG