In this digital age, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. In the case of educational materials in creative or artistic projects, or simply adding some personal flair to your area, Working Income Tax Benefit Eligibility can be an excellent resource. This article will take a dive deeper into "Working Income Tax Benefit Eligibility," exploring the different types of printables, where to get them, as well as how they can be used to enhance different aspects of your lives.

Get Latest Working Income Tax Benefit Eligibility Below

Working Income Tax Benefit Eligibility

Working Income Tax Benefit Eligibility -

The Canada Workers Benefit is a tax credit offering up to 1 428 to eligible individuals and 2 461 to eligible families to supplement lower incomes To claim the CWB you must pay taxes earn a working income below the net income level set for your province and be a Canadian resident age 19 or older on December 31 of the year you re

2024 02 09 Learn about the Canada Workers Benefit CWB and the advanced Canada workers benefit ACWB tax credits for low income workers including eligibility amounts and how to claim

The Working Income Tax Benefit Eligibility are a huge selection of printable and downloadable materials that are accessible online for free cost. These resources come in various forms, including worksheets, templates, coloring pages and much more. The great thing about Working Income Tax Benefit Eligibility lies in their versatility as well as accessibility.

More of Working Income Tax Benefit Eligibility

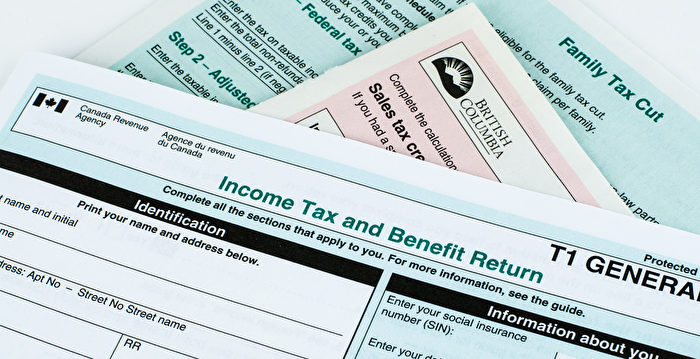

2023 Social Security Income Limit Social Security Intelligence 2023

2023 Social Security Income Limit Social Security Intelligence 2023

The Canada Workers Benefit CWB is a refundable tax credit for low income individuals and families who have a working income over 3 000 The CWB is made up of two parts the basic amount and the disability supplement The amount you receive for each as applicable is calculated based on your working income

Who Is Eligible The Canada Workers Benefit tax credit is only available for low income earners so you cannot claim if your net income is above the set thresholds You must also be a Canadian resident for the entire year and at least 19 years of age to claim workers benefit

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Personalization This allows you to modify the design to meet your needs such as designing invitations making your schedule, or decorating your home.

-

Educational Value: Downloads of educational content for free offer a wide range of educational content for learners of all ages, which makes these printables a powerful aid for parents as well as educators.

-

Simple: Quick access to numerous designs and templates helps save time and effort.

Where to Find more Working Income Tax Benefit Eligibility

Working Income Tax Benefit

Working Income Tax Benefit

Eligibility Benefits References Canada workers benefit The Canada Workers Benefit CWB is a refundable tax credit in Canada Introduced in 2007 under the name Workers Income Tax Benefit WITB it offers tax relief to working low income individuals and encourages others to enter the workforce 1

2021 CWB Enhancements CWB on the Tax Return Which Spouse Claims the CWB Calculators which include the Canada Workers Benefit CWB on the Detailed Canadian Tax Calculators CWB Eligibility CWB Family Working Income Adjusted Net Income CWB Disability Supplement Automatic Advance Payments for the Canada Workers

In the event that we've stirred your interest in printables for free Let's find out where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Working Income Tax Benefit Eligibility designed for a variety applications.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Perfect for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- The blogs are a vast range of topics, ranging from DIY projects to planning a party.

Maximizing Working Income Tax Benefit Eligibility

Here are some ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Working Income Tax Benefit Eligibility are an abundance of fun and practical tools that cater to various needs and passions. Their availability and versatility make them an invaluable addition to your professional and personal life. Explore the wide world of Working Income Tax Benefit Eligibility and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes, they are! You can print and download these materials for free.

-

Does it allow me to use free templates for commercial use?

- It depends on the specific rules of usage. Always read the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright violations with Working Income Tax Benefit Eligibility?

- Some printables may contain restrictions on use. Check these terms and conditions as set out by the designer.

-

How can I print Working Income Tax Benefit Eligibility?

- Print them at home with a printer or visit the local print shops for superior prints.

-

What program is required to open printables for free?

- The majority of PDF documents are provided in PDF format. These is open with no cost software, such as Adobe Reader.

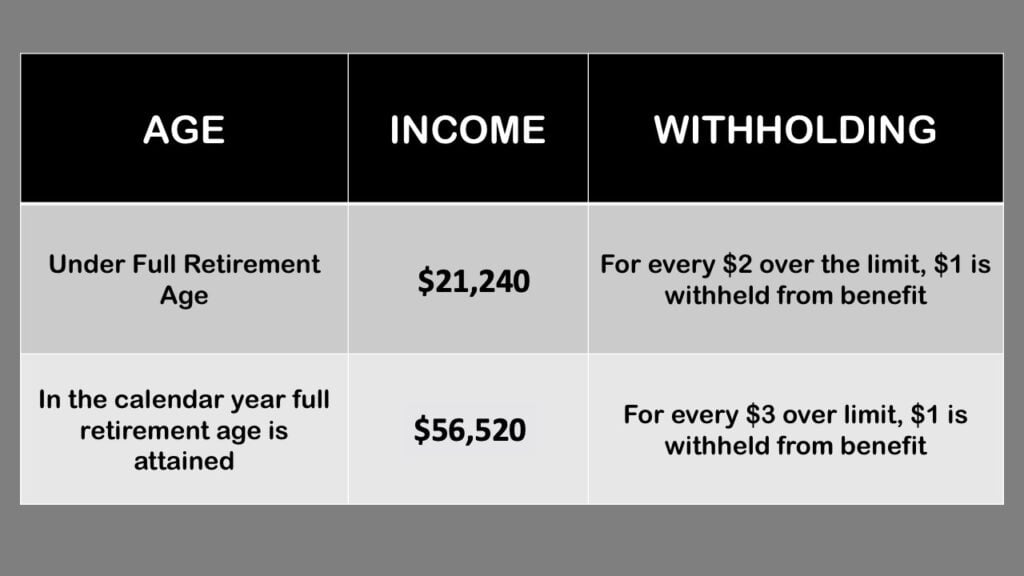

Canada Workers Benefit CWB Payment Dates Amounts And Eligibility 2023

Check more sample of Working Income Tax Benefit Eligibility below

2461 4 Redian

The Cross party Case For The Working Income Tax Benefit

Federal Government Hoping To Expand Take Up Of Working Income Tax

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

2461 4 Redian

1 75

https://www.canada.ca/en/revenue-agency/services...

2024 02 09 Learn about the Canada Workers Benefit CWB and the advanced Canada workers benefit ACWB tax credits for low income workers including eligibility amounts and how to claim

https://www.canada.ca/.../canada-workers-benefit-qa.html

For 2021 and later tax years the budget proposes that the basic CWB amount be equal to 27 of working income over 3 000 to a maximum of 1 395 for single individuals without dependants and 2 403 for families couples and single parents

2024 02 09 Learn about the Canada Workers Benefit CWB and the advanced Canada workers benefit ACWB tax credits for low income workers including eligibility amounts and how to claim

For 2021 and later tax years the budget proposes that the basic CWB amount be equal to 27 of working income over 3 000 to a maximum of 1 395 for single individuals without dependants and 2 403 for families couples and single parents

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

The Cross party Case For The Working Income Tax Benefit

2461 4 Redian

1 75

2461 4 Redian

Lasopafranchise Blog