In the digital age, when screens dominate our lives yet the appeal of tangible, printed materials hasn't diminished. No matter whether it's for educational uses, creative projects, or just adding an extra personal touch to your space, What Is 80d In Income Tax have become a valuable source. The following article is a dive into the sphere of "What Is 80d In Income Tax," exploring their purpose, where you can find them, and how they can be used to enhance different aspects of your life.

Get Latest What Is 80d In Income Tax Below

What Is 80d In Income Tax

What Is 80d In Income Tax -

Verkko Income Tax Section 80D What is Section 80D Section 80D of the Income Tax Act 1961 offers deduction for money spent on health insurance and maintaining your health and is significant for your tax planning and personal finance What deductions are allowed u s 80D Money spent as premium for health insurance policy

Verkko 15 helmik 2023 nbsp 0183 32 Section 80D of the Income tax Act 1961 is one such option for taxpayers to save income tax Section 80D offers tax deduction on the medical insurance premium paid Here is all you need to know about claiming deduction under Section 80D to save income tax

What Is 80d In Income Tax provide a diverse assortment of printable, downloadable resources available online for download at no cost. These resources come in many forms, like worksheets templates, coloring pages and many more. One of the advantages of What Is 80d In Income Tax is in their variety and accessibility.

More of What Is 80d In Income Tax

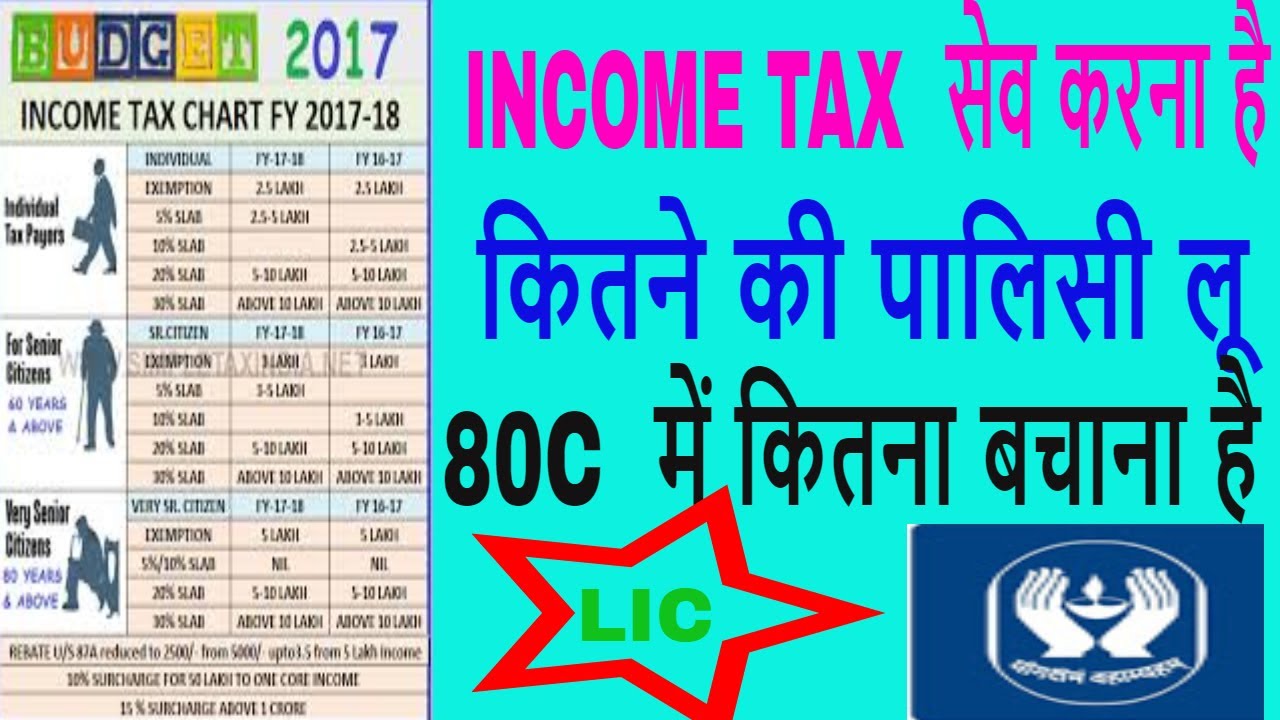

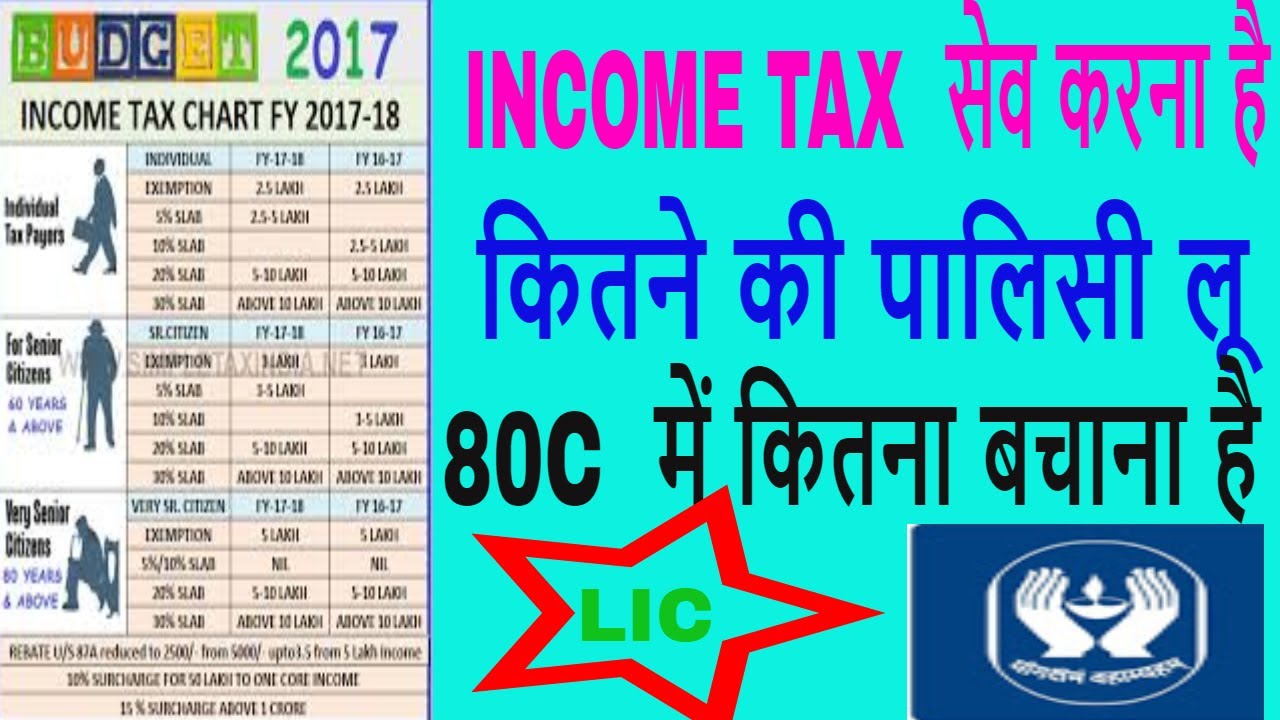

HOW TO SAVE INCOME TAX 80C 80D BY LIC NEW INCOME TAX SLAB 2018 YouTube

HOW TO SAVE INCOME TAX 80C 80D BY LIC NEW INCOME TAX SLAB 2018 YouTube

Verkko The Central Government of India provides provisions for taxpayers to claim deductions and benefits in respect to health insurance premium paid under Section 80D of the Income Tax Act A tax

Verkko 17 marrask 2023 nbsp 0183 32 According to Section 80D of the Income Tax Act of 1961 senior citizens in India are eligible for the health insurance tax benefits These benefits may be claimed by the senior citizen themselves or by their children if the latter pays the bill for the elderly parent s health insurance

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: The Customization feature lets you tailor printables to your specific needs when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value The free educational worksheets can be used by students of all ages. This makes them a useful source for educators and parents.

-

Convenience: instant access a variety of designs and templates reduces time and effort.

Where to Find more What Is 80d In Income Tax

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

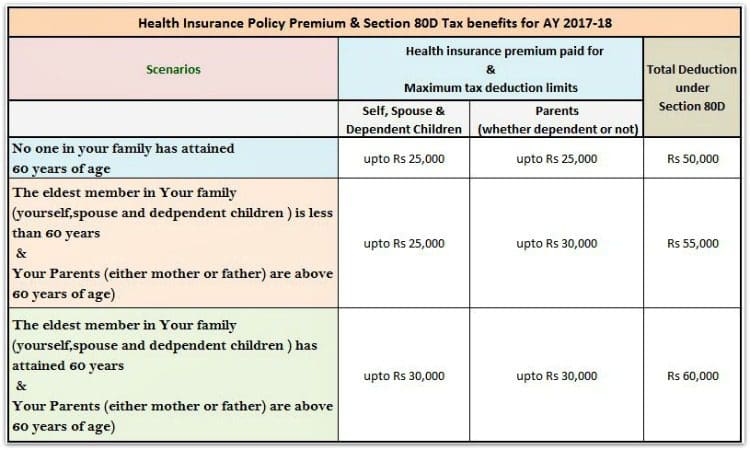

Verkko 14 maalisk 2022 nbsp 0183 32 Section 80D allows taxpayers to avail tax deductions on the premiums paid towards health and medical insurance in a financial year March 14 2022 10 59 IST Section 80D permits a deduction of

Verkko 9 tammik 2020 nbsp 0183 32 Section 80D allows tax deduction benefits up to Rs 25 000 Rs 50 000 for senior citizens for health insurance premium paid for self or dependent family members including spouse and children

Since we've got your curiosity about What Is 80d In Income Tax, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection with What Is 80d In Income Tax for all motives.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing What Is 80d In Income Tax

Here are some inventive ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

What Is 80d In Income Tax are an abundance filled with creative and practical information that cater to various needs and preferences. Their accessibility and flexibility make they a beneficial addition to both professional and personal life. Explore the endless world of What Is 80d In Income Tax to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is 80d In Income Tax really completely free?

- Yes, they are! You can download and print these materials for free.

-

Do I have the right to use free printables for commercial use?

- It is contingent on the specific terms of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright concerns with What Is 80d In Income Tax?

- Some printables may contain restrictions regarding usage. Make sure you read the terms and conditions set forth by the creator.

-

How can I print What Is 80d In Income Tax?

- You can print them at home using either a printer at home or in the local print shops for the highest quality prints.

-

What program do I need in order to open printables that are free?

- A majority of printed materials are in PDF format, which is open with no cost programs like Adobe Reader.

Income Tax Deductions List FY 2018 19 List Of Important Income Tax

Section 80D Deduction Income Tax Finaxis

Check more sample of What Is 80d In Income Tax below

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Health Insurance Tax Benefits Under Section 80D

Section 80D Income Tax Deduction For Medical Insurance Preventive

Unboxing Canon 80D What s In The Box YouTube

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

Preventive Check Up 80d Wkcn

https://economictimes.indiatimes.com/wealth/tax/you-can-claim-maximum...

Verkko 15 helmik 2023 nbsp 0183 32 Section 80D of the Income tax Act 1961 is one such option for taxpayers to save income tax Section 80D offers tax deduction on the medical insurance premium paid Here is all you need to know about claiming deduction under Section 80D to save income tax

https://www.etmoney.com/learn/income-tax/everything-you-need-to-know...

Verkko 9 maalisk 2023 nbsp 0183 32 Section 80D of the Income tax act allows you to take tax deductions for the expenses incurred towards healthcare It is restricted to costs incurred towards medical insurance critical illness and other health related riders offered with a life insurance policy and healthcare related expenses for senior citizens including

Verkko 15 helmik 2023 nbsp 0183 32 Section 80D of the Income tax Act 1961 is one such option for taxpayers to save income tax Section 80D offers tax deduction on the medical insurance premium paid Here is all you need to know about claiming deduction under Section 80D to save income tax

Verkko 9 maalisk 2023 nbsp 0183 32 Section 80D of the Income tax act allows you to take tax deductions for the expenses incurred towards healthcare It is restricted to costs incurred towards medical insurance critical illness and other health related riders offered with a life insurance policy and healthcare related expenses for senior citizens including

Unboxing Canon 80D What s In The Box YouTube

Health Insurance Tax Benefits Under Section 80D

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

Preventive Check Up 80d Wkcn

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

Income Tax Deductions Under Section 80C 80CCC 80CCD 80D 100Utils