In this digital age, where screens have become the dominant feature of our lives however, the attraction of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding an extra personal touch to your area, Tuition Tax Deduction Form have become an invaluable resource. This article will dive through the vast world of "Tuition Tax Deduction Form," exploring what they are, how to get them, as well as what they can do to improve different aspects of your lives.

Get Latest Tuition Tax Deduction Form Below

Tuition Tax Deduction Form

Tuition Tax Deduction Form -

The Consolidated Appropriations Act of 2021 shifted the deduction for qualified tuition and expenses to instead increase the income limitation on the lifetime learning credit enabling qualifying taxpayers to still receive benefits

Use Form 8917 Rev January 2020 to figure and take the deduction for tuition and fees expenses paid in calendar years 2018 2019 and 2020 and later years if the deduction is extended This deduction is based on adjusted qualified education expenses paid to an eligible educational institution postsecondary

Tuition Tax Deduction Form cover a large collection of printable items that are available online at no cost. They come in many formats, such as worksheets, templates, coloring pages, and much more. The attraction of printables that are free is in their versatility and accessibility.

More of Tuition Tax Deduction Form

New IRS Rule Tax Deduction For Special Education Tuition Elder Law

New IRS Rule Tax Deduction For Special Education Tuition Elder Law

Form 1098 T is reported as an Education Credit Federal Section Deductions Credits Education Credits Where are qualified expenses reported Beginning in tax year 2018 schools report a student s qualified expenses based on how much the student paid during the year The school reports the amount paid in Box 1 of the form

Form 8917 offers a tax deduction called the Tuition and Fees Deduction while Form 8863 offers two tax credits The two tax credits you can claim on Form 8863 are the American Opportunity Tax Credit and the Lifetime Learning Credit A tax deduction reduces your taxable income thus lowering your tax bill indirectly

The Tuition Tax Deduction Form have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Personalization There is the possibility of tailoring printing templates to your own specific requirements be it designing invitations, organizing your schedule, or even decorating your house.

-

Educational Use: The free educational worksheets are designed to appeal to students of all ages. This makes the perfect instrument for parents and teachers.

-

The convenience of The instant accessibility to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Tuition Tax Deduction Form

2018 Tuition And Fees Deduction Form

2018 Tuition And Fees Deduction Form

For your 2024 this deduction is worth the amount you paid in interest for your student loans up to 2 500 which is the maximum deduction In order to qualify for the deduction you must meet the following criteria You paid interest this year on a qualified student loan You re using any filing status except married filing separately

The Tuition and Fees Deduction lets you take a deduction for expenses paid to an eligible education institution up to 4 000 The student in this case could be you your spouse or your dependent you claim on your return We go into a couple specific dependent situations later

We hope we've stimulated your curiosity about Tuition Tax Deduction Form Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection and Tuition Tax Deduction Form for a variety uses.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets including flashcards, learning tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a wide range of interests, including DIY projects to party planning.

Maximizing Tuition Tax Deduction Form

Here are some unique ways to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Tuition Tax Deduction Form are a treasure trove of creative and practical resources that can meet the needs of a variety of people and passions. Their accessibility and flexibility make they a beneficial addition to the professional and personal lives of both. Explore the endless world that is Tuition Tax Deduction Form today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tuition Tax Deduction Form really for free?

- Yes you can! You can download and print these tools for free.

-

Do I have the right to use free printables to make commercial products?

- It's determined by the specific terms of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables could be restricted on their use. Check the terms and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home with the printer, or go to the local print shops for top quality prints.

-

What program is required to open printables that are free?

- Most printables come in PDF format. These can be opened with free software, such as Adobe Reader.

The Tuition And Fees Tax Deduction

:max_bytes(150000):strip_icc()/GettyImages-168790288-5921fe51886541b0bf7286000f6c29df.jpg)

IRS Form 8917 Tuition Fees Deduction Stock Video Footage 10473112

Check more sample of Tuition Tax Deduction Form below

2018 Tuition And Fees Deduction Form

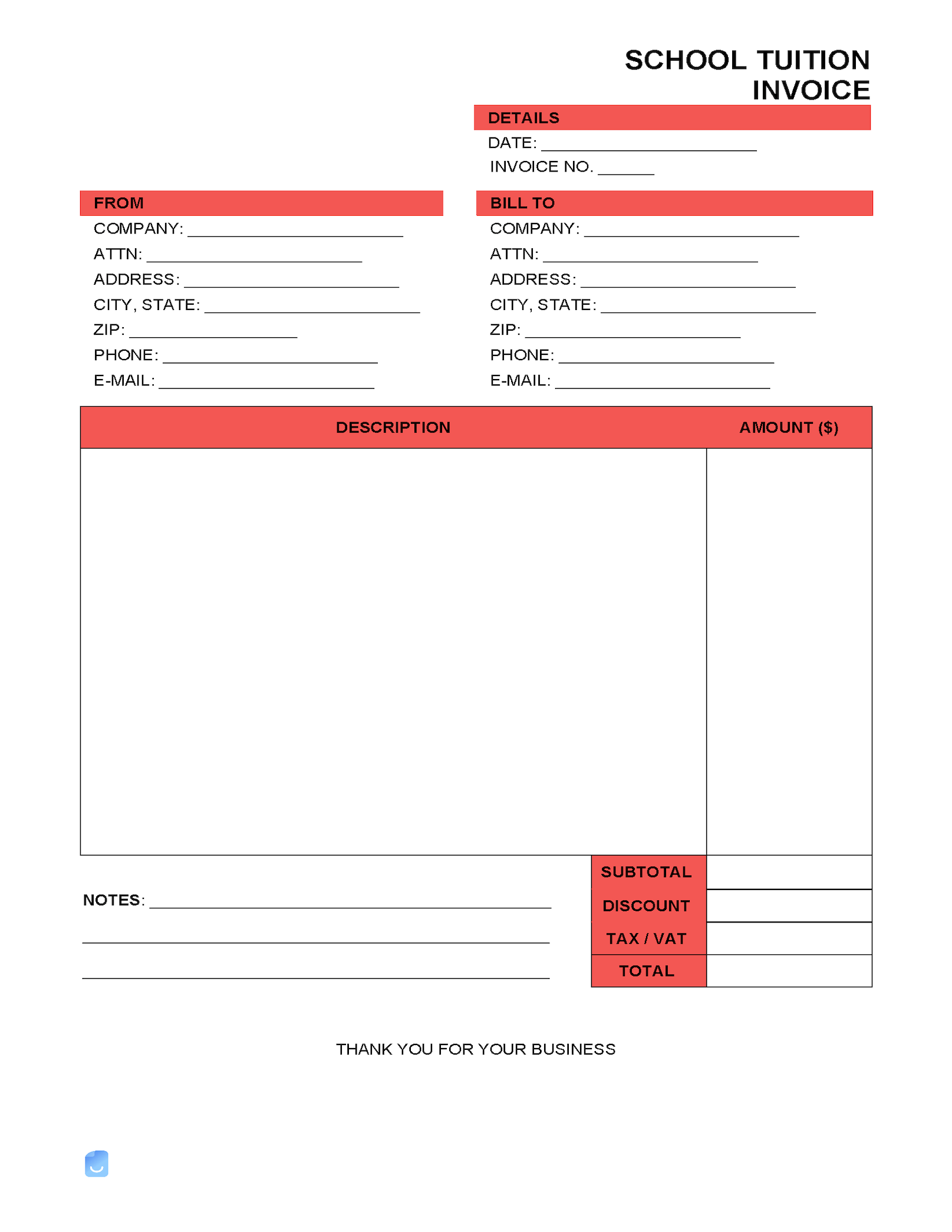

Explore Our Image Of Law Firm Invoice Template Invoice Template Word

Tax Tips Tuition Textbook Credits Accounting Bookkeeping

Tuition And Fees Deduction 2023 Form

Printable Tax Deduction Form For Donations Printable Forms Free Online

Tuition Tax Deduction Everything You Need To Know To File In 2022

https://www.irs.gov/pub/irs-pdf/f8917.pdf

Use Form 8917 Rev January 2020 to figure and take the deduction for tuition and fees expenses paid in calendar years 2018 2019 and 2020 and later years if the deduction is extended This deduction is based on adjusted qualified education expenses paid to an eligible educational institution postsecondary

https://www.investopedia.com/form-8917-tuition-and...

Form 8917 is the Internal Revenue Service IRS tax form that a taxpayer must fill out to receive a tax deduction called the tuition and fees deduction The deduction has been

Use Form 8917 Rev January 2020 to figure and take the deduction for tuition and fees expenses paid in calendar years 2018 2019 and 2020 and later years if the deduction is extended This deduction is based on adjusted qualified education expenses paid to an eligible educational institution postsecondary

Form 8917 is the Internal Revenue Service IRS tax form that a taxpayer must fill out to receive a tax deduction called the tuition and fees deduction The deduction has been

Tuition And Fees Deduction 2023 Form

Explore Our Image Of Law Firm Invoice Template Invoice Template Word

Printable Tax Deduction Form For Donations Printable Forms Free Online

Tuition Tax Deduction Everything You Need To Know To File In 2022

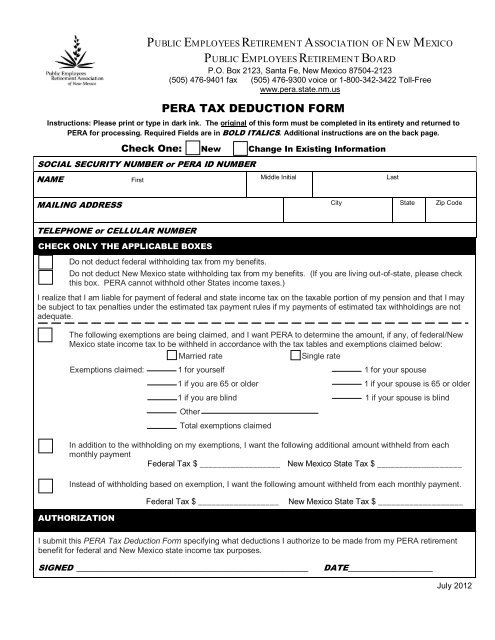

PERA TAX DEDUCTION FORM Public Employees Retirement

Tax Deduction Shellark

Tax Deduction Shellark

Irs Gov 2017 Income Tax Tables Cabinets Matttroy