In this age of electronic devices, with screens dominating our lives and the appeal of physical printed material hasn't diminished. For educational purposes and creative work, or simply to add an individual touch to the area, Wife Education Exemption In Income Tax have become a valuable resource. Here, we'll take a dive in the world of "Wife Education Exemption In Income Tax," exploring their purpose, where they are available, and how they can improve various aspects of your daily life.

What Are Wife Education Exemption In Income Tax?

Wife Education Exemption In Income Tax cover a large assortment of printable material that is available online at no cost. They are available in numerous forms, including worksheets, templates, coloring pages, and more. One of the advantages of Wife Education Exemption In Income Tax is their versatility and accessibility.

Wife Education Exemption In Income Tax

Wife Education Exemption In Income Tax

Wife Education Exemption In Income Tax -

[desc-5]

[desc-1]

Do This Work To Get Exemption In Income Tax Savings Upto 2 Lakh On

Do This Work To Get Exemption In Income Tax Savings Upto 2 Lakh On

[desc-4]

[desc-6]

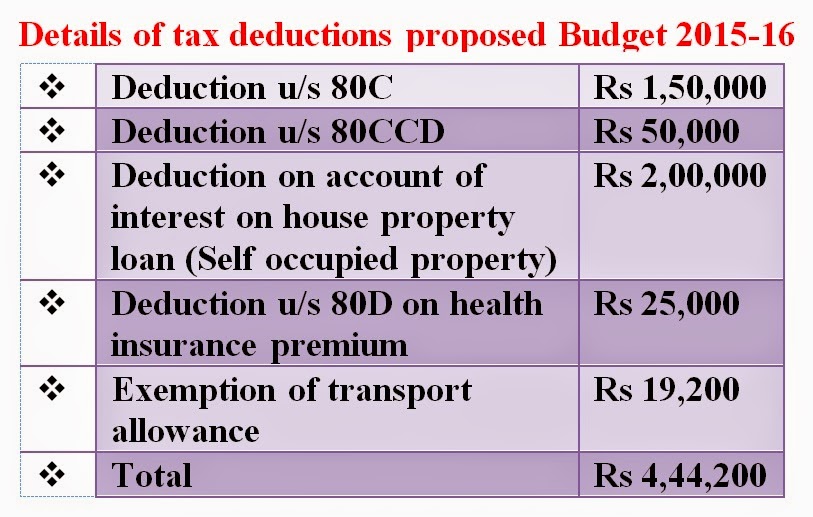

Income Tax Exemption Limit In The Budget 2015 16 StaffNews

Income Tax Exemption Limit In The Budget 2015 16 StaffNews

[desc-9]

[desc-7]

Section 11 Income Tax Act Exemptions For Charitable Trusts

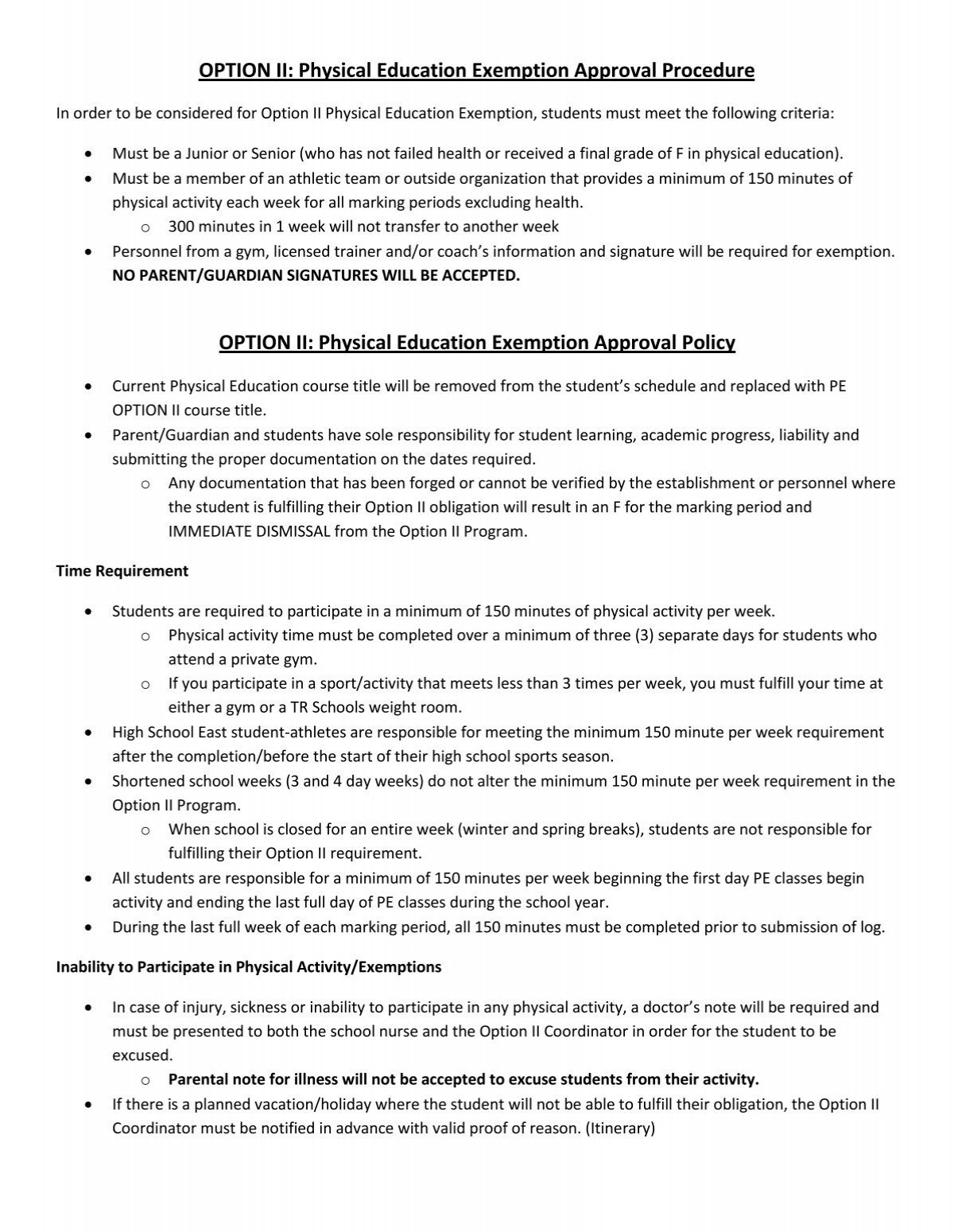

OPTION II Physical Education Exemption Approval Procedure

Avoid Mistakes While Claiming HRA On The ITR Ebizfiling

Exemptions Still Available In New Tax Regime with English Subtitles

Husband Can Claim Capital Gain Exemption For Investment Made In The

Budget 2023 Know In 10 Points What Are The Expectations From The

Budget 2023 Know In 10 Points What Are The Expectations From The

ITAT Allows Income Tax Exemption To Society Engaged In Imparting