In this digital age, in which screens are the norm, the charm of tangible printed items hasn't gone away. For educational purposes and creative work, or just adding an element of personalization to your home, printables for free are a great source. With this guide, you'll take a dive through the vast world of "What Is Excise And Customs Duty," exploring what they are, where they are, and ways they can help you improve many aspects of your lives.

Get Latest What Is Excise And Customs Duty Below

What Is Excise And Customs Duty

What Is Excise And Customs Duty -

In the 2000s and 2010s Customs levied about a third of Finland s state revenue on an annual basis In 2015 the Finnish Government decided that the levying of car tax excise duties and value added tax on non EU imports was to be transferred from Customs to the Tax Administration As of 1 January 2017 the Tax Administration is responsible

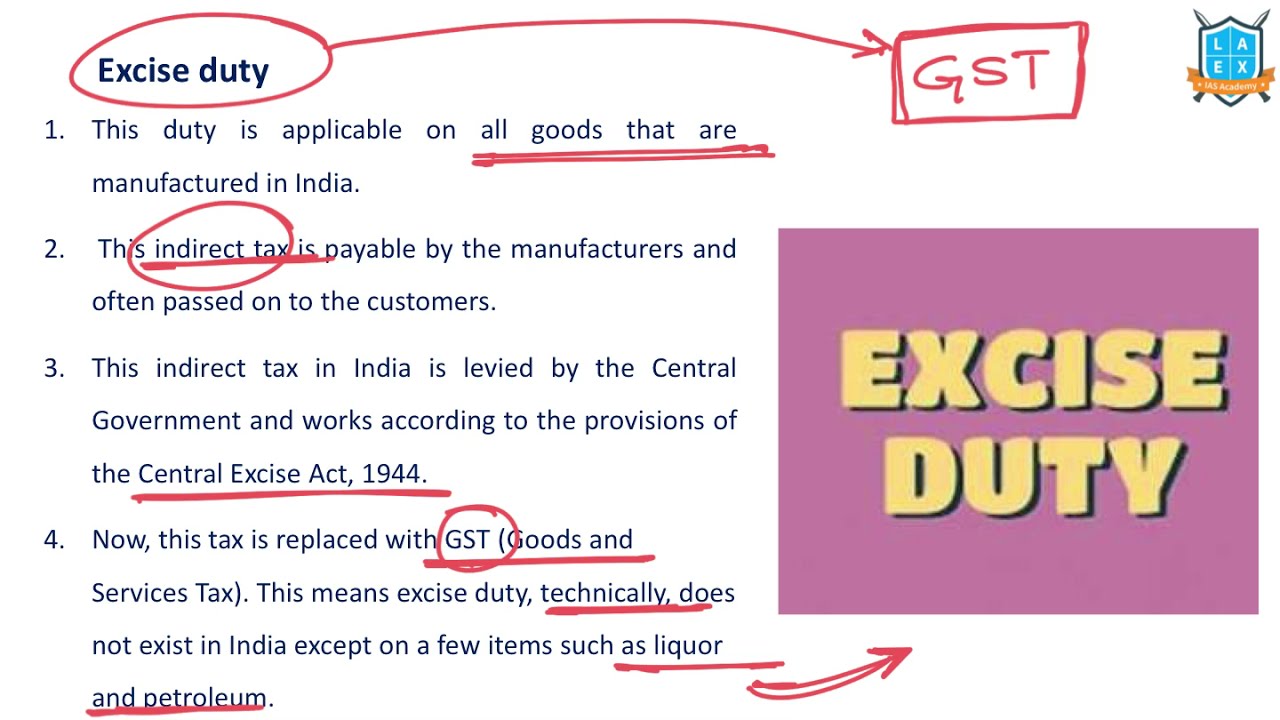

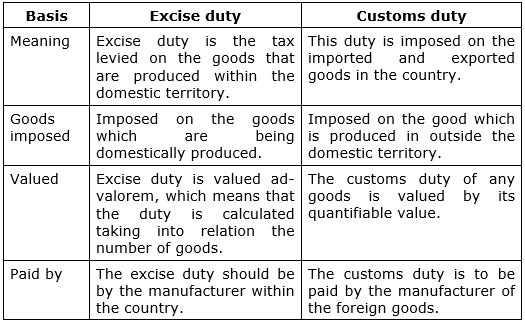

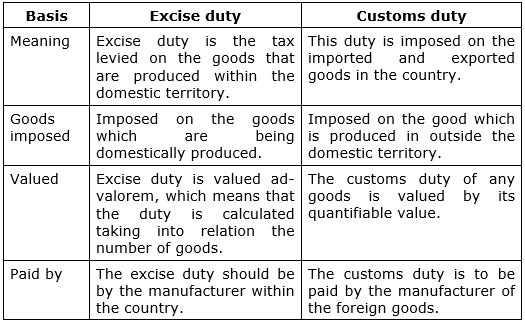

Excise duty is a tax on the production or sale of goods within a country while custom duty is a tax on goods imported from another country Excise duty is charged as a percentage of the value of the goods while custom duty can be charged based on the value quantity or weight of the imported goods

Printables for free include a vast range of downloadable, printable materials online, at no cost. They are available in a variety of forms, like worksheets coloring pages, templates and much more. The appealingness of What Is Excise And Customs Duty is in their versatility and accessibility.

More of What Is Excise And Customs Duty

What Is Excise Tax How It Works Examples 2023

What Is Excise Tax How It Works Examples 2023

Import duty is a tax collected on imports and some exports by a country s customs authorities A good s value will usually dictate the import duty Depending on the

Excises are often associated with customs duties which are levied on pre existing goods when they cross a designated border in a specific direction customs are levied on goods that become taxable items at the border while excise is levied on goods that came into existence inland

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

customization: You can tailor designs to suit your personal needs whether it's making invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value Free educational printables can be used by students of all ages, making them a vital source for educators and parents.

-

The convenience of The instant accessibility to numerous designs and templates cuts down on time and efforts.

Where to Find more What Is Excise And Customs Duty

What Are Excise And Customs Duties In The UK

What Are Excise And Customs Duties In The UK

Overview customs and excise Quick Reference Duties charged on goods both home produced and imported to raise revenue for governments In England customs date from the reign of Edward I when duties were raised on wool and leather Tunnage and poundage was introduced under Edward II

Taxation Excise duties Common Excise Duty Provisions Common provisions which apply to all products subject to excise duties under EU law are set out in Council Directive EU 2020 262 which repeals and replaces Council Directive 2008 118 EC as

Since we've got your curiosity about What Is Excise And Customs Duty we'll explore the places the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of What Is Excise And Customs Duty designed for a variety motives.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a wide selection of subjects, all the way from DIY projects to planning a party.

Maximizing What Is Excise And Customs Duty

Here are some creative ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet to aid in learning at your home for the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

What Is Excise And Customs Duty are an abundance filled with creative and practical information which cater to a wide range of needs and interests. Their availability and versatility make them a great addition to both professional and personal life. Explore the vast array of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes, they are! You can download and print these tools for free.

-

Can I use free printables for commercial purposes?

- It is contingent on the specific usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may have restrictions in their usage. Make sure you read the terms and conditions offered by the creator.

-

How do I print What Is Excise And Customs Duty?

- You can print them at home using either a printer or go to a local print shop to purchase better quality prints.

-

What program do I require to view printables that are free?

- The majority of printed documents are in the format of PDF, which can be opened with free software such as Adobe Reader.

What Is Excise Tax A Complete Guide With Calculations

What Is Excise Duty And How It Is Calculated Business Insider India

Check more sample of What Is Excise And Customs Duty below

Customs Excise GST Inspector Complete Uniform Motivational Video For

What Is Excise Duty Definition Nature Imposed On Which Products Excise

What Is Excise Tax Shared Economy Tax

Excise Duty Vs Custom Duty What s The Difference With Table

What Is Excise Duty Definition Rates Types Latest News

What Is Excise Tax And How Does It Differ From Sales Tax

https://askanydifference.com/difference-between...

Excise duty is a tax on the production or sale of goods within a country while custom duty is a tax on goods imported from another country Excise duty is charged as a percentage of the value of the goods while custom duty can be charged based on the value quantity or weight of the imported goods

https://taxation-customs.ec.europa.eu/taxation-1/excise-duties_en

Excise duties are indirect taxes on the sale or use of specific products such as alcohol tobacco and energy The revenue from these excise duties goes entirely to the country to which they are paid EU countries agreed on common EU rules to make sure that excise duties are applied in the same way and to the same products everywhere in the

Excise duty is a tax on the production or sale of goods within a country while custom duty is a tax on goods imported from another country Excise duty is charged as a percentage of the value of the goods while custom duty can be charged based on the value quantity or weight of the imported goods

Excise duties are indirect taxes on the sale or use of specific products such as alcohol tobacco and energy The revenue from these excise duties goes entirely to the country to which they are paid EU countries agreed on common EU rules to make sure that excise duties are applied in the same way and to the same products everywhere in the

Excise Duty Vs Custom Duty What s The Difference With Table

What Is Excise Duty Definition Nature Imposed On Which Products Excise

What Is Excise Duty Definition Rates Types Latest News

What Is Excise Tax And How Does It Differ From Sales Tax

Excise And Taxation Inspector Past Papers Ppsc Download

What Is The Difference Between The Excise Duty And Customs Duty

What Is The Difference Between The Excise Duty And Customs Duty

Difference Between Excise Duty And Customs Duty Diferr