In this age of electronic devices, where screens have become the dominant feature of our lives but the value of tangible printed materials isn't diminishing. No matter whether it's for educational uses and creative work, or simply adding an extra personal touch to your home, printables for free can be an excellent source. For this piece, we'll dive into the world "Us Heat Pump Tax Credit," exploring their purpose, where to locate them, and how they can improve various aspects of your life.

Get Latest Us Heat Pump Tax Credit Below

Us Heat Pump Tax Credit

Us Heat Pump Tax Credit -

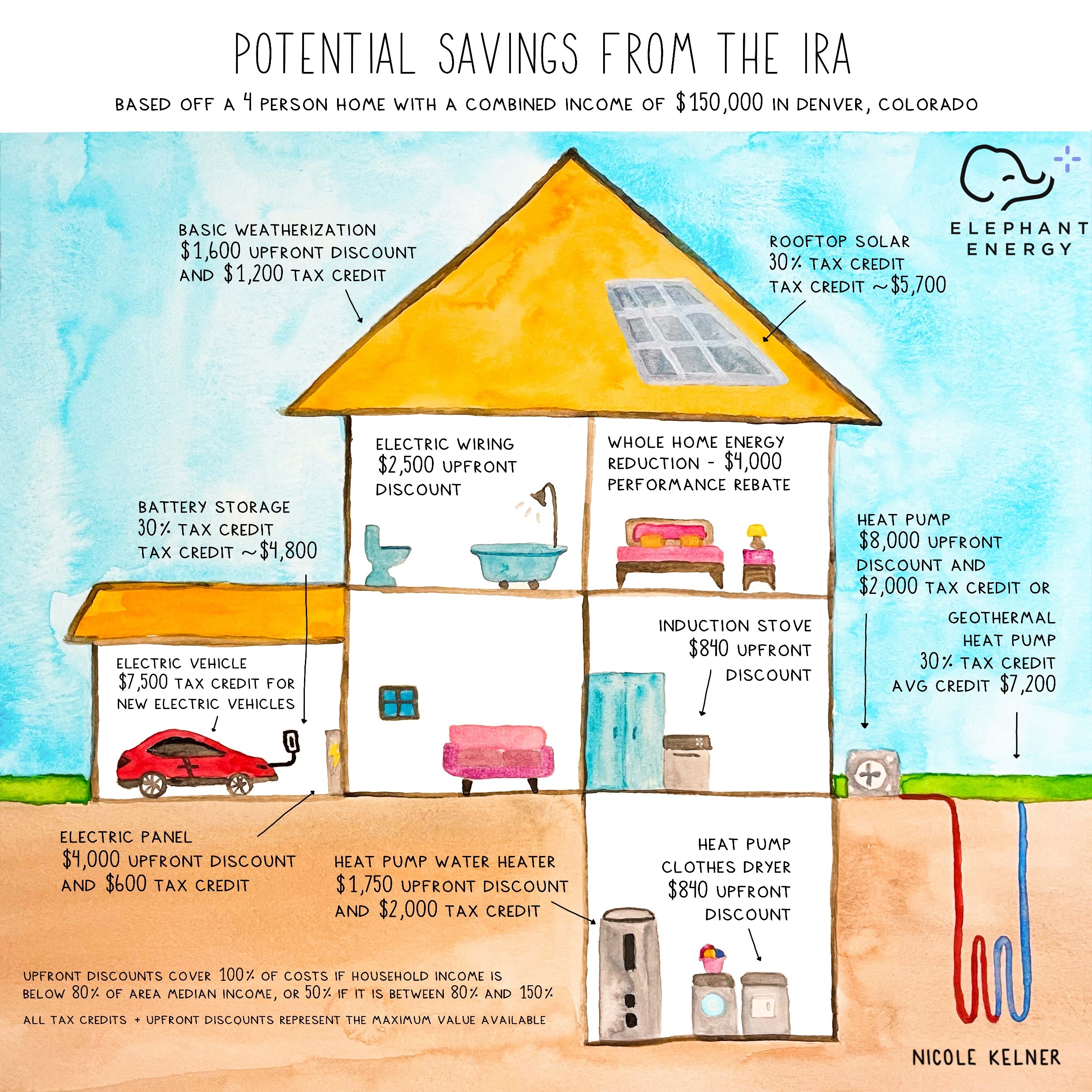

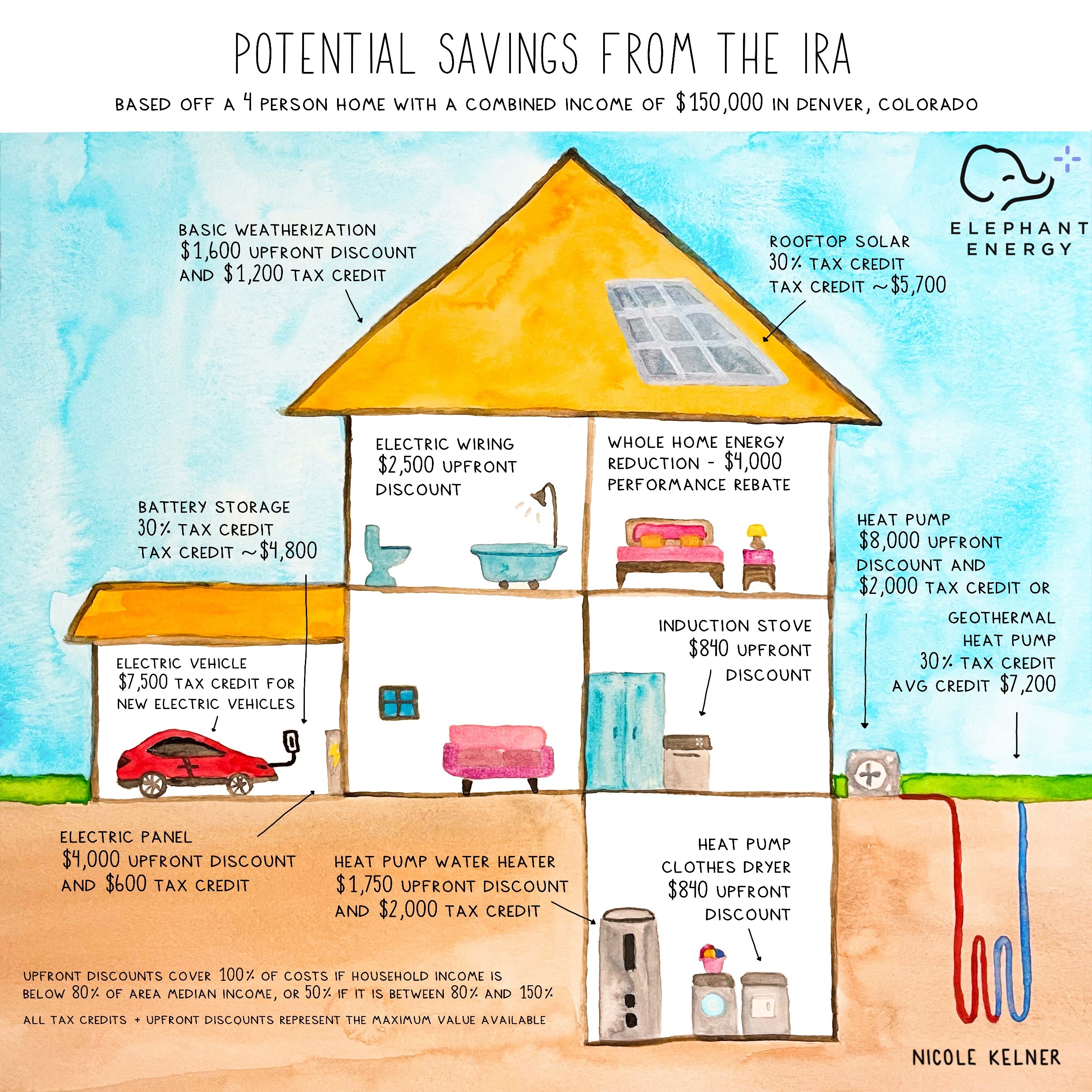

Thanks to the IRA if you made or are planning to make certain qualified energy efficient improvements to your home after January 1 2023 you may qualify for a tax credit from the IRS For

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings

Us Heat Pump Tax Credit include a broad range of printable, free documents that can be downloaded online at no cost. These materials come in a variety of kinds, including worksheets templates, coloring pages, and more. The attraction of printables that are free is in their versatility and accessibility.

More of Us Heat Pump Tax Credit

How To Take Advantage Of The Heat Pump Tax Credit

How To Take Advantage Of The Heat Pump Tax Credit

Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year

Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems Tax Credit 30 for systems placed in service by 12 31 2019

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Customization: The Customization feature lets you tailor printables to fit your particular needs be it designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value: Education-related printables at no charge provide for students of all ages. This makes them a great device for teachers and parents.

-

Simple: immediate access various designs and templates, which saves time as well as effort.

Where to Find more Us Heat Pump Tax Credit

Air Source Heat Pump Tax Credit 2023 Comfort Control

Air Source Heat Pump Tax Credit 2023 Comfort Control

Through tax credits and rebates President Biden s Inflation Reduction Act IRA provides new opportunities to homeowners and renters to make energy efficient upgrades such as heat pump installations to their homes Heat pumps are a year round heating and cooling solution for many homes and climates they are energy efficient and

If you install an efficient heat pump you are eligible for a federal tax credit that will cover 30 up to 2 000 of the heat pump cost and installation This tax credit through the Inflation Reduction Act is available through 2032 and is

Now that we've piqued your curiosity about Us Heat Pump Tax Credit We'll take a look around to see where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Us Heat Pump Tax Credit designed for a variety applications.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing including flashcards, learning materials.

- Ideal for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs are a vast range of interests, that range from DIY projects to planning a party.

Maximizing Us Heat Pump Tax Credit

Here are some ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print out free worksheets and activities for teaching at-home also in the classes.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Us Heat Pump Tax Credit are an abundance of practical and imaginative resources catering to different needs and desires. Their availability and versatility make them an invaluable addition to both professional and personal lives. Explore the vast array of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Us Heat Pump Tax Credit really cost-free?

- Yes, they are! You can download and print these tools for free.

-

Can I make use of free printables in commercial projects?

- It's dependent on the particular rules of usage. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables could have limitations on usage. Be sure to review the terms and conditions offered by the designer.

-

How do I print printables for free?

- You can print them at home using an printer, or go to a print shop in your area for more high-quality prints.

-

What program must I use to open printables at no cost?

- Most PDF-based printables are available in the format of PDF, which is open with no cost software such as Adobe Reader.

New Electric Heat Pump Tax Credits Climate Control

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

Check more sample of Us Heat Pump Tax Credit below

2023 Heat Pump Tax Credit What You Need To Know Flotechs Plumbing

Heat Pump Tax Credit 2023 All You Need To Know Clover Services

IRA Heat Pump Tax Incentives What You Really Need To Know YouTube

Inflation Reduction Act IRA The Ultimate Guide To Saving

Expired Tax Credits Expected To Be Renewed 2022 04 14 ACHR News

Heat Pump Tax Credit 2022 What Iowa Homeowners Need To Know

https://www.energystar.gov/.../air-source-heat-pumps

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings

https://www.irs.gov/credits-deductions/home-energy-tax-credits

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Inflation Reduction Act IRA The Ultimate Guide To Saving

Heat Pump Tax Credit 2023 All You Need To Know Clover Services

Expired Tax Credits Expected To Be Renewed 2022 04 14 ACHR News

Heat Pump Tax Credit 2022 What Iowa Homeowners Need To Know

P L Heating Rebates Tax Credits

Geothermal Heat Pump Tax Credits Approved By Congress Geothermal

Geothermal Heat Pump Tax Credits Approved By Congress Geothermal

Heat Pump Tax Credits Get Rewarded For Sustainable Heating And Cooling