In the digital age, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. If it's to aid in education such as creative projects or simply adding an element of personalization to your home, printables for free are a great source. With this guide, you'll take a dive into the world of "Work Clothes Tax Credit," exploring what they are, how to find them and how they can improve various aspects of your lives.

Get Latest Work Clothes Tax Credit Below

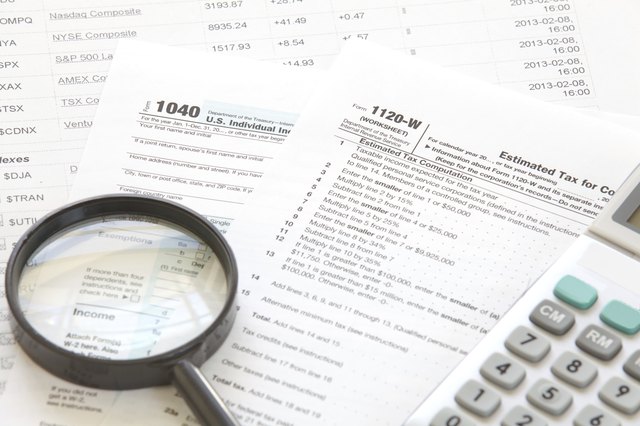

Work Clothes Tax Credit

Work Clothes Tax Credit -

1 min read Share Determining if work tools and uniforms as well as works clothes are tax deductible depends on a couple of factors In regard to uniforms you can deduct the cost of the uniforms and their upkeep dry cleaning if both of the following apply Your job requires that you wear special clothing such as a uniform

July 06 2021 12 46 Updated Follow You can deduct the cost and upkeep of work clothes and uniforms if you mustwear them as a condition of your employment and the clothes are not suitable for everyday wear As an exception clothing that is considered a marketing cost can be considered

Work Clothes Tax Credit encompass a wide variety of printable, downloadable materials online, at no cost. They are available in a variety of designs, including worksheets templates, coloring pages and much more. One of the advantages of Work Clothes Tax Credit is their versatility and accessibility.

More of Work Clothes Tax Credit

Clothes Rent Meals What Is Tax Deductible Humphries Associates

Clothes Rent Meals What Is Tax Deductible Humphries Associates

That s right the IRS allows for certain items of clothing to be written off as business expenses depending on how they re used Eligible pieces of clothing can be claimed alongside your other deductible expenses on Schedule C of your tax return You have to be self employed to write off your work clothes

Did it count as business related clothing for tax purposes The answer in my case was no However your situation may be different here s how to know if your business clothes are tax deductible and how to claim them

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Customization: It is possible to tailor printed materials to meet your requirements be it designing invitations to organize your schedule or decorating your home.

-

Educational Impact: Free educational printables offer a wide range of educational content for learners of all ages, which makes them an invaluable tool for parents and teachers.

-

An easy way to access HTML0: The instant accessibility to various designs and templates, which saves time as well as effort.

Where to Find more Work Clothes Tax Credit

Quantity Limited Promotion Leather Boho Skirt Flower Embroidery Midi

Quantity Limited Promotion Leather Boho Skirt Flower Embroidery Midi

Working Tax Credit how much money you get hours you need to work eligibility claim tax credits when you stop work or go on leave

Clothing is one of the more contested tax deductions and it tends to get rejected a lot But this doesn t mean you should avoid deducting work related clothing expenses on your tax return altogether Here s an overview of the clothing purchases that can and can t be deducted as a business expense

We hope we've stimulated your curiosity about Work Clothes Tax Credit Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Work Clothes Tax Credit to suit a variety of purposes.

- Explore categories such as decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- The perfect resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs covered cover a wide range of topics, from DIY projects to planning a party.

Maximizing Work Clothes Tax Credit

Here are some ideas of making the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets for free for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Work Clothes Tax Credit are a treasure trove of fun and practical tools that meet a variety of needs and interests. Their access and versatility makes them an essential part of the professional and personal lives of both. Explore the plethora of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes, they are! You can print and download these documents for free.

-

Can I make use of free printables in commercial projects?

- It's contingent upon the specific terms of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using Work Clothes Tax Credit?

- Certain printables may be subject to restrictions on usage. Make sure to read the terms and conditions set forth by the author.

-

How can I print Work Clothes Tax Credit?

- Print them at home using your printer or visit an in-store print shop to get premium prints.

-

What program will I need to access printables at no cost?

- The majority are printed in PDF format. These can be opened with free software, such as Adobe Reader.

How To Claim A Tax Deduction For Work Clothes Sapling

Are Work Clothes Tax deductible For Self employed EMS

Check more sample of Work Clothes Tax Credit below

Clothes Rent Meals What Is Tax Deductible Hunter Withers

Tax Deduction For Work Clothing Uniform

Upward Assumption Jet Peluche Cuore Rally Metal Seller

Donation Value Guide 2019 Spreadsheet Unique Goodwill Donation

Clothes Rent Meals What Is Tax Deductible Corbeau Accounting

Are Work Clothes Tax Deductible For Self Employed The TurboTax Blog

https://tmi.ukko.fi/hc/en-us/articles/4403570724753

July 06 2021 12 46 Updated Follow You can deduct the cost and upkeep of work clothes and uniforms if you mustwear them as a condition of your employment and the clothes are not suitable for everyday wear As an exception clothing that is considered a marketing cost can be considered

https://www.gov.uk/tax-relief-for-employees/...

Uniforms work clothing and tools You may be able to claim tax relief on the cost of repairing or replacing small tools you need to do your job for example scissors or an electric drill

July 06 2021 12 46 Updated Follow You can deduct the cost and upkeep of work clothes and uniforms if you mustwear them as a condition of your employment and the clothes are not suitable for everyday wear As an exception clothing that is considered a marketing cost can be considered

Uniforms work clothing and tools You may be able to claim tax relief on the cost of repairing or replacing small tools you need to do your job for example scissors or an electric drill

Donation Value Guide 2019 Spreadsheet Unique Goodwill Donation

Tax Deduction For Work Clothing Uniform

Clothes Rent Meals What Is Tax Deductible Corbeau Accounting

Are Work Clothes Tax Deductible For Self Employed The TurboTax Blog

26 Self Employed Seamstress Free Sewing Pattern

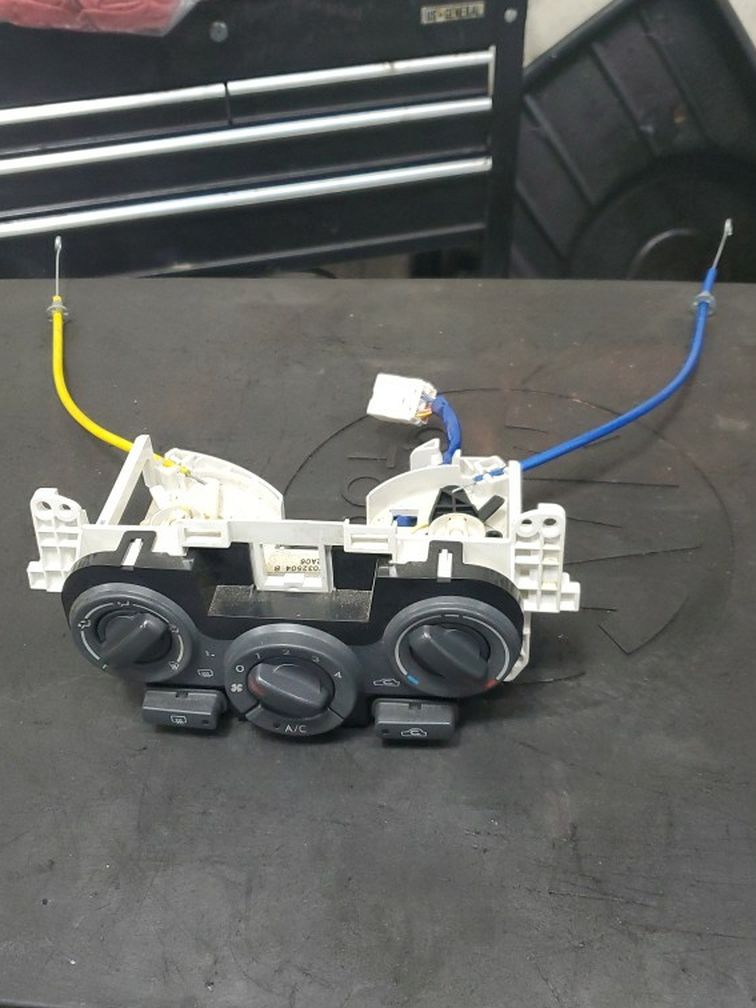

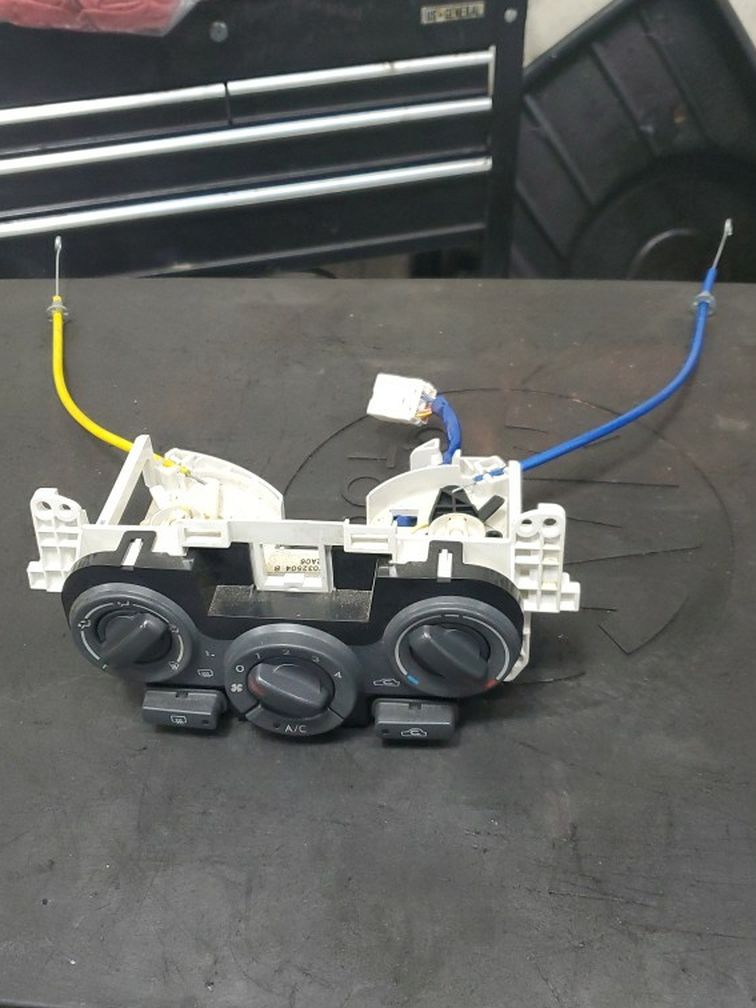

Hight Quality Guaranteed Heater Chassis Control By For Sale Kent And

Hight Quality Guaranteed Heater Chassis Control By For Sale Kent And

Cheap Online Shop Silver DG Earrings In Clip on Earrings Clip on