In this digital age, where screens have become the dominant feature of our lives and the appeal of physical printed objects isn't diminished. Be it for educational use project ideas, artistic or just adding an element of personalization to your area, 1098 T Tax Deduction 2022 are now a vital resource. This article will take a dive into the sphere of "1098 T Tax Deduction 2022," exploring the benefits of them, where they are, and how they can add value to various aspects of your daily life.

Get Latest 1098 T Tax Deduction 2022 Below

1098 T Tax Deduction 2022

1098 T Tax Deduction 2022 - 1098 T Tax Deduction 2022, 1098-t Tax Credit 2022, Is 1098-t Tax Deductible, Who Can Claim 1098 T Deduction

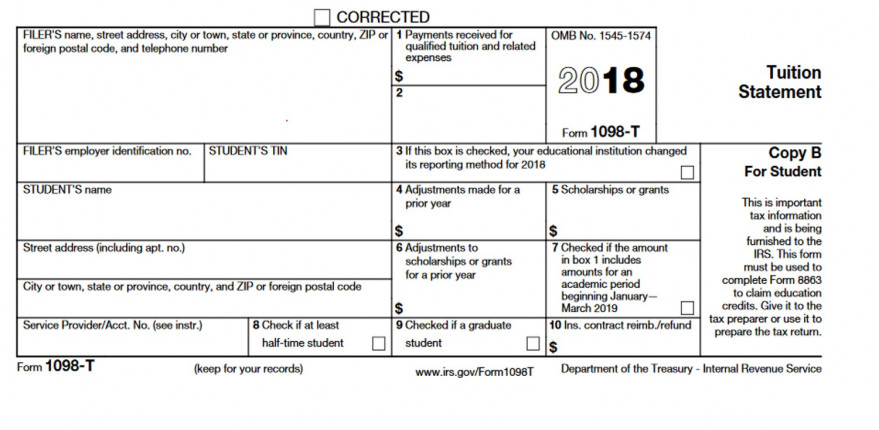

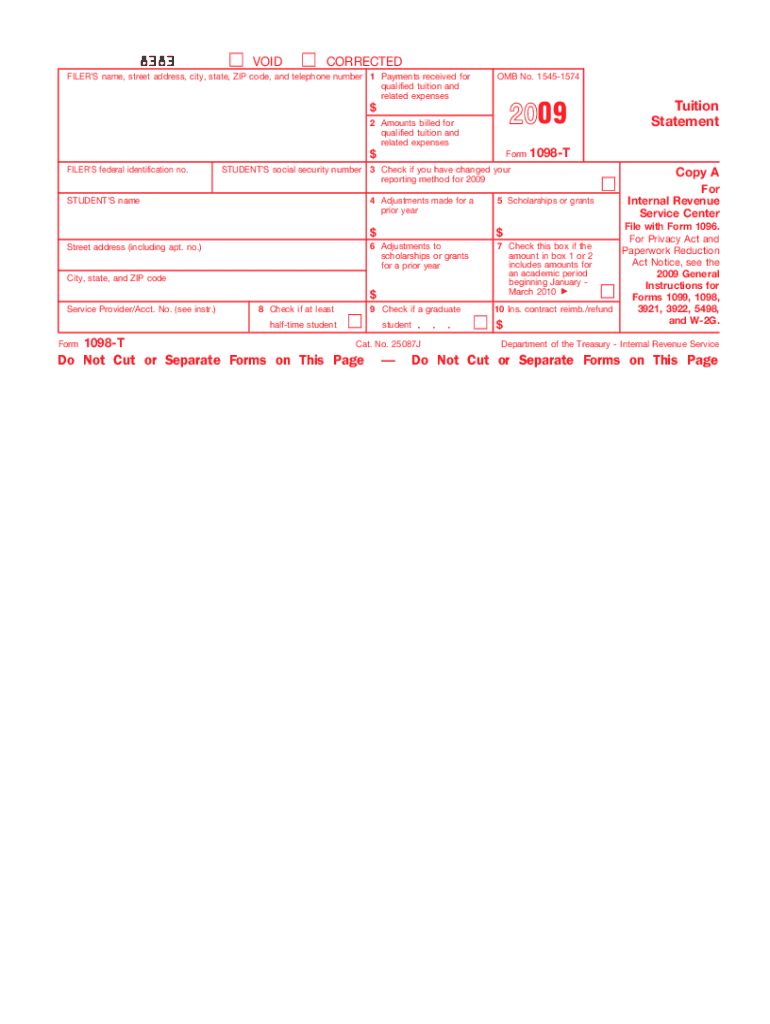

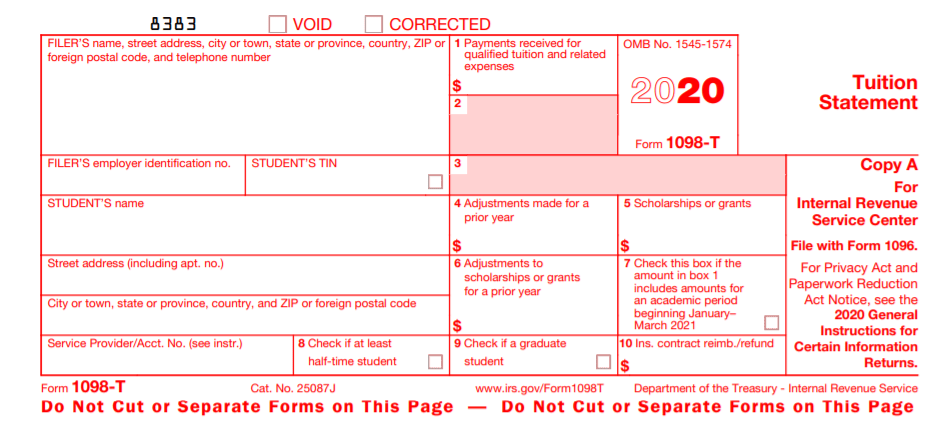

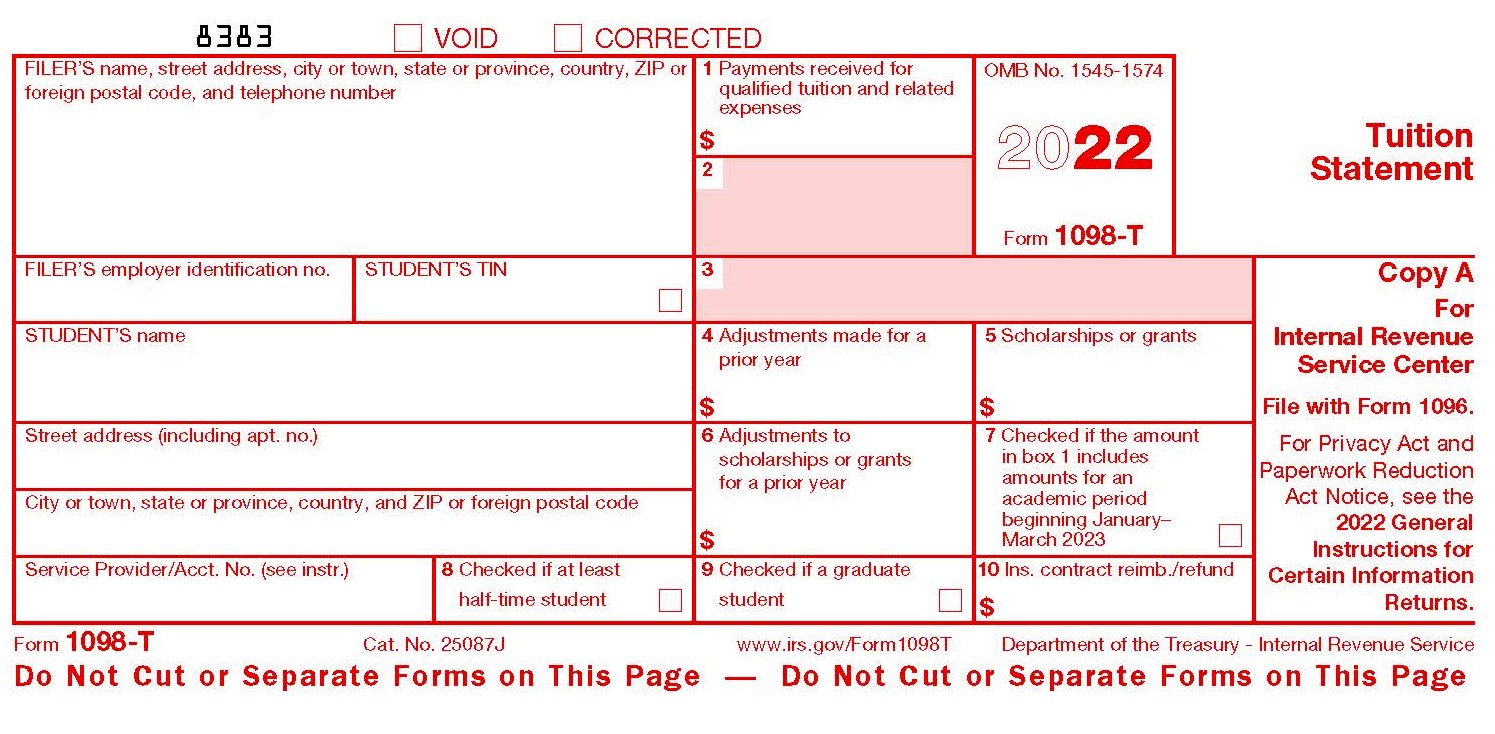

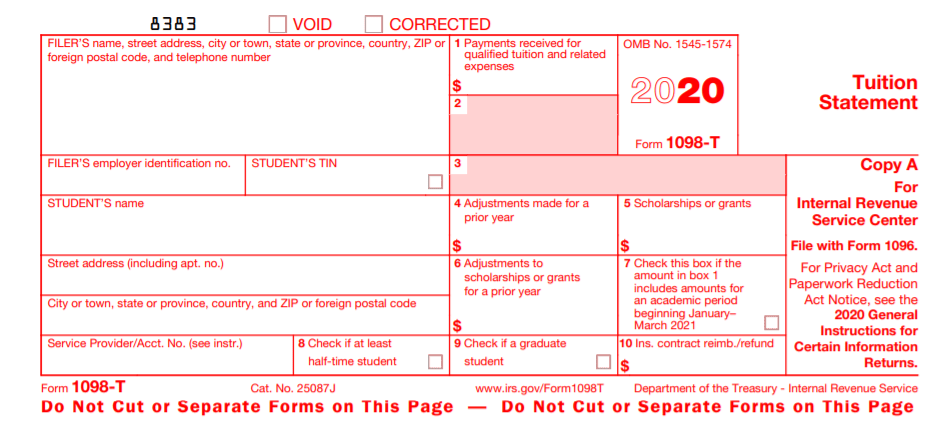

Tax Benefits for Education 1098 T tax statement As required by the Internal Revenue Service IRS Form 1098 T is mailed by January 31 to all students who had qualified tuition and other related educational expenses paid during the previous calendar year Southeastern utilizes the services of ECSI to process 1098 T tax forms

Information about Form 1098 T Tuition Statement including recent updates related forms and instructions on how to file Form 1098 T is used by eligible educational institutions to report for each student the enrolled amounts they received for qualified tuition and related expense payments

Printables for free cover a broad array of printable material that is available online at no cost. These materials come in a variety of kinds, including worksheets templates, coloring pages and more. The benefit of 1098 T Tax Deduction 2022 is their flexibility and accessibility.

More of 1098 T Tax Deduction 2022

Tax Form 1098 T Education Credits Explained YouTube

Tax Form 1098 T Education Credits Explained YouTube

Education Credits and Deductions Form 1098 T Education tax credits help offset the expenses of higher learning by reducing the tax an individual would owe the IRS and may increase their refund if they have no tax liability

Education tax forms In January your school will send you Form 1098 T a tuition statement that shows the education expenses you paid for the year You ll use that form to enter the

1098 T Tax Deduction 2022 have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

customization We can customize the templates to meet your individual needs be it designing invitations or arranging your schedule or even decorating your home.

-

Educational Impact: The free educational worksheets can be used by students of all ages, which makes the perfect tool for parents and educators.

-

It's easy: instant access many designs and templates helps save time and effort.

Where to Find more 1098 T Tax Deduction 2022

1098T Information Student And Departmental Account Services Lewis

1098T Information Student And Departmental Account Services Lewis

Eligible educational institutions file Form 1098 T for each student they enroll and for whom a reportable transaction is made The loan amount will be deducted from your tax refund reducing the refund amount paid directly to you OBTP B13696 2022 HRB Tax Group Inc When you use an ATM in addition to the fee charged by the bank

With a 1098 T the business your college reports how much qualified tuition and expenses you or your parents paid it during the tax year The IRS uses these forms to match data from information returns to income deductions and credits reported on individual income tax returns

After we've peaked your interest in 1098 T Tax Deduction 2022 Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of needs.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free as well as flashcards and other learning tools.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, starting from DIY projects to planning a party.

Maximizing 1098 T Tax Deduction 2022

Here are some ideas of making the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

1098 T Tax Deduction 2022 are a treasure trove of innovative and useful resources designed to meet a range of needs and needs and. Their access and versatility makes they a beneficial addition to your professional and personal life. Explore the plethora that is 1098 T Tax Deduction 2022 today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can print and download these free resources for no cost.

-

Do I have the right to use free printouts for commercial usage?

- It's dependent on the particular terms of use. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Are there any copyright concerns with 1098 T Tax Deduction 2022?

- Certain printables might have limitations on usage. You should read the terms and condition of use as provided by the creator.

-

How can I print 1098 T Tax Deduction 2022?

- Print them at home using an printer, or go to a local print shop to purchase premium prints.

-

What software do I require to open printables for free?

- The majority of printed documents are with PDF formats, which can be opened with free software like Adobe Reader.

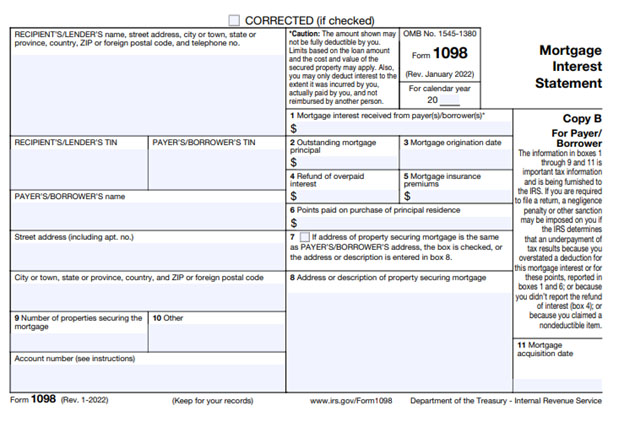

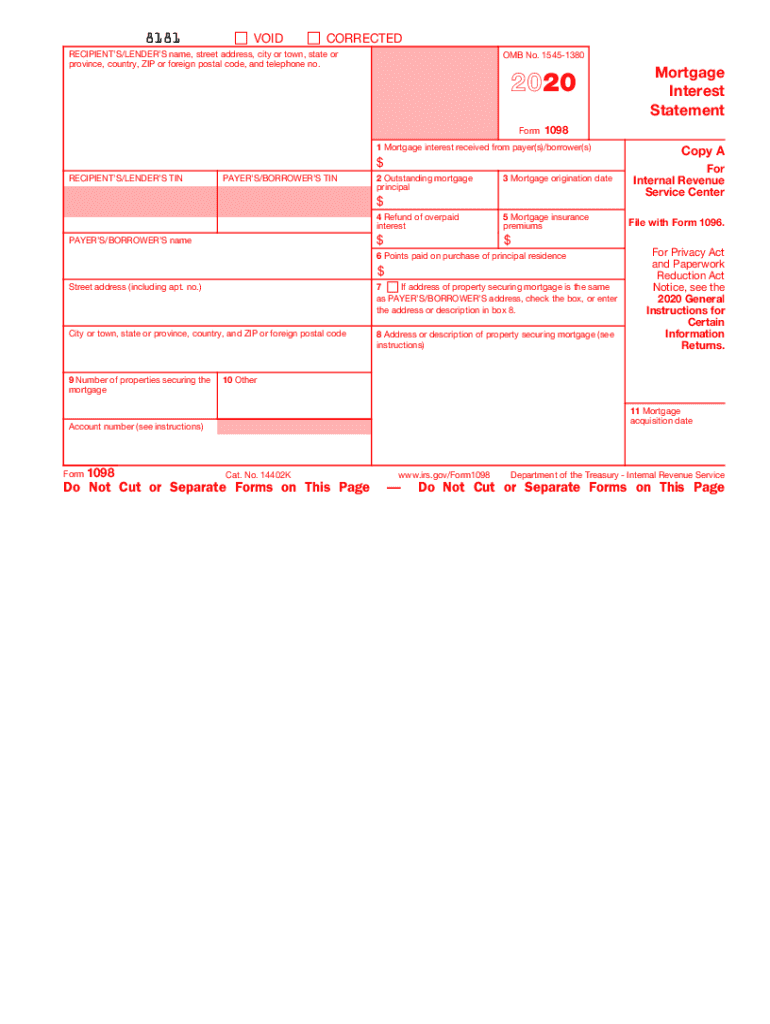

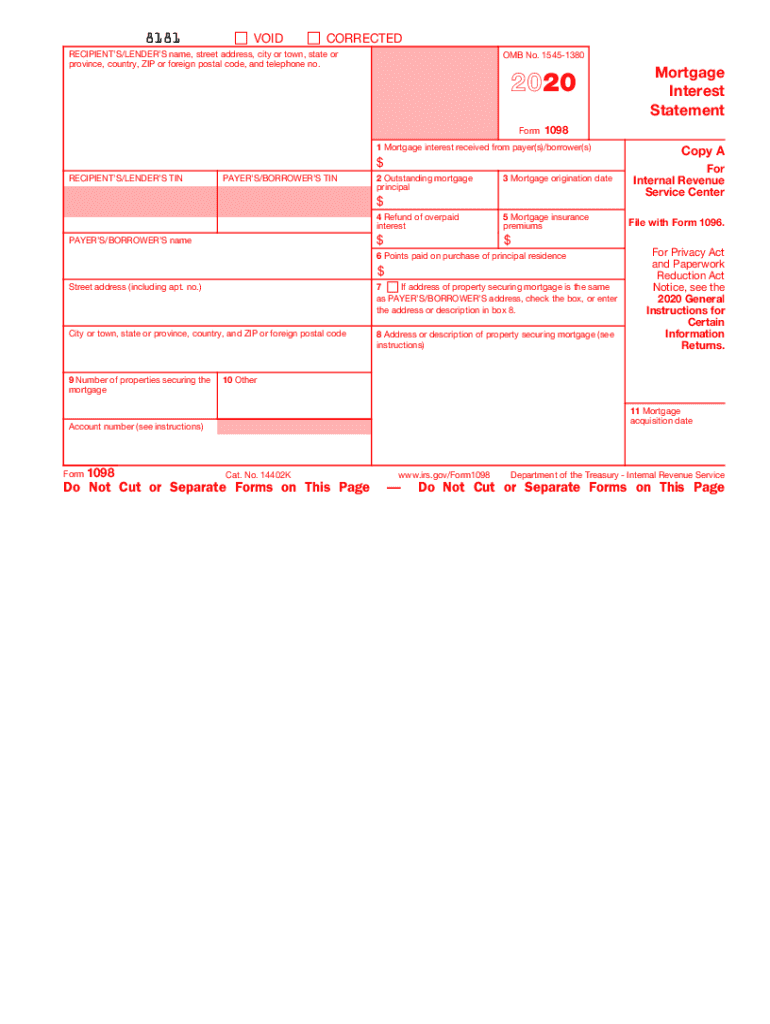

32 Where To Get 1098 Mortgage Form AmeerAllanah

Understanding Your 1098 T Tax Form UC San Diego SFS YouTube

Check more sample of 1098 T Tax Deduction 2022 below

1098 T Form Nipodcup

1098 T Form Printable Printable Forms Free Online

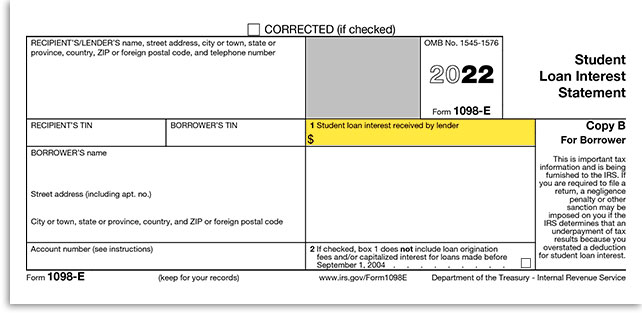

Tax Form 1098 E How To Write Off Interest On Your Student Loan Sound

IRS 1098 2020 Fill Out Tax Template Online US Legal Forms

IRS 1098 E 2020 2022 Fill Out Tax Template Online US Legal Forms

Frequently Asked Questions About The 1098 T The City University Of

https://www.irs.gov/forms-pubs/about-form-1098-t

Information about Form 1098 T Tuition Statement including recent updates related forms and instructions on how to file Form 1098 T is used by eligible educational institutions to report for each student the enrolled amounts they received for qualified tuition and related expense payments

https://www.irs.gov/credits-deductions/individuals/...

The Form 1098 T is a form provided to you and the IRS by an eligible educational institution that reports among other things amounts paid for qualified tuition and related expenses The form may be useful in calculating the amount of the allowable education tax credits

Information about Form 1098 T Tuition Statement including recent updates related forms and instructions on how to file Form 1098 T is used by eligible educational institutions to report for each student the enrolled amounts they received for qualified tuition and related expense payments

The Form 1098 T is a form provided to you and the IRS by an eligible educational institution that reports among other things amounts paid for qualified tuition and related expenses The form may be useful in calculating the amount of the allowable education tax credits

IRS 1098 2020 Fill Out Tax Template Online US Legal Forms

1098 T Form Printable Printable Forms Free Online

IRS 1098 E 2020 2022 Fill Out Tax Template Online US Legal Forms

Frequently Asked Questions About The 1098 T The City University Of

/Form1098-5c57730f46e0fb00013a2bee.jpg)

Home Mortgage Interest Deduction Second Home Home Sweet Home

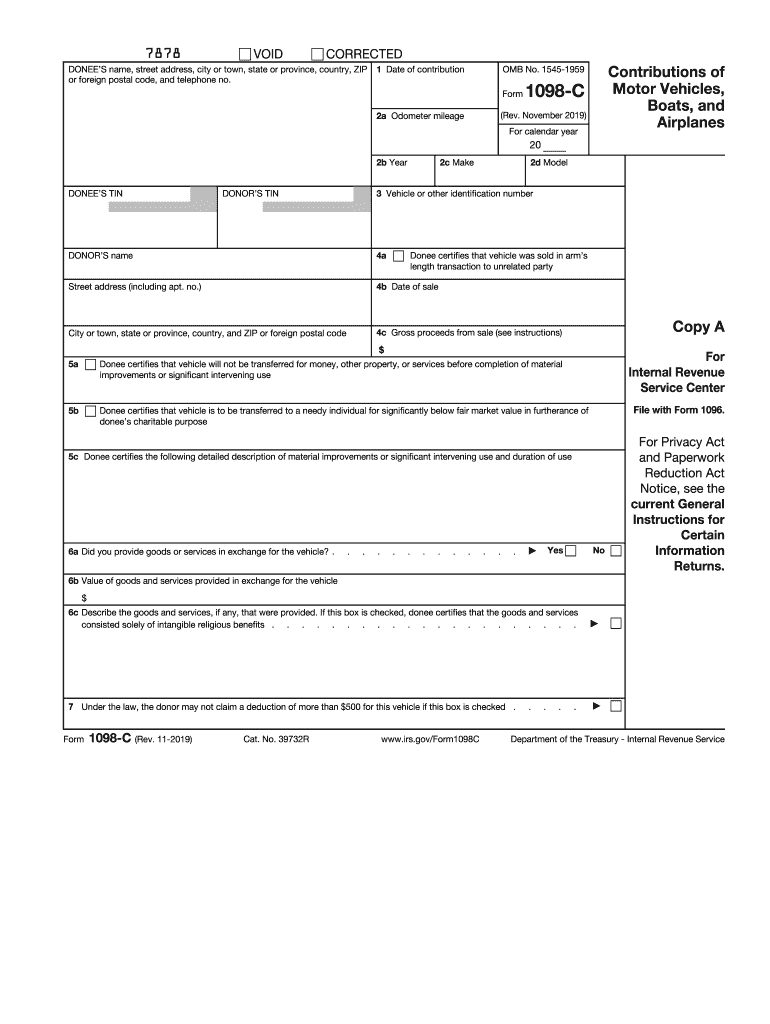

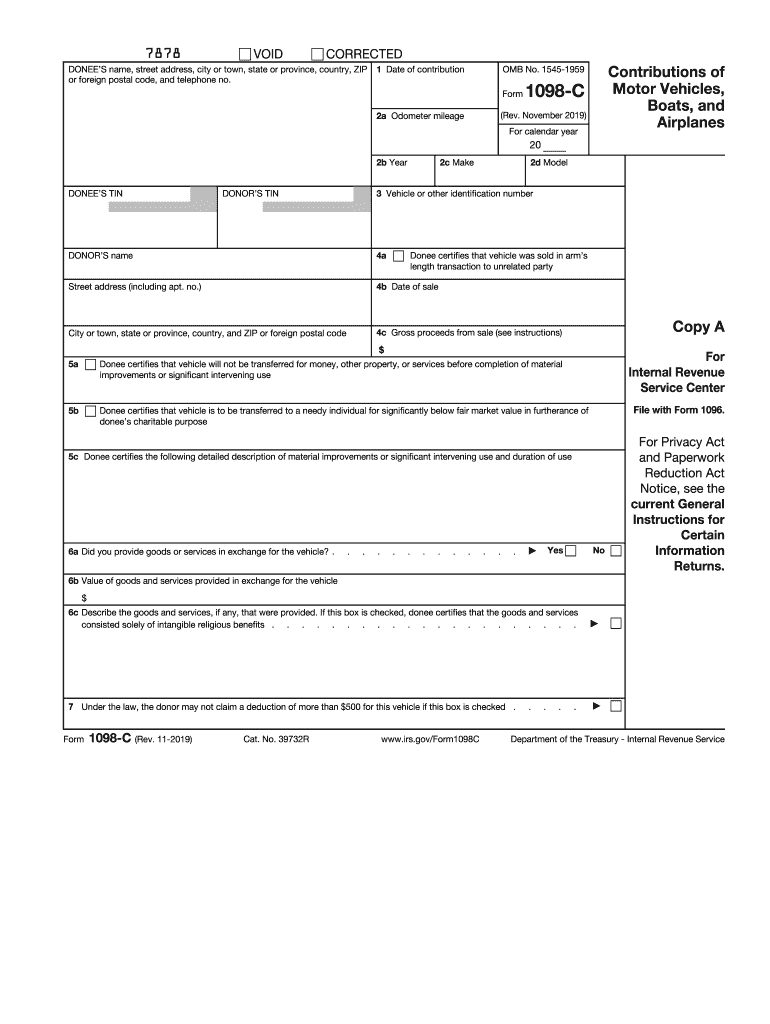

IRS 1098 C 2019 2021 Fill And Sign Printable Template Online US

IRS 1098 C 2019 2021 Fill And Sign Printable Template Online US

Your 1098 E And Your Student Loan Tax Information