In this digital age, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Be it for educational use and creative work, or simply adding a personal touch to your home, printables for free are now an essential source. For this piece, we'll dive in the world of "Can You Claim Fuel On Tax," exploring what they are, where to find them and how they can enrich various aspects of your lives.

Get Latest Can You Claim Fuel On Tax Below

Can You Claim Fuel On Tax

Can You Claim Fuel On Tax - Can You Claim Fuel On Tax, Can You Claim Fuel On Tax Australia, Can You Claim Gas On Taxes, Can You Claim Gas On Taxes For Doordash, Can You Claim Gas On Taxes Canada, Can You Claim Petrol On Tax Return, Can You Claim Petrol On Tax Australia, Can U Claim Fuel On Tax, Can You Claim Gas On Taxes For Uber Eats, Can You Claim Gas On Taxes In Sc

Verkko Guidance Travel mileage and fuel rates and allowances Updated 5 April 2023 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per

Verkko You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel If your employer

Can You Claim Fuel On Tax include a broad range of downloadable, printable items that are available online at no cost. These resources come in many types, like worksheets, templates, coloring pages and much more. The appealingness of Can You Claim Fuel On Tax lies in their versatility as well as accessibility.

More of Can You Claim Fuel On Tax

How To Warranty Claim Fuel Pump PDI Job Card Hero Connect

How To Warranty Claim Fuel Pump PDI Job Card Hero Connect

Verkko Guidance Rates and allowances travel mileage and fuel allowances Rates and allowances for travel including mileage and fuel allowances From HM Revenue amp Customs Published 13 June 2013 Last

Verkko quot If you re claiming petrol costs using the logbook method either claim actual petrol costs for your work journeys remember to keep receipts or you can estimate petrol costs by multiplying

Can You Claim Fuel On Tax have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Individualization You can tailor the design to meet your needs, whether it's designing invitations making your schedule, or even decorating your home.

-

Educational Use: Free educational printables offer a wide range of educational content for learners from all ages, making them a useful tool for parents and educators.

-

Accessibility: immediate access various designs and templates helps save time and effort.

Where to Find more Can You Claim Fuel On Tax

Can You Deduct Your Gas And Oil Expenses If You Use Your Car For

Can You Deduct Your Gas And Oil Expenses If You Use Your Car For

Verkko 2 marrask 2023 nbsp 0183 32 For example you pay a rate of 52 95 pence per litre for petrol diesel biodiesel and bioethanol and a rate of 28 88 pence per kg for LPG Fortunately you can reclaim VAT on fuel when it comes to fuel used for business miles or on a company car And with the HMRC s fuel card tax calculator it should be easy to figure it out

Verkko Can you claim gasoline and mileage on taxes In short the answer is no The type of deduction method you choose will determine whether or not you can claim gasoline or mileage on your taxes not both

In the event that we've stirred your curiosity about Can You Claim Fuel On Tax, let's explore where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of applications.

- Explore categories such as the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free with flashcards and other teaching materials.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Can You Claim Fuel On Tax

Here are some creative ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Can You Claim Fuel On Tax are an abundance of innovative and useful resources that can meet the needs of a variety of people and interest. Their accessibility and versatility make these printables a useful addition to any professional or personal life. Explore the vast collection that is Can You Claim Fuel On Tax today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes they are! You can download and print these tools for free.

-

Does it allow me to use free printables for commercial use?

- It is contingent on the specific terms of use. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright violations with Can You Claim Fuel On Tax?

- Some printables may have restrictions on use. Check the terms of service and conditions provided by the designer.

-

How do I print Can You Claim Fuel On Tax?

- Print them at home using any printer or head to a local print shop for top quality prints.

-

What program do I require to open printables for free?

- Many printables are offered in the format of PDF, which is open with no cost software, such as Adobe Reader.

Can You Claim Input Tax Credit On Travel

Jennifer Garner Reacts To Ben Affleck Saying Their Divorce Is His

Check more sample of Can You Claim Fuel On Tax below

What Can You Claim On Tax Return 2021

Liquid Mercury Found Inside An Ancient Pyramid In Mexico Some Claim It

Petrol Is So Expensive Right Now Here s How Much Fuel You Can Claim On

IRS Provides Procedures To Claim Fuel Credits

The Worst Cars Of The 1970s Facty

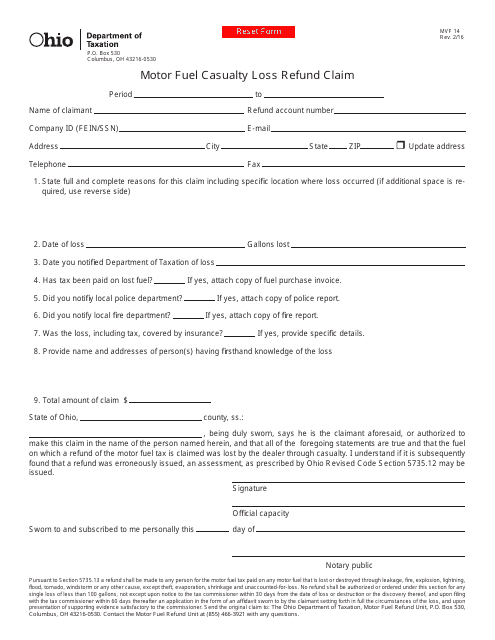

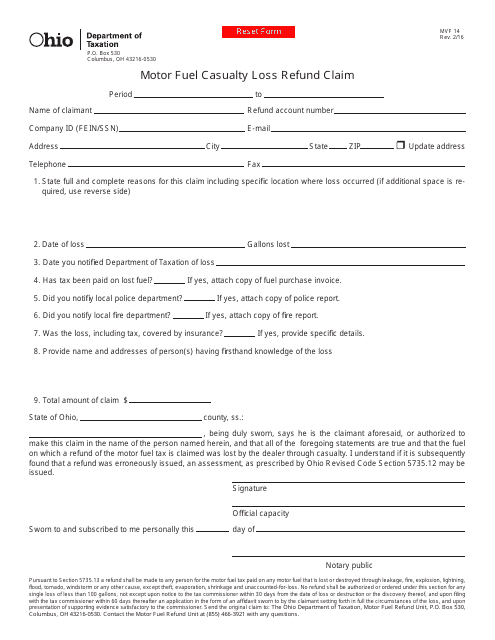

Form MVF14 Download Fillable PDF Or Fill Online Motor Fuel Casualty

https://www.gov.uk/tax-relief-for-employees/vehicles-you-use-for-work

Verkko You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel If your employer

https://www.fuelcardservices.com/understanding-fuel-expenses-how-ca…

Verkko 14 helmik 2022 nbsp 0183 32 HMRC allows you to make claims for every mile you drive provided the journey is for work purposes This allows you to cover some of the costs of running a company vehicle Helping reduce your fuel expenses is the most notable benefit of this but the relief can also be helpful in managing other running costs

Verkko You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel If your employer

Verkko 14 helmik 2022 nbsp 0183 32 HMRC allows you to make claims for every mile you drive provided the journey is for work purposes This allows you to cover some of the costs of running a company vehicle Helping reduce your fuel expenses is the most notable benefit of this but the relief can also be helpful in managing other running costs

IRS Provides Procedures To Claim Fuel Credits

Liquid Mercury Found Inside An Ancient Pyramid In Mexico Some Claim It

The Worst Cars Of The 1970s Facty

Form MVF14 Download Fillable PDF Or Fill Online Motor Fuel Casualty

Suzuki Jimny 2014 Motor Lovers

Gas Receipt Template Excel Fabulous Receipt Forms

Gas Receipt Template Excel Fabulous Receipt Forms

Fuel Tax Credit UPDATED JUNE 2022