In this digital age, when screens dominate our lives but the value of tangible printed objects hasn't waned. For educational purposes project ideas, artistic or simply adding an individual touch to your space, Adoption Expenses Tax Credit are now an essential source. Through this post, we'll dive deeper into "Adoption Expenses Tax Credit," exploring what they are, where to find them and the ways that they can benefit different aspects of your life.

Get Latest Adoption Expenses Tax Credit Below

Adoption Expenses Tax Credit

Adoption Expenses Tax Credit - Adoption Expenses Tax Credit, Adoption Expenses Tax Deductible 2022, Adoption Expenses Tax Deductible Canada, Failed Adoption Expenses Tax Deductible, Are Adoption Expenses Tax Deductible 2021, How Much Is The Adoption Tax Credit, Can You Claim Adoption Expenses On Taxes

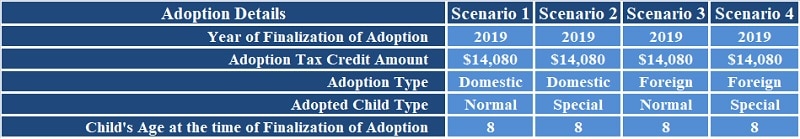

How much is the adoption tax credit For adoptions finalized in 2023 tax returns claimed in 2024 the maximum amount a family can receive as credit is 15 950 per adopted child For adoptions finalized in 2022 tax returns claimed in 2023 the maximum amount a family can receive as credit is 14 890 per

Tax benefits for adoption include both a tax credit for qualified adoption expenses paid to adopt an eligible child and an exclusion from income for employer provided adoption assistance The credit is nonrefundable which means it s limited to your tax liability for the year

Adoption Expenses Tax Credit cover a large variety of printable, downloadable content that can be downloaded from the internet at no cost. These printables come in different designs, including worksheets coloring pages, templates and more. The beauty of Adoption Expenses Tax Credit lies in their versatility and accessibility.

More of Adoption Expenses Tax Credit

Giving Adoption Tax Credit Where Credit Is Due Foster Care Newsletter

Giving Adoption Tax Credit Where Credit Is Due Foster Care Newsletter

If you paid adoption expenses in 2023 you might qualify for a credit of up to 15 950 for each child you adopted The credit amount depends on your income The credit is reduced if your adjusted gross income AGI is more than 201 010 You can t get the credit if you earn more than 241 010 Adoption benefits

Taxpayers can receive a tax credit for all qualifying adoption expenses up to 15 950 in 2023 The maximum credit is indexed for inflation Taxpayers may also exclude from income qualified adoption expenses paid or reimbursed by an employer up to the same limit as the credit

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Personalization The Customization feature lets you tailor the design to meet your needs whether you're designing invitations making your schedule, or decorating your home.

-

Educational Impact: Printables for education that are free offer a wide range of educational content for learners of all ages, making them a vital tool for parents and educators.

-

Easy to use: Access to a plethora of designs and templates can save you time and energy.

Where to Find more Adoption Expenses Tax Credit

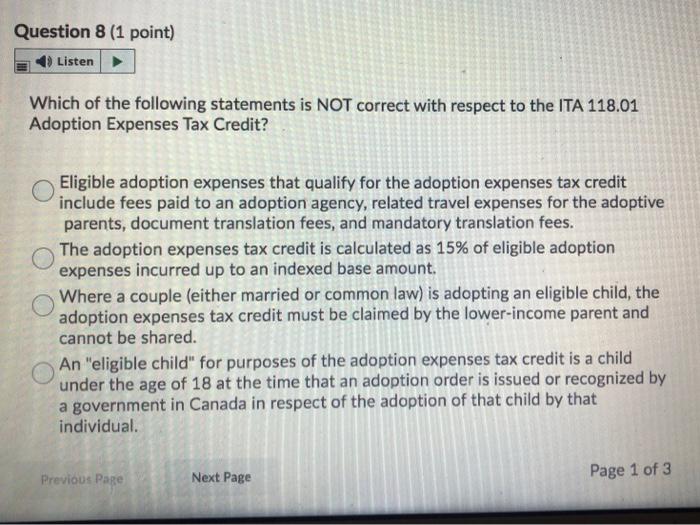

Solved Question 8 1 Point Listen Which Of The Following Chegg

Solved Question 8 1 Point Listen Which Of The Following Chegg

The adoption tax credit is designed to help parents with the expenses related to adopting a child under the age of 18 including a child with special needs You can claim this tax credit if you adopt a United States Citizen child or if you adopt a child from another country

The adoption tax credit is a nonrefundable tax credit meant to provide you relief for the qualified costs you pay when adopting a child The credit adjusts for inflation and amounts to 15 950 in

Now that we've piqued your curiosity about Adoption Expenses Tax Credit and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Adoption Expenses Tax Credit for all motives.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a broad variety of topics, ranging from DIY projects to planning a party.

Maximizing Adoption Expenses Tax Credit

Here are some inventive ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Adoption Expenses Tax Credit are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and pursuits. Their accessibility and flexibility make them an essential part of each day life. Explore the world of Adoption Expenses Tax Credit and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can download and print these resources at no cost.

-

Can I download free printouts for commercial usage?

- It's all dependent on the terms of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Do you have any copyright issues in Adoption Expenses Tax Credit?

- Some printables could have limitations in use. Be sure to review the terms and condition of use as provided by the author.

-

How can I print Adoption Expenses Tax Credit?

- You can print them at home with printing equipment or visit a local print shop to purchase superior prints.

-

What program do I require to open printables for free?

- Most PDF-based printables are available in PDF format, which can be opened with free programs like Adobe Reader.

Claiming Adoption Expenses Canada 2022 TurboTax Canada Tips

Download Adoption Tax Credit Calculator Excel Template ExcelDataPro

Check more sample of Adoption Expenses Tax Credit below

Claiming Adoption Related Expenses 2022 TurboTax Canada Tips

Adoption Credit ADKF

Adoption Credit ADKF

The Adoption Tax Credit Helps Families With Adoption Related Expenses

Tax Tips Business Solutions Barrie

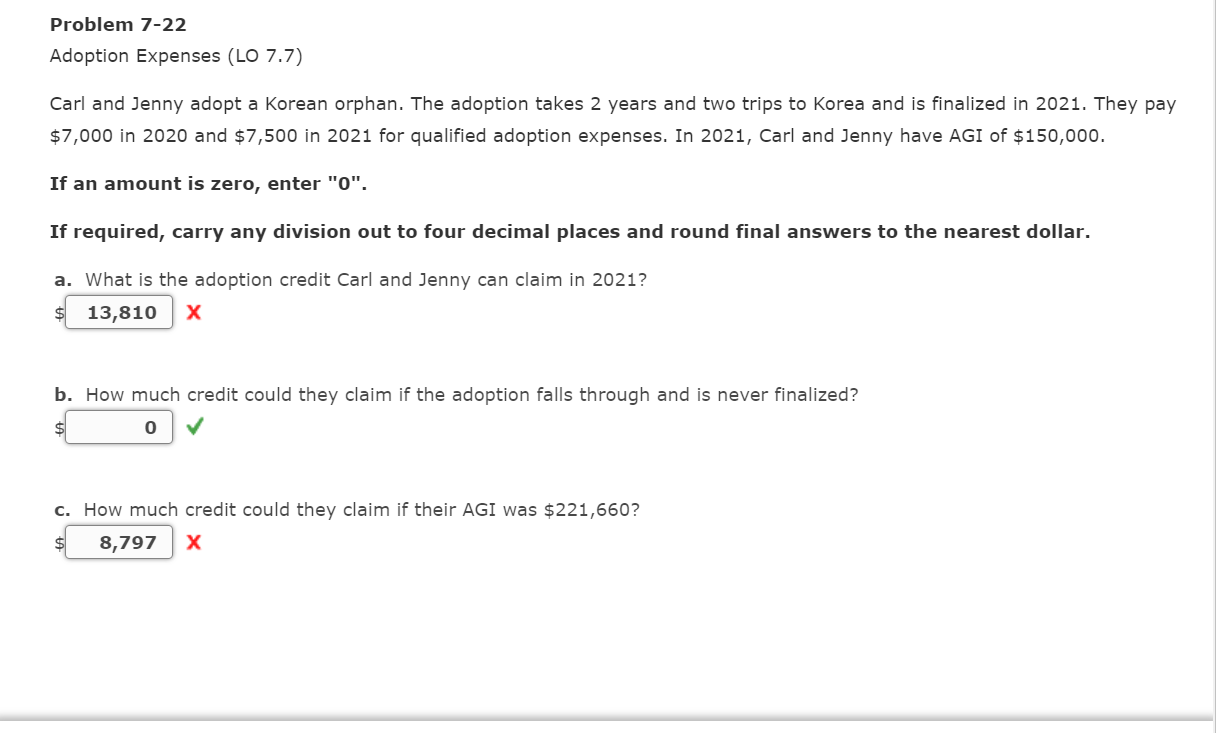

Solved Problem 7 22 Adoption Expenses LO 7 7 Carl And Chegg

https://www.irs.gov/taxtopics/tc607

Tax benefits for adoption include both a tax credit for qualified adoption expenses paid to adopt an eligible child and an exclusion from income for employer provided adoption assistance The credit is nonrefundable which means it s limited to your tax liability for the year

https://www.irs.gov/newsroom/understanding-the-adoption-tax-credit

The maximum adoption credit taxpayers can claim on their 2021 tax return is 14 440 per eligible child There are income limits that could affect the amount of the credit Taxpayers should complete Form

Tax benefits for adoption include both a tax credit for qualified adoption expenses paid to adopt an eligible child and an exclusion from income for employer provided adoption assistance The credit is nonrefundable which means it s limited to your tax liability for the year

The maximum adoption credit taxpayers can claim on their 2021 tax return is 14 440 per eligible child There are income limits that could affect the amount of the credit Taxpayers should complete Form

The Adoption Tax Credit Helps Families With Adoption Related Expenses

Adoption Credit ADKF

Tax Tips Business Solutions Barrie

Solved Problem 7 22 Adoption Expenses LO 7 7 Carl And Chegg

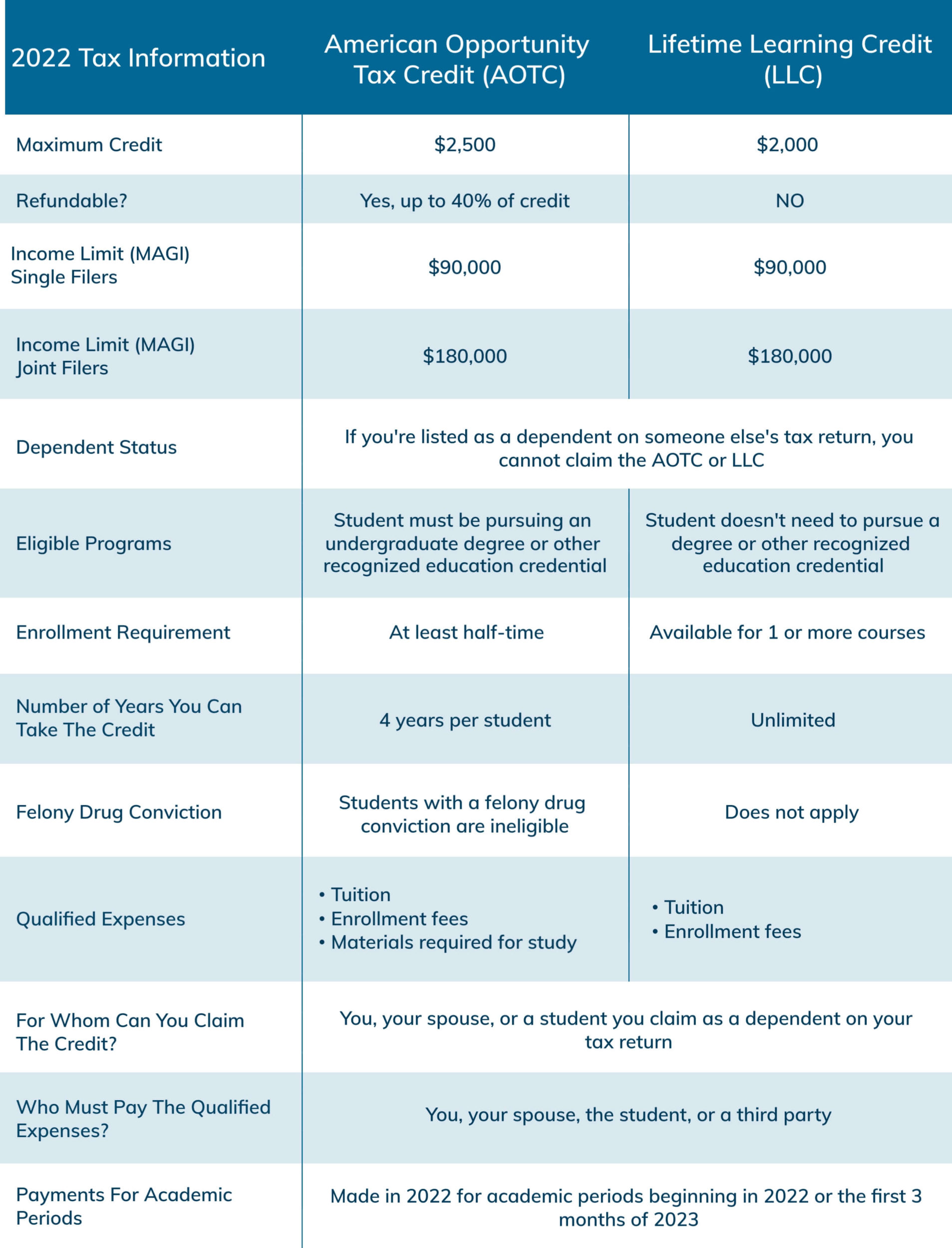

2022 Education Tax Credits Are You Eligible

How To Use The Adoption Tax Credit Adoption

How To Use The Adoption Tax Credit Adoption

2022 How Does The Adoption Tax Credit Work Struggle Shuttle