In this day and age where screens rule our lives yet the appeal of tangible printed items hasn't gone away. No matter whether it's for educational uses, creative projects, or just adding the personal touch to your space, 2023 Solar Tax Credit Form are now a useful source. For this piece, we'll take a dive deep into the realm of "2023 Solar Tax Credit Form," exploring what they are, how to locate them, and how they can enhance various aspects of your life.

Get Latest 2023 Solar Tax Credit Form Below

2023 Solar Tax Credit Form

2023 Solar Tax Credit Form - 2023 Solar Tax Credit Form, Irs Solar Tax Credit 2023 Form, Federal Tax Credit For Solar Form, Solar Tax Credit If I Get A Refund, Solar Tax Credit When Financing

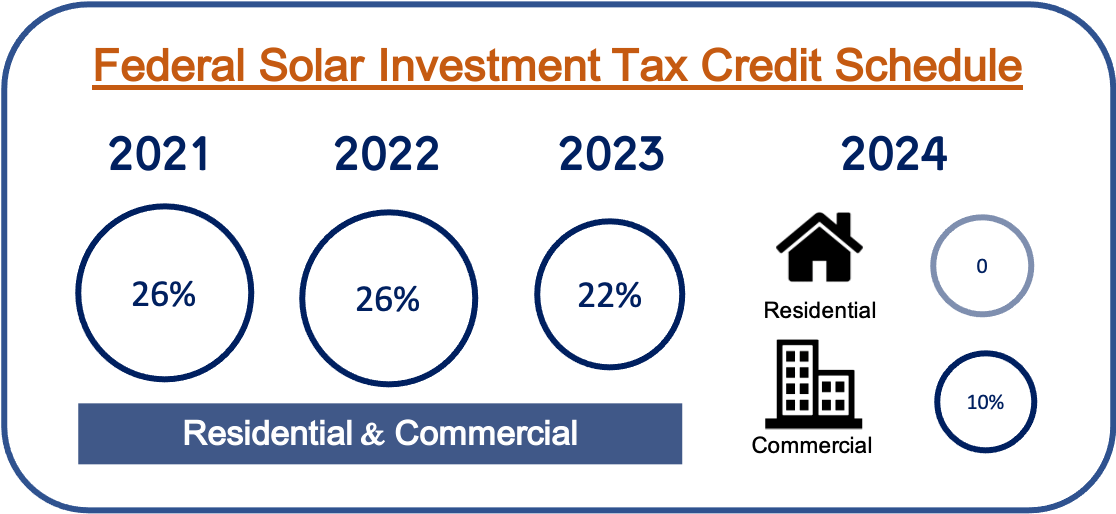

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Need to jump ahead Federal solar tax

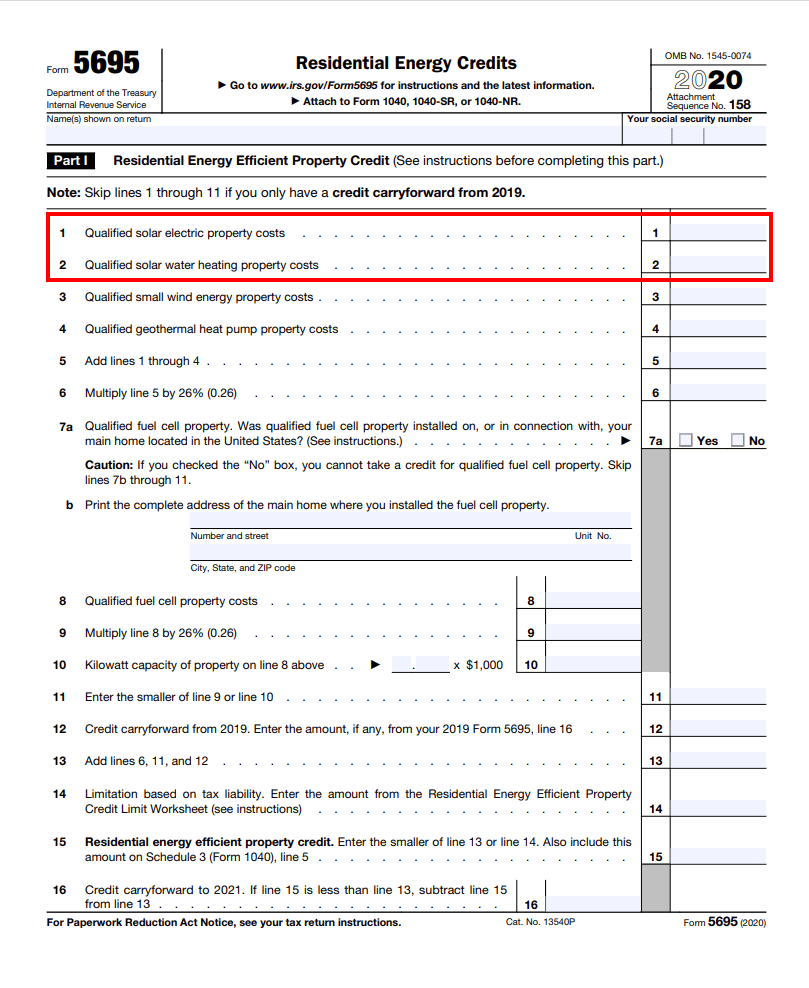

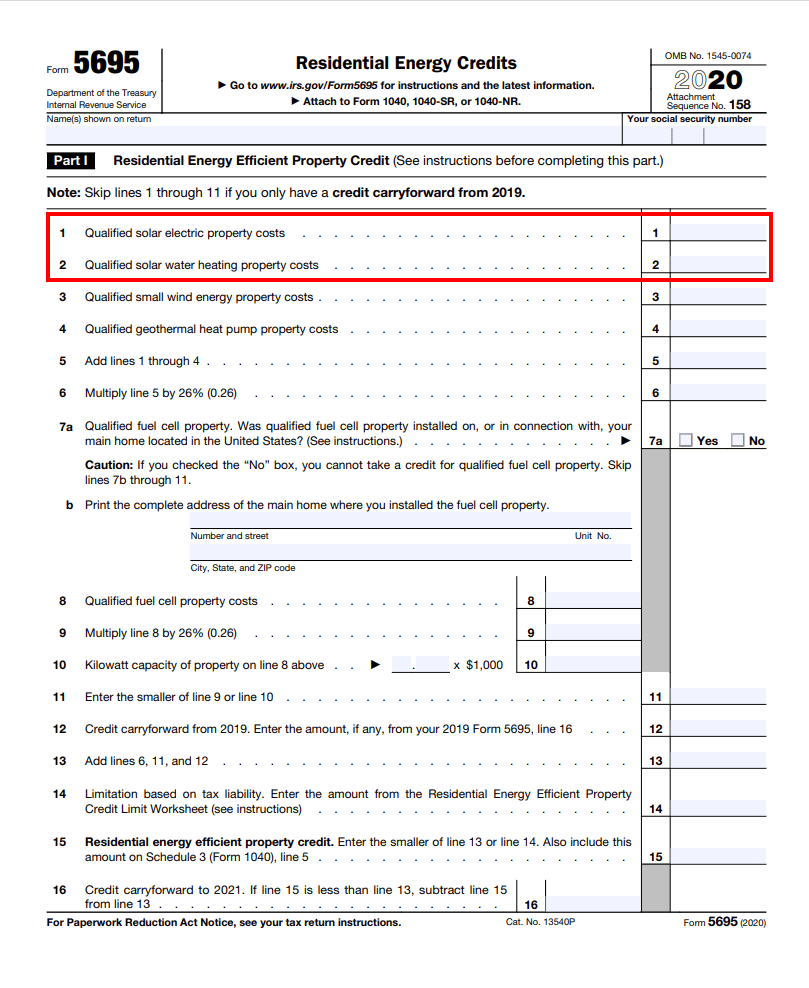

Page Last Reviewed or Updated 01 Feb 2024 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

Printables for free cover a broad selection of printable and downloadable content that can be downloaded from the internet at no cost. They come in many formats, such as worksheets, coloring pages, templates and many more. The attraction of printables that are free is in their variety and accessibility.

More of 2023 Solar Tax Credit Form

Irs Solar Tax Credit 2022 Form

Irs Solar Tax Credit 2022 Form

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

This resource from the U S Department of Energy DOE Solar Energy Technologies Office SETO provides an overview of the federal investment and production tax credits for businesses nonprofits and other entities that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP energy generation

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Personalization You can tailor printed materials to meet your requirements for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your house.

-

Educational Value Downloads of educational content for free provide for students of all ages, making them an invaluable device for teachers and parents.

-

It's easy: The instant accessibility to various designs and templates cuts down on time and efforts.

Where to Find more 2023 Solar Tax Credit Form

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Form 5695 is the document you submit to get a credit on your tax return for installing solar panels on your home We commonly think of Tax Form 5695 as the Residential Clean Energy Credit Form You can request a copy of Form 5695 from the Internal Revenue Service IRS Website and also review their Form 5695 instructions

How to claim the solar tax credit IRS Form 5695 instructions By Ben Zientara Updated 02 12 2024 Note The information below can be used if filing taxes in 2023 for a solar installation that was placed into service in 2022 It s that time of year again tax time

Since we've got your interest in 2023 Solar Tax Credit Form, let's explore where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of 2023 Solar Tax Credit Form for various reasons.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- The blogs covered cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing 2023 Solar Tax Credit Form

Here are some creative ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

2023 Solar Tax Credit Form are a treasure trove of fun and practical tools that meet a variety of needs and needs and. Their access and versatility makes them a fantastic addition to any professional or personal life. Explore the endless world that is 2023 Solar Tax Credit Form today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can print and download these free resources for no cost.

-

Does it allow me to use free templates for commercial use?

- It's based on the usage guidelines. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables might have limitations regarding their use. Check the terms and conditions offered by the author.

-

How do I print 2023 Solar Tax Credit Form?

- You can print them at home with an printer, or go to a local print shop to purchase top quality prints.

-

What software is required to open printables that are free?

- The majority of PDF documents are provided with PDF formats, which can be opened with free programs like Adobe Reader.

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Check more sample of 2023 Solar Tax Credit Form below

NJ Solar Tax Credit Explained

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Tax Credit ITC Sungenia Solar

Solar Tax Credit Calculator NikiZsombor

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

https://www.irs.gov/forms-pubs/about-form-5695

Page Last Reviewed or Updated 01 Feb 2024 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

https://www.energy.gov/sites/default/files/2023-03/...

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023

Page Last Reviewed or Updated 01 Feb 2024 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023

Tax Credit ITC Sungenia Solar

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

Solar Tax Credit Calculator NikiZsombor

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

How To File Solar Tax Credit IRS Form 5695 Green Ridge Solar

Irish Andrew

Irish Andrew

New Mexico Solar Tax Credit 2022 Deafening Bloggers Pictures