In this age of electronic devices, where screens rule our lives, the charm of tangible printed materials hasn't faded away. Whether it's for educational purposes project ideas, artistic or simply to add an extra personal touch to your home, printables for free are now a vital source. For this piece, we'll dive through the vast world of "What Is Tax Deducted At Source With Example," exploring their purpose, where to locate them, and how they can enrich various aspects of your lives.

Get Latest What Is Tax Deducted At Source With Example Below

What Is Tax Deducted At Source With Example

What Is Tax Deducted At Source With Example -

Tax Deducted at Source TDS is a system introduced by Income Tax Department where the person responsible for making specified payments such as salary commission professional fees interest rent etc is liable to deduct a certain percentage of tax before making payment in full to the receiver of the payment

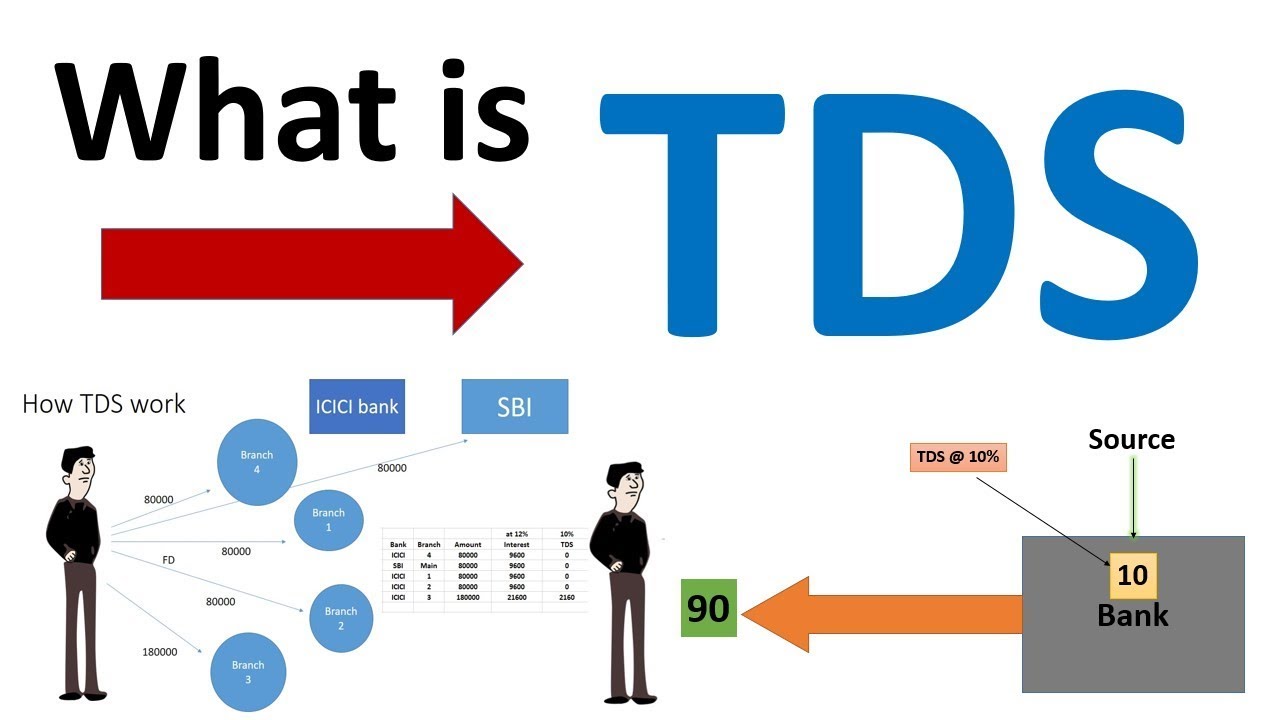

TDS stands for Tax Deducted at Source a provision under the Indian Income Tax Act where a percentage of your income such as salary consulting fees or bank interest is taken out before you receive it The deducted amount is deposited with the Income Tax IT department TDS applies to individuals and businesses

What Is Tax Deducted At Source With Example cover a large selection of printable and downloadable materials available online at no cost. These printables come in different forms, like worksheets templates, coloring pages, and more. The attraction of printables that are free is in their variety and accessibility.

More of What Is Tax Deducted At Source With Example

What Is Tax Deducted At Source A Step by step Approach With Examples

What Is Tax Deducted At Source A Step by step Approach With Examples

TDS refund is the refund issued by the income tax authority when your TDS deducted or advance taxes paid exceeds your actual tax liability When you earn any income like salary house rent interest etc TDS is deducted by the payer and the deducted amount is further remitted to the government

It applies to various sources of income such as salaries interest from fixed deposits commissions dividends rent professional fees etc It is not applicable to all people transactions or incomes That said the TDS

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Customization: It is possible to tailor printed materials to meet your requirements, whether it's designing invitations planning your schedule or decorating your home.

-

Educational value: Downloads of educational content for free are designed to appeal to students from all ages, making them a valuable resource for educators and parents.

-

It's easy: Quick access to various designs and templates saves time and effort.

Where to Find more What Is Tax Deducted At Source With Example

Tax Deducted At Source TDS In India SAP News

Tax Deducted At Source TDS In India SAP News

Example of Tax Deducted at Source TDS has to be deducted at the applicable rates only For example the TDS rate on rent payments to resident individuals and HUFs by resident individuals and HUFs is 5 when the rent is more than Rs 50 000 p m

Components of TDS According to the Income Tax Act there are different types of payments where taxes are eligible to be deducted Some examples of such payments are salary interest professional fees rent winnings such as lottery and races royalties contractor fees commission and more

We've now piqued your interest in What Is Tax Deducted At Source With Example Let's see where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of What Is Tax Deducted At Source With Example designed for a variety objectives.

- Explore categories such as furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets, flashcards, and learning tools.

- Ideal for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- These blogs cover a wide range of interests, including DIY projects to planning a party.

Maximizing What Is Tax Deducted At Source With Example

Here are some fresh ways to make the most use of What Is Tax Deducted At Source With Example:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

What Is Tax Deducted At Source With Example are an abundance of creative and practical resources that satisfy a wide range of requirements and pursuits. Their access and versatility makes them a fantastic addition to both personal and professional life. Explore the vast collection of What Is Tax Deducted At Source With Example right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes they are! You can print and download these resources at no cost.

-

Can I utilize free printables for commercial uses?

- It's determined by the specific rules of usage. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may come with restrictions on their use. Make sure to read the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- Print them at home using the printer, or go to a print shop in your area for higher quality prints.

-

What software do I need to run What Is Tax Deducted At Source With Example?

- The majority of printables are in the PDF format, and can be opened with free programs like Adobe Reader.

1 What Is Tax Deducted At Source TDS YouTube

What Is Tax Deducted At Source And Tax Collected At Source YouTube

Check more sample of What Is Tax Deducted At Source With Example below

Tds What Is Tax Deducted At Source What Are The Tds Rates Scripbox Vrogue

TDS 1 What Is Tax Deducted At Source How To Deduct TDS TDS Kiya

TDS What Is Tax Deducted At Source Deduction Rules Payment Methods

WHAT IS TDS Tax Deducted At Source Source Of Income Tax

What Is Tax Deducted At Sources How TDS Is Calculated

What Is Tax Deducted At Source TDS Top Points To Note YouTube

https:// fi.money /blog/posts/how-to-calculate-tds...

TDS stands for Tax Deducted at Source a provision under the Indian Income Tax Act where a percentage of your income such as salary consulting fees or bank interest is taken out before you receive it The deducted amount is deposited with the Income Tax IT department TDS applies to individuals and businesses

https:// cleartax.in /s/tds

Tax liability in a case where TDS is already deducted from Income On salary TDS is deducted based on the income tax slab applicable to you In the case of other income types the TDS rates are fixed and vary between 10 and 20 The tax rates are not based on your total income Hence you would suffer a TDS on your receipts in

TDS stands for Tax Deducted at Source a provision under the Indian Income Tax Act where a percentage of your income such as salary consulting fees or bank interest is taken out before you receive it The deducted amount is deposited with the Income Tax IT department TDS applies to individuals and businesses

Tax liability in a case where TDS is already deducted from Income On salary TDS is deducted based on the income tax slab applicable to you In the case of other income types the TDS rates are fixed and vary between 10 and 20 The tax rates are not based on your total income Hence you would suffer a TDS on your receipts in

WHAT IS TDS Tax Deducted At Source Source Of Income Tax

TDS 1 What Is Tax Deducted At Source How To Deduct TDS TDS Kiya

What Is Tax Deducted At Sources How TDS Is Calculated

What Is Tax Deducted At Source TDS Top Points To Note YouTube

What Is TDS Tax Deduction At Source How To Calculate TDS Tax

What Is TDS Tax Deducted At Source 15 Questions Answered

What Is TDS Tax Deducted At Source 15 Questions Answered

113 Tax Deducted at Source Discount Brokers In India Samco Securities