In this age of technology, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. If it's to aid in education and creative work, or simply adding the personal touch to your home, printables for free have become an invaluable resource. With this guide, you'll take a dive into the sphere of "What Is Input Tax Credit," exploring what they are, how they are, and how they can add value to various aspects of your lives.

Get Latest What Is Input Tax Credit Below

What Is Input Tax Credit

What Is Input Tax Credit -

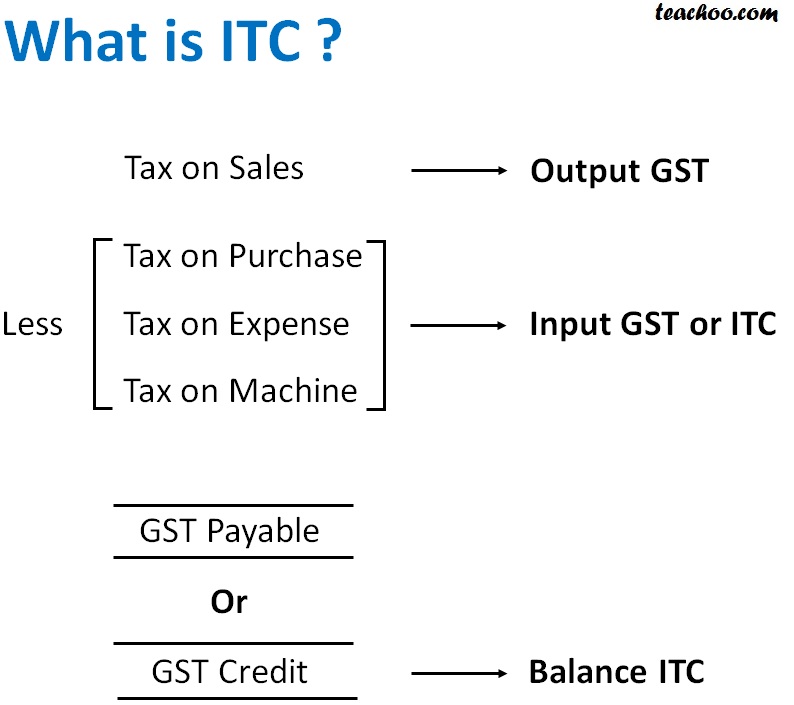

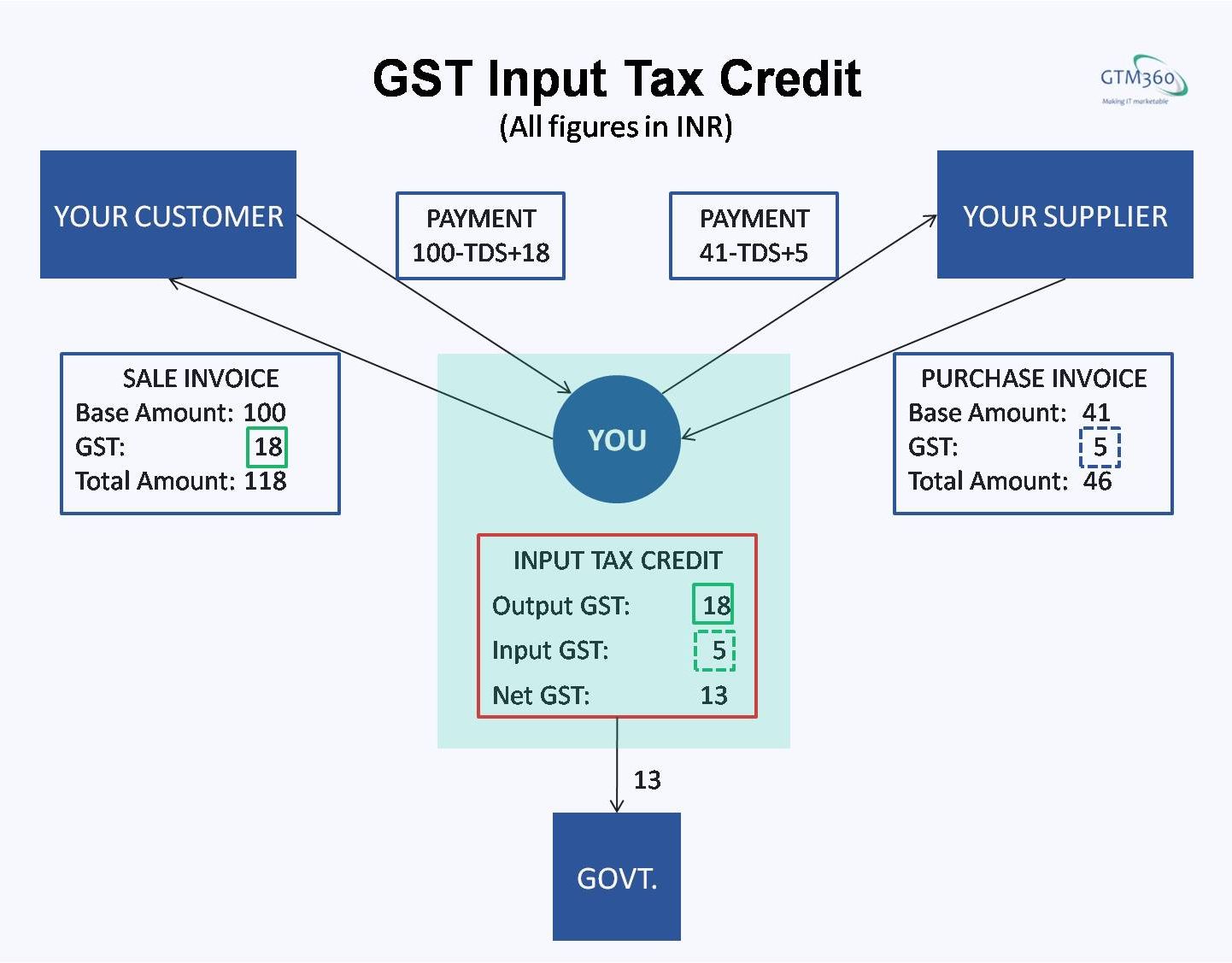

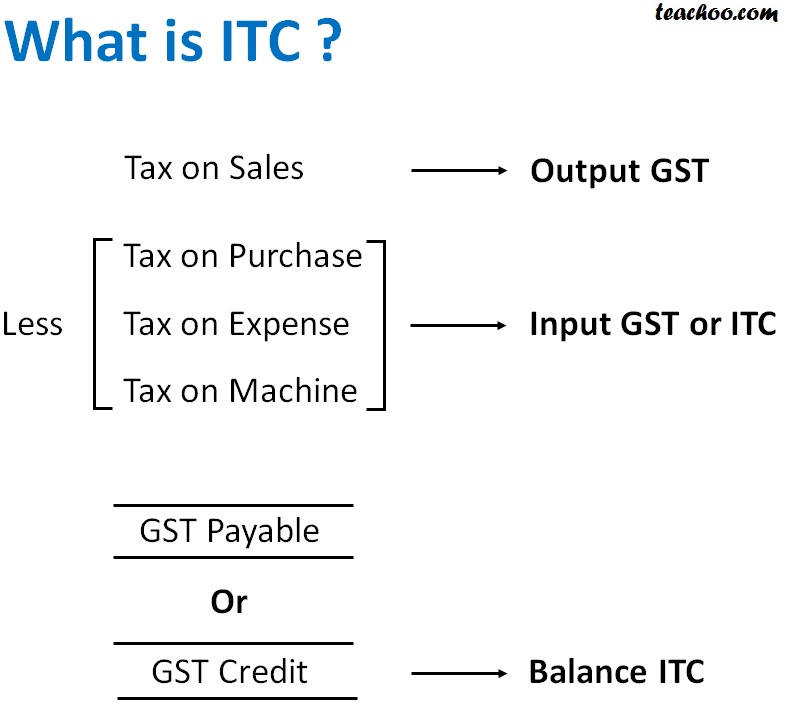

What is input tax credit Input tax credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs and pay the balance amount Here s how When you buy a product service from a registered dealer you pay taxes on the purchase

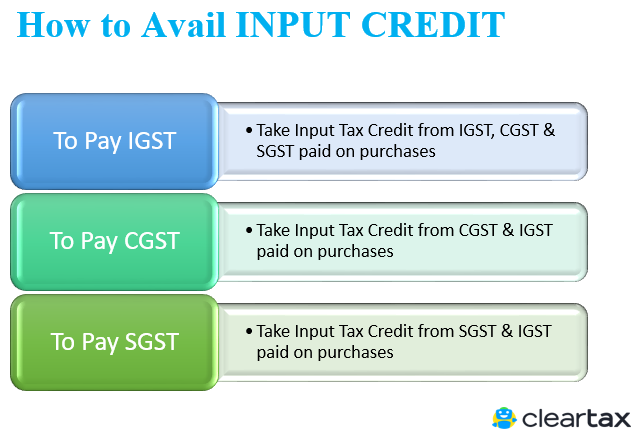

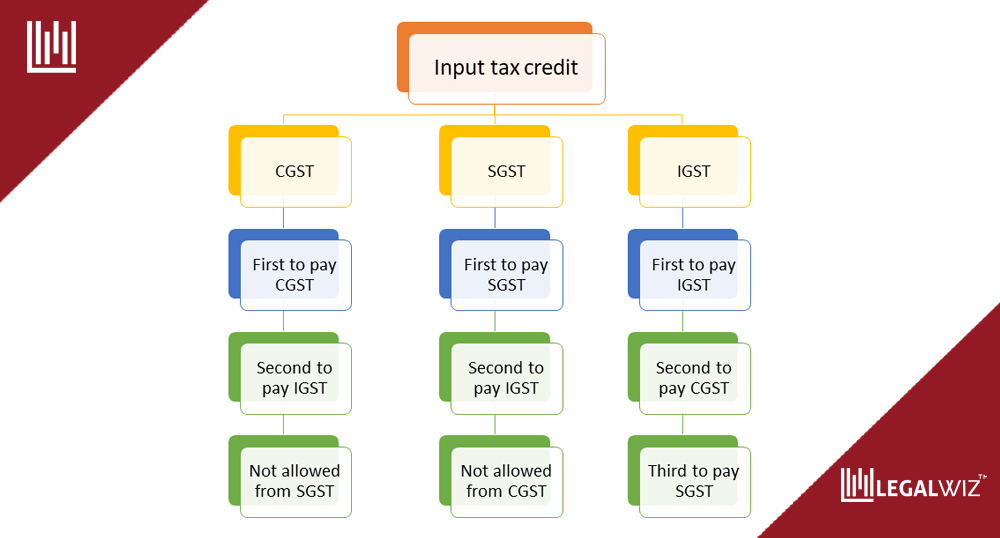

What is input tax credit ITC ITC as a concept was initiated mainly for three below reasons To levy tax on additional value only To reduce eradicate cascading effect It can be taken on GST incurred for input supply which can be used to make supply of payments of tax liability on output supply

What Is Input Tax Credit encompass a wide array of printable materials online, at no cost. These materials come in a variety of forms, including worksheets, templates, coloring pages and more. The great thing about What Is Input Tax Credit is their versatility and accessibility.

More of What Is Input Tax Credit

Important Points Of Input Tax Credit In GST Input Tax Credit In GST

Important Points Of Input Tax Credit In GST Input Tax Credit In GST

Input credit means that when you pay tax on output you can deduct the tax you ve already paid on inputs and pay the difference When you buy a product service from a registered dealer you pay taxes on

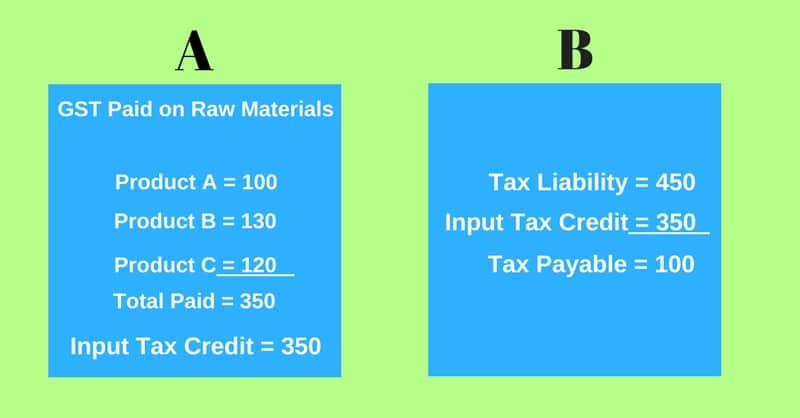

Input tax credit ITC is the tax paid by the buyer on purchase of goods or services Such tax which is paid at the purchase when reduced from liability payable on outward supplies is known as input tax credit In other words input tax credit is tax reduced from output tax payable on account of sales Lets Understand With the help of

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Customization: This allows you to modify printables to fit your particular needs be it designing invitations making your schedule, or even decorating your home.

-

Educational Value: Educational printables that can be downloaded for free are designed to appeal to students of all ages, which makes these printables a powerful tool for parents and educators.

-

Accessibility: immediate access a variety of designs and templates saves time and effort.

Where to Find more What Is Input Tax Credit

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions

ITC Input Tax Credit is the tax where a business pays on a purchase and when it makes the sale it can reduce its tax liability In short businesses can reduce their tax liability on purchases by claiming credit to the extent of GST How does the ITC work

Since we've got your interest in printables for free, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection and What Is Input Tax Credit for a variety motives.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning tools.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs are a vast variety of topics, that includes DIY projects to party planning.

Maximizing What Is Input Tax Credit

Here are some ways to make the most of What Is Input Tax Credit:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

What Is Input Tax Credit are an abundance of creative and practical resources that satisfy a wide range of requirements and hobbies. Their accessibility and flexibility make them a valuable addition to each day life. Explore the vast world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can download and print these materials for free.

-

Can I use free printables for commercial use?

- It depends on the specific conditions of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright issues with What Is Input Tax Credit?

- Some printables may come with restrictions regarding usage. Be sure to read the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- Print them at home using printing equipment or visit an area print shop for higher quality prints.

-

What program do I need to open What Is Input Tax Credit?

- The majority of PDF documents are provided in PDF format. They can be opened using free software, such as Adobe Reader.

What Is Input Tax Credit Or ITC Under GST ExcelDataPro

GST For Normies Part 2 Talk Of Many Things

Check more sample of What Is Input Tax Credit below

What Is Input Credit Under GST And How To Claim It

Input Tax Credit ITC Under GST TaxAdda

Conditions Made To Claim Input Tax Credit Authoritative Blog

GST Input Tax Credit On Supply Of Goods Or Services

Gst Input Tax Credit Tax Credits Pie Chart Chart

Input Tax Credit Under GST How To Claim Calculation Method

https://www.captainbiz.com/blogs/understanding...

What is input tax credit ITC ITC as a concept was initiated mainly for three below reasons To levy tax on additional value only To reduce eradicate cascading effect It can be taken on GST incurred for input supply which can be used to make supply of payments of tax liability on output supply

https://cleartax.in/glossary/input-tax-credit

Input tax credit refers to the mechanism of claiming a reduction of tax paid on the inputs of a business or profession In India under the Goods and Service Tax GST law a business enterprise can claim an input tax credit while calculating output tax on their goods sold or services provided

What is input tax credit ITC ITC as a concept was initiated mainly for three below reasons To levy tax on additional value only To reduce eradicate cascading effect It can be taken on GST incurred for input supply which can be used to make supply of payments of tax liability on output supply

Input tax credit refers to the mechanism of claiming a reduction of tax paid on the inputs of a business or profession In India under the Goods and Service Tax GST law a business enterprise can claim an input tax credit while calculating output tax on their goods sold or services provided

GST Input Tax Credit On Supply Of Goods Or Services

Input Tax Credit ITC Under GST TaxAdda

Gst Input Tax Credit Tax Credits Pie Chart Chart

Input Tax Credit Under GST How To Claim Calculation Method

What Is Input Tax Credit ITC Under GST Accoxi

An In Depth Look At Input Tax Credit Under Gst Razorpay Business Www

An In Depth Look At Input Tax Credit Under Gst Razorpay Business Www

GST Archives LegalWiz in