In this digital age, where screens dominate our lives The appeal of tangible, printed materials hasn't diminished. In the case of educational materials project ideas, artistic or just adding some personal flair to your area, Tuition Fees Rebate In Income Tax India are now a vital source. Here, we'll dive into the sphere of "Tuition Fees Rebate In Income Tax India," exploring what they are, where to locate them, and the ways that they can benefit different aspects of your daily life.

Get Latest Tuition Fees Rebate In Income Tax India Below

Tuition Fees Rebate In Income Tax India

Tuition Fees Rebate In Income Tax India -

Web 27 juin 2023 nbsp 0183 32 5 min read CONTENTS Show An education loan helps you not only finance your foreign studies but it can save you a lot of tax as well If you have taken an education loan and are repaying the same then the

Web 17 f 233 vr 2017 nbsp 0183 32 This is because tuition fee qualifies for tax benefit under Section 80C of the Income tax Act 1961 The amount of tax benefit is within the overall limit of the section

Tuition Fees Rebate In Income Tax India include a broad collection of printable materials that are accessible online for free cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages, and more. The benefit of Tuition Fees Rebate In Income Tax India is in their versatility and accessibility.

More of Tuition Fees Rebate In Income Tax India

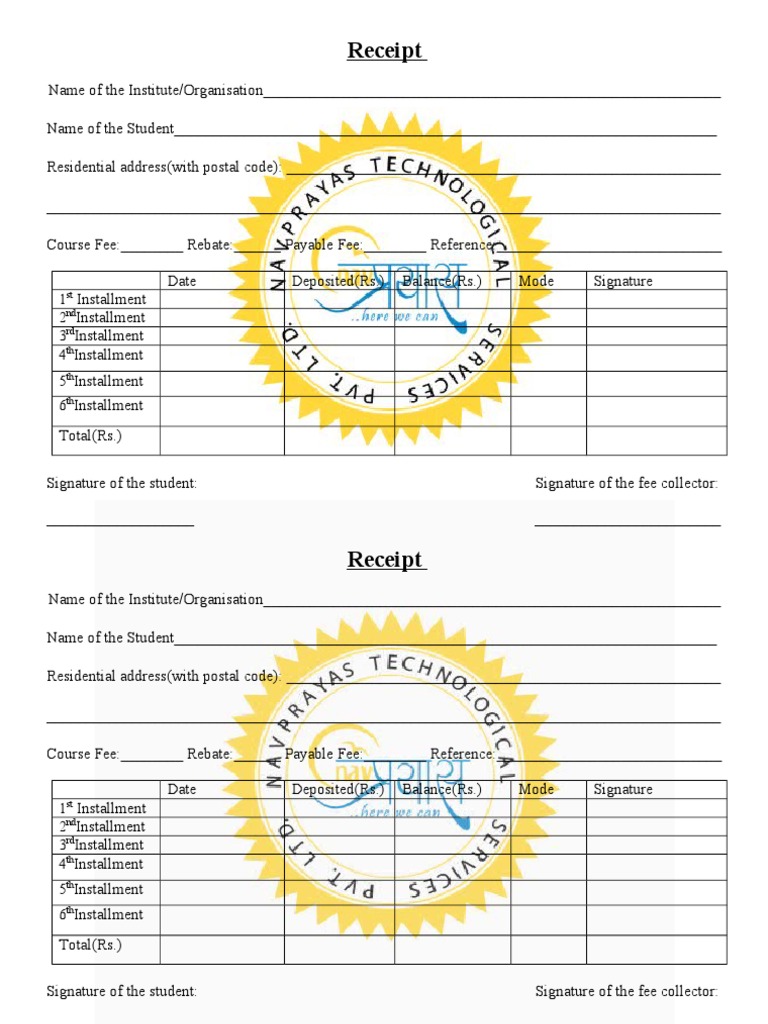

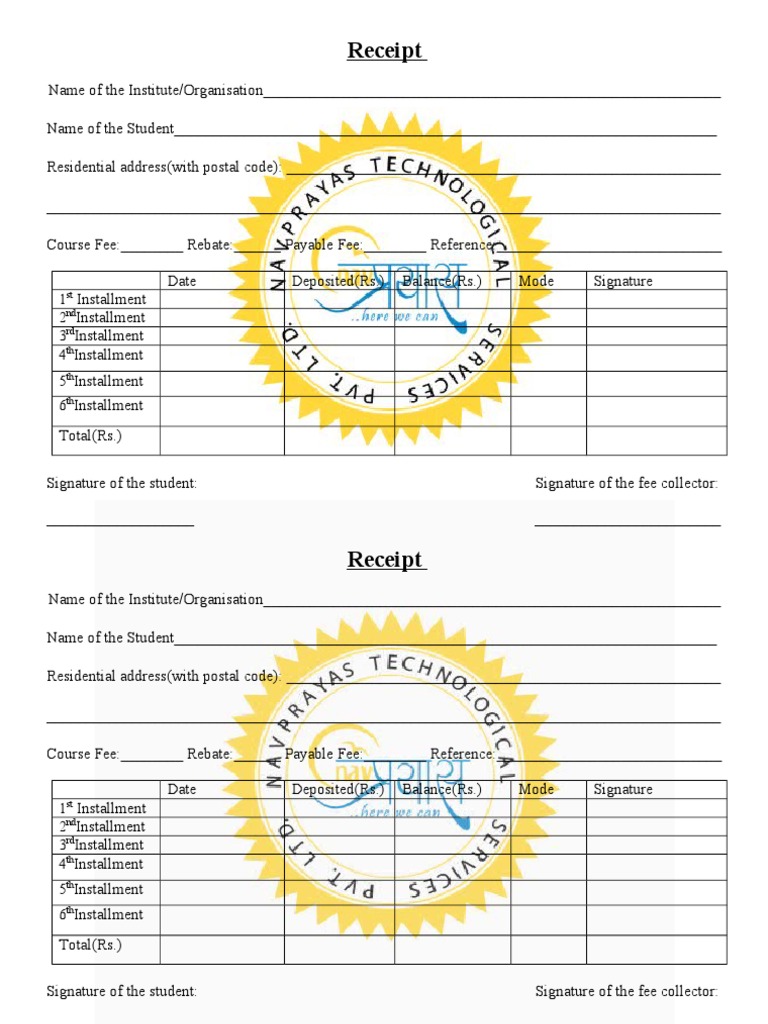

Receipts Archives DSF

Receipts Archives DSF

Web Tuition fees deduction in India can be claimed by individuals employed in India under section 10 14 of the Income Tax Act as Children s Educational Allowance Section 10

Web 3 oct 2021 nbsp 0183 32 You can claim a deduction upto Rs 1 50 lakh every year for tuition fee paid for maximum of two children in respect of full time education in India This deduction is not exclusive but is

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: It is possible to tailor print-ready templates to your specific requirements in designing invitations or arranging your schedule or even decorating your home.

-

Educational Impact: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, making them an essential tool for parents and educators.

-

An easy way to access HTML0: You have instant access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Tuition Fees Rebate In Income Tax India

Section 80C Child Tuition School Education Fees AY 2018 19 Meteorio

Section 80C Child Tuition School Education Fees AY 2018 19 Meteorio

Web Income Tax Tax Benefits on Tuition Fees Tax Benefits on Tuition Fees amp Education Fees Tuition and education fees are eligible for tax benefits in India Deductions of up

Web 14 juil 2022 nbsp 0183 32 The amount paid as tuition fees qualifies for tax benefit under section 80C up to a maximum limit of Rs 1 5 lakh per annum It means under income tax rules you are allowed to deduct the fee

After we've peaked your interest in printables for free Let's look into where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Tuition Fees Rebate In Income Tax India for various goals.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- These blogs cover a broad variety of topics, ranging from DIY projects to party planning.

Maximizing Tuition Fees Rebate In Income Tax India

Here are some innovative ways in order to maximize the use of Tuition Fees Rebate In Income Tax India:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tuition Fees Rebate In Income Tax India are an abundance of fun and practical tools that cater to various needs and interest. Their accessibility and versatility make these printables a useful addition to the professional and personal lives of both. Explore the vast world of Tuition Fees Rebate In Income Tax India today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes they are! You can download and print these documents for free.

-

Can I download free printables for commercial purposes?

- It's contingent upon the specific conditions of use. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Are there any copyright issues when you download Tuition Fees Rebate In Income Tax India?

- Some printables may come with restrictions on their use. Always read the terms of service and conditions provided by the author.

-

How do I print printables for free?

- Print them at home using either a printer or go to a local print shop to purchase premium prints.

-

What software do I need to run printables that are free?

- Most printables come in PDF format, which can be opened using free programs like Adobe Reader.

Printable Free Professional Fee Receipt Templates At

I Want Tuition Fee Certificate From School For Tax Deduction Brainly in

Check more sample of Tuition Fees Rebate In Income Tax India below

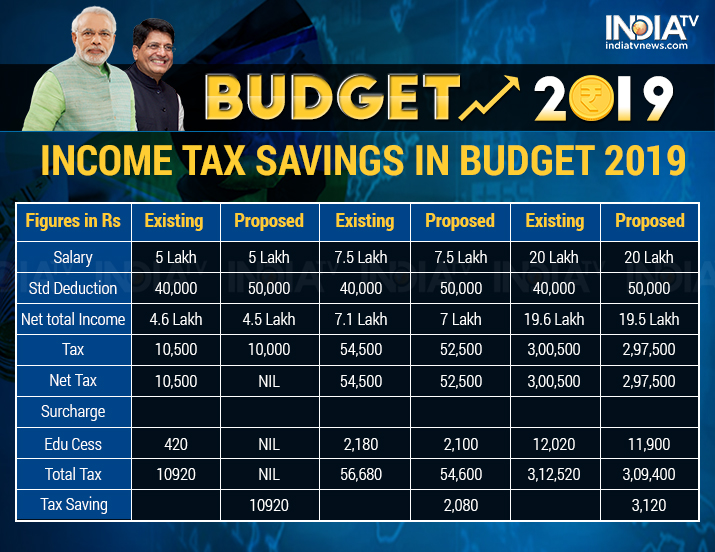

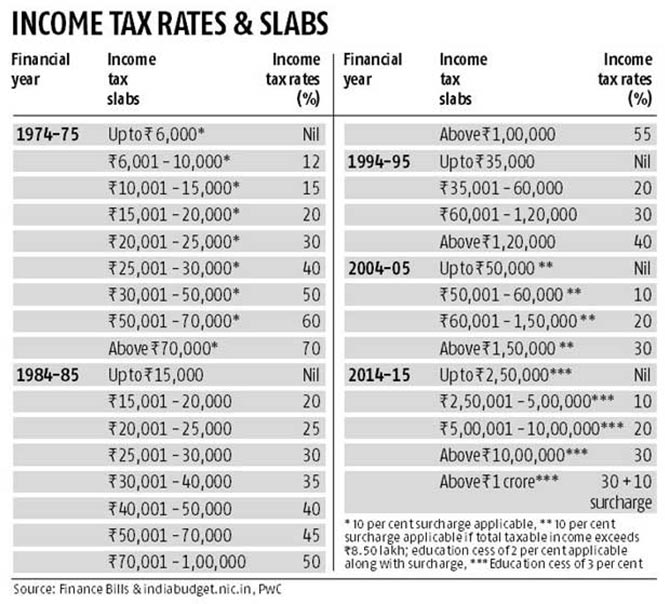

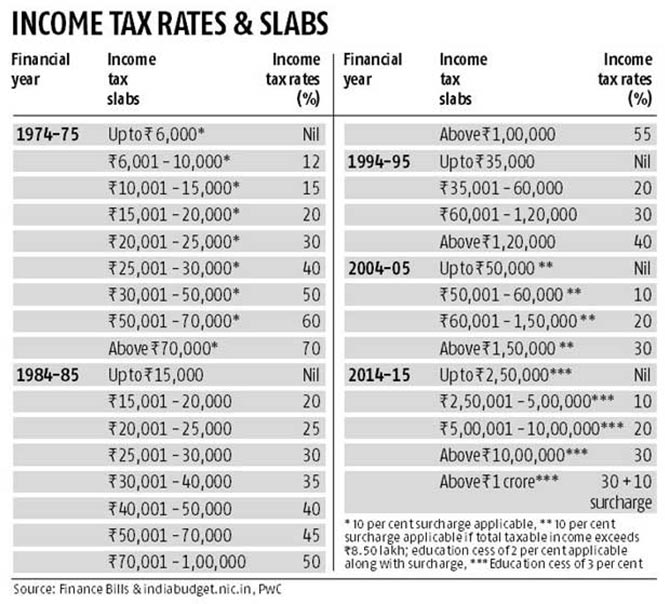

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Download Tuition Fee Receipt Template In Word Format

Interim Budget 2019 Check How Will Income Tax Rebate Announced By Fin

Student Tuition Fee Report Sample Templates Tuition Receipt Template

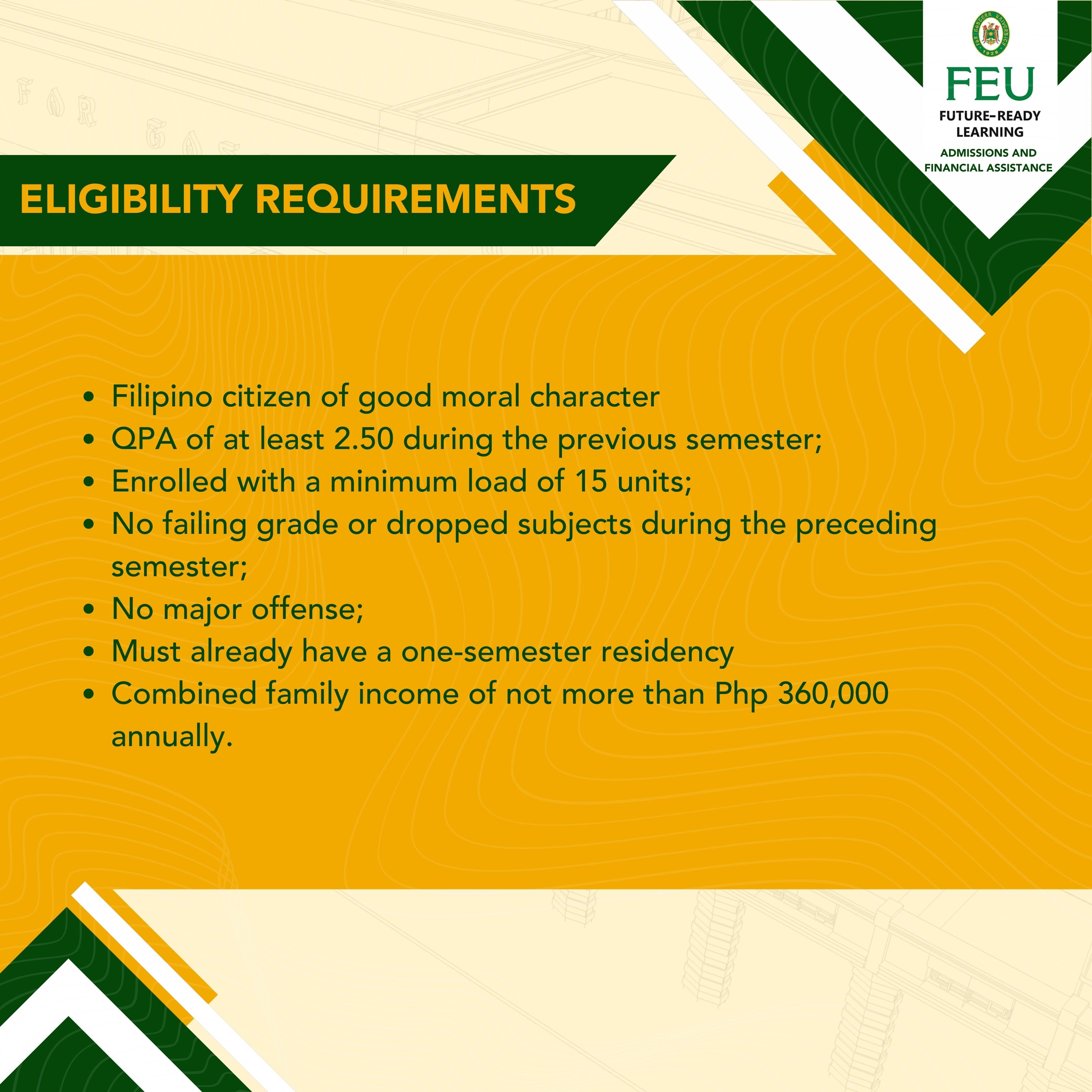

FEU TUITION DISCOUNT Far Eastern University

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://economictimes.indiatimes.com/wealth/tax/how-to-claim-tax...

Web 17 f 233 vr 2017 nbsp 0183 32 This is because tuition fee qualifies for tax benefit under Section 80C of the Income tax Act 1961 The amount of tax benefit is within the overall limit of the section

https://instafiling.com/tuition-fees-exemption …

Web 5 janv 2023 nbsp 0183 32 The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can claim up to Rs 1 5 lakh for a tax deduction

Web 17 f 233 vr 2017 nbsp 0183 32 This is because tuition fee qualifies for tax benefit under Section 80C of the Income tax Act 1961 The amount of tax benefit is within the overall limit of the section

Web 5 janv 2023 nbsp 0183 32 The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can claim up to Rs 1 5 lakh for a tax deduction

Student Tuition Fee Report Sample Templates Tuition Receipt Template

Download Tuition Fee Receipt Template In Word Format

FEU TUITION DISCOUNT Far Eastern University

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Old Tax Rates Hot Sex Picture

Old Tax Rates Hot Sex Picture

Top Notch Income Tax Calculation Statement How To Prepare A Cash Flow