In a world in which screens are the norm, the charm of tangible printed objects isn't diminished. Whether it's for educational purposes project ideas, artistic or simply to add an element of personalization to your area, What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible are now a useful source. In this article, we'll take a dive deep into the realm of "What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible," exploring what they are, how to find them, and how they can improve various aspects of your life.

Get Latest What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible Below

What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible

What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible -

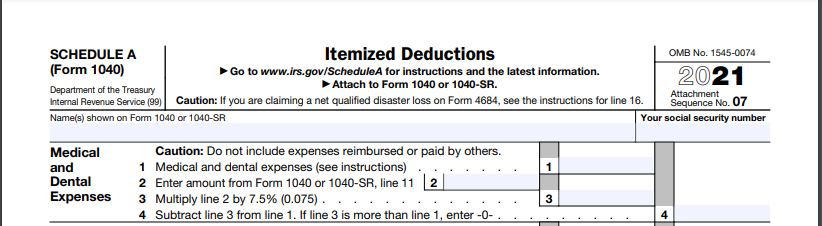

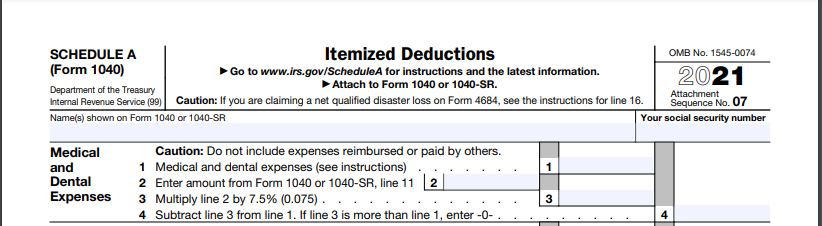

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you

Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 and

Printables for free cover a broad collection of printable materials that are accessible online for free cost. They come in many types, such as worksheets templates, coloring pages, and many more. The benefit of What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible lies in their versatility and accessibility.

More of What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible

What Expenses Are Tax Deductible When Selling A House Home Selling

What Expenses Are Tax Deductible When Selling A House Home Selling

If you re paying a lot of healthcare costs out of your own pocket can you deduct those medical expenses from your taxes The short answer is yes but there

Some medical expenses are tax deductible at the federal level under two general conditions Your qualifying medical expenses for the year exceed 7 5 of your adjusted gross income AGI which is

What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Flexible: The Customization feature lets you tailor the design to meet your needs whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Worth: Printables for education that are free offer a wide range of educational content for learners from all ages, making the perfect device for teachers and parents.

-

Simple: Access to numerous designs and templates will save you time and effort.

Where to Find more What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat

We hope we've stimulated your interest in What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible Let's find out where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible for all reasons.

- Explore categories such as design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free or flashcards as well as learning tools.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to planning a party.

Maximizing What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible

Here are some innovative ways of making the most of What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible are a treasure trove of practical and innovative resources that cater to various needs and desires. Their accessibility and versatility make them a wonderful addition to both professional and personal life. Explore the vast collection of What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes they are! You can download and print the resources for free.

-

Can I make use of free printables to make commercial products?

- It depends on the specific conditions of use. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may contain restrictions in their usage. Check these terms and conditions as set out by the author.

-

How do I print printables for free?

- Print them at home with any printer or head to an area print shop for high-quality prints.

-

What software must I use to open printables at no cost?

- Many printables are offered in the format PDF. This can be opened using free software like Adobe Reader.

What Medical Expenses Are Tax Deductible

Common Health Medical Tax Deductions For Seniors In 2023

Check more sample of What Percentage Of Out Of Pocket Medical Expenses Are Tax Deductible below

The Leafly Marketwatch What Percentage Of Your Dispensary Visitors Are

Report Consumers Out of pocket Medical Expenses Rising

How Seniors Can Save Money On Out of Pocket Medical Expenses

What Expenses Are Tax Deductible A Guide To Get Every Cent Possible

Medical Expenses Are Tax Deductible Why Donate More YouTube

Out of Pocket Medical Expenses In Health Insurance Benefit Resource Inc

https://www.kiplinger.com/taxes/tax-deductions/...

Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 and

https://www.nerdwallet.com/article/taxes/me…

For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 and

For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

What Expenses Are Tax Deductible A Guide To Get Every Cent Possible

Report Consumers Out of pocket Medical Expenses Rising

Medical Expenses Are Tax Deductible Why Donate More YouTube

Out of Pocket Medical Expenses In Health Insurance Benefit Resource Inc

Average Out of Pocket Medical Expenses Reach 2 042 Credit

Did You Pay Medical Expenses In 2021 New Rule For Medical Deductions

Did You Pay Medical Expenses In 2021 New Rule For Medical Deductions

The Leafly Marketwatch What Percentage Of Your Dispensary Visitors Are