In the digital age, when screens dominate our lives The appeal of tangible printed material hasn't diminished. If it's to aid in education as well as creative projects or simply adding the personal touch to your space, What Is 80e In Income Tax can be an excellent resource. Here, we'll take a dive into the sphere of "What Is 80e In Income Tax," exploring their purpose, where to locate them, and how they can enhance various aspects of your lives.

Get Latest What Is 80e In Income Tax Below

What Is 80e In Income Tax

What Is 80e In Income Tax -

Section 80E of the Income Tax Act 1961 relates to deduction for the repayment of Interest on Education Loan Customers of HDFC Credila can avail Income Tax Deduction on

Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan

What Is 80e In Income Tax include a broad assortment of printable items that are available online at no cost. They come in many designs, including worksheets coloring pages, templates and many more. The beauty of What Is 80e In Income Tax is in their variety and accessibility.

More of What Is 80e In Income Tax

Income Tax Deduction In Case Of Higher Education Loan U s 80E YouTube

Income Tax Deduction In Case Of Higher Education Loan U s 80E YouTube

What is Section 80E of Income Tax Act Section 80E of the Income Tax Act is a tax saving provision that provides tax deductions to individuals who have taken

Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a tax deduction for the

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Modifications: You can tailor the design to meet your needs when it comes to designing invitations or arranging your schedule or even decorating your home.

-

Education Value Educational printables that can be downloaded for free are designed to appeal to students of all ages. This makes them a great device for teachers and parents.

-

An easy way to access HTML0: immediate access the vast array of design and templates can save you time and energy.

Where to Find more What Is 80e In Income Tax

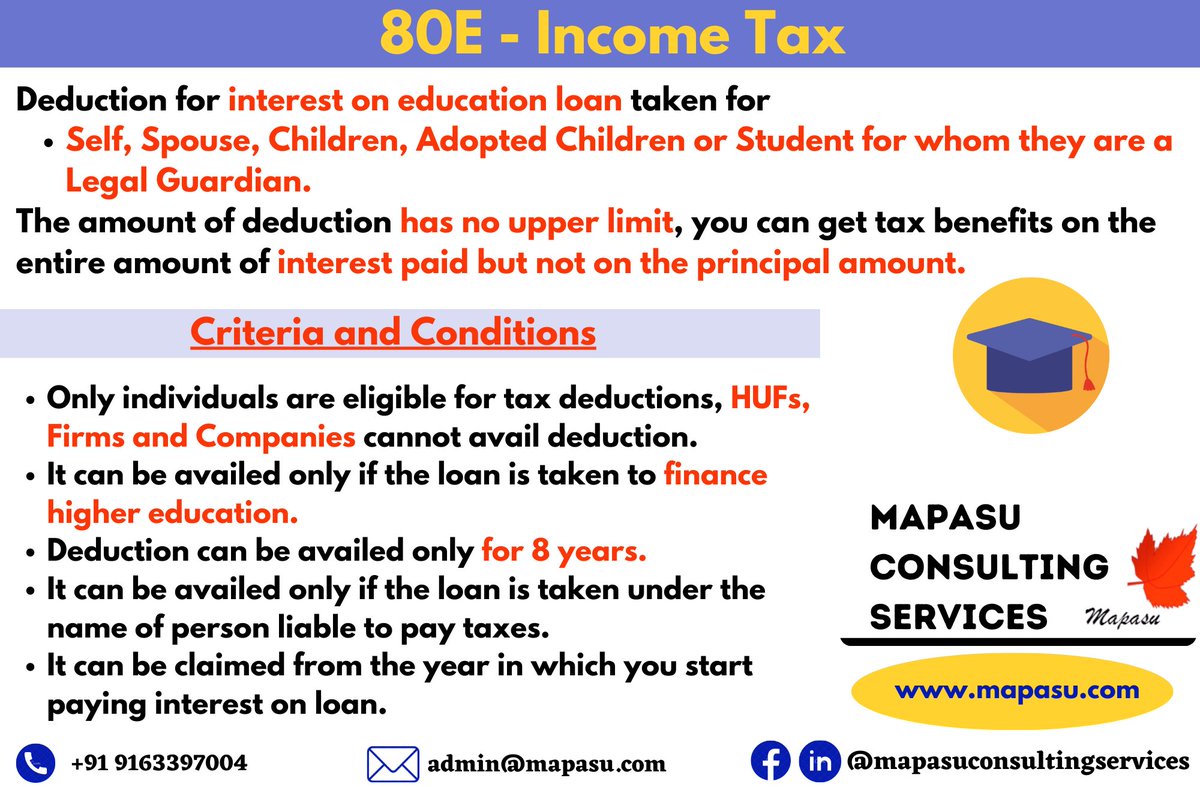

Section 80E Of Income Tax Act Income Tax Deduction On Education Loan

Section 80E Of Income Tax Act Income Tax Deduction On Education Loan

Section 80E Income Tax Benefits on Education Loan Tax Section 80E provides deduction regarding the interest on loan taken for higher education

All about section 80E of Income Tax Act 1961 CA Ankur Singhal Income Tax Articles Download PDF 14 Dec 2019 39 945 Views 6 comments Essential

We've now piqued your curiosity about What Is 80e In Income Tax Let's see where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection and What Is 80e In Income Tax for a variety reasons.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a wide variety of topics, that range from DIY projects to party planning.

Maximizing What Is 80e In Income Tax

Here are some creative ways of making the most of What Is 80e In Income Tax:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home and in class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

What Is 80e In Income Tax are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and desires. Their accessibility and flexibility make them an invaluable addition to both professional and personal lives. Explore the plethora of What Is 80e In Income Tax to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes, they are! You can download and print these items for free.

-

Can I use the free printables for commercial purposes?

- It's determined by the specific usage guidelines. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables could have limitations regarding usage. Check the conditions and terms of use provided by the author.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in an area print shop for higher quality prints.

-

What software do I need to run printables for free?

- The majority of PDF documents are provided with PDF formats, which can be opened using free software like Adobe Reader.

How To Save Income Tax 80C 80E 80G 80D Deduction YouTube

How To Save Income Tax In India 2021 Under Section 80C 80D 80E How

Check more sample of What Is 80e In Income Tax below

Section 80E Of Income Tax Act Income Tax Deduction On Education Loan

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

Mapasu On Twitter Income Tax Section 80E income tax

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

Ways To Save Income Tax Save Tax U s 80C 80D 80EE 80E 80G 80GG 80GA

80E Deduction Tax Benefit Income Tax Deduction Education Loan

https://cleartax.in/s/tax-benefits-on-education-loan

Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan

https://tax2win.in/guide/sec-80e-deducti…

What is section 80E of Income Tax Section 80E is the income tax deduction from taxable income which covers the

Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan

What is section 80E of Income Tax Section 80E is the income tax deduction from taxable income which covers the

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

Ways To Save Income Tax Save Tax U s 80C 80D 80EE 80E 80G 80GG 80GA

80E Deduction Tax Benefit Income Tax Deduction Education Loan

Section 80E Deductions Under Section 80E Of Income Tax Act

Deduction Under Section 80E Income Tax Act 1961 CommerceLesson in

Deduction Under Section 80E Income Tax Act 1961 CommerceLesson in

SAVE COMPLETE INCOME TAX ON EDUCATION LOAN U S 80E AccounTax Guru