In this digital age, in which screens are the norm, the charm of tangible printed materials hasn't faded away. Be it for educational use or creative projects, or simply to add some personal flair to your space, What Is The Tax Credit For 2022 Rav4 Hybrid are now an essential source. With this guide, you'll dive deeper into "What Is The Tax Credit For 2022 Rav4 Hybrid," exploring their purpose, where they are available, and how they can be used to enhance different aspects of your lives.

Get Latest What Is The Tax Credit For 2022 Rav4 Hybrid Below

What Is The Tax Credit For 2022 Rav4 Hybrid

What Is The Tax Credit For 2022 Rav4 Hybrid -

As of late 2023 just seven plug in hybrids are eligible for a federal tax credit but there s a workaround

Credit available for vehicles acquired through 9 30 2022 Credit available for vehicles acquired 10 1 2022 through 12 31 2022 Prius Prime Plug In Hybrid 2017 2022 4 502 2 251 Prius Plug in Electric Drive Vehicle 2012 2015 2 500 1 250 RAV4 EV 2012 2014 7 500 3 750 RAV4 Prime Plug in Hybrid 2021 2022 7 500 3 750 Lexus NX

Printables for free include a vast range of downloadable, printable content that can be downloaded from the internet at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and many more. The beauty of What Is The Tax Credit For 2022 Rav4 Hybrid is their versatility and accessibility.

More of What Is The Tax Credit For 2022 Rav4 Hybrid

My Ordered EV No Longer Qualifies For The Tax Credit What Other Car

My Ordered EV No Longer Qualifies For The Tax Credit What Other Car

During the first two quarters buyers will be eligible for a 3 750 tax credit and in the final two quarters they ll get a 1 875 credit As a reminder the federal tax credit is not a

All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

What Is The Tax Credit For 2022 Rav4 Hybrid have risen to immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Personalization It is possible to tailor printed materials to meet your requirements when it comes to designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Benefits: The free educational worksheets are designed to appeal to students of all ages, which makes them a vital tool for parents and teachers.

-

Easy to use: instant access the vast array of design and templates saves time and effort.

Where to Find more What Is The Tax Credit For 2022 Rav4 Hybrid

What Is The Minimum Tax Credit And How Does It Work For ISOs San

What Is The Minimum Tax Credit And How Does It Work For ISOs San

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

2022 Toyota RAV4 Hybrid models The 2022 Toyota RAV4 Hybrid is available in five trim levels LE XLE SE new for 2022 XLE Premium XSE and Limited All trims are powered by a

We've now piqued your interest in printables for free Let's see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of What Is The Tax Credit For 2022 Rav4 Hybrid suitable for many purposes.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- The blogs covered cover a wide range of interests, all the way from DIY projects to party planning.

Maximizing What Is The Tax Credit For 2022 Rav4 Hybrid

Here are some ways how you could make the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

What Is The Tax Credit For 2022 Rav4 Hybrid are a treasure trove filled with creative and practical information that meet a variety of needs and preferences. Their availability and versatility make them an essential part of your professional and personal life. Explore the vast collection of What Is The Tax Credit For 2022 Rav4 Hybrid today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can print and download these files for free.

-

Are there any free printouts for commercial usage?

- It depends on the specific rules of usage. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with What Is The Tax Credit For 2022 Rav4 Hybrid?

- Some printables may contain restrictions in their usage. Always read the terms and conditions set forth by the creator.

-

How do I print printables for free?

- You can print them at home with an printer, or go to an area print shop for top quality prints.

-

What software do I need to run printables at no cost?

- The majority of printed documents are in the format PDF. This can be opened with free software, such as Adobe Reader.

What Is The Tax Credit For Chevy Silverado EV

The Power Of The Tax Credit For Buying An Electric Vehicle Symphona

Check more sample of What Is The Tax Credit For 2022 Rav4 Hybrid below

Does The RAV4 Prime Qualify For A Federal Tax Credit 2023 YouTube

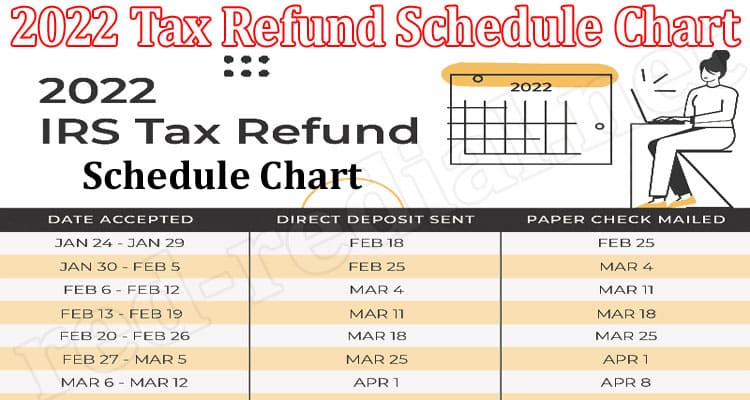

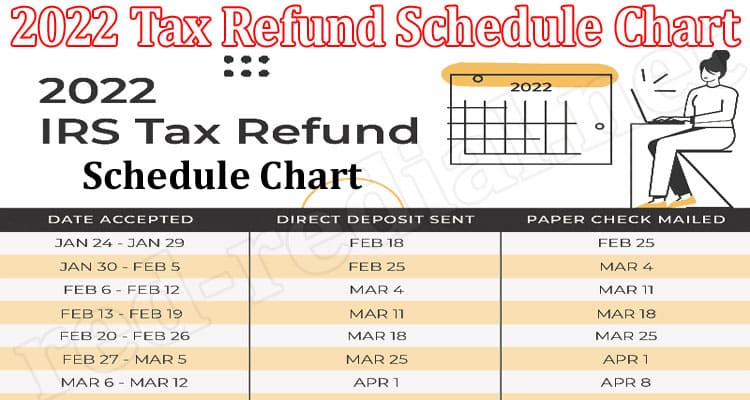

2022 Tax Refund Schedule Chart Mar A Precise Info

RAV4 Prime Buying Tips After Federal Tax Credit Is No Longer

What Is The Tax Credit For Electric Vehicles EV EVmotorcity

What Is The Tax Credit For Solar Panels YouTube

Simplifying The Retirement Plan Tax Credit For Start Ups

https://www. irs.gov /credits-deductions/...

Credit available for vehicles acquired through 9 30 2022 Credit available for vehicles acquired 10 1 2022 through 12 31 2022 Prius Prime Plug In Hybrid 2017 2022 4 502 2 251 Prius Plug in Electric Drive Vehicle 2012 2015 2 500 1 250 RAV4 EV 2012 2014 7 500 3 750 RAV4 Prime Plug in Hybrid 2021 2022 7 500 3 750 Lexus NX

https://www. irs.gov /credits-deductions/credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

Credit available for vehicles acquired through 9 30 2022 Credit available for vehicles acquired 10 1 2022 through 12 31 2022 Prius Prime Plug In Hybrid 2017 2022 4 502 2 251 Prius Plug in Electric Drive Vehicle 2012 2015 2 500 1 250 RAV4 EV 2012 2014 7 500 3 750 RAV4 Prime Plug in Hybrid 2021 2022 7 500 3 750 Lexus NX

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

What Is The Tax Credit For Electric Vehicles EV EVmotorcity

2022 Tax Refund Schedule Chart Mar A Precise Info

What Is The Tax Credit For Solar Panels YouTube

Simplifying The Retirement Plan Tax Credit For Start Ups

2023 Tax Credit On Insulation Energy Efficient Home Improvement Tax

The Employee Retention Tax Credit For Real Estate Agencies

The Employee Retention Tax Credit For Real Estate Agencies

New Castle County Residents Will Benefit From A Property Tax Rebate