In the digital age, where screens rule our lives yet the appeal of tangible printed products hasn't decreased. No matter whether it's for educational uses, creative projects, or simply to add a personal touch to your home, printables for free can be an excellent source. The following article is a take a dive into the world "Virginia State Income Tax Rate Reduction," exploring the different types of printables, where to locate them, and what they can do to improve different aspects of your life.

Get Latest Virginia State Income Tax Rate Reduction Below

Virginia State Income Tax Rate Reduction

Virginia State Income Tax Rate Reduction -

Use our income tax calculator to estimate how much tax you might pay on your taxable income Your tax is 0 if your income is less than the 2023 2024 standard deduction determined by your

The bill establishes the 2023 individual income tax rebate fund which provides a rebate of up to 200 for individuals or up to 400 for married persons filing joint returns for Virginia residents who file their 2022 Form 760 Individual Income Tax Return by November 1 2023

Virginia State Income Tax Rate Reduction encompass a wide assortment of printable, downloadable materials online, at no cost. These printables come in different designs, including worksheets templates, coloring pages, and many more. The value of Virginia State Income Tax Rate Reduction is their versatility and accessibility.

More of Virginia State Income Tax Rate Reduction

State Income Tax Vs Federal Income Tax What s The Difference

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What s The Difference

Income Tax Rate Reduction The proposed plan includes significant cuts to individual income tax rates in Virginia without changing the existing bracket structure starting from the calendar year 2025 Under the plan the state would continue to have four relatively narrow income tax brackets

The House passed legislation Tuesday to reduce the top income tax rate from 5 75 to 5 5 which is estimated to cut revenues by roughly 333 million in the 2024 fiscal year

Virginia State Income Tax Rate Reduction have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Customization: The Customization feature lets you tailor printed materials to meet your requirements, whether it's designing invitations making your schedule, or even decorating your home.

-

Educational Benefits: Printables for education that are free provide for students of all ages, making them a great resource for educators and parents.

-

Simple: The instant accessibility to the vast array of design and templates is time-saving and saves effort.

Where to Find more Virginia State Income Tax Rate Reduction

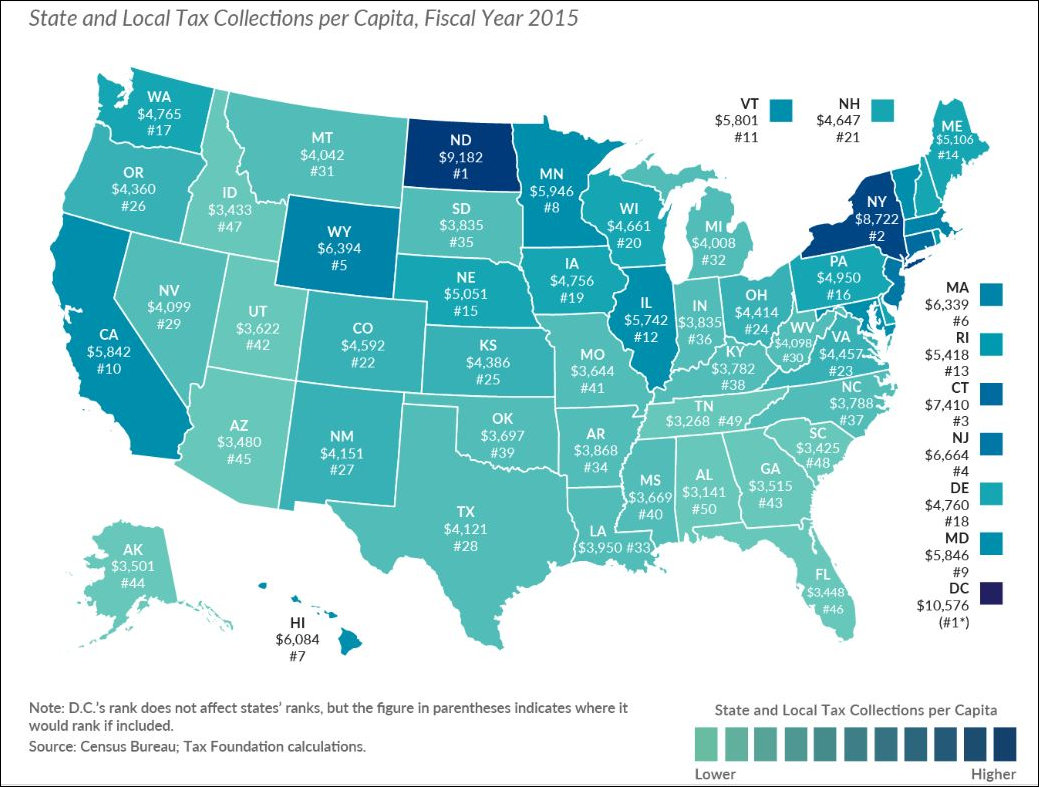

2023 State Income Tax Rates And Brackets Tax Foundation

2023 State Income Tax Rates And Brackets Tax Foundation

In the next few weeks the state will send out 3 2 million tax rebate payments of up to 250 per person but that money is only going to Virginians who made enough to owe state income taxes

Find out how much you ll pay in Virginia state income taxes given your annual income Customize using your filing status deductions exemptions and more

If we've already piqued your interest in Virginia State Income Tax Rate Reduction Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Virginia State Income Tax Rate Reduction suitable for many objectives.

- Explore categories like design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free including flashcards, learning tools.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- These blogs cover a broad range of topics, that includes DIY projects to planning a party.

Maximizing Virginia State Income Tax Rate Reduction

Here are some new ways of making the most use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home as well as in the class.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Virginia State Income Tax Rate Reduction are an abundance of creative and practical resources that satisfy a wide range of requirements and needs and. Their availability and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast world of Virginia State Income Tax Rate Reduction today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Virginia State Income Tax Rate Reduction truly cost-free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I utilize free printing templates for commercial purposes?

- It depends on the specific rules of usage. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues with Virginia State Income Tax Rate Reduction?

- Some printables may have restrictions on use. Make sure you read the terms and conditions set forth by the designer.

-

How do I print Virginia State Income Tax Rate Reduction?

- Print them at home using your printer or visit a local print shop to purchase high-quality prints.

-

What software is required to open Virginia State Income Tax Rate Reduction?

- The majority of printed documents are in PDF format. They is open with no cost software like Adobe Reader.

Ohio Tax Update Ohio 2020 2021 Biennial Budget Tax Reform CSH

Virginia State Income Tax Calculator

Check more sample of Virginia State Income Tax Rate Reduction below

What To Expect When Filing Your Taxes This Year

.jpg?width=1667&name=tax graphic_2020 (1).jpg)

BusinessMirror May 27 2022 By BusinessMirror Issuu

Virginia State Income Tax Returns Here s What You Need To Know

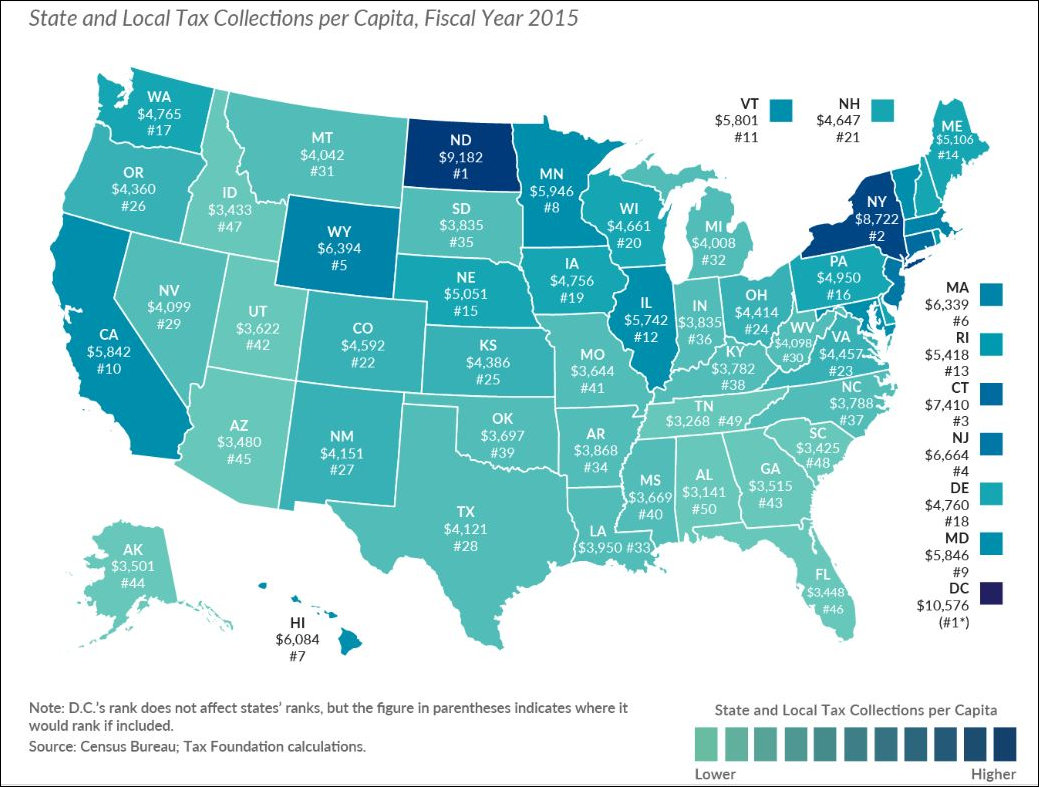

Virginia State Local Taxes Per Capita 4 457 Bacon s Rebellion

28 West Virginia Paycheck Calculator JazmineHaadiya

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

Would You Like A Safer Home And Tax Savings Solid Rock Enterprises

https://www.bdo.com/insights/tax/virginia-s...

The bill establishes the 2023 individual income tax rebate fund which provides a rebate of up to 200 for individuals or up to 400 for married persons filing joint returns for Virginia residents who file their 2022 Form 760 Individual Income Tax Return by November 1 2023

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg?w=186)

https://www.governor.virginia.gov/newsroom/news...

The reductions in individual income tax mean 86 of taxpaying Virginians will enjoy the benefits of a lower top tax rate and an additional 14 000 Virginians will pay no state income taxes

The bill establishes the 2023 individual income tax rebate fund which provides a rebate of up to 200 for individuals or up to 400 for married persons filing joint returns for Virginia residents who file their 2022 Form 760 Individual Income Tax Return by November 1 2023

The reductions in individual income tax mean 86 of taxpaying Virginians will enjoy the benefits of a lower top tax rate and an additional 14 000 Virginians will pay no state income taxes

Virginia State Local Taxes Per Capita 4 457 Bacon s Rebellion

BusinessMirror May 27 2022 By BusinessMirror Issuu

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

28 West Virginia Paycheck Calculator JazmineHaadiya

Would You Like A Safer Home And Tax Savings Solid Rock Enterprises

Fillable Form Chicago Income Tax Preparation Disclosure Form

Virginia Tax Table Infoupdate

Virginia Tax Table Infoupdate

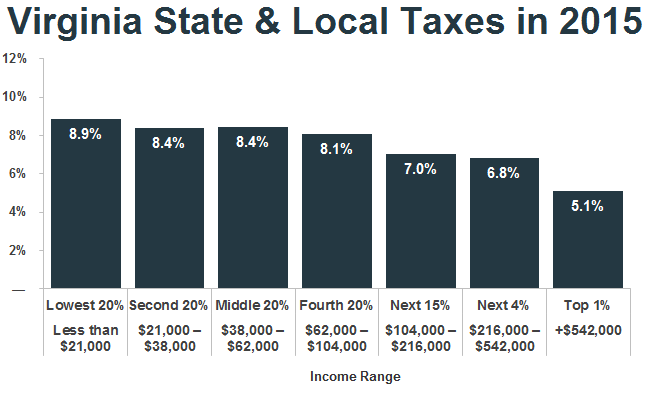

New Analysis Low Income Taxpayers In Virginia Pay Higher Rate Than