In the digital age, where screens dominate our lives but the value of tangible printed items hasn't gone away. Whether it's for educational purposes for creative projects, simply to add an element of personalization to your space, Travel Expenses Tax Deduction 2022 have proven to be a valuable source. We'll dive into the world "Travel Expenses Tax Deduction 2022," exploring the different types of printables, where to locate them, and the ways that they can benefit different aspects of your lives.

Get Latest Travel Expenses Tax Deduction 2022 Below

Travel Expenses Tax Deduction 2022

Travel Expenses Tax Deduction 2022 -

Learn more The Finnish Tax Administration June 27 updated Guidance No VH 2486 00 01 00 2022 on the deduction of employee travel expenses The updated guidance includes 1 the increased threshold to 8 400 euros US 8 885 from

However you can deduct your travel expenses including meals and lodging while traveling between your temporary place of work and your tax home You can claim these expenses up to the amount it would have cost you to stay at your temporary place of work

Printables for free include a vast variety of printable, downloadable items that are available online at no cost. The resources are offered in a variety styles, from worksheets to coloring pages, templates and many more. The attraction of printables that are free is their flexibility and accessibility.

More of Travel Expenses Tax Deduction 2022

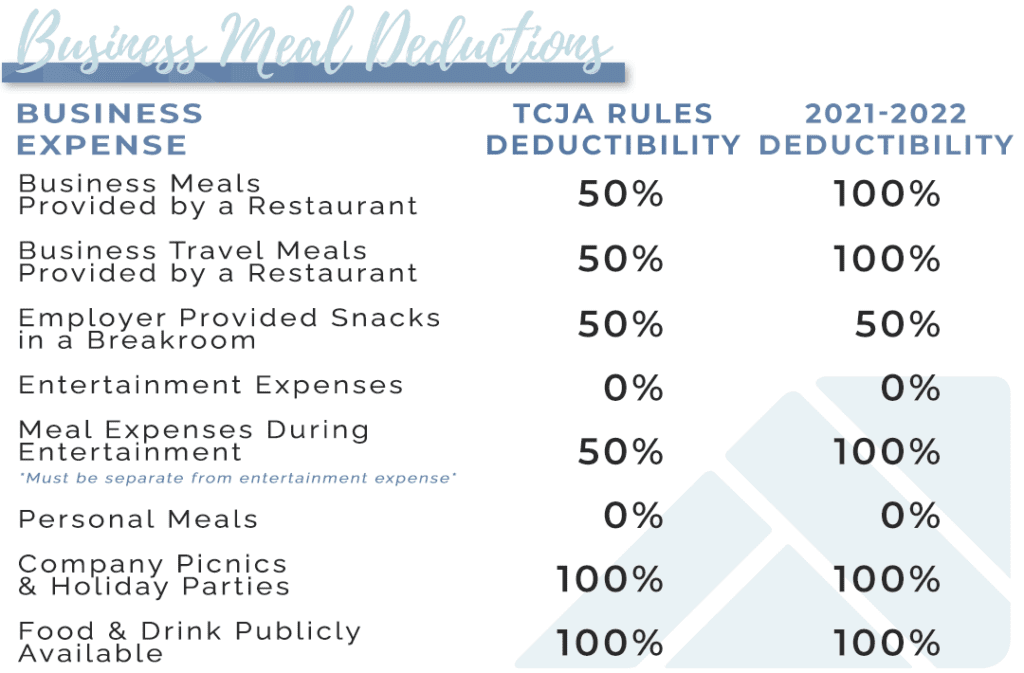

10 Business Tax Deductions Worksheet Worksheeto

10 Business Tax Deductions Worksheet Worksheeto

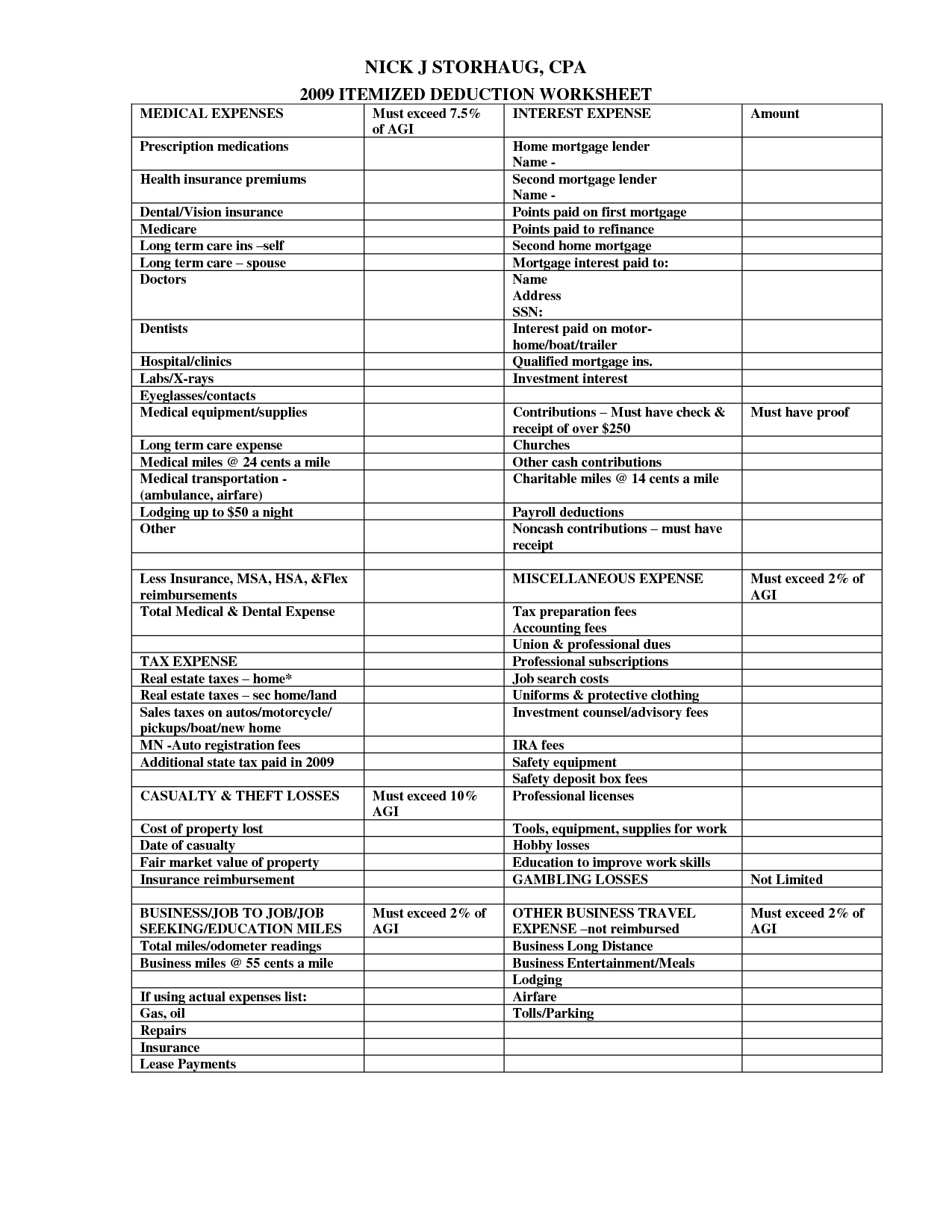

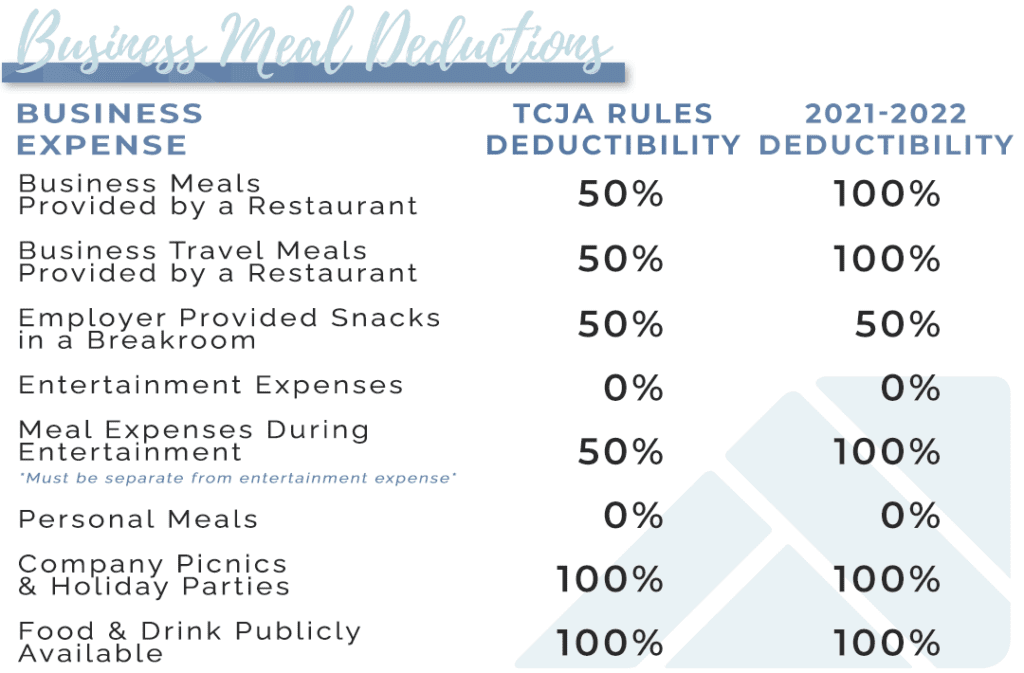

How to Deduct Travel Expenses with Examples By Ryan Smith on November 3 2022 Good news most of the regular costs of business travel are tax deductible Even better news as long as the trip is primarily for business you can tack on a few vacation days and still deduct the trip from your taxes in good conscience

IRS Tax Tip 2022 104 July 11 2022 Business travel can be costly Hotel bills airfare or train tickets cab fare public transportation it can all add up fast The good news is business travelers may be able to off set some of those costs by claiming business travel deductions when they file their taxes

Travel Expenses Tax Deduction 2022 have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization You can tailor the templates to meet your individual needs in designing invitations planning your schedule or even decorating your house.

-

Education Value These Travel Expenses Tax Deduction 2022 offer a wide range of educational content for learners of all ages. This makes the perfect instrument for parents and teachers.

-

The convenience of The instant accessibility to an array of designs and templates helps save time and effort.

Where to Find more Travel Expenses Tax Deduction 2022

Business Tax Itemization Worksheet

Business Tax Itemization Worksheet

Can I deduct travel expenses SOLVED by TurboTax 5278 Updated November 30 2023 If you re self employed or own a business you can deduct work related travel expenses including vehicles airfare lodging and meals The expenses must be ordinary and necessary

Key Takeaways Travel expenses are tax deductible only if they were incurred to conduct business related activities Only ordinary and necessary travel expenses are deductible expenses that

Now that we've piqued your curiosity about Travel Expenses Tax Deduction 2022 We'll take a look around to see where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Travel Expenses Tax Deduction 2022 for all applications.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- The perfect resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- The blogs covered cover a wide range of interests, from DIY projects to planning a party.

Maximizing Travel Expenses Tax Deduction 2022

Here are some unique ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Utilize free printable worksheets to aid in learning at your home or in the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Travel Expenses Tax Deduction 2022 are an abundance filled with creative and practical information designed to meet a range of needs and hobbies. Their availability and versatility make these printables a useful addition to your professional and personal life. Explore the wide world of Travel Expenses Tax Deduction 2022 today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes, they are! You can print and download these resources at no cost.

-

Does it allow me to use free printables for commercial use?

- It's determined by the specific terms of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using Travel Expenses Tax Deduction 2022?

- Some printables may contain restrictions on their use. Be sure to review these terms and conditions as set out by the creator.

-

How do I print Travel Expenses Tax Deduction 2022?

- Print them at home using an printer, or go to a local print shop for better quality prints.

-

What program is required to open printables at no cost?

- The majority of PDF documents are provided in PDF format. They can be opened with free programs like Adobe Reader.

Printable Tax Organizer Template

1040 Deductions 2016 2021 Tax Forms 1040 Printable

Check more sample of Travel Expenses Tax Deduction 2022 below

10 Ultimate Tips Starting A Blog Writing Off Travel Expenses 2023

Real Estate Expense Tracking Spreadsheet With Regard To Realtor Expense

![]()

How To Make The Most Out Of Your Business Travel Tax Tips With A CPA

Realtors Tax Deductions Worksheet

Meal Expenses Covered By Department Of Transportation Rules 2018

Travel Nursing Cardiac Cath Lab Nursing RNNetwork Travel Nursing Blog

https://www.irs.gov/publications/p463

However you can deduct your travel expenses including meals and lodging while traveling between your temporary place of work and your tax home You can claim these expenses up to the amount it would have cost you to stay at your temporary place of work

https://www.vero.fi/en/individuals/vehicles/...

Travel expenses may be reimbursed with tax exempt per diems or meal money It may be that your employer pays a reimbursement to you in the form of per diem allowances

However you can deduct your travel expenses including meals and lodging while traveling between your temporary place of work and your tax home You can claim these expenses up to the amount it would have cost you to stay at your temporary place of work

Travel expenses may be reimbursed with tax exempt per diems or meal money It may be that your employer pays a reimbursement to you in the form of per diem allowances

Realtors Tax Deductions Worksheet

Real Estate Expense Tracking Spreadsheet With Regard To Realtor Expense

Meal Expenses Covered By Department Of Transportation Rules 2018

Travel Nursing Cardiac Cath Lab Nursing RNNetwork Travel Nursing Blog

Printable Itemized Deductions Worksheet

Small Business Tax Deductions Worksheet

Small Business Tax Deductions Worksheet

Can You Claim Car Expenses As A Tax Deduction